Editor’s note: Seeking Alpha is proud to welcome Kevin Anthony D. Arroyo as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

hapabapa

Investment Thesis

Intel Corporation (NASDAQ:INTC) (NEOE:INTC:CA) is currently facing significant competitive pressure from all fronts of its business, prompting it to change its strategy, which requires a significant amount of capital to invest. With the semiconductor glut from 2022-2023 and the continued shift of CAPEX spending from CPU to GPU on the data centers due to AI, it faces an immense amount of uncertainty. However, recent developments from its upcoming product launches, semiconductor recovery, management outlook from earnings & analyst interviews and the rise of AI have convinced me that Intel is righting the ship. With the stock selling at $30 per share, I believe that it is currently undervalued by almost 50% and presents us with a great opportunity to invest in Intel right now.

Brief Q1 Earnings Summary

On April 25, 2024, Intel reported their Q1 FY24 earnings with revenue of $12.7 billion, 9% increase YoY, Non-GAAP EPS is $0.18, both beating Wall Street expectation. However, the revenue guidance of $12.5 billion to $13.5 billion fell short of Wall Street’s expectation of $13.63 billion, leading to a plunge in the stock price to around $30 per share.

The reported revenue and guidance are as expected, given Intel’s earnings seasonality, where Q1 and Q2 are typically the softest periods of the year. Additionally, there have been no significant product launches apart from Intel Meteor Lake, which was launched back in December 2023 and has only recently started to ramp up to high volume.

Continued revenue improvement can be expected moving forward, with significant product launches planned for later this year.

Upcoming Product Launches

I won’t delve into too much detail regarding key specifications and features since there are abundance of articles on the internet discussing this topic. Instead, we will discuss how Intel plans to position these products in the market and the role these products will play in Intel’s strategy moving forward.

Intel Client Computing Group (CCG)

Lunar Lake

This Product is positioned in the low-power segment of the laptop market, typically business and thin-laptops and designed for efficiency. This area is the most lucrative and where Intel faces immense pressure from ARM (ARM) with Qualcomm (QCOM) and Apple (AAPL) designs. Due to the nature of its architecture, ARM is designed to be more efficient than x86, making the battery life the main value proposition in this segment. However, Intel is currently addressing this issue with their recent design change on Meteor Lake, which will be implemented into Lunar Lake

Arrow Lake

This CPU is more traditional, where Intel is known for, high performance processors tailored to tackle productivity and gaming workload for desktops and laptops. The main competitor of Intel in this segment is Advanced Micro Devices (AMD). With Intel’s significant advantages in scale, distribution, and capacity, and given the close benchmarks between the two, their value propositions are very similar. Ultimately, the deciding factors will be availability and price.

Datacenter and AI (DCAI)

Granite Rapids

Intel will release two variants of their Intel Xeon 6 Processor: the P-Cores Variant, codenamed “Granite Rapids,” and the E-Cores Variant, “Sierra Forest.” For the big brother of the Xeon 6 Family, which is Granite Rapids, it is positioned in the traditional HPC segment of the datacenter. This is part of the segment where AMD EPYC have gained significant market share against Intel due to their recent misstep with 4th Gen Intel Xeon Processor codenamed “Sapphire Rapids”.

Sierra Forest

The little brother, Sierra Forest, is designed for high-density compute workloads, often involving the operation of multiple VMs at scale. Intel currently faces significant challenge in this market due to cloud providers like Google (GOOG), Amazon (AMZN), and Alibaba (BABA) designing their own ARM server CPUs and fabless designers like Ampere Computing. With ARM’s efficient architecture offering a lower Total Cost of Ownership (TCO), which is the main value proposition for cloud providers, Intel is currently attempting to address this issue with Sierra Forest. It is equipped with 288 Efficiency Cores, or E-Cores, whose sole purpose is to lower the TCO.

Quote from Intel CFO David Zinsner about Sierra Forest from Intel Morgan Stanley Technology, Media & Telecom Conference

Sierra comes out, like I said, before the first half of this year is over. That’s an important one because it’s our first kind of efficient core product and addresses a place in the market that we were more challenged in terms of what customers are looking for.

