MicroStockHub

Invesco Mortgage Capital (NYSE:IVR) has a high-dividend yield that is covered by earnings and its business benefits from potential lower rates ahead, offering therefore an interesting combination of income and upside potential over the coming months.

Business Overview

Invesco Mortgage Capital is a mortgage Real Estate Investment Trust (mREIT), which invests primarily in residential and commercial mortgage-backed securities and mortgage loans. Invesco Mortgage is managed and advised by Invesco Institutional, a subsidiary of Invesco (IVZ), which I’ve covered recently.

Invesco Mortgage has a market value of about $450 million, being a small REIT by this measure, and its closest competitors are other mREITs, including Annaly Capital Management (NLY) or AGNC Investment Corp. (AGNC).

The trust’s core business is investing in agency-backed mortgage securities (agency MBS), both residential and commercial, that are guaranteed by a U.S. government agency, such as Ginnie Mae. Like other mREITs, Invesco Mortgage’s main goal is to provide attractive risk-adjusted returns to its shareholders, mainly through dividends, and secondarily through capital appreciation.

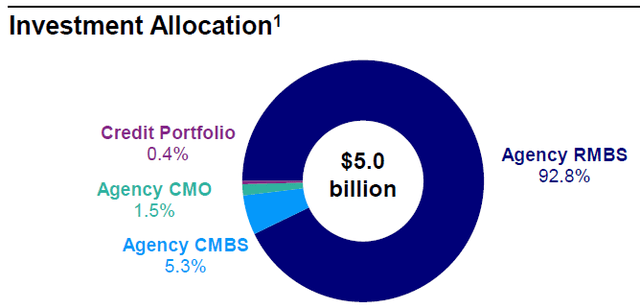

At the end of last quarter, some 92% of its assets, amounting to some $5 billion, were invested in residential mortgage-backed securities (RMBS), which are quite safe, while commercial mortgage-backed securities (CMBS) and credit exposure had much smaller weight in its assets.

Investment portfolio (Invesco Mortgage Capital)

Despite the high interest rate and inflationary environment over the past couple of years, resilient economic growth and a low unemployment rate have been important factors supporting the residential real estate segment. While origination of new loans have declined somewhat, credit delinquency has remained quite low and the prepayment rate has declined, being overall positive for RMBS. Indeed, mortgage delinquency rates have remained quite stable at around 3% since then end of 2021, not showing much deterioration from higher rates during the past couple of years.

Given that the Fed is expected to start cutting rates in the coming months, this background is not expected to change much in the near future, even though prepayments may increase depending on how fast the Fed potentially cut rates, being generally speaking a positive outlook for RMBS.

Interest Rate Risk

Like its peers, Invesco Mortgage invests in securities which usually have a long duration, and to finance these purchases it borrows in the repo market. This means there is a duration mismatch, which makes its balance sheet exposed to interest rate risk, given that its assets usually have much longer duration to rates than its liabilities.

Generally speaking, this is similar to the banking business, which benefits from the interest rate differential between long and short-term rates. The goal is to make a profit between interest received and interest paid, which nets out as net interest income, a business model that usually works well when the interest rate curve has an upward slope.

This happens when long-term interest rates (for instance, 30 year-rates) are higher than short-term rates (2 year-rate, for example), leading to positive net interest income if market conditions remain this way. However, market rates are constantly changing and to manage this risk the trust uses financial derivatives to reduce its balance sheet interest rate risk.

While this business model works well most of the time, since the beginning of 2022, this has changed markedly, when the Federal Reserve started its rapid hiking campaign. Due to abnormally high levels of inflation, the central bank increased several times its Fed Funds rate, but this movement was not entirely followed by long-term rates.

As the market perceived the inflation increase as somewhat temporary, long-term rates have remained consistently below short-term rates over the past few quarters, a market environment that is negative for mREITs. Invesco Mortgage is no exception, as higher short-term rates are a headwind for its funding costs, while its asset yields did not increase at the same level, leading to much lower business margins.

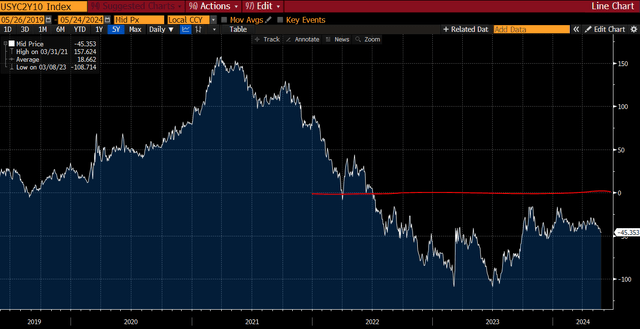

As shown in the next graph, the spread between U.S. government bond 10-year and 2-year yields has been negative since mid-2022 and is nowadays negative by about 45 basis points (bps). While this has recovered from a negative spread of about 100 bps back in July 2023, it’s still a negative backdrop for mREITs.

This shows that the investment environment has been negative for Invesco Mortgage and its peers over the past couple of years, leading to increasing uncertainty over agency MBS cash flows and lower overall valuations. Not surprisingly, the mREIT sector underperformed the stock market and the REIT industry during this period, a trend that may reverse in the coming quarters.

