Bloomberg/Bloomberg via Getty Images

Fannie Mae (OTCQB:FNMA) and Freddie Mac (OTCQB:FMCC) are two companies in conservatorship retaining their earnings since September 2019 on their path out of conservatorship. Combined they now have over $125B in net worth which is an all-time record high. Since the companies have begun retaining earnings, the FHFA has been diligently preparing them to responsibly exit conservatorship. Over the years, numerous lawsuits have challenged the government’s actions during conservatorship. In August of last year, a jury decided that the government acted in bad faith when arranging the net worth sweep. Since then, prior Democratic White House housing officials have come out separately saying that the conservatorship should end as well as how they would allocate $90B to solve the nation’s affordable housing crisis. In fact, the CEO of Fannie Mae came out associating ending the conservatorship with a victory lap.

Investment Thesis

The litigation so far and the pending litigation has not and probably will not result in the legal system forcing the government to release Fannie Mae and Freddie Mac from conservatorship. The Trump administration came up 6 months to a year too short from being able to restructure and effectuate an equity offering. While I believe that it is true that if Trump becomes president again, releasing Fannie and Freddie from conservatorship is a sure thing, I think that the politics are concurrently heating up to drive Biden admin action. Further, I believe the steps the Biden administration has taken to prepare the companies to exit conservatorship points to where things are headed despite the administration not explicitly prioritizing resolving the conservatorships.

For the Biden administration to move forward with recapitalizing and releasing Fannie and Freddie from conservatorship, housing needs to gain steam as a political issue. With there being a housing supply shortage and inflation running high, this sets the stage for a victory lap where the government’s equity stake is restructured and the proceeds go to increasing housing supply and thus combating inflation. In any restructuring via recap and release where the government is able to monetize its equity position, junior preferred would be made whole and common would potentially have upside if the government decides to write down their SPSPA liquidation preference or if the equity markets value reformed GSEs with higher than historical valuations. Junior preferred shares currently trade at ~15% of face value.

Fannie Mae FY 2023 Earnings Highlights

The CEO of Fannie Mae Priscilla Almodovar pointed out that the companies have been profitable on a quarterly basis for 24 quarters in a row:

The fourth quarter capped another successful year. Fannie Mae reported $3.9 billion in net income, marking our twenty-fourth consecutive quarter of positive earnings

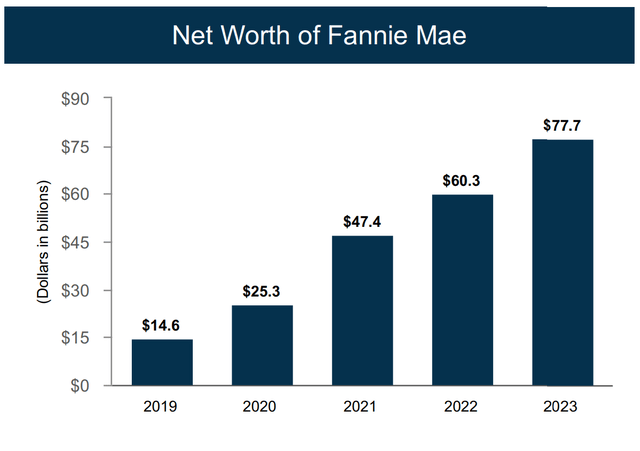

Since they have been able to retain all their earnings, their net worth has exploded higher since 2019, not bad for a company in conservatorship:

Fannie Mae Net Worth (Fannie Mae Net Worth)

Fannie Mae has been retaining tens of billions of dollars a year. The earnings press release also points out increasing home prices:

- Home prices grew 7.1% on a national basis in 2023 according to the Fannie Mae Home Price Index

This factors into higher inflation and affordability as the CEO pointed out:

It was a challenging year for housing, with higher mortgage rates, limited homes for sale, and high home prices weighing on affordability.

Should the Biden administration take action to increase housing supply and decrease mortgage rates through administrative recap and release, more Americans could find their way into home ownership.

