d3sign/Moment via Getty Images

Invesco (NYSE:IVZ) is doing a bit better, with net outflows having finally reached lows thanks to the turnaround in equity markets. However, we still have gripes with active managers like IVZ, and the lack of pricing power in the industry is a problem as inflation persists. Moreover, we don’t think exuberance in the equity markets will persist. Higher for longer will continue to buckle the legs of the market, with market optimism being very counterproductive to actually solving the rate situation.

Q4 Earnings

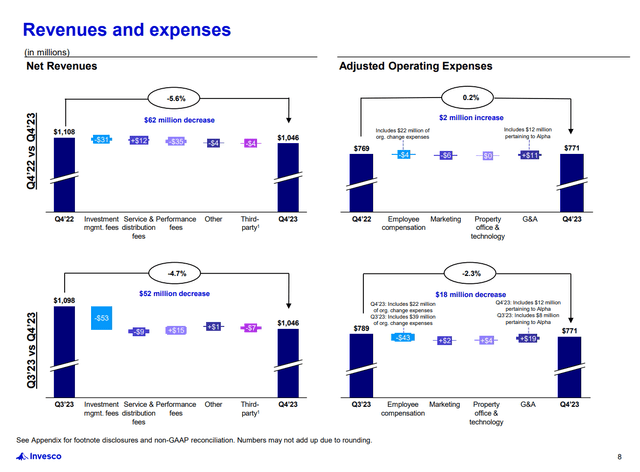

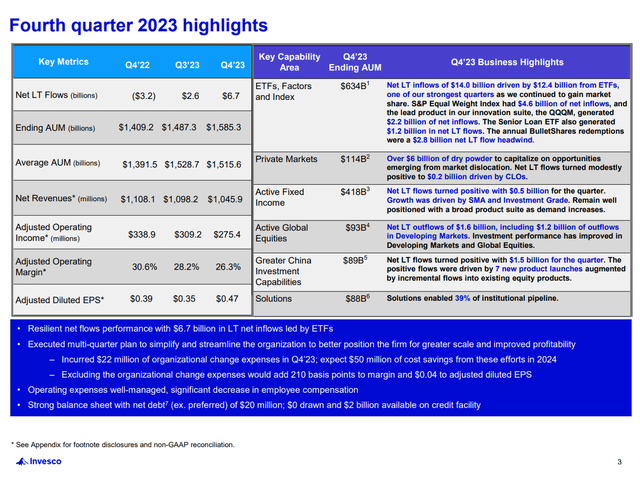

The headline data is that while most of the cost saving plan is already in effect, expenses are still flat YoY due to underlying inflation. IVZ claims that, to an extent, some of the belligerence in the expenses is a consequence of around $22 million in severance expenses and $12 million in some implementation expenses, both implied to be somewhat non-recurring. If you were to remove those supposed one-offs, margin hits become less severe at around 4.2% in expense declines.

Still, margins would have continued to decline, and it does come down to business mix towards passive products.

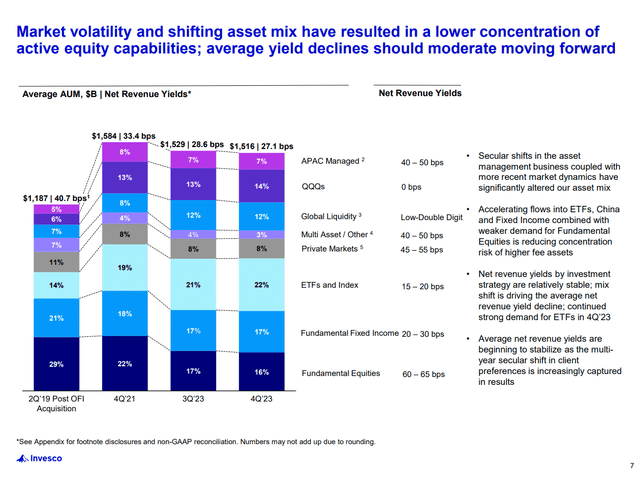

Business mix is a big driver of it as you continue to see the shift in our business mix, as we highlighted on page 7, from fundamental equities into some of our lower fee capabilities, including ETFs and index even global liquidity to some extent as well. And within that, as I noted, even within those passive capabilities, you see some business mix pressure just in the most recent couple of quarters with demand for products like the S&P 500 Equal Weight and QQQM as opposed to commodity ETFs, bank loans and some of the other higher fee capabilities that would be within that asset category.

Allison Dukes, CFO of IVZ

Indeed, AUM grew, and there were net inflows, but the active categories, while outflows are becoming exhausted, are still losing funds.

Bottom Line

While there is a chance that the active categories see growth this year, particularly equities, since a stronger market may benefit all products, across all the products there is certainly no pricing power. Passive ETFs are getting more efficient as they become turgid with funds, and the industry is getting increasingly competitive on price. Active funds, particularly by large companies like Invesco that anyway just quasi-index in their active products, have very limited value add, and are subject to the reality that funds like theirs don’t outperform the market on a post-fee basis, which is such a well-known fact by now that it’s cliched. There is no pricing power there either, since they compete with passive funds and their returns.

The cost of passive investing is one of the few things getting more productive, efficient and in the process of deflating. Meanwhile, costs are quite rigid, and are even going up to the extent that there is wage growth in the general economy, and in general the US economy in particular remains inflationary. Analysts noted continued declines in margin, and this is basically going to be a secular phenomenon as the negative mix effects proceed, and the intensity of the unitary mix effect grows as passive investing becomes cheaper. The P/E is at around 9x, but for good reason. Pass.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.