Andy Roberts

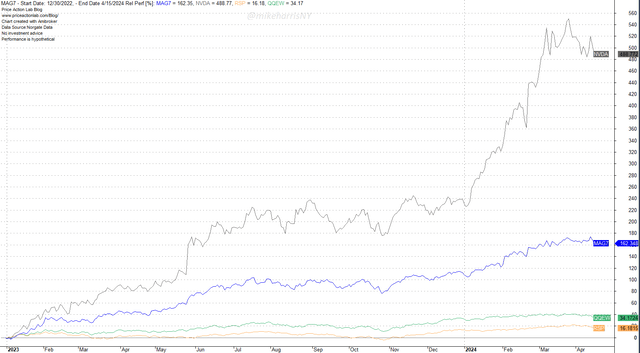

From January 3, 2023, to April 15, 2024, the magnificent seven equal-weight index has been up 162%. NVIDIA Corporation (NVDA) has contributed a spectacular 489% to the rise of this index.

Relative Performance of Magnificent 7 Equal-weight Index, NVDA, and equal-weight S&P 500 and NASDAQ-100 ETFs from January 3, 2023 to April 15, 2024 (Price Action Lab Blog-Norgate Data)

In the same period, the equal-weight NASDAQ-100 (QQEW) and S&P 500 (RSP) ETFs are up only 34.2% and 16%, respectively.

Breadth has been low and a few large-cap stocks have provided support to the market. These are the stocks that have mostly benefited from “Stage 3” inflationary growth.

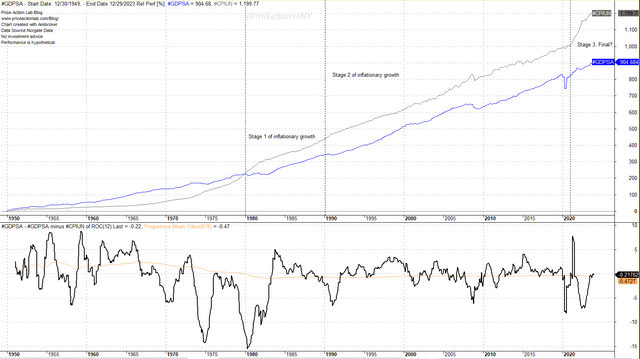

Relative performance of CPI and GDP since 1950 (Price Action Lab Blog-Norgate Data)

The notion of inflationary growth has been controversial among economists. However, there is not a single subject of economics that has not been controversial for economists, since there are wide diverging opinions based on political and ideological foundations.

The above chart shows what I label as the three stages of inflationary growth that started after the high inflation period of the 1970s. The rise of the gray line (CPI) above the blue line (GDP) occurred in early 1980 with the start of stage 1 inflationary growth. Stage 2 inflationary growth started in 1990 and powered the dot-com rally but also led to two busts and bear markets, 2000–2002 and 2008.

Inflationary growth, bubble creation, and subsequent busts are inextricably related. The architects know, and many professionals know, but the public may not fully comprehend these dynamics and their possible adverse effects on their portfolio value.

The pandemic stimulus enforced stage 3 inflationary growth. The divergence of inflation growth from GDP growth is evident in the above chart. As a result, we have the phenomenon of the magnificent 7, and cap-weighted indexes are rising despite deteriorating breadth. The bottom chart shows the difference in the 12-month rate-of-change of GDP and CPI. The difference has remained below zero since 1980, according to the cumulative average. The idea that inflation has been the driving force behind growth is one, albeit contentious, explanation. The main driver was inflation rather than productivity gains as manufacturing moved to Asia and financial engineering took its place.

Inflationary growth cannot drive equity prices up without a good narrative. In the 1990s, the narrative was the new “information highway.” This led to extreme excesses but also to some useful technology that helped the US dominate in the information technology space and global platform applications (social media, short-term rentals, ride services, etc.)

The new narrative is “artificial intelligence”. Also, in this case, something good will emerge, but will it be significant enough to prolong stage 3 inflationary growth and maintain the advantage of the US economy over global competition? More importantly, is stage 3 of inflation the final step before a great reset?

“Forecasts are hard, especially about the future,” is a phrase attributed to Niels Bohr, who invented the atomic model. All I can say is that this model of inflationary growth involves high risks of economic uncertainty and an uncle point. This is a point after which the economic system cannot function and a reset is necessary. Never before in the history of the markets has diversification in “real” assets been more important. The recent rally of gold to new all-time highs and exploding real estate prices around the world are an indication that many investors are looking for protection in “real” assets in case this new stage 3 of inflationary growth implodes.

Summary

From January 3, 2023, to April 15, 2024, the Magnificent 7 equal-weight index has seen a 162% increase, with Nvidia Corp. contributing 489% to its rise. The same period saw the equal-weight NASDAQ-100 and S&P 500 ETFs up only 34.2% and 16%, respectively. Large-cap stocks, which have mostly benefited from “Stage 3” inflationary growth, have largely supported the market. The concept of inflationary growth has been controversial among economists, with three stages: Stage 1, Stage 2, and Stage 3. The pandemic stimulus enforced Stage 3, with the difference between GDP and CPI remaining below zero since 1980. The new narrative of “artificial intelligence” is a potential solution to prolong Stage 3 inflationary growth and maintain the US economy’s advantage over global competition. The recent rally of gold and exploding real estate prices indicate that investors are seeking protection in case of a failure in Stage 3 of inflationary growth.