Freddie Mac FY 2023 Earnings Highlights

The third bullet point in Freddie Mac’s 2023 earnings report summary indicates the continued benefit to Freddie Mac’s earnings of rising home prices.

- Net income of $2.9 billion, an increase of 65% year-over-year, primarily driven by higher net revenues and a credit reserve release in Single-Family in the fourth quarter of 2023 compared to a credit reserve build in Single-Family in the fourth quarter of 2022.

- Net revenues of $5.4 billion, an increase of 11% year-over-year, driven by higher net interest income and non-interest income.

- Benefit for credit losses of $0.5 billion, primarily driven by a credit reserve release in Single-Family due to improvements in house prices.

While Freddie Mac and Fannie Mae benefit from rising home prices, home prices are a large factor driving inflation. Thus, it would be a political victory to allocate money to increasing housing supply and all the more reason to believe the Biden admin would at least want to take action. Freddie Mac now has a net worth of $47.7B and has been profitable for many years and should no longer be held in conservatorship.

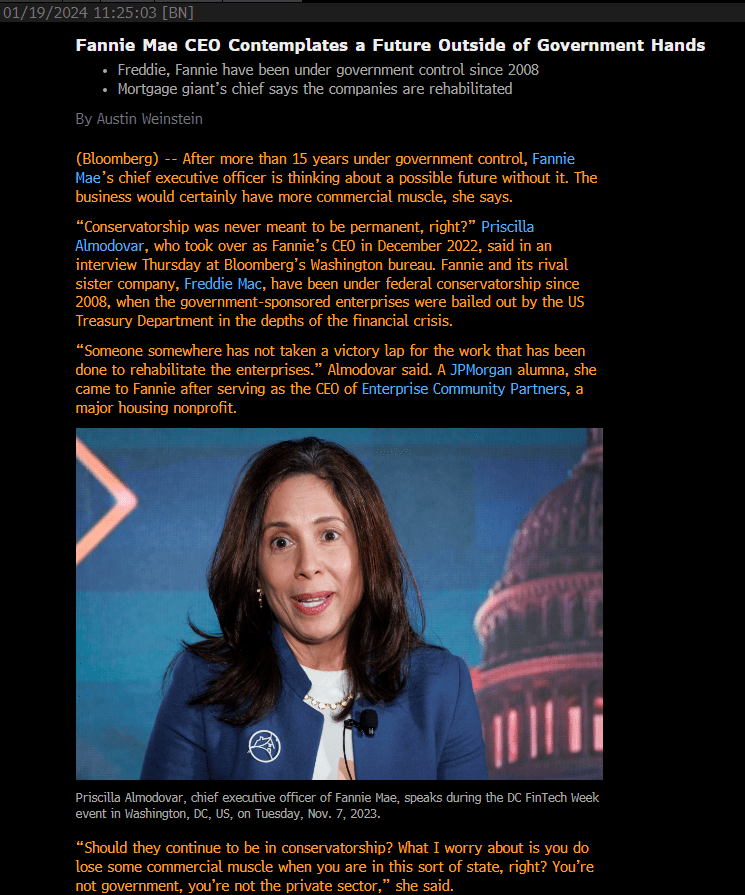

Fannie Mae CEO: Exiting Conservatorship = A Victory Lap

The CEO of Fannie Mae on January 19 equated the end of conservatorship with a Victory Lap.

Fannie Mae CEO Victory Lap (Fannie Mae CEO Victory Lap)

Prior FHFA director James Lockhart had previously told Inside Mortgage Finance that this was precisely the sort of public commentary the CEOs should be engaging in:

This was precisely the sort of public commentary that former Federal Housing Finance Agency Director James Lockhart recently told Inside Mortgage Finance the GSEs should be engaging in. He said that, despite the edict against lobbying by the GSEs, as long as they don’t ask for specific votes, it’s fine for them to educate Congress and the public about issues like the conservatorship.

Prior Democrat Admin Officials

James Parrott and David H Stevens are two prior Democratic leaders of housing finance reform issues.