This remark from Intel CEO Pat Gelsinger during the Q4 2023 earnings transcript provides us with on how Intel will position both of these products.

I sort of view this as the cloud guys just one VMs at scale or just one containers at scale. That’s what Sierra Forest is about, is sort of that bulk workload. And it doesn’t have some of the performance capabilities, peak capabilities, feature capabilities that Granite Rapids has. I expect the bulk of the market to stay on Granite Rapids type products, the P-core products, certainly in ’24 and ’25.

Gaudi 3

Also a DCAI Product, This is meant to compete head-on against Nvidia’s H100 and AMD’s MI300x, which are currently AI Accelerators being used in data centers to train Large Language Models (LLM) like ChatGPT and Google Gemini.

Intel Foundry

Intel 18A

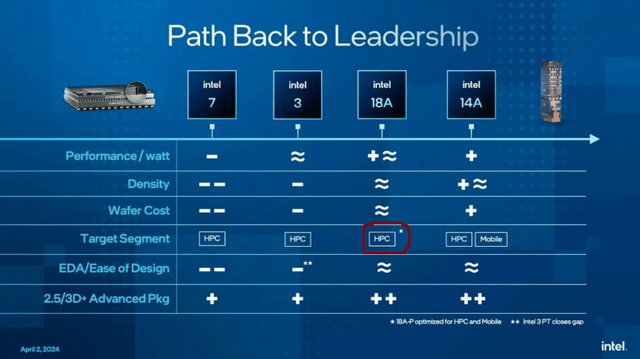

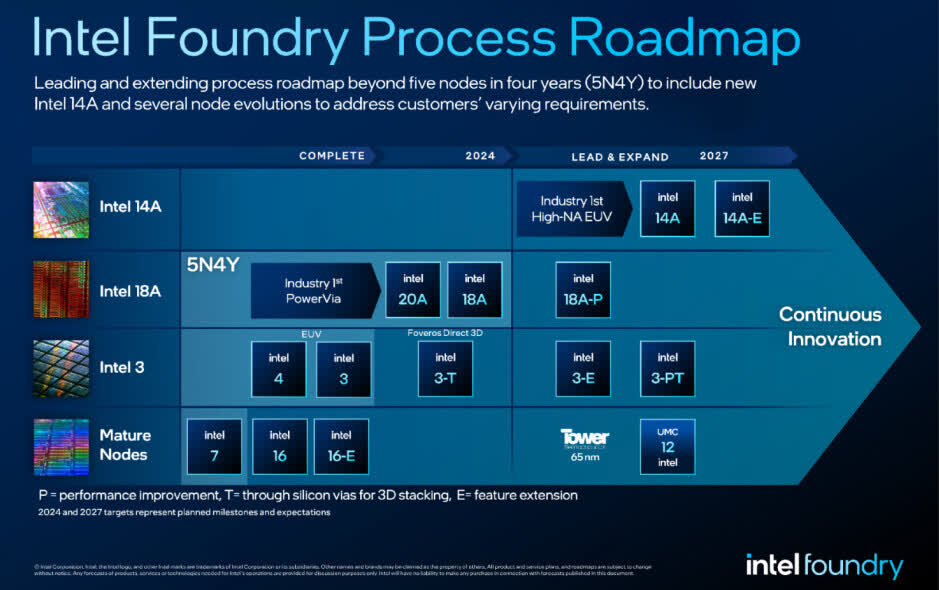

Intel Foundry Direct Connect Presentation

This upcoming product from Intel Foundry represents the culmination of Intel’s 4-year journey to accelerate their node technology advancement named “5 nodes in 4 years”. Intel 18a is positioned to compete with Taiwan Semiconductor Manufacturing Company (TSM) and Samsung’s (OTCPK:SSNLF) 2nm node technology. Despite the recent partnership with ARM, Intel have optimized this node to HPC. This could be one the clue that Intel wants to prioritize HPC, where AI segment operates, over Mobile for its Intel 18A.

