JHVEPhoto

Investment Thesis – Q4 FY23 Update

Intel is a semiconductor firm that faces multiple headwinds moving into 2024. Decreased demand for their x86-based chips has hurt Intel’s revenues and profitability significantly while a soft computing landscape has further hurt the firm’s bottom- and top-line.

While their IFS business has the potential to generate massive returns for the company in the long run, the segment still requires huge amounts of capex to reach an economically competitive scale.

The solid 22% rise in valuations since I last wrote about Intel has left shares trading at around a 10% overvaluation.

Therefore, I now change my rating to a Sell and believe better opportunities exist for value-oriented investors.

Company Background

Intel is an American semiconductor chip design and manufacturing company. Intel is the original developer of the x86 chip architecture present in most current-day personal computers (PCs).

The firm has also recently begun diversifying its product portfolio to include graphics processing units (GPUs) in a bid to enter into direct competition with NVIDIA (NVDA) and AMD (AMD).

In 2021 Intel established their new “Intel Foundry Services” (IFS) business. This expansion into the foundry business has been launched with the intent of becoming the second-largest foundry in the world by 2030.

This new business is intended to directly compete with Samsung (OTCPK:SSNLF) and Taiwanese TSMC (TSM) by offering technology companies a more geopolitically secure alternative to their current semiconductor supply chains.

While Intel’s vertical expansion in the semiconductor industry may be lucrative, the process of achieving these lofty goals will require huge amounts of time and capex.

Economic Moat – Q4 FY23 Update

I conducted a full in-depth analysis of Intel’s business structure, processes, and moatiness back in September 2023. To gain a true understanding of their operations, I recommend reading that article here.

In this update piece, I would like to cover some key business developments within their Client Computing Group (CCG) segment along with progress in the expansion of the IFS business.

Intel’s newest set of Core Ultra processors built on Intel 4 processes has just been launched. The firm hopes tight AI integration with Microsoft’s newest versions of the Windows operating system will allow their processors to beat rivals in performance and efficiency.

However, many new independent performance testing reports have noted that Intel’s newest CPUs have delivered underwhelming performance in a large number of real-world tests often being beaten by rivaling chips made by AMD and Qualcomm.

The x86 architecture still being pursued by Intel struggles to meet the efficiency possible in the ARM CPU architecture developed and licensed by ARM to the likes of QUALCOMM (QCOM), Apple (AAPL), and Microsoft (MSFT).

A failure to match performance of rivals could ultimately see Intel’s mobile PC chips become obsolete, especially if the next version of Windows is fully optimized for ARM-based processors.

While I still see Intel’s enduring relationship with PC manufacturers as positive, I believe there are sufficient signs to suggest the firm is struggling to develop its own lineup of consumer-grade chips at the same pace as rivals.

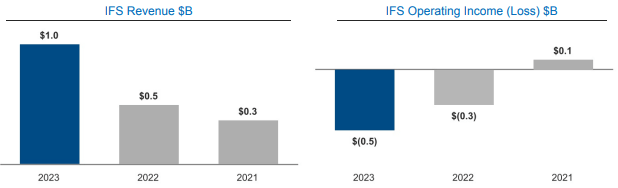

Intel’s IFS business segment continues to grow at a rapid pace. The firm has continued to gain new customers for their foundry services resulting in 63% YoY revenue growth.

A partnership with United Microelectronics Corporation (UMC) on the development of a 12-nanometer semiconductor process platform designed for high-growth mobile, communications infrastructure, and networking applications further increases the robustness of the business segment in the long run.

Despite these gains, operating losses continued to mount for the business in 2024, as significant capex and investment are still required to achieve a sufficient scale of operations for IFS to be competitive and profitable.

The lack of ability for intel to generate profits from this business while simultaneously having to further increase investment into IFS is not surprising given their growth ambitions. Nevertheless, I am reluctant to assign any real moatiness to this business segment until A-tier customers such as Apple or Microsoft partner up with IFS.

Given the continued perceived degradation in the performance offered by Intel’s newest CCG products and the steady yet still insufficiently groundbreaking progress made by IFS, I am obliged to objectively downgrade Intel’s moat rating from wide to moderate.

Financial Situation – Q4 FY23 Update

Intel has had a few difficult years from a profitability perspective as the investment ramp-up into their IFS business has coincided with a post-pandemic drop in PC demand.

This has left Intel’s gross, operating, and net margins down by almost 50% relative to 2019 figures along with negative FCF and relatively muted net income figures.

