SOPA Images/LightRocket via Getty Images

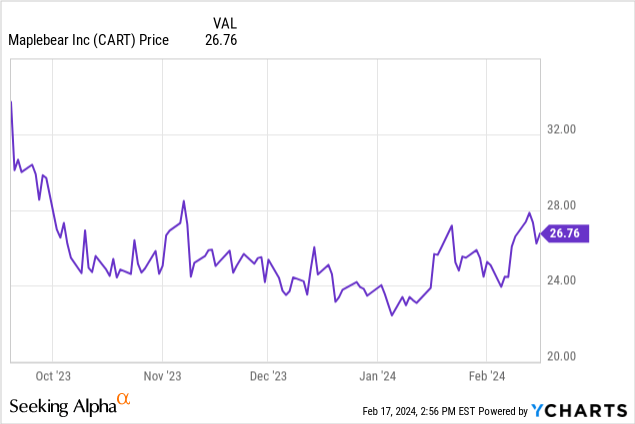

Instacart (NASDAQ:CART) is a chief example of a company that was celebrated and much anticipated for an IPO during its time as a public unicorn, but largely forgotten as a public stock. With single-digit growth rates and a “boring” consumer business, most investors have ignored Instacart and moved onto shinier AI plays.

But in my view, there’s a lot to like here. In an expensive stock market, Instacart is delivering real profit expansion and trades at very modest valuation multiples. It also recently delivered very strong Q4 results that showed continued slim-downs in opex alongside consistent order growth. With the stock still down ~10% from its IPO levels, I remain a fervent buyer here.

The bull case for Instacart is still vibrant

I last wrote a bullish article on Instacart in November, when the stock was trading closer to $25 per share. Instacart has appreciated since then, but not nearly as much as other stocks in the tech sector. At the same time, the company has made a number of operational improvements that should be lauded. All in all, I remain quite bullish on this stock.

First, we should note that the company recently decided to lay off 250 employees, or roughly 7% of the company’s total headcount. Instacart is following the lead of many other tech stocks in a “year of efficiency” (which is really spanning across multiple years now), and these actions will further boost Instacart’s bottom line.

Second, and perhaps more meaningfully, the company has continued to reduce barriers to using the platform. For example, the company has now integrated a wide swath of grocery store loyalty/membership programs, removing the disincentive to use Instacart. And starting in Q4, Instacart is now also accepting HSA/FSA payments for eligible products, further removing the need to shop directly at a store to make use of full benefits. Now more than ever, shopping on Instacart delivers the same experience and benefits as shopping directly.

For investors who are newer to Instacart, here is my full long-term bull case for this company:

- Tremendous market opportunity with the grocery sector relatively underpenetrated by tech. There’s a rule in the tech sector that companies should tackle big problems only, and the grocery industry is anything but small. Instacart addresses a $1.2 trillion grocery industry in the U.S. alone, of which only 12% is conducted online (that share, however, has quickly quadrupled from 2019).

- Prominent network effects among brands, retailers, and consumers. Instacart has a strong business development engine, connected to over 80,000 stores across the country. It has also built direct relationships with consumer-products brands who advertise within the application. It is also branching out overseas, recently inking a partnership with Whole Foods Canada.

- Advertising revenue opportunity. Ad revenue is growing more quickly than transaction revenue, and represents a huge (and high-margin) source of revenue growth for Instacart. Today, ad revenue represents less than one-third of overall revenue.

- Profitability is in its bones. Unlike many other technology companies, Instacart was profitable before it went public. The company has continued to slide up its adjusted EBITDA margin with scale, as the company benefited from fee increases that it passed on to consumers successfully last year. Recent layoffs will also help to boost the bottom line.

Valuation update

And in spite of these strengths, Instacart still trades quite cheaply in my view. At current share prices near $26, Instacart has a market cap of $7.50 billion. After we net off the considerable $1.74 billion of cash and marketable securities on Instacart’s most recent balance sheet, the company’s resulting enterprise value is $5.76 billion.

The company has not issued full-year guidance yet, only guiding to 7-10% y/y GTV (gross transaction value) growth in Q1 (an acceleration vs. 7% growth in Q4, wherein revenue growth was also similar at 6% y/y – all else equal, we’d expect revenue growth to accelerate as well) and $150-$160 million in adjusted EBITDA. Consensus, meanwhile, has a full-year revenue target of $3.28 billion for the company, representing 8% y/y growth. If we assume a 21% adjusted EBITDA margin on this revenue target (flat to FY23, which doesn’t intake any benefits from revenue accelerating or layoffs reducing opex), adjusted EBITDA in FY24 would be $689 million.

This puts Instacart’s valuation at just 8.4x EV/FY24 adjusted EBITDA. We should note as well that the company recently authorized an additional $500 million for its buyback program, bringing the total to $1 billion – an excellent use of its considerable balance sheet resources and takes great advantage of low current share prices. Think about it opportunistically – Instacart sold shares at $30/apiece in its IPO, and is now buying shares back at more than 10% below those levels: ignore current market sentiment and keep riding the potential rebound here.