James Parrott

James Parrott served as a senior advisor at the National Economic Council (NEC) in the Obama White House. He led the team of advisers charged with counseling the cabinet and president on housing issues during one of the most tumultuous times in the history of housing policy, helping them navigate through the collapse of the housing market and the early days of GSE reform. On February 12, he has written with Mark Zandi on how to solve the nation’s affordable housing crisis. He estimates that his plan would put millions of families into homes:

Taken together, these moves would trigger a dramatic increase in the supply and affordability of entry-level homes and put millions of families into position to take advantage of it.

He estimates the ultimate cost to be $90B:

This would be an aggressive effort, costing as much as roughly $90 billion over the next decade, according to our budget analysis, depending on how aggressive Congress wants to be.

Note that this $90B cost would seem to be covered by the CBO’s estimate of what the government’s warrants would be worth $100B. As such, it would seem there is a potential solution here being advocated by influential Democratic housing experts that costs about the same amount that the government would reap from ending the conservatorships.

David H Stevens

David H Stevens was the former assistant secretary of Housing and FHA commissioner under President Obama. In December, he wrote in favor of ending the conservatorships:

HERA explicitly provided guidelines for FHFA to take the GSEs out of conservatorship.

…

But ultimately FHFA has the authority – even a duty – under HERA to take the GSEs out of conservatorship, working with the Treasury which holds its preferred stock.

…

FHFA and the Treasury should release the GSEs from conservatorship as soon as possible.

David H Stevens has been advocating for the end of the conservatorships since the Supreme Court ruled that FHFA is a political agency in June 2021. My last correspondence with him before he passed last month was a message from him, “Well done” with reference to my most recent article that he contributed to. I wish we still had his voice to push this forward. Regardless of personal opinions on his message, he held a unique ability to captivate listeners. Reluctantly, I must acknowledge his prophetic accuracy, making his absence felt even more deeply.

Janet Yellen Hearing Testimony

On February 6, Treasury’s Janet Yellen attended a House Financial Services committee where she answered some questions on Fannie and Freddie:

Mr. FitzGerald: When Fannie Mae and Freddie Mac were taken into conservatorship in 2008, Treasury received warrants that give it the right to buy common stock in each of the GSEs equal to 80% of the total outstanding shares and those warrants expire in September 7 of 2028. In August of 2020 the Congressional Budget Office issued a report that estimated Treasury could receive the $190B for its Senior Preferred shares in addition to $110 billion from exercising its warrants in the GSEs. FHFA Director Thompson in the hearing last May said that the two of you have not discussed these warrants. The conservatorship has gone on for — I think you could agree — probably too long now. I am concerned that the conservatorship of the GSEs and the warrants could be used to further politicize the entities. Have you or your staff given any consideration to the monetization of Treasury’s warrants in the GSEs?

Janet Yellen: This is not a matter that I’m up to speed on. I’m not knowledgeable about this. I have a staff that spends a great deal of time thinking about it but I’ve not had a discussion with them about this. I would appreciate it if I could get back to you on this matter.

What we can see from this is that there are staff at Treasury who spend a great deal of time thinking about what to do with Treasury’s equity stake in Fannie and Freddie. Also, it is my view that Treasury is not in the driver’s seat of administrative reform. Direction would come from the White House. Who is to say why Janet Yellen’s staff has been spending all this time looking at the valuation of Treasury’s equity position. It is hard to imagine it being relevant unless there is interest from the White House.

White House National Economic Council Observations

In my view, there have been indications from within the White House that support the path of the Biden administration moving recap and release.

Prior Biden WH NEC Director Brian Deese

Brian Deese posted on twitter late last year that we need to take action on housing now.

We need more active fiscal policy on housing. We need to incentivize the building of affordable housing. We should do that now, and not admire the problem in 2025/26/27.

To provide context around the gravitas of Brian Deese and James Parrott, they both originally worked on the third amendment net worth sweep.

Bowler testified that prior to finalizing the Third Amendment, “as Treasury Staff negotiated with FHFA staff, the Treasury staff . . . would propose the National Economic Council as to developments and the two people that we proposed would be Brian Deese and Jim Parrott.