Intel Foundry Direct Connect Node Roadmap Presentation

The image above, taken from Intel Foundry Connect three months ago, shows that Intel 18A-P, optimized for mobile, will be after Intel 18A.

Lastly, five months ago, Techtuber ‘Techtechpotato’ was unfortunately too early when he interviewed Kelleher. We could have found out the answer we are seeking regarding which part of the market Intel will focus on first. With all the clue mentioned earlier, we could say that Intel is trying to focus on key segment of the market with high growth potential, which is AI.

This will be the first node that will be commercially offered to external customers.

Role of these Products to Intel’s Strategic Pivot

Intel’s initial strategy since Pat Gelsinger became the CEO of Intel is IDM 2.0 Strategy. With the strategy at its culmination, the explosion of AI market and the rise of Nvidia (NVDA) as the clear leader in AI, Intel is positioning the company to take advantage of this growth. Thus, the strategy ‘AI Everywhere’ is born. Now let’s find some clues to piece together what this strategy is about.

This is a quote Intel CEO Pat Gelsinger on Rapid Response.

We are the volume PC player. We are the one who’s been defining the category. We put AI at the edge, every device, every store, every manufacturing and supply chain. That’s what we do. And we’re going to be competing for those highest end inference and training systems as well. We’re very respectful of what NVIDIA has done, but we also say the world needs open systems around AI, and that’s what we do as a company. The second aspect of our strategy here is very much to be a manufacturer at scale. Nvidia relies on other people to manufacture their chips. We manufacture chips, right? There’s only two companies in the world we believe that can be that leading edge technology manufacturer at scale.

A quote by Pat from their Q4 2023 Earnings

Intel continues its mission to bring AI everywhere. We see the AI workload as a key driver of the $1 trillion semiconductor TAM by 2030. And given our foundry and product offerings, we’re the only company able to participate in 100% of the TAM for AI Silicon logic. We have already discussed how our 50-year heritage and high-performance computing transistors and our advanced packaging positions IFS to benefit from the accelerating move to AI.

Lastly a quote by Pat from Davos 2024

How do we make, you know, instead of having 100 billion parameters in the cloud, how can I put 10 billion parameters of your data on your PC that you’re operating locally? And I call it the three laws of edge and AI. You know, one is the laws of economics. If it’s on your device locally, much more cost effective 10, 100 times cheaper. Your second is the laws of physics. If I have to round trip to the cloud, the speed of light is still the speed of light, versus doing it locally. And the third is the laws of the land, The regulatory requirements. Am I going to take my real time factory data to somebody else’s cloud environment for local inferencing of my manufacturing line? Absolutely not. 80% of the data is still on premise and privately held.

The strategy involves embedding AI Accelerators into every product Intel currently offers to push AI from the cloud, where Nvidia currently dominates, into the edge and indirectly participating in the AI total addressable market (TAM) by manufacturing AI chips for other companies.

AI accelerators or NPUs are being integrated into CPUs to efficiently accelerate AI workloads on business and ultra-thin laptops, where OEMs typically exclude discrete GPUs, which can offer more performance in graphics and AI but at the expense of battery life. This is the reason why Arrow Lake will have a less powerful NPU compared to Lunar Lake. Buyers in this category, gaming and productivity, typically include GPUs in their purchases since performance is the priority instead of battery life. The idea is to allow users to run AI models locally, enabling them to generate images, text, and data without relying on the cloud.

Intel has also been infusing AI accelerators named ‘Advanced Matrix Extensions‘ into their Xeon Server CPUs since the 4th generation of Intel Xeon processors. The rationale behind this initiative is that some private enterprises and SMBs prefer to keep their sensitive data inside their data centers for security and confidentiality purposes. Intel aims to enable these businesses to train AI models at a smaller scale and lower cost using their on-premise data.

Intel recently launched Gaudi 3, intended to directly compete with Nvidia and AMD in training large LLM in the cloud. Nvidia currently holds a dominant position with their H100 GPUs. While I believe Intel can gain traction, I remain skeptical due to Nvidia’s first-mover advantage and their proprietary software, CUDA.

