sommart

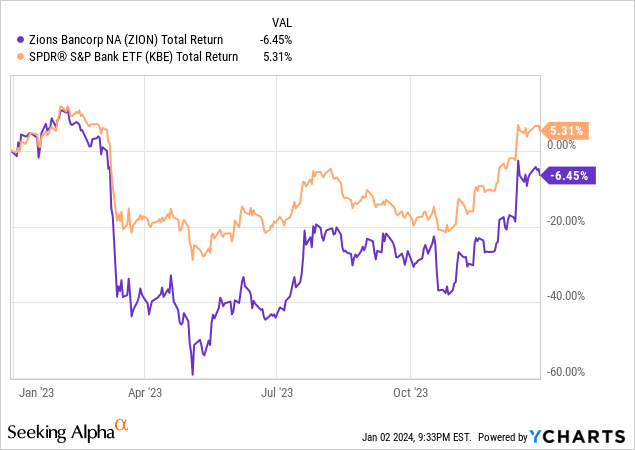

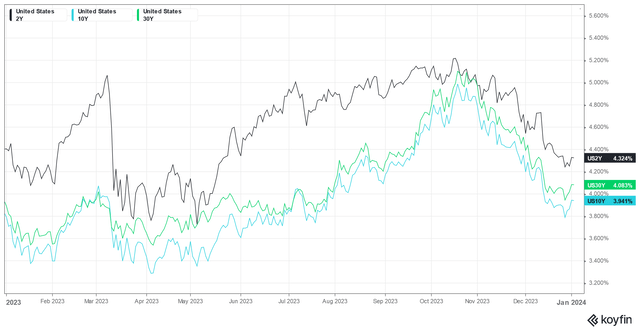

Zions Bancorporation (NASDAQ:ZION) endured a wild ride in 2023 along with many other small regional banks due to the banking crisis in March 2023 led by the collapse of Silicon Valley Bank. The main culprit was a sudden surge in long-term US Treasury yields which caused the banks’ long duration assets to devalue considerably, triggering withdrawals en masse. However, as the long-term rates peaked in October 2023 at about ~5% for the 10-year which has come down significantly to just under 4%, bank shares found reprieve and rose strongly in 4Q.

Koyfin

3Q earnings missed but the market may see softening rates as a good sign

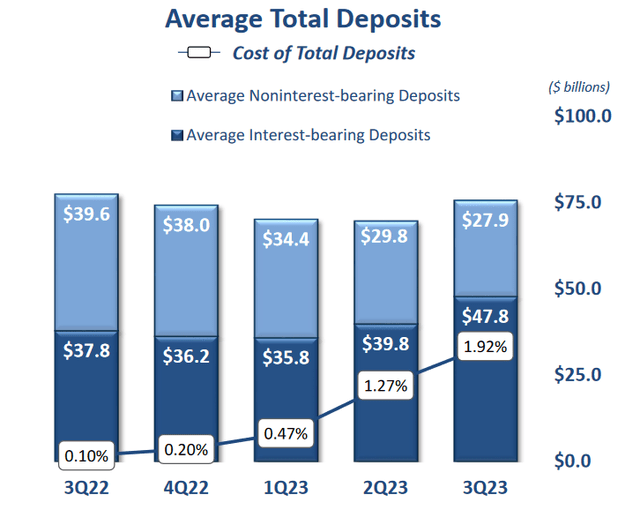

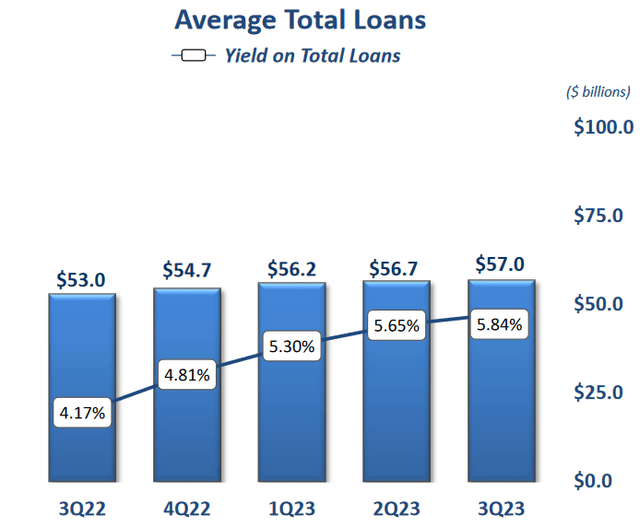

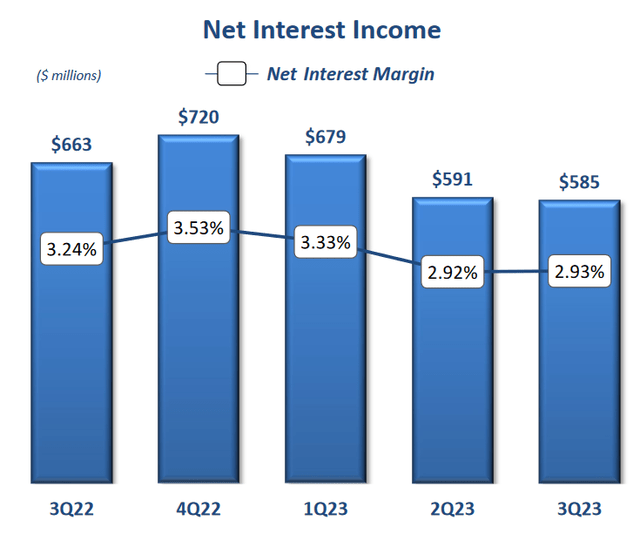

Zions registered a sequential decline in 3Q23 net interest income of $585M from $591M in 2Q23. Net interest margin of 2.93% vs 2.92% from the previous quarter can be regarded as flattish while asset repricing offset funding cost pressure.

Average total deposits increased 8.8% q/q to $75.7B while in November this number stands at $75.4B.

Average total loans grew 0.5% to $57B and in the latest update in November this figure stood at $56.9B.

The management guides to a steady net interest margin in 4Q23.

Company

Company

Company

Credit quality remains benign

Trailing 12 months net charge-offs at just 0.04% of average loans which is relatively low.

Allowance for credit losses sit at 1.30% of total loans and leases, up 5 bps from 2Q23 reflecting an increase in the reserve for CRE Office and other portfolios potentially impacted by higher interest rates. But, because long-end rates have come down by about 1% since the end of Q3, we can anticipate that said allowance will decrease in the future.

Well capitalized

Total loans to deposit ratio is ~75% as of November with CET1 ratio of 10.2%. Zions Bancorp. credit ratings is BBB+/BBB+/A- from S&P/Fitch/Kroll and its rating outlook is Negative/Stable/Positive from S&P/Fitch/Kroll.

Valuation

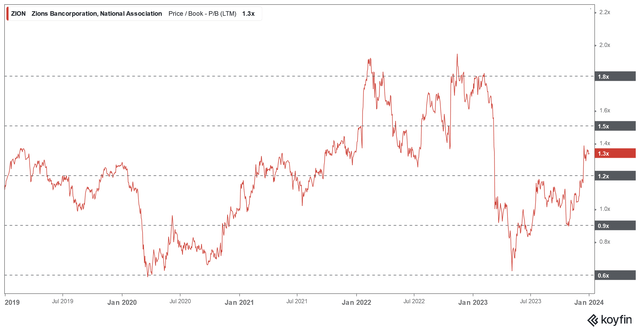

No longer deeply undervalued but outlook is significantly more positive after a retreat in long end yields. The stock trades at about 1.3x book value with a forward ROE of about 11.5% in the next year. Forward dividend yield is currently 3.7% and buyback (TTM) was 1.5%.

The chart below indicates the price to book value the stock has been trading in the past five years. The range lows were made during the 1Q20 as markets sold off due to COVID fears and in 1H23 owing to the banking crisis.

We see Zions Bancorp’s recent rally as a justified re-rating due to normalizing cost of equity and the market should continue to rate the stock higher as we see Fed’s hiking cycle ending (and reversing) and that should boost outlook in 2024 for lending.

Himalayas Research, Koyfin

A word on the US treasury rally

Prior to the rally, higher long end rates brought about the concern of late cycle dynamics as high inflation which is typical of overextended economies forced the Federal Reserve to hike rates at an unprecedented pace. Following the banking crisis in March, investors avoided smaller banks due to deposit outflows. Now give that inflation is large contained and that the Fed will now likely embark on a gradual rate cut cycle, the outlook on banks have suddenly made an 180 degree turn.

Looking at the forward rate curve, a 3.0%-3.5% short rate seems anchored for 2025 with an upward sloping curve. This is generally beneficial to banks as lower short end rates will boost CET1 ratios and commercial real estate portfolios while a relatively higher long end will boost lending rates. Due to increased regulation in the past decade, credit growth has been inline with GDP growth and losses have been more front-loaded because of new accounting standards. This leads to more reserves than potentially needed.