Q4 download

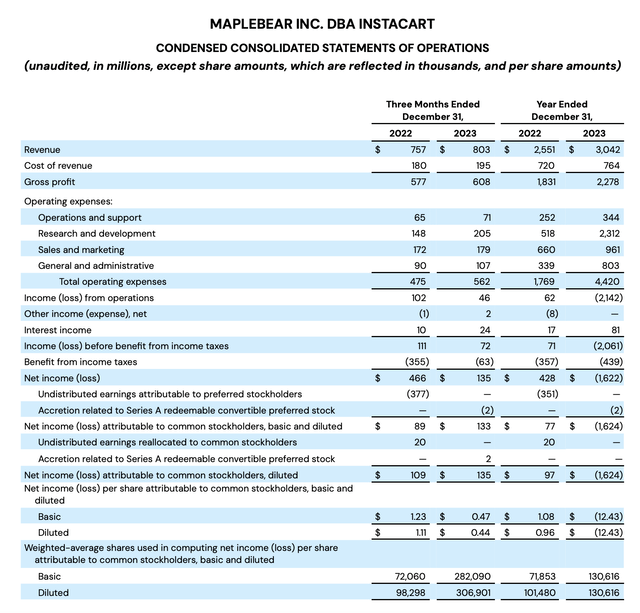

Let’s now go through Instacart’s latest quarterly results in greater detail. The Q4 earnings summary is shown below:

Instacart Q4 results (Instacart Q4 shareholder letter)

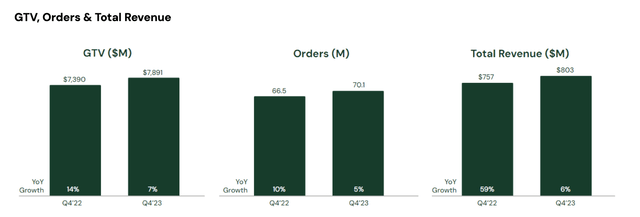

Revenue grew 6% y/y to $803 million, roughly in line with Street expectations. The company cited strong orders ahead of the holiday season. As shown in the chart below, GTV also expanded 7% y/y to $7.9 billion:

Instacart top-line metrics (Instacart Q4 shareholder letter)

As a reminder, the company expects GTV to accelerate to 7-10% y/y in Q1 (though note that the company is citing some small benefit in Q1 due to Leap Day, or February 29, in the quarter adding a day of sales).

Management also believes it has gained market share versus competitors. Per CEO Fidji Simo’s remarks on the Q4 earnings call:

In short, with every order we complete, we’re getting better and smarter, which allows us to reinvest and generate even more orders. This virtuous cycle enabled by our scale and combined with our leadership position, makes it incredibly hard for any other player in the industry to replicate the experience we deliver. That’s why we continue to deepen our lead over competitors.

Based on supported data, we increased our share of sales amongst digital platforms in Q4 and in 2023, with more than 50% of share of small baskets under $75 and more than 70% share of large baskets over $75.”

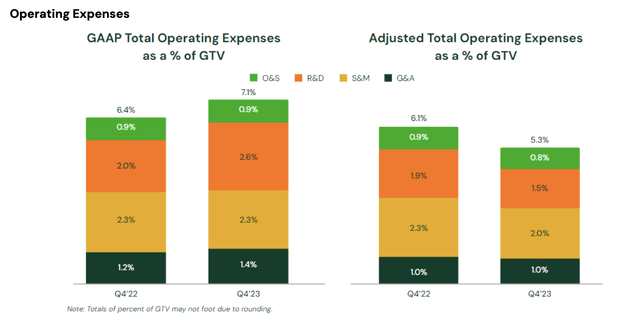

From a profitability standpoint, Instacart managed to shave down opex (adjusted for stock-based comp) down to 5.3% of GTV, an 80bps improvement over the prior-year quarter:

Instacart opex savings (Instacart Q4 shareholder letter)

Note that the company expects profitability as a percentage of revenue and GTV to improve in FY24, driven in no small part by the company’s layoff decisions. It’s important to note that Instacart’s layoffs don’t just impact the rank and file, but the company also let go of its COO and Chief Architect roles, with no plans to backfill them.

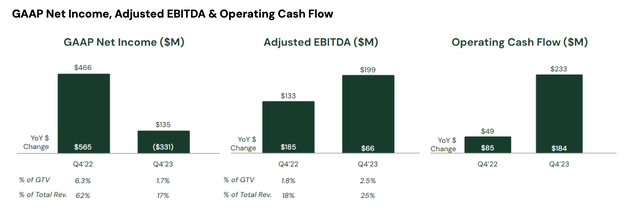

Adjusted EBITDA in Q4 grew 50% y/y to $199 million, representing a 25% adjusted EBITDA margin: 7 points better than the year-ago quarter.

Instacart profitability (Instacart Q4 shareholder letter)

The company also generated an enviable $532 million of free cash flow in FY23 at a 17% margin, providing considerable resources to keep funneling share buybacks on top of an already cash-rich and debt-free balance sheet.

Key takeaways

Though Instacart is firmly out of the tech limelight, I continue to view this stock as a company that offers consistent growth and meaningful profit expansion. Single-digit adjusted EBITDA valuation multiples provide ample downside cushion here in case the broader market turns south again. Now, low single-digit growth rates and greater adoption of grocer-owned shipping programs (like Amazon Fresh) are risks here, but I continue to see more reward than risk in buying Instacart in the mid-$20s.