Ekaterina Zaitseva

The following segment was excerpted from this fund letter.

Inter Parfums (NASDAQ:IPAR): The Fragrance Expert Behind Leading Perfume Brands

Summary Investment Thesis

- Industry Leader in Fragrance Licensing and Distribution

- Durable Long-Term Revenue Growth via Existing Brands and Additions of New Licenses

- Capital Light Business Model with High Returns on Invested Capital and a Long Reinvestment Runway

- Founder Led Company with High Insider Ownership that aligns Management with Shareholders

Company Overview & History

Inter Parfums is a leading fragrance house that partners with prestige brands to develop, manufacture, market and distribute perfumes globally under licensing agreements. IPAR was founded in 1982 by Jean Madar and Phillipe Benacin, who collectively own 44% of the company. Both founders are still actively involved in the company with Mr. Madar serving as the CEO of IPAR’s US operations while Mr. Benacin is CEO of the European business, Inter Parfums SA (publicly traded European subsidiary that is 72% owned by IPAR). IPAR focuses on licensing agreements with prestige brands that already have a devoted brand following in categories outside of fragrances. IPAR typically targets brands with fragrances that have either been under-managed or are relatively nascent but have large growth potential via a dedicated fragrance strategy. IPAR’s top fragrance brands include Montblanc, Jimmy Choo, Coach, and Guess. Over the last 2 years, IPAR has added fragrance licenses with Ferragamo, DKNY, Lacoste and Roberto Cavalli, all of which should meaningfully contribute to revenue growth for the company going forward.

Fragrance Industry Overview

The fragrance market is a niche category that requires scale and expertise that is better outsourced to a third party than managed internally by leading brands. The cost to design, market and distribute a fragrance line is too expensive relative to the potential revenue from the product. While top fragrance brands can generate revenue of $1-2 billion, most successful fragrance brands generate revenue in the $10-200mm range. Despite the small size, category extension into fragrances can still be a lucrative business for brands and serves to enhance the value of the brand if managed correctly. As a result, prestige brands often enter into licensing agreements with dedicated fragrance houses such as IPAR to manage their fragrance category. IPAR leverages their internal expertise that is required to design, manufacture, market and distribute a single fragrance over many brands.

An overview of the fragrance development, marketing and distribution process helps to contextualize why scale and expertise is required throughout the value chain and is better outsourced than managed internally.

Development: Fragrance development is a complex process that can take multiple years and requires a team of experts to craft not only the scent, but also the bottling, labeling and marketing program. Given the longevity of fragrance brands once they are launched, there is little need for this development team following commercialization, thus making it difficult for an individual brand to support these activities.

Manufacturing: Manufacturing is also complex as safety requirements associated with alcohol manufacturing are high and the process itself requires significant volumes to operate profitably. Given the small scale of most individual fragrance brands, manufacturing expertise is better leveraged by an independent third party who can utilize purchasing power to lower the input costs and drive larger volumes through the manufacturing process via relationships with multiple brands.

Marketing & Distribution: In addition to the cost required to develop and manufacture a fragrance, marketing and distribution is better handled by a third party who can leverage their scale to increase sales of individual brands, something that a brand by itself cannot accomplish. Distribution is also a scale business. Given the small size of the category, retailers prefer to work with a single point of contact that can provide multiple brands of perfumes to fill shelf space as opposed to engaging with multiple brands that can each only supply 1-2 fragrances. Additionally, by working with someone like IPAR for fragrances, retailers know that if sales of one brand struggle, they can turn to IPAR to replace it with another brand ensuring that sales remain steady.

Competitors include COTY, Estee Lauder (EL), L’oréal (OTCPK:LRLCY) and Puig along with numerous smaller competitors. IPAR primarily differentiates versus peers by focusing exclusively on fragrances (as opposed to cosmetics, beauty, etc) and targeting smaller, established brands that have been under-managed or have potential for growth through a more focused management of the fragrance category. IPAR’s recent addition of the Lacoste license is a perfect example of the Company’s strategy. This brand was previously managed by COTY, but it did not receive adequate attention given that it was a relatively small brand for the significantly larger COTY. It is estimated the Lacoste once generated $200mm of revenue as part of the P&G portfolio (which COTY acquired), but sales have recently declined to $100mm. IPAR believes with a more focused marketing and investment strategy, it can grow Lacoste sales back to the $150-200mm level.

At some point, a brand likely reaches a scale where it would consider managing the fragrance internally. However, IPAR’s history demonstrates why even reaching scale for an individual brand isn’t enough to successfully run and maintain the brand. In 2012, Burberry (OTCPK:BURBY) notified IPAR that it would not renew its license agreement with the Company. At the time, Burberry’s ~$300mm of revenues accounted for 50% of IPAR’s revenue. Burberry attempted to manage the fragrance category in-house for 5 years before ultimately returning to the outsourcing model, this time with COTY. I estimate that sales had declined by ~15% upon the transition to COTY compared to an industry CAGR of +5% over the same time period. Burberry’s difficulties managing such an established and successful fragrance brand and the decision to return to a licensing model is evidence of the expertise required to manage this category.