It would appear that the two leading White House officials who orchestrated the net worth sweep to keep the companies in conservatorship may be setting the stage for their exit.

WH NEC Director Lael Brainard

Lael Brainard for the first time in the Biden administration publicly addressed housing in December of last year. That’s notable in its own right. She spoke about fully utilizing their administrative authorities to address the challenge of housing affordability:

Our first major priority is increasing the supply of affordably priced homes in order to lower housing costs. We are using every lever at our disposal – legislative proposals, our administrative authorities, our convening power, and our bully pulpit – to do so.

But we cannot wait for Congress to act. Through our Housing Supply Action Plan, we are reducing barriers to housing and offering new and improved financing for affordable housing development.

In August, Daniel Hornung was promoted within the NEC as the housing guy. Further, the White House CEA director Jared Bernstein previously wrote about how to structure recap and release:

The key, then, is to a) put private capital in a “first loss” position ahead of the government, and b) set a price for the government insurance that accurately reflects and offsets the expected taxpayer costs of the backstop, something the GSEs decidedly did not do.

The White House definitely has definitely been spending more time on housing the past year. This past week Lael Brainard came out saying that they are still struggling to convince the American public that they are winning the battle against inflation and that

Americans are “fed up” with high prices for everyday purchases such as many food products and housing, and said the Biden administration would seek to push them down

The administration has the political lever through its controlling interest in Fannie and Freddie to increase housing supply and task Fannie and Freddie to buy down mortgage rates to fight inflation and increase affordability.

Recent Legal Developments

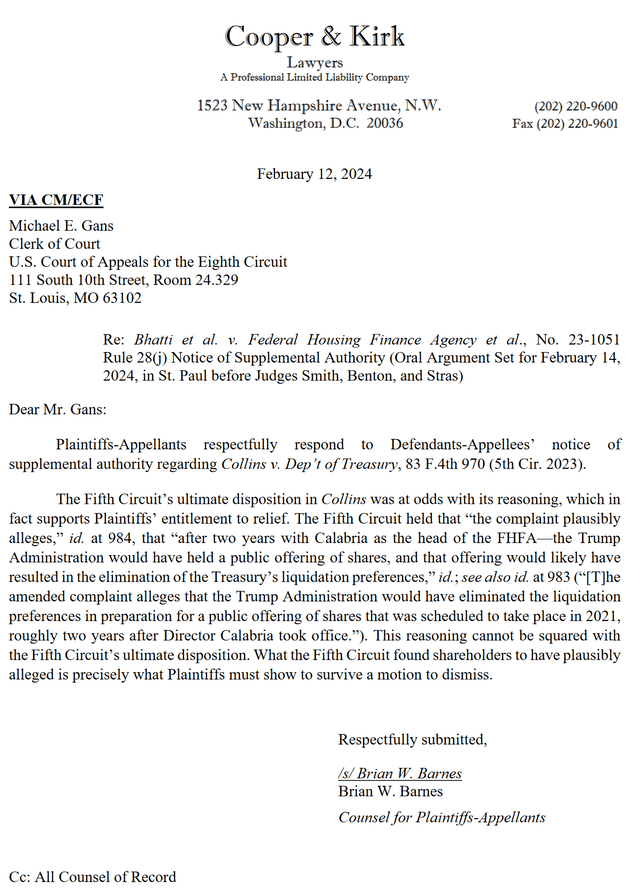

Bhatti v. FHFA had oral arguments February 14 before the Eighth Circuit that you can listen to here. If you are interested in the summary of what is going on there — they are basically disputing the Collins ruling. There is a letter that summarizes their argument below:

Eighth Circuit Court Letter (Eighth Circuit Court Letter)

So far the legal system has not been impressed with this line of reasoning in the fifth circuit. It will be interesting to see if the Eighth circuit court agrees with plaintiffs.