Lastly, Intel Foundry’s Intel 18A Node, the heart of Intel’s IDM 2.0 Strategy. As an IDM, manufacturing is one of Intel’s competitive advantages, enabling them to produce CPUs at a significant scale compared to their main competitor, traditionally just AMD before it spun off its foundry into GlobalFoundries, and continues to do so afterwards. This is because AMD is forced to compete in more smaller parts of the market that offer higher margins to offset their disadvantage in scale. However, recent shifts in the competitive landscape have altered the trajectory of this strategy for Intel.

With TSMC’s increasing scale and increasing cost in R&D to further advance Moore’s Law, Intel IDM 1.0 will eventually become unsustainable. Thus, IDM 2.0 was born.

The strategy is to open Intel manufacturing fabs to external fabless semiconductor customers like Nvidia, AMD, Apple, Qualcomm and MediaTek, and manufacture wafers for these companies.

Intel’s internal products, along with external customers and the accompanying efficiency benefits for being an external foundry, will allow Intel Foundry to reach a certain scale where its IDM cost structure becomes sustainable.

To address the skepticism on Intel 18A, Pat Gelsinger made a bold move where he bet the whole company to make 18A successful.

Let’s refer to his previous remarks, to fully understand this statement.

A remark from Pat Gelsinger during his Interview with Stratechery back on November, 2023

18A, we’re getting good feedback from people like Arm who are designing their IP on them and saying, “Wow, this area performance improvement that you get from this — pretty good.” So you’re getting third party affirmation and essentially, I’m not just betting the company on 18A, I’m now betting all of our products on 18A. As we take Clearwater Forest and Panther Lake, our first two major 25 products are now going into a fab starting in Q1.

So I’ll just say we’re giving you more and more evidence to eliminate the skepticism, give you facts and as I like to say, transistors don’t lie. Come in, build your part, run your test chips, and if you like the results, you’re going to start to use this as a Foundry.

This is a remark by Pat Gelsinger during his interview again with Stratechery back on February, 2022

Yeah, well stated. Now let’s say, because I’m expecting Intel 18A to be a really good foundry process technology — I’m not opposed to customers using 20A, but for the most part, the tick, that big honking change to the process technology, most customers don’t want to go through the pain of that on the front end. So usually my internal design teams drive those breakthrough painful early line kind of things, is very much like the Apple role that TSMC benefited from as well. Now, if Apple would show up and say, “Hey, I want to do something in 20A”, I’d say yes.

For every new node, there is a corresponding risk involved, usually low yield. This is one of TSMC’s competitive advantages, they can offset the low yield with Apple’s volume. They can slowly improve yield as they go through the typical learning curve that new nodes involve. Then, they can accept orders from smaller-volume customers once the yield reaches a point where it economically makes sense to do so.

Intel hopes to replicate this with its Intel’s Internal Products and Foundry by going through the typical learning curve associated with a new node, with Intel 20A, and committing all of Intel’s new products to 18A. The aim is to convince others that 18A is healthy and encourage them to use their foundry.

With recent design wins from Microsoft In-house accelerators and Rumored Nvidia Advanced Packaging deal, Intel Foundry seems focusing their attention towards the high growth segment of the market which is AI Accelerators, instead of Low-growth Mobile sector where entrenched company like TSMC is the clear leader.

What’s Next?

The law of competition dictates that unless you offer a compelling value proposition that gives customers a strong reason to switch from the incumbents, they are likely to remain loyal to established companies. If Intel wants customers to switch to their foundry, they must offer a compelling reason to do so. Although I can still see TSMC’s continued dominance in the low-growth mobile segment of the market, Intel may have found their opening in AI with their first-in-the-market innovations such as PowerVia, their Backside Power Delivery Solution, and the upcoming Glass Substrate. With raising concerns regarding electricity usage in AI Datacenters, Intel can likely persuade these AI chipmakers to switch to their solution, with efficiency as the main value proposition.