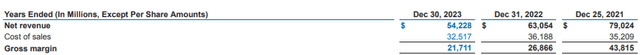

INTC FY23 Q4 10K

The Q4 FY23 report is no different with Intel seeing net revenues down 11% to $54B in FY23 compared to $63B the year prior and $79B in FY21. Gross margins have contracted by over 50% over the last two years as COGS have stayed essentially unchanged.

This drop has come as a result of poor performance across Intel’s CCG, DCAI, and NEX segments, impacting revenues significantly despite solid YoY gains by IFS.

Despite some slightly mixed reviews around recent generations of Intel consumer-grade CPUs and GPUs, the firm’s CCG segment saw solid 33% growth YoY in Q4 thanks to a decent holiday season PC market and some new chip releases.

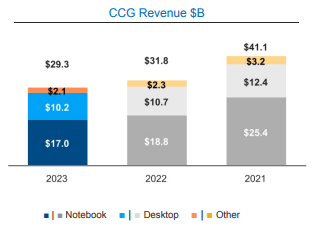

INTC FY23 Q4 10K

Nevertheless, Intel’s revenues in the CCG segment continue to fall dramatically YoY as a result of decreased demand for desktop CPUs and increased competition from Apple, AMD, and Qualcomm chips in mobile computing.

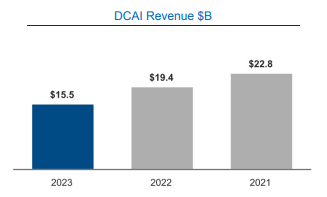

INTC FY23 Q4 10K

A similar situation occurred in their DCAI segment with revenue down 20% YoY to just $15.5B driven by a decrease in server volume demand. A softening server CPU data center market has also impacted Intel tangibly.

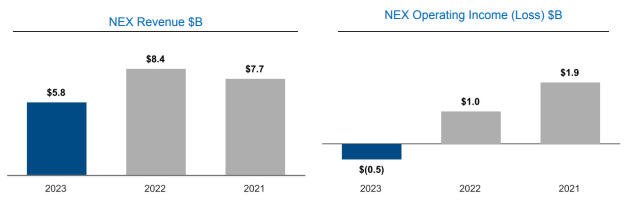

INTC FY23 Q4 10K

Intel’s NEX segment also saw muted revenues and very lack luster operating income in FY23. The $2.6B drop in revenues was a result of tempered customer purchases as a recessionary environment impacts the propensity for firms to update their network infrastructure.

The losses made by the NEX segment come as a surprise to me. Intel claims these were due to lower product margins driven by lower revenues. Such a lack of profitability from a once healthy business segment is concerning and suggests Intel is struggling to find sufficient volume for its network products.

INTC FY23 Q4 10K

IFS continued to grow rapidly in revenues YoY thanks to a significant ramp-up in operations. The higher packaging revenues continue to be offset by the massive spending required to drive the business’ growth, which is to be expected for at least another few years to come.

INTC FY23 Q4 10K

The poor segment results across the board have left Intel with just $93M in operating income and a net income of $1.68B. This is in stark contrast to even FY21 when Intel made a massive $19.5B in operating income.

Such a massive degradation in profitability and revenues cannot be ignored due to the universal nature of the issues. Essentially all of Intel’s key business operations have suffered over the last few years due to the firm being too slow to adapt to a changing market landscape and increasing levels of competition.

I believe Intel’s manufacturing operations have significantly degraded the firm’s ability to generate profits from its operations during PC market downturns due to certain levels of scale being required to operate these fabrication processes efficiently.

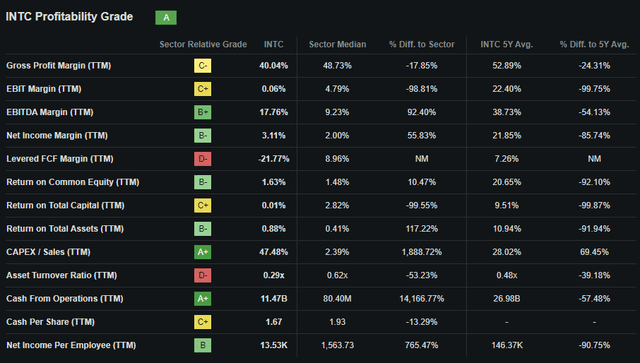

Seeking Alpha | INTC | Profitability

Seeking Alpha’s Quant assigns Intel with an “A” profitability rating. I believe this is quite an optimistic summary of Intel’s current profit generation abilities considering the losses the firm has posted for FY23.

