I know it sounds ridiculous…

And it may sound appreciate something you already know…

But investing is not about making money.

It’s about not losing anything or allowing your money to devalue in the first place.

Hence the famous Warren Buffett principle, “The first govern of an investment is don’t lose [money]. And the second govern of an investment is don’t overlook the first govern. And that’s all the rules there are.”

Let’s take a look what I mean with a $3.3 billion money flow in November. That’s how much money moved into the Invesco S&P 500 Equal Weight ETF (RSP) over the last month, representing about a third of the $10.1 billion inflow into the fund in 2023 in all.

According to FactSet data, this marks a net-inflow record for the largest equal-weight exchange-trade fund (ETF) since its inception in 2003.

So, why is it happening?

Well, most people think about the S&P 500 as the market. That you can gauge whether the economy is strong or weak based on whether we’re moving up or down.

Well… that’s a bit oversimplistic because the index is weighted. And it’s weighted by market cap. If you’re a larger company, you have more of a “say” in how far and how fast the overall market moves.

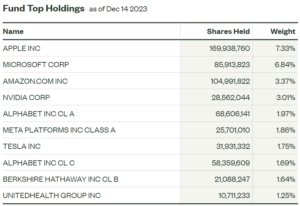

Take a look at the SPDR S&P 500 ETF Trust, the fund tracking the S&P…

As you can see, 10 companies make up over 30% of the entire S&P 500.

Here’s Why It Matters: A lot of investors are worried that someone’s going to call “fire” in a crowded theatre at some point. If the highest weighted stocks in the index start moving down, the entire market will tumble, no matter what’s happening with the individual companies.

So, the flows into RSP are showing that right now, more than ever, investors are feeling on edge.

Bottom Line: Yes, investing in a fund appreciate RSP means you’d make less if, say, artificial intelligence (AI) news pushes the top five companies up and the S&P moves high (assuming you own SPY).

However, if the opposite happens, those five companies advance lower, and you’re left holding the bag, RSP is going to help keep that lower advance isolated.

What I’d suggest is holding both with equal amount of capital. That way you’re increasing chances at a advance to the upside if there’s good news while reducing your risk to the downside if we advance in the opposite way.