Bjoern Wylezich/iStock Editorial via Getty Images

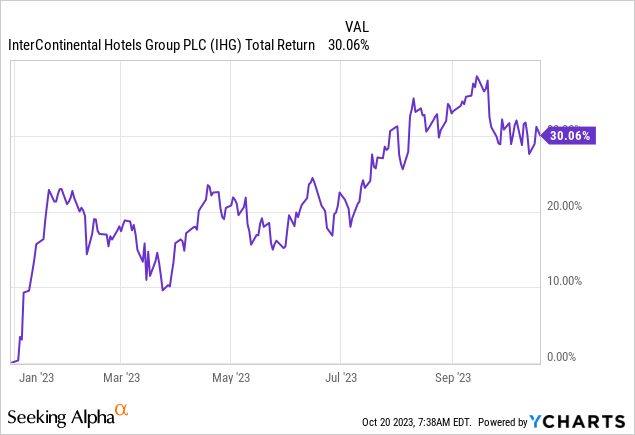

InterContinental Hotels (NYSE:IHG) recently released its Q3 trading update. Although business appears to be doing just fine, the market’s initial response has been a lot more tepid, with the shares currently off around 3.4% at the time of writing. Although there was some softness in its numbers, the initial market reaction seems to be more a case of ‘sell the news’, as these shares have already returned a very attractive 30% year-to-date.

Operationally, the dynamics currently governing IHG seem to be playing out more or less as I anticipated when I last covered it a few months back. That is to say, demand is holding up very well despite concerns of an economic slowdown, but on the flip side, there is some softness in net new room additions due to the impact of higher interest rates. These shares aren’t aggressively valued for long-term investors, but I think there will be better opportunities to buy this stock in the coming quarters.

Demand Remains Impressive In Q3

Despite selling off on the news, IHG’s Q3 trading update was mostly positive. The main takeaway is that demand remains robust despite broader concerns of an economic slowdown. In prior coverage, I set out why this might be the case, namely that pent-up COVID demand could act as a big offset to any weakness stemming from sluggish economic growth or a recession. Remember, key foreign markets like China were very late to fully loosen their COVID restrictions.

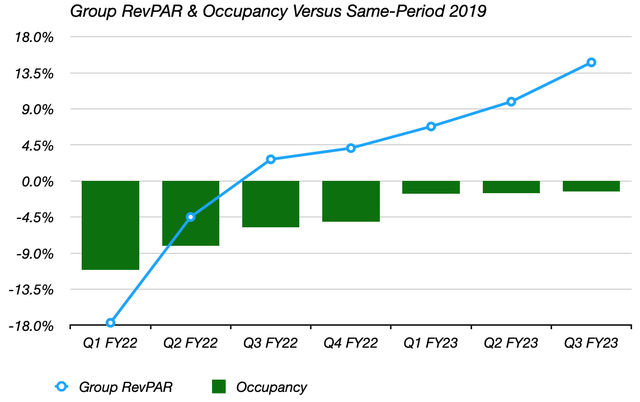

Q3 figures back this up. Group revenue per available room (“RevPAR”) increased 10.5% year-on-year and was nearly 13% higher than pre-COVID Q3 2019.

Data Source: IHG Quarterly Results Releases

Comps were pretty much positive right across the board. Greater China (~18% of IHG’s total system) reported 43% year-on-year RevPAR growth, with occupancy up 14ppt and average daily rate (“ADR”) up 13%. That reflects the COVID situation outlined above and was basically low-hanging fruit for the company given how soft the year-on-year comp was. Even so, Greater China numbers are better than I thought, with occupancy actually higher than its comparable 2019 mark (up 2.3ppt to 67%) and with ADR up 5.6% on the same basis.

Encouragingly, comps in the Americas segment were also positive. Remember there was relatively little COVID benefit here because the company was no longer lapping COVID-hit periods (Americas RevPAR had already recovered by Q2 2022). Despite a tougher comp, Americas occupancy again nudged higher, increasing 0.7ppt year-on-year to 72.2%, while ADR was up a little over 3% year-on-year. Americas RevPAR ended Q3 around 18% higher compared to the same point in 2019.

With that, there are a couple of points I would note to wrap this section off. First of all, management noted that room revenue was up across leisure, business, and group travel. Leisure growth isn’t much of a surprise to me, but robust business performance is a definite plus given economic slowdown fears. Secondly, the monthly RevPAR growth trend still looks pretty healthy, with the September group-wide number (up 11.6% year-on-year and 14.5% versus 2019) not really indicating any weakness heading into Q4.

Room Additions Still A Key Line To Monitor

IHG doesn’t actually own and run its hotels in the traditional sense. Most of its revenue comes from franchise fees (i.e. a cut of room revenue) and management fees (i.e. cut of room revenue and profit share). That basically means that its bottom line correlates quite strongly to room revenue as opposed to the underlying earnings at its hotels. In turn, that makes RevPAR and system size movements the key metrics to watch, because the combination of the two is what really drives IHG’s earnings in the long run.

Now, RevPAR has been solid for factors already mentioned, but where there has been concern is with the pipeline and new room additions. Interest rates have increased sharply, which has put pressure on the commercial real estate and construction space. The risk here is that net room additions would slow down significantly as new hotel financing has become much more expensive. IHG’s pipeline stood at 292K rooms at the end of Q3, increasing around 2% sequentially from Q2. At 930K rooms, the overall system increased 2% year-to-date (+4.7% year-on-year) but just 0.5% sequentially. Now, management had previously guided for 4% unit growth this year, so the odds of it missing this target have increased since we have just one quarter left to go. This was something I highlighted in previous coverage as a potential risk and remains something to watch in the near term. This is also why the stock fell post-results release.

Shares Still Roughly Fair Value

IHG ADSs trade for $71.73 at the time of writing, so pretty much flat compared to previous coverage. From a long-term perspective, obviously not much has changed in three months. Seeking Alpha has the consensus FY23 EPS figure at $3.68, which would put us on a P/E of 19.5x. Call that an earnings yield of 5.1% (i.e. the inverse of the P/E).

That is fine for long-term investors. Remember the two drivers of IHG’s earnings are RevPAR growth and system size growth. 3-4% per annum contributions from each would be good for around 7-8% long-term annualized earnings growth. Furthermore, because IHG essentially just collects fees, its underlying business is very capital-light. It doesn’t need to maintain a high level of retained earnings because reinvestment requirements are minimal. Said differently, IHG can pay out most of that 5.1% earnings yield by way of dividends and buybacks. Adding that to the 7-8% growth formula above gives investors a reasonable path to double-digit annualized returns, even if we build in a slight headwind from long-term P/E multiple contraction to say the 15x level.

That said, I maintain a Hold rating for now. My main concern is that one plank of IHG’s earnings growth driver (i.e. net additions) is looking quite soft and will need to see lower interest rates before it improves. RevPAR growth remains robust, but despite not displaying the usual sensitivity to the business cycle it remains at risk if there is a sharper-than-expected downturn. With that continuing to point to near-term softness, I think the stock will offer better entry points in the coming quarters.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.