I also begin to find Intel’s balance sheet a little concerning. The firm currently has $43.3B in current assets with current liabilities amounting to $28.1B. This leaves the firm with a current ratio of 1.54x and a quick ratio of 1.01x.

Total assets amount to $191.6B with total liabilities just $81.6B. The firm has $106B in total shareholders’ equity. This leaves the firm with an excellent debt/equity ratio of 0.47x and a financial leverage ratio of 1.81x for FY23.

While these metrics initially suggest Intel’s capital allocation is sound, the reality of their situation could not be further from the case.

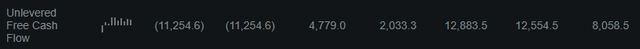

Seeking Alpha | INTC | Cash Flow Statement

Considering Intel’s unlevered FCF for FY23 was -$11.3B along with their total cash and equivalents dropping by $4B YoY to just $7.08B, the firm does not have the resources required to fund their massive investment in the IFS business.

While I still think IFS is the key to Intel’s long-term profitability, it is clear that Intel will require a huge amount of external financing to achieve the growth planned for its IFS business.

Intel will most likely receive a large portion of funds from planned U.S. incentive programs along with other strategic partnerships. Nevertheless, there is a real possibility that the firm will be forced to take on significant long-term debt which could undermine their traditionally sound balance sheet strategy.

INTC FY23 Q4 10K

Intel has about $50B in long-term debt with a majority being due after 2029. I believe this gives Intel sufficient breathing space to get their IFS business up and running thus generating sufficient cash flows to finance these debentures.

However, given the significant investment still required by Intel to ensure their IFS business can reach an efficient scale, I am not optimistic about their overall long-term debt profile and believe a significant increase will occur in their debt levels over the next five years.

Moody’s affirms their A2 credit rating for Intel for their senior unsecured domestic notes. The outlook is stable. A2 is classified as credit obligations which are “judged to be of upper-medium grade” and “low credit risk” by Moody’s.

Intel’s 2024 outlook is also slightly disappointing with the firm forecasting the March quarter to see revenues fall to around $12.5B. While management remained optimistic on the Q4 conference call about the firm’s long-term prosperity, 2024 looks set to be a challenging year for the firm in my opinion.

Overall, I believe Intel is facing a difficult reality at the present time. The firm’s loss of competitiveness in the PC market has coincided with the ramping-up of the IFS business leaving Intel’s revenues and margins in a degraded state all the while significant capex and investment are required.

I believe this will tangibly degrade Intel’s balance sheets, which will make the firm more reliant on potentially volatile external funding.

Valuation

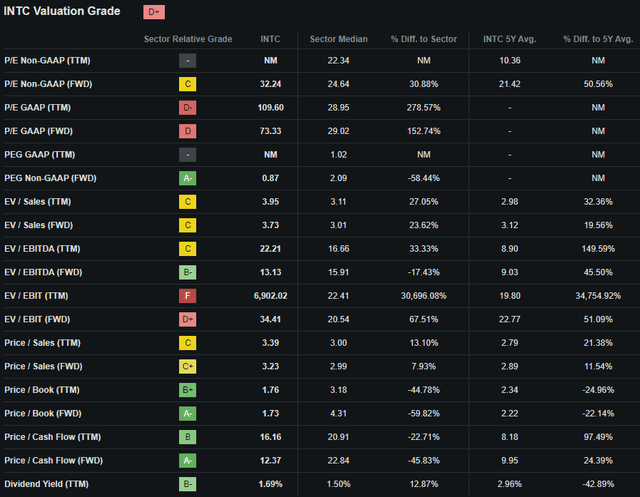

Seeking Alpha | INTC | Valuation

Seeking Alpha’s Quant assigns Intel with a “D+” Valuation rating. I believe this is an accurate representation of the value present in Intel stock today due to the uncertainty regarding the time required for the firm to return to profitability.

The firm currently trades at a P/E GAAP TTM ratio of 109.66x along with a P/CF TTM of just 16.16x. This massive P/E ratio comes as Intel struggles to generate positive earnings from its operations and helps illustrate just how pricey shares currently are.

Their TTM EV/EBITDA of 22.21x is a little elevated to my liking especially when considering their EV/Sales TTM of 3.95x is already 32% higher than their 5Y average.

