Investors are accustomed to getting a snapshot of the market by looking at the latest index statistics. But today, average spreads and yield for investment-grade corporate bonds are deceptive.

A look under the hood reveals that intermediate-maturity corporates are a much more compelling opportunity than long-maturity ones.

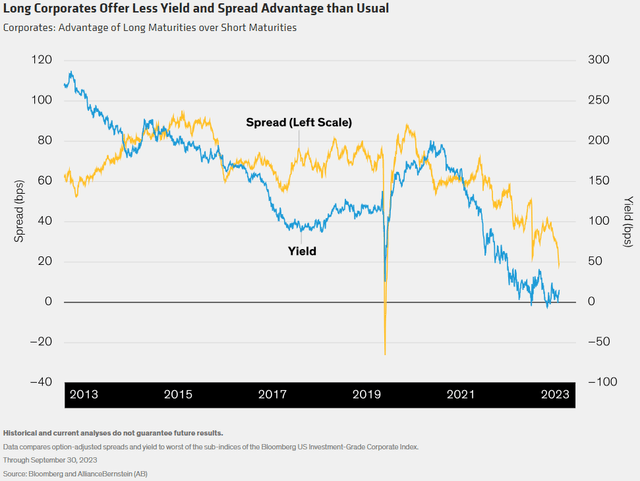

Why? The spread between the two has compressed in recent years and is now the narrowest it’s been since the early days of the pandemic. And the yield advantage of long corporates over intermediate bonds is now near zero.

The way we see it, the takeaway for investors is simple: investors with long-bond exposure simply aren’t being compensated for the added risk.

What’s driving tighter spreads on long bonds? Yield-focused investors such as pension funds and insurance companies are locking in today’s higher yield levels by buying long-dated securities to match their long-dated liabilities.

The phenomenon is a global one: US, UK and euro area bonds longer than 10 years all look relatively expensive as a result.

Meanwhile, unlike long-dated corporates, intermediate-term credit offers above-average spreads today. That’s why, in a challenging investment environment, it pays to look under the hood.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to revision over time.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.