Koldunova_Anna/iStock via Getty Images

Just emerging from a multi-month dormancy to command the investing world’s spotlight, investors are still discussing the reasons for gold’s breakout to record highs and, more importantly, if the gold bull still has legs. The most common assumption is that the fed funds outlook is the reason for the metal’s latest strength, a point well supported by near-term interest rate expectations. However, a far bigger catalyst for gold’s demand explosion merits discussion; namely, the persistence of consumer price inflation.

Gold has always enjoyed a wide perception among investors as being not only an excellent barometer of inflationary pressure, but also as being perhaps the ultimate inflation hedge. For instance, gold prices dramatically increased in value during the inflationary times of the 1970s, rising 20-fold on the back of rising consumer prices before peaking in 1980.

Indeed, it was the wide perception that the living costs of those days were becoming unsustainable which kicked off the gold demand boom of that era, as consumers and investors alike sought ways to protect the value of their savings by owning gold.

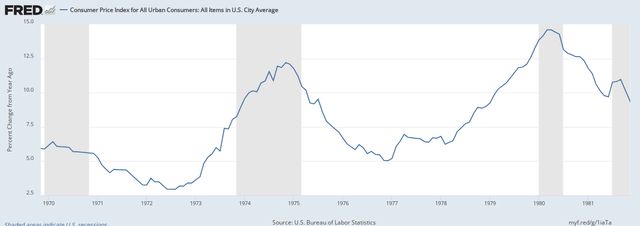

What’s more, the waxing and waning of retail level pricing in the 1970s closely corresponded to the dominant trends in gold’s price. Consider the following graph, which shows the year-over-year change in the consumer price index (CPI), one of the most commonly followed inflation metrics.

There were two major peaks in the yearly CPI rate during that decade: one at the end of 1974 and the other at the end of the decade in early 1980. In both instances, gold prices retreated sharply just as the CPI rate was reversing lower. Gold peaked just under $150 an ounce in December 1974, then peaked again at a multi-decade high around $800 at the start of 1980.

The correlation has held true throughout the last several decades, including another major CPI rate peak in late 1990 that confirmed a major multi-year downturn for gold prices into the ‘90s and a collapse of the CPI in 2008 that was accompanied by a 35% drop in gold prices that same year (which was huge by that metal’s standards).

The relationship between the CPI and the gold price isn’t always a case of the CPI leading gold lower; in fact, gold and the CPI can expand and contract simultaneously, but more often than not, gold leads the CPI by at least a couple of months. This was most recently seen in March 2022, when gold peaked at $2,050 and then promptly dropped 20% over the next seven months. The CPI rate of change, by contrast, didn’t drop until July of that year.

Regardless of whether gold leads the CPI or vice versa, the link between consumer prices and gold prices is inextricable. Most recently, we witnessed a more than 60% drop in the CPI yearly percentage change between June 2022 and June 2023—the biggest and sharpest drop since the 2008 credit crisis! Yet during this same time, gold’s price was barely changed when measured from year-to-year.

Since then, gold has remained near its record peak before breaking out to new highs in March, while CPI velocity has remained virtually unchanged. This naturally begs the question: why?

The answer is straightforward: gold is likely anticipating a coming increase in the year-over-year CPI rate (and probably a major one). We can speculate on what might be the catalysts for a resumption of consumer price increases, but the most likely candidates would be higher wartime federal spending and possible supply-chain problems.

On the latter score, the ModernRetail website opined that a “perfect storm” of supply-chain issues could adversely affect retailers worldwide, including disruptions in the Suez Canal and record drought at the Panama Canal, causing shippers to divert around the Cape of Africa. Patrick Penfield, professor of supply-chain management Syracuse University, was quoted by ModernRetail as saying:

A lot of these folks are now refueling in South Africa, and South Africa is known to have very high fuel costs for ships, almost the highest. They don’t really have the infrastructure to handle all these additional ships that are coming around the Cape of Africa.

With that said, the potential for rising retail costs are clearly on the horizon. And this, more than perhaps any single factor, accounts for the expanding interest in owning gold as an inflation hedge.

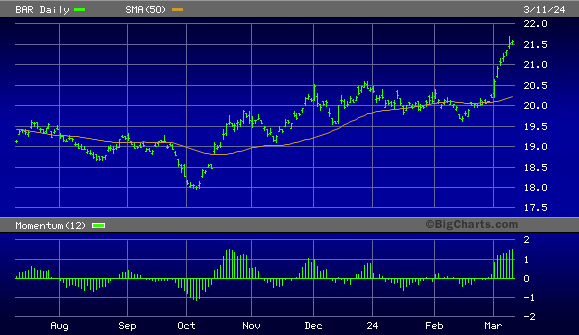

On a technical note, my favorite gold tracking fund, the GraniteShares Gold Trust (BAR), continues to benefit from the increase in safety-related demand for the yellow metal. The ETF’s price is obviously becoming stretched from its underlying 50-day moving average (one of the most widely watched—and psychologically significant—trend lines among investors). This argues for a possible pullback or “pause that refreshes” in the immediate term.

BigCharts

However, given the persistence of inflation pressures and the higher chances for even more inflation in the months ahead, any weakness in gold from here I view as a buying opportunity for long-term-oriented participants.