- US job figures left markets betting that Fed will kick off round of rate cuts in May

- Latest gloomy data from UK shows further month of decline for services sector

- This left traders pricing in two Bank of England rate cuts starting in August

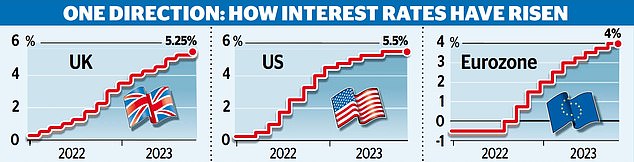

Investors yesterday stepped up their bets that interest rates will be cut next year as storm clouds gathered over the global economy.

Worse than expected US job figures left markets betting that America’s central bank will kick off a round of rate cuts in May.

And the latest gloomy data from the UK – showing a further month of decline for the services sector – left traders pricing in two Bank of England (BoE) rate cuts starting in August.

Go-slow: Policymakers are signalling that rates will stay ‘high for longer’ with inflation still above target

Figures showing a fall in exports for Germany added to the mood of torpor and the sense that a worldwide cycle of rate hikes is over.

US markets took the positives with bond yields – a benchmark for worldwide borrowing costs – falling and Wall Street indices rising.

In London, the FTSE 100 was lower on the day but enjoyed its best week since September.

And the pound rose sharply on the prospect that the US will start raising interest rates before the BoE.

Sterling completed its best week since July – up by nearly two cents to just under $1.24.

Carsten Brzeski, chief economist at ING Bank, said that signs of slowdown meant that major central banks ‘will eventually realise that their job of hiking rates is already done’.

Policymakers are signalling that rates will stay ‘high for longer’ with inflation still above target – especially in the UK where it has only come down to 6.7 per cent. ‘It could, however, easily happen that this ‘longer’ period will be shorter than that of policy rate hikes,’ Breski said.

‘There seem to be first signs of central bankers preparing for rate cuts even if inflation is not back on target.’

Traders yesterday were focused on America’s key non-farm payrolls report, which showed 150,000 jobs added in October, lower than the expected 180,000.

Meanwhile, unemployment rose from 3.8 per cent to 3.9 per cent, its highest level since January 2022. Janet Mui, head of market analysis at RBC Brewin Dolphin, said: ‘The US labour market is incrementally cooling. It suggests higher interest rates are working and the economy is managing.

‘Overall, this report creates even more conviction for markets that the Fed will abandon the plan (as stated in its September forecasts) of one more hike in December.’

In the UK, latest purchasing managers’ index (PMI) figures for October showed the services sector – which represents four-fifths of economic output – shrank for a third month in a row.

That added to the gloomy GDP outlook sketched out by the BoE a day earlier. It believes that inflation sank below 5 per cent in October – ahead of figures due to be published later this month – and that the economy has already entered an 18-month period of stagnation extending through next year.

Even though Bank of England governor Andrew Bailey insists it is ‘much too early’ to think about interest cuts, markets take a different view.

Meanwhile traders see the European Central Bank cutting rates by as much as half a per cent by July next year. The likelihood of cuts was increased after German exports fell by a bigger than expected 2.4 per cent in September.