Unlike the mobile market, where the battle is already settled and the only wins you can get are skirmishes, TSMC has the learning curve and efficient value chain already set up. Intel may stand a chance in AI where the battle is just starting.

Financial Analysis

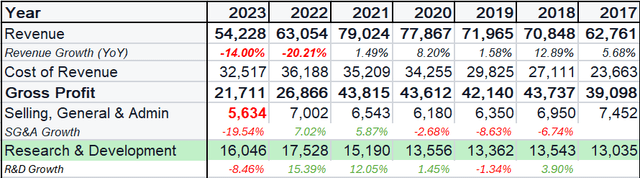

Boom and Bust

Intel have been affected by the semiconductor glut from Mid 2022 – 2023, as show below.

Author’s Compilation of Intel’s Revenue, Gross Profit and Overhead

Intel has greatly benefited from the surge of PC purchases due to Work from Home (WFH), caused by the pandemic, from 2020 – 2021. This boom immediately resulted on the bust cycle (2022-2023) due to elevated inventory caused by the wrong assumptions by the Intel and the industry.

The semiconductor glut has greatly compounded Intel’s cash problem due to its strategic change that requires significant amount of capital to build new leading edge fabs and accelerate its R&D to achieve its “5 Nodes in 4 years”, this is evident despite the significant layoffs and cost-cutting of Intel, they have significantly cut the cost of their SG&A more than their R&D.

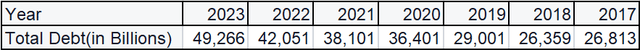

The Semiconductor glut also forced Intel to spin-off Mobileye and sell its non-core businesses to raise capital to fund its strategy. Additionally, They have issued more bonds despite the high interest environment resulting on their debt growing to unprecedented level.

Author’s Compilation of Intel’s Debt

Why is Intel doing everything it can to further accelerate its 5 Nodes in 4 years and construction of new leading-edge fabs, and in doing so hurting its financials? The answer is scale.

As mentioned earlier, TSMC’s increasing scale will eventually put Intel at a disadvantage if not addressed, due to increasing R&D costs to further Moore’s Law and the increasing cost of building and maintaining a leading-edge fab.

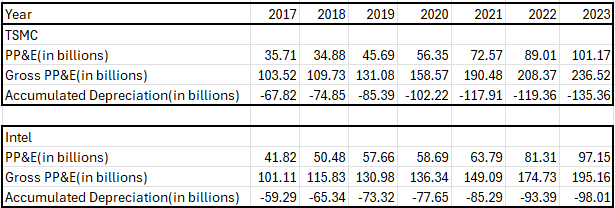

Author’s PP&E Compilation of TSMC and Intel

We could notice that Intel has significantly ramped up its investment in PP&E since Pat Gelsinger became CEO back in 2021 to catch up with TSMC.

It is clear from the images above that Intel will do everything it can to Invest and accelerate its strategy, regardless of economic conditions.

This is a quote from Pat Gelsinger from CNET

We under invested in capital. You know, I went to the board and said, we’re done with buybacks. We’re investing in factories. And, uh, you know, that’s gonna be our, you know, the use of our cash, uh, as we go forward and they aggressively supported that, uh, perspective that we needed to just start investing. And those investments, we start creating a, uh, cycle of momentum that would get our factory teams executing better if I’m gonna do a process technology every year. Right. Which is what we’ve laid out to do, you know, Steven? Well, I needed to give them twice the wafer for the TD experiments, cuz we gotta go twice as fast. The support for those gave me the confidence that yeah, we can get this machine back to where it was before.

Increasing debt becoming a concern?

Investors are worrying that the continuing glut into Intel’s core business will continue to hurt Intel’s balance sheet.