Timing & Catalysts

Tim Pagliara, an activist shareholder, is optimistic the Biden administration will start politicizing housing affordability and inflation and that this will bring GSE recap and release to the table as an actionable solution and that the State of the Union address by Biden will be revealing:

Bloomberg reports the recapitalization and release of the GSE’s as a “Trump” trade. I believe it is the Biden trade. March 7, SOTU is one of the latest ever scheduled. Watch Housing and the shortage of single family homes become a major theme. Biden will call for a recommitment to the American Dream of home ownership. Recap, release, monetization of the warrants will be part of the solution.

Two days before the SOTU address, Super Tuesday will likely determine Trump officially wins the Republican party’s nomination. Fannie and Freddie junior preferred shares still trade at a significant discount to his election probabilities. In theory this gap should close or there until there is less money to be arbitraged out of Shorting Trump election odds and going long Fannie and Freddie junior preferred. For those skeptical that Trump would move forward with recap and release he did write a letter saying he would have but he ran out of time:

In another Trump administration, with 5+ years of retained earnings and FHFA as a political appointee, recap and release in my view is a sure thing. This doesn’t even take into account that Fannie Mae is expected to hit statutory minimum capital on a preferred stock adjusted basis in the next year and a half. How do you keep a company like that in conservatorship?

Treasury FY 2023 Budget

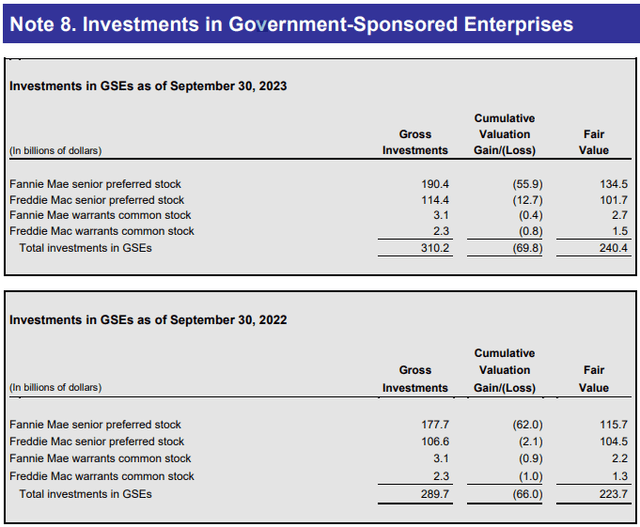

The government published its updated FY 2023 valuation of its senior preferred stock in both companies on February 15:

Treasury FY 2023 Balance Sheet Note 8 (Treasury FY 2023 Balance Sheet Note 8)

The government increased the FV of its senior preferred stock due to higher projected cash flows:

The FV of the senior preferred stock-as measured by unobservable and observable inputs-increased as of September 30, 2023, when compared to September 30, 2022. Fannie Mae’s senior preferred stock drove this increase primarily due to higher projected cash flows and a decrease in credit-related expenses.

The Treasury report continues:

To date, Congress has not passed legislation nor has FHFA taken action to end the GSEs’ conservatorships.

It looks like Treasury is blaming FHFA as the party responsible for needing to take action while FHFA is saying it needs someone at Treasury to help restructure the SPSPA agreement. Seeing as how both federal agencies are controlled by the White House, this seems more like a pending policy decision while both federal agencies wait for the green light.

Summary & Conclusion

Administrative action with respect to Fannie Mae and Freddie Mac has been a long time coming ever since Mark Calabria worked with Steven Mnuchin to begin the retention of earnings in 2019. Inflation is a real problem with rising home prices and this also exacerbates the affordable housing crisis:

One of the most important issues in the President’s economic agenda – lowering costs and increasing access to housing for Americans.

…

Our first major priority is increasing the supply of affordably priced homes in order to lower housing costs.

It would seem to me that they should want to monetize their equity position to solve the funding problem. Treasury staff seem to be actively engaged in valuing Treasury’s equity position. The companies may have $125B of net worth (All-time record high), but the government still has not officially let them go and raise capital and exit conservatorship. When they do, shareholders stand to benefit and the CBO report suggests junior preferred specifically can expect face value. The only step left to really kickstarting administrative action is raising awareness. Here’s to helping make affordable housing and fighting inflation more visible political priorities so that the government can take the victory lap.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.