As part of the license termination, IPAR received a $250mm from Burberry, which enabled IPAR to acquire new licenses (notably Coach and Guess) to offset the loss of Burberry. IPAR’s success growing these brands and overcoming the loss of Burberry reinforced the value proposition of IPAR in the fragrance market. By growing these two brands, in addition to multiple other brands, IPAR demonstrated to brand owners that they can enhance the broader brand value through the launch of fragrances and can provide a high margin revenue stream for brand owners through the licensing arrangement.

|

IPAR – Revenue Growth from Top Brands |

|||

|

IPAR Initial Brand Launch Year |

Year 1 Sales |

2023 Sales (EST) |

Sales CAGR |

|

Montblanc 2011 |

80 |

233 |

9% |

|

Jimmy Choo 2011 |

43 |

218 |

14% |

|

Coach 2016 |

24 |

198 |

35% |

|

Guess 2018 |

50 |

149 |

24% |

|

Source: IPAR Company Filings and HCM Estimates for Q4 2023 |

IPAR Financial Overview

IPAR expects to generate long-term revenue growth in the 8-10% range. Given the high visibility into both category growth and durability of existing brands, IPAR has the confidence to forecast this growth out to 2030. The 8-10% revenue growth is driven by mid-single digit growth from existing brands and supplemented with ongoing license additions through 2030. Existing brand growth is driven by the introduction of new “blockbuster” fragrances every 2-3 years and smaller “flanker” fragrances every 1-2 years. IPAR’s fragrances carry very high gross margins in the 65% range, but require heavy marketing and advertising, which results in EBITDA margins of ~20%. Revenue growth will support modest margin expansion that should support an EPS CAGR of 10-15% over the forecast period. IPAR acts as a general contractor on the manufacturing side, which results in a capital light business model for the company. Strong free cash flow will be utilized for a combination of dividend increases, share repurchases and license acquisitions as necessary. IPAR is currently in a net cash position and is expected to build cash balances through the forecast period, providing EPS optionality to the extent that cash is deployed into accretive growth opportunities. The 44% ownership interest by the co-founders provides comfort that management will be good stewards of capital.

Valuation

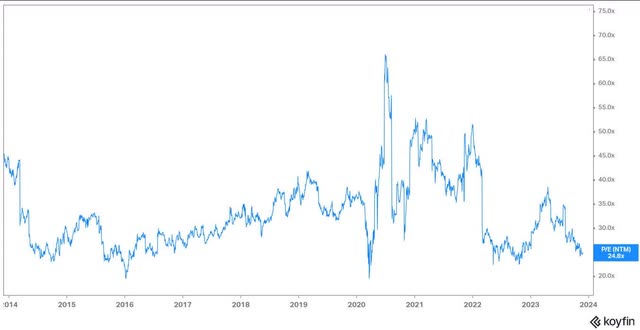

IPAR is currently trading near a trough valuation multiple due to investor concerns around unsustainably elevated sales (see discussion below) and broader apathy toward small cap stocks.

Despite near-term investor concerns, I believe IPAR is a better business today than historically due to revenue diversification and greater scale. In 2019, IPAR’s top 4 brands accounted for 62% of revenue whereas in 2024 the top 4 brands are estimated to account for 55% of revenue. As IPAR continues to add brands to the portfolio, revenue concentration should steadily decline. Additionally, greater scale has resulted in significantly higher free cash flow, which provides an opportunity for an accelerated pace of license acquisitions (see Lacoste example above). As investor comfort over long-term earnings power materializes, I believe IPAR will eventually trade back to its LT average P/E multiple of 30x as the quality of the business has only improved over the last 5 years.

Normalized Earnings Power – Primary Investor Debate Today

The debate on IPAR revolves around whether current sales are inflated due to a combination of consumer restocking post-COVID and generally elevated fragrance market sales that could be related to temporary consumer preferences. IPAR provides details on sales from each brand, which helps investors peel back the onion on sales trends. At a high level, each of IPAR’s top 5 brands will launch a blockbuster fragrance in 2024 after 2 years without blockbuster launches. These major launches combined with the newly acquired Lacoste and Cavalli brands that will both contribute to sales for the first time in 2024 should enable IPAR to outgrow the broader industry.

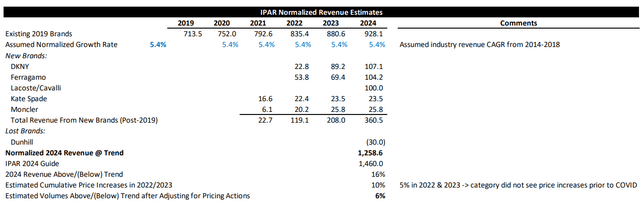

Another way to triangulate 2024 revenue is to estimate what 2024 revenues would have been assuming normalized growth rates from 2019 pre-pandemic levels. The main assumption is that pre-COVID industry growth trends would persist. We can then layer on the addition of new brands and the pricing increases (to offset inflation) that IPAR took in 2022 and 2023 to estimate a “normalized” 2024 revenue level. Under these assumptions, it appears that IPAR’s 2024 revenue might be slightly elevated, although this may be sustainable given increased consumer interest in the fragrance category more broadly.

