A top Indian official has reportedly warned the Narendra Modi government that high tariffs on smartphone components could cost the country its ambition of becoming a export hub.

“The geopolitical realignment is forcing supply chains to shift out of China … We must act now, or they will shift to Vietnam, Mexico and Thailand,” Indian deputy IT Minister Rajeev Chandrasekhar said in government documents seen by Reuters.

“India has high production cost due to highest tariffs amongst key manufacturing destinations,” wrote Chandrasekhar wrote.

Also on AF: India’s Close Scrutiny of China Firms Worries Suppliers – Xiaomi

Smartphone manufacturing is a key plank of Indian Prime Minister Narendra Modi’s ambitions to boost the economy and create jobs.

Over the past two years, the government has succeeded in attracting companies such as Apple, Foxconn and Samsung to India, the world’s second-largest mobile market.

But lawmakers and lobby groups for Apple and other firms argue India’s high tariffs are a deterrent for companies de-risking their supply chains beyond China. Nations offering lower tariffs on components have raced ahead of India in phone exports, they say.

US Ambassador Eric Garcetti recently said foreign investments were not flowing into India at the pace they should be, and were going to countries like Vietnam instead, because of the tariffs.

“If you tax inputs … you’re not protecting a market. What you are doing is limiting a market,” he said.

“Made in India” phones use many parts made locally, but companies import many high-end parts from China and elsewhere due to supply-chain limitations. These parts are then subject to the high tariffs the government has put in place to protect the local manufacturers, raising overall costs.

“Match China, beat Vietnam”

Chandrasekhar in his documents flagged how lower taxes in China and Vietnam helped boost their exports.

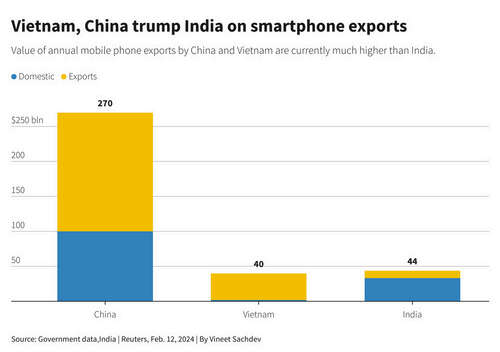

Exports accounted for only 25% of India’s smartphone production last year, compared with 63% of China’s $270 billion worth of production and 95% of Vietnam’s $40 billion worth, he said.

Chandrasekhar’s documents were addressed to India’s Finance Minister Nirmala Sitharaman last month to lobby for lower tariffs in the annual budget. The finance ministry did lower taxes on some components, including battery covers, to 10% from 15%, but did not agree to many other tariff cut requests.

India still imposes a 20% tax on parts including chargers, some circuit boards and fully assembled phones. The IT minister wanted those taxes to be reduced to 15% this year.

Chandrasekhar also argued that Vietnam and China do not levy tariffs above 10% on components from their “most-favoured nation” trading partners or nations with whom they have free-trade agreements. India does not do that and imposes “high” tariffs on many components, he said.

“We have to match China and beat Vietnam on tariffs to attract” global supply chains, Chandrasekhar wrote. “No country with high tariffs has or can attract” them.

Domestic demand ‘near saturation’

India’s smartphone production grew 16% year-on-year to $44 billion last year. That success, Modi’s government says, is mostly due to financial incentives given to companies to produce more.

India is seeking to account for 25% of global electronics manufacturing by 2029, but the official documents showed its stake was currently at just 4%, even though Apple, Foxconn and Xiaomi had all boosted production recently.

Last week, Xiaomi privately asked New Delhi to lower tariffs on more components used in cameras and USB cables, saying it will help “aligning with the competitive manufacturing economies like China and Vietnam.”

While surging local demand has helped keep the local manufacturing industry profitable, Chandrasekhar said in his letter that this “domestic market of smartphones will shortly near saturation” as users don’t change phones that often.

India’s goal to take mobile phone production to over $100 billion a year – with 50% of that exported – needs a new strategy, the minister said.

“Tariffs are becoming a hurdle,” the minister said in his presentation. “We need to shift tariff policy to suit our new ambitions. Exports, not domestic.”

- Reuters, with additional editing by Vishakha Saxena

Also read:

India to Permit Apple, Samsung, Lenovo to Import PCs, Tablets

Apple Supplier Foxconn to Spend $500m on Plants in India

Apple Bets on India’s Middle Class in Hunt for Future Markets

Xiaomi to Switch India Strategy in Bid to Rival Samsung

Israel’s Tower Proposes $8bn Chip Plant in India – Express