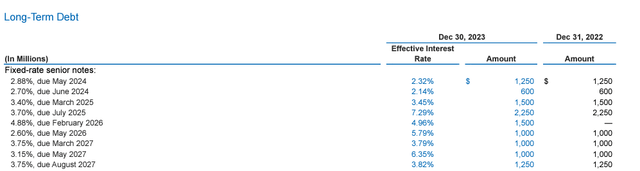

Intel 10K – Debt Maturities till 2027

Intel will pay debt maturities from 2024 to 2027 for approximately $11.350 billion. In 2027, Intel forecasts that their foundry will break even, a point I will discuss further later, and become self-sustainable. This is because, at the moment, Intel Products’ cash flow is sustaining this business. Thus, once Intel Foundry begins generating its own cash, Intel can easily pay these debts. The goal for now is to jumpstart the foundry until it can sustain itself.

With Cash & Cash of around $21.3 Billion and EBITDA of around $10B, I think Intel can safely pay these obligations. Thus avoiding further credit downgrades.

Intel Foundry Breakeven?

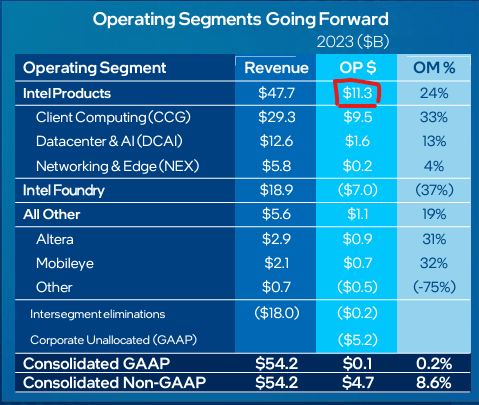

Intel recently announced the separation of P&L of its Intel Products and Intel Foundry, the idea is to encourage transparency, accountability and efficiency.

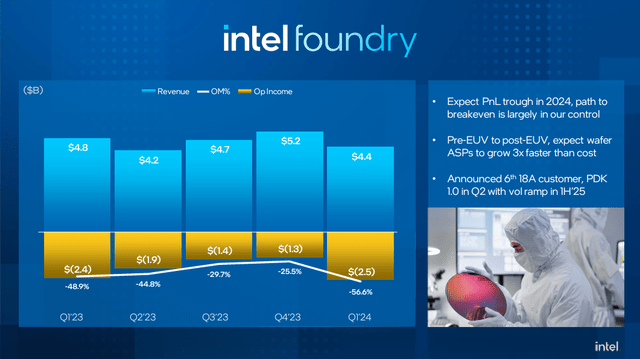

Intel Foundry Q1 Earnings presentation

For decades, Intel’s foundry operations have primarily aimed to benefit the Intel Product Group. This setup leads to numerous inefficiencies, this is evident on the $7B Losses they have generated in 2023

As Intel goes through its learning curve of being an external foundry and ramps up Post-EUV Nodes for Intel Products, which have higher ASP, along with the recent foundry wins. I believe that Intel Foundry’s target of breaking even by 2027 is achievable.

This is a quote from Intel CFO David Zinsner from Intel Q1 2024 Earnings Transcript

Of course, revenue will be part of that. But a lot of that is within our control. It’s things like 18A wafer pricing growing at 3x the cost of 18A that will help drive margins. The pull-in of tiles, as Pat mentioned, internally is going to drive better gross margins for us over time.

Intel Products Profitable!

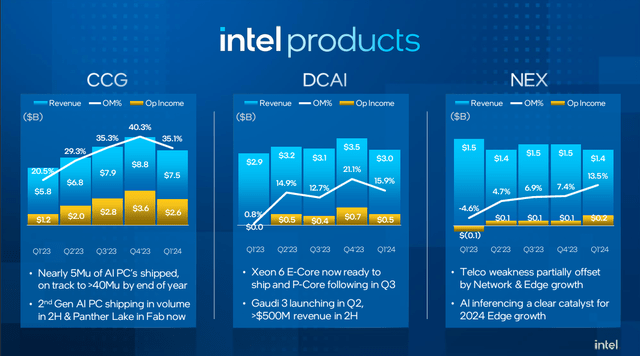

Intel Product Q1 Earnings Presentation

CCG continued to perform well with consistent quarter-over-quarter growth in 2023. I expect Intel CCG to achieve year-over-year growth from the client group, particularly with the high-volume ramp of Meteor Lake, the upcoming release of Microsoft Windows 12 and Microsoft Copilot utilizing NPU is expected to serve as a catalyst for the upcoming PC refresh cycle.

I expect DCAI’s revenue to experience high single-digit year-over-year growth for this year, with Emerald Rapids ramping up alongside the launch of Gaudi 3, Sierra Forest, and Granite Rapids acting as tailwinds. However, significant revenue from these 3 products will be next year, once ramp up goes to High-Volume. Networking and Edge Group(NEX) currently faces elevated inventory and Intel expects that to go through the rest of the year with improvement at the start of 2025.

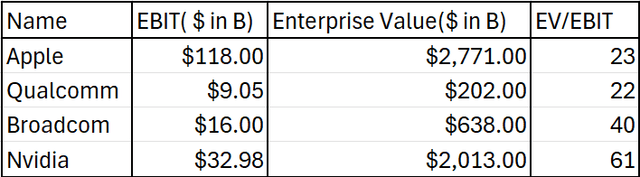

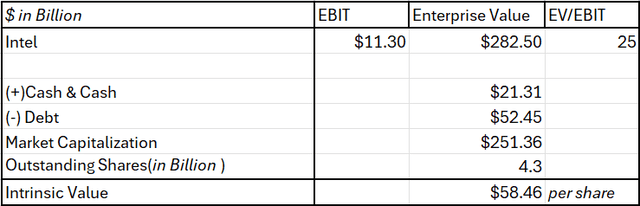

Valuation

To valuate Intel, I will use relative valuation using EV/EBIT multiplier to determine Intel’s Intrinsic Value. With Nvidia clearly the outlier among the four companies mentioned, given its insanely high growth potential, we will use the average of Apple, Qualcomm, and Broadcom to determine the appropriate multiple for calculating the enterprise value of Intel. Both Apple and Qualcomm currently operate in a low-growth mobile industry, like Intel with its client segment. To account for the potential of Intel in the DCAI market, I will use a conservative 25x multiple to determine its enterprise value.

Intel New Segment reporting presentation Author’s Intrinsic Value Calculation

With an intrinsic value of $58 per share, it is currently 45% undervalued based on the current stock price. The rationale behind this intrinsic value is the assumption that the market will eventually put an appropriate valuation on Intel’s Product business, Intel Foundry will eventually break even or be spun off. At the current stock price, we are essentially buying Intel Foundry, the future, along with its other businesses, NEX, Mobileye and Altera, for free.

Risk

Competition

With all the points mentioned earlier, competition is also reacting. AMD and Qualcomm are releasing their own client CPUs with the same goal, integrating AI into your PC. In addition, AMD and ARM server CPUs continue to pressure Intel with their high core count server offerings.

TSMC will continue to dominate the leading edge for the foreseeable future, unless Intel can offer a value proposition that entice customers to switch from TSMC. I expect revenue growth for Intel foundry will mostly come from Intel Internal Products, AI chips.

Long Lead Times on Building New Fabs

According to Intel, it could take 4-5 Years to build a leading edge fab and 1-2 years to prepare it to manufacture chips. It’s crucial to acknowledge that significant changes can occur within this timeframe. Assumptions made at the outset may entirely diverge from the reality experienced 5 years down the line. Intel already learned a hard lesson with this after forecasting a rosy revenue growth in Intel Businesses back at their Investor Day, which we all know how it turns out.

Share Dilution

With a significant amount of capital being invested into new fabs, there may be no buyback to offset the stock dilution due to Intel’s share-based compensation program for the foreseeable future.

Conclusion

Although Intel is currently facing a lot of challenges, I believe that Intel is pursuing the right strategy by not attempting to directly challenge the entrenched incumbents in an established industry, where statistically the majority fail. Instead, Intel is leveraging its existing strengths to shift the battle away from the leader’s main strengths and take advantage of high-growth opportunities. With the current stock price of $30, I believe that given with all its potential, it is currently priced in a way where you are essentially acquiring its other businesses and future for free.