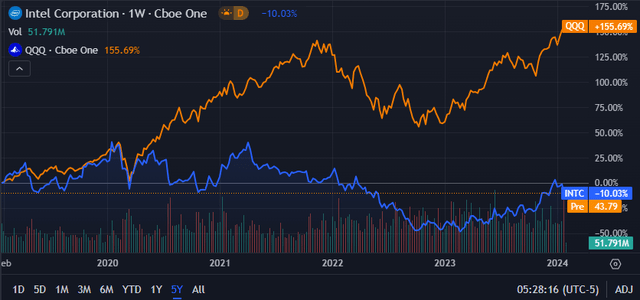

Seeking Alpha | INTC | 5Y Advanced Chart

Considering a 5Y chart, Intel shares are trading at relatively low valuations. Over the last 5Y, the firm has produced -10% returns with a mid-2021-2022 selloff resulting in significant valuation degradation.

Of course, it must be noted that in FY21 Intel was extracting significant margins from their business and was still enjoying real competitive advantages in their CCG market.

Over the last 5Y Intel has soundly been outperformed by over 160% by the popular tech fund QQQ which tracks the Nasdaq 100 index.

Seeking Alpha | INTC | 3M Advanced Chart

Over the last 3M shares rallied over 40% thanks to a solid bull run that lasted surprisingly long. Nevertheless, the massive 15% drop in valuations as a result of the disappointing Q4 results has placed some downward momentum on shares.

The Value Corner

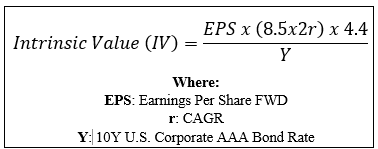

To gain a better understanding of the value present in shares from an objective perspective, I’m going to utilize The Value Corner’s specially formulated Intrinsic Value Calculation (IVC).

Using Intel’s current share price of $43.84, an estimated 2024 EPS of $1.36, a conservative “r” value of 0.11 (11%), and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 4.74x, I derive a base-case IV of $40.80. This represents an 8% overvaluation in the firm.

When using a more optimistic CAGR value for r of 0.14 (14%) to reflect a scenario where Intel aces the execution of new processes, fabs, and consumer chips, Intel appears to be undervalued by around 10% with an intrinsic value of $48.90 per share.

Considering both the base and best-case valuations, I believe Intel is currently trading at what is a fair valuation. The firm is not the semiconductor powerhouse it was even two years prior and is facing some tangible headwinds moving into 2024.

In the short term (3-12 months), I find it difficult to say exactly what may happen to valuations. While shares appear fairly valued after the post-results selloff, any further negative catalysts could result in continued downward pressure.

In the long term (2-10 years), I believe Intel will achieve its goal of becoming the second-largest fab in the world. Their more limited geopolitical risk profile should prove advantageous against competitors TSMC while support by the U.S. and EU could allow Intel to innovate at a rapid pace.

Nevertheless, the road to achieving such successes is fraught with pitfalls and ongoing concerns that create real uncertainty around the exact timeline for Intel’s turnaround.

Risks Facing Intel – Q4 FY23 Update

Intel still faces material risks with the primary factors coming from competition within their CCG segment and the potential for IFS to struggle to achieve profitability.

To read an in-depth analysis of these threats, please refer to my previous article here.

In this update, I would only like to discuss the continued increase of competition facing their CCG business segment.

Quite simply, it appears Intel’s x86 processor architecture is beginning to become slightly outdated. ARM-based processors are now beginning to surpass Intel’s CPUs both in terms of power and efficiency.

This places real pressure on Intel’s dominance within the mobile PC market. The 2010s saw Intel benefit from an essential monopoly within this space with limited competition coming from AMD in the market.

In 2024 Microsoft, Apple, and Qualcomm are all expected to release more of their own ARM-based mobile chips that could offer customers massive performance and ultra-long battery life compared to Intel’s x86 architecture CPUs.

Furthermore, multiple reports suggest Microsoft’s next version of Windows will fully support ARM-based CPUs which would only further fuel the adoption of these processors in PCs.

Therefore, I believe Intel’s CCG segment now faces further risk from ARM processors overtaking their own processors in the mobile computing space.

I believe Intel’s ESG risk profile has not changed and see no real threats in these categories for the firm.

Summary

Intel’s struggles have continued in FY23 with a disappointing set of Q4 results undoing some of the appreciation in share prices achieved in 2023.

While I still believe the firm has a compelling business case for the future, it is undeniable that Intel faces multiple headwinds heading into 2024. A relatively uncompetitive set of CCG products and a softening demand environment for computing products place pressures on Intel’s profitability and ability to finance its growth prospects.

When combined with a valuation that suggests shares are trading somewhere near a fair price, I find it impossible to advocate building a position in the chip giant at the current time.

Therefore, I must double downgrade my rating from a Buy to a Sell as the current valuation is too dear given the headwinds currently facing Intel.