Intel Corporation (INTC -2.10%) stock lost 12% following the release of its fourth-quarter and full-year 2023 earnings report. Although the 10% revenue growth in Q4 appeared promising, the revenue outlook for Q1 did not meet investor expectations.

Still, the semiconductor stock has risen by more than 45% over the last year even when accounting for the post-earnings decline. This conflict may leave investors wondering whether Intel’s stock-price growth had gone too far or if the drop represents a hiccup in an otherwise robust recovery.

The state of Intel

Admittedly, Intel investors have seen little reason for optimism over the last few years. Industry changes and a lead in artificial intelligence (AI) led to Nvidia becoming the leading semiconductor stock. Also, Intel losing its technical lead in the CPU space led to market-share gains for AMD and a need to turn to Taiwan Semiconductor (TSMC) to produce its most advanced chips.

However, Pat Gelsinger returned to the company in 2021 and became Intel’s CEO. Gelsinger set a plan to regain Intel’s technical lead by 2025. This has not yet occurred, but its Emerald Rapids Xeon and Meteor Lake processors have significantly closed the gap. Also, its integrated GPU (iGPU) could significantly boost its data center and AI capabilities.

Additionally, Gelsinger founded Intel Foundry Services (IFS), seeking to upgrade its foundries and open its manufacturing capacity to outside clients. IFS is already the ninth-largest third-party chip producer in the world, according to TrendForce. Among its clients are Amazon, Cisco, and the Department of Defense.

Intel’s financials

Nonetheless, these plans have come at a significant cost. The company announced an intent to spend $100 billion on U.S. manufacturing capacity. It also plans to spend up to 80 billion euros ($87 billion) to add capacity in Europe over the next decade.

Amid struggles for both the company and the industry, Intel’s $54 billion in revenue for 2023 fell 14% yearly. Also, the company reported $12 billion in negative free cash flow for 2023 and an additional $4.1 billion in negative free cash flow the year before. With that, Intel slashed its dividend in early 2023 from $1.46 per share annually to $0.50 per share. That move saved Intel $2.9 billion last year.

However, its financials have shown signs of improvement. The $12.2 billion to $13.2 billion in revenue forecast for the first quarter of 2024 may have disappointed investors, but it would represent a 9% yearly increase at the midpoint. That predicted increase would also continue an uptrend as Q4 revenue rose 10% to $15 billion.

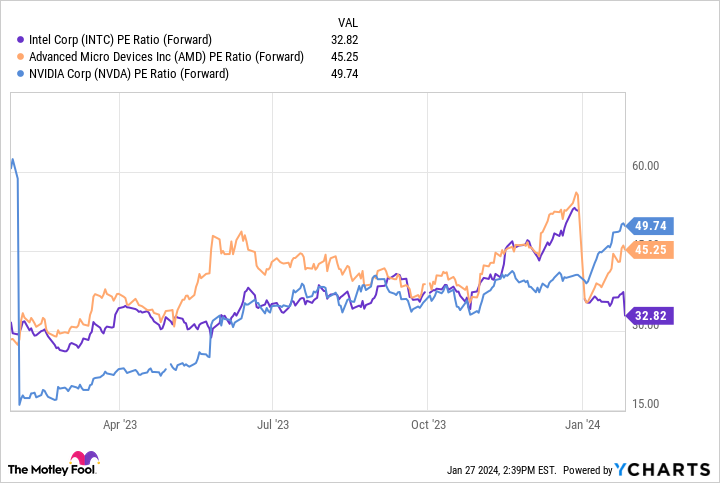

Additionally, the early success of the foundry business and its data center and AI chips had stoked investor optimism, leading to the yearly growth in the stock. Also, the forward price-to-earnings (P/E) ratio of 33 means it sells at a significant discount over its major competitors in the chip-design space. Such factors may persuade some investors to consider buying Intel on the dip.

INTC PE Ratio (Forward) data by YCharts.

Consider Intel stock

Although Intel’s lower-revenue outlook failed to meet investor expectations, it is more than likely a temporary setback and a buying opportunity.

Admittedly, the company has work to do before matching the technical prowess of its peers. Nonetheless, its chips have shown considerable improvements, and its success in the foundry business has attracted prominent clients. Since the recent sell-off allows investors to buy Intel at a discount, they stand a higher chance of earning market-beating returns from the stock.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Will Healy has positions in Advanced Micro Devices and Intel. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Cisco Systems, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.