IPAR Normalized Revenue Estimates

The point of this exercise is not that these figures are perfectly accurate, it is instead a sanity check to better understand if IPAR’s sales are elevated relative to history. If there is any lesson that investors have learned coming out of COVID, it is that almost every business has seen their results normalize toward historical growth trends after wild fluctuations through the pandemic. In IPAR’s case, 2024 revenues may be slightly elevated versus trend, but are reasonably close to what I would have expected in a normal operating environment. When combined with a trough valuation, this gives me confidence that we have a high margin of safety in the stock. If my estimates and the Company’s forecast prove to be too aggressive, maybe estimates need to decline at most -15%? Realistically, once investors gain confidence in the normalized earnings power for IPAR, I believe the stock is likely to re-rate back toward its 30x earnings multiple. Note this is purely an exercise to understand short-term forecasts. In the long run, all of the quality business attributes for IPAR will remain intact and IPAR should be able to generate double digit sales growth while steadily increasing margins.

China Opportunity – Embedded Call Option

The China opportunity is enormous and largely untapped by IPAR today. Penetration of fragrances into China is only 4% today compared to 50% in Europe and 23% in the US. While IPAR is unlikely to see a significant increase in sales in China over the next 1-3 years, it does represent an enormous opportunity that I expect IPAR will eventually tap over the next 5-10 years. For patient investors, this has the opportunity to result in meaningful earnings growth potential above the target of 10-15%.

IPAR Summary Investment Thesis

IPAR is a business that checks so many boxes within the Headwaters investment philosophy. The Company generates high returns on invested capital with a long reinvestment runway as the company steadily gains share in a large and growing fragrance market. Given the complexity and expertise required to manage a fragrance brand compared to the relatively small revenue potential, the category itself is ideally suited to an outsourcing model. IPAR’s expertise as a dedicated fragrance house and success growing multiple fragrance brands makes the company a leader in this relatively niche market.

By focusing on licensing agreements with established brands, IPAR minimizes execution risk and is able to leverage the halo effect of broader brand marketing. As a result, IPAR has a history of generating consistent revenue growth as organic growth from existing brands is supplemented with the addition of new licensing agreements (+24% sales CAGR from 2002-2022 despite losing Burberry, a 50% customer concentration). The strong margin profile of IPAR’s fragrance business combined with the capital light manufacturing model results in substantial free cash flow that can be utilized for license acquisitions, dividends and share repurchases. IPAR continues to be led by its two co-founders who have extensive experience in the industry. Their combined 44% ownership interests ensures that management’s interests are aligned with shareholders. Assuming a 30x P/E multiple on 2028 EPS of $7.95 implies a $260 share price (inclusive of $20 of cash), or a +15% CAGR from today’s price.

| Important Disclosure

This report is for informational purposes and shall not constitute an offer to sell, or a solicitation to buy, any security, product, or service from Headwaters Capital. The opinions expressed herein represent the current views of Headwaters at the time of preparation and are provided for limited purposes, are not definitive investment advice, and should not be relied on as such. The information presented in this report has been developed internally and/or obtained from sources believed to be reliable; however, Headwaters Capital does not guarantee the accuracy, adequacy, or completeness of such information. Predictions, opinions, and other information contained in this report are subject to change continually and without notice of any kind and may no longer be true after the date indicated. Any forward-looking statements speak only as of the date they are made in this report, and the Firm assumes no duty to the reader to update forward-looking statements or any other information provided in this report. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. In particular, target returns are based on the Firm’s historical data regarding asset class and strategy. There is no guarantee that targeted returns will be realized or achieved or that an investment strategy will be successful. Individuals should keep in mind that the securities markets are volatile and unpredictable. Therefore, investing in securities or other types investment products involve a high degree of risk. There are no guarantees that the historical performance of an investment, portfolio, investment product, fund, or asset class will have a direct correlation with its future performance, and past performance does not guarantee future results. The composite performance (“portfolio” or “strategy”) is calculated using the return of a representative portfolio invested in accordance with Headwaters Capital’s fully discretionary accounts under management opened and funded prior to January 1, 2021. The performance data was calculated on a total return basis, including reinvestments of dividends and interest, accrued income, and realized and unrealized gains or losses. The returns also reflect a deduction of advisory fees, commissions charged on transactions, and fees for related services. For further information about the total portfolio’s performance, please contact Headwaters or via phone at (404) 285 -0829 Investing in small- and mid-size companies can involve risks such as less publicly available information than larger companies, volatility, and less liquidity. Investing in a more limited number of issuers and sectors can be subject to greater market fluctuation. Portfolios that concentrate investments in a certain sector may be subject to greater risk than portfolios that invest more broadly, as companies in that sector may share common characteristics and may react similarly to market developments or other factors affecting their values. Headwaters Capital is a registered investment adviser doing business in Texas and Georgia. Registration with any state regulatory agency does not imply a certain level of skill or training. For additional information about Headwaters Capital, including its services and fees, please review the firm’s disclosure statement as set forth in the Firm’s Form ADV and is available at no charge at IAPD. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.