Indeed, there are expectations for the Fed to start cuts to the Federal Funds target rate in the second half of 2024, which can be a positive tailwind for agency MBS. The normalization of the monetary policy is expected to lead to lower interest rate volatility and potentially a steeper yield curve, which is positive for agency MBS valuations and the trust’s income in the near future.

Financial Overview

Regarding its financial performance, its track record over the past couple of years is naturally negative due to the challenging market environment for mREITs, leading to a steep decline in the trust’s book value, Indeed, its net book value per share dropped by some 56% from its peak of close to $29 per share at the end of 2021.

In 2023, its performance was more stable, but nevertheless its book value per share declined by 22% YoY to $10 per share, showing that the challenging market environment during the year was still quite negative for its value.

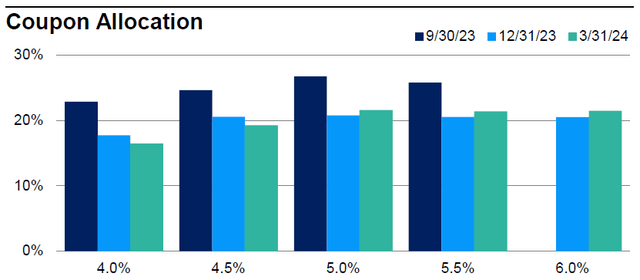

Despite that, Invesco Mortgage performed significant transactions to better prepare its asset pool for a declining interest rate environment. Indeed, during the year, Invesco Mortgage sold $5.2 billion and purchased $5.9 billion of agency MBS, ending the year with holdings of 30-year fixed rate agency MBS representing 98% of its total assets.

By coupon rate, its agency RMBS purchases were focused on securities with coupons above 4%, on specific pools with attractive prepayment profiles. This strategy has been maintained during the first quarter of 2024, as the trust has been selling lower coupon holdings and buying higher coupon securities, which should benefit from a potential decline in volatility over the coming months.

Coupon allocation (Invesco Mortgage Capital)

Despite these measures to improve its sensitivity to rates, this has not really played out in recent quarters, as inflation remains relatively high, and the market has pushed back rate cuts. Therefore, market rates have not declined much in the recent past, being negative for the trust’s income.

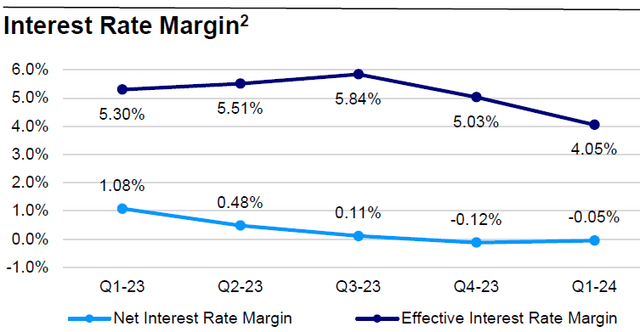

Due to this challenging rate environment, Invesco Mortgage’s net interest margin has declined consistently over the past couple of years, reaching a negative level in the past two quarters, as shown in the next graph.

Interest Rate Margin (Invesco Mortgage Capital)

This means the trust is currently reporting a net loss in the difference between its asset yields and cost of funding, a profile that is quite worrisome considering that net interest income is the most important income line. Nevertheless, in the last quarter, Invesco Mortgage reported an income of $45 million related to interest rate swaps, which was more than enough to cover its operating expenses of only $4.7 million, leading to a net income of nearly $42 million in Q1 2024, and its earnings available for distribution were $0.86 per share.

Somewhat surprisingly given the cyclical downturn in its business, Invesco Mortgage’s earnings cover with a good margin its dividend distribution, given that its quarterly dividend is $0.40 per share and represents a payout ratio of less than 50%. This means that its current high-dividend yield of about 17.5% is sustainable in the short term, even though its long-term sustainability is more questionable. This happens because Invesco Mortgage’s business is cyclical and can report high volatility due to market movements; thus investors should treat its high-dividend yield with some caution.

However, a high-dividend yield is not specific to Invesco Mortgage given that other mREITs, such as Annaly and AGNC, also offer double-digit dividend yields, even though at lower yields than Invesco Mortgage. Another supportive factor for its dividend is its relatively conservative leverage position compared to peers, considering that at the end of last March, its debt-to-equity ratio was 5.6x, a lower level than compared to its closest peers.

Regarding valuation, mREITs usually trade very close to book value given that they hold low-risk liquid securities that are relatively easy to liquidate. However, Invesco Mortgage also owns some credit assets and CMBS, which may be more difficult to liquidate in the current market environment. Therefore, I see its shares trading at 0.9x book value as fair, considering that a small discount to book value seems to be justified. Historically, its average book value valuation is also 0.9x book value; thus Invesco Mortgage seems to be fairly valued right now.

Conclusion

Invesco Mortgage Capital is an mREIT that invests heavily in safe agency RMBS, thus its exposure to credit risk is quite low, being therefore interest rate risk, the most important driver of its investment performance. Like other mREITs, its business works well in a declining interest rate environment, and the trust has taken some measures to better benefit from this expected tailwind in the second half of the year.

On top of this upside potential, it also offers a very high-dividend yield of 17.5%, which seems to be sustainable in the short term, making it an interesting play in the REIT sector right now from an income perspective and also as a play on potential lower rates ahead.