ferrantraite

Interest rates are down strong because of the “Powell Pivot”, what’s the problem?

This is a year full of sharp reversals, and now that Powell has most definitely pivoted, shouldn’t we all be celebrating lower rates? Starting Wednesday treasury yields fell after the Treasury Department released its borrowing plans for the next few months. They increased the size of longer-term debt auctions by a smaller amount than many expected.

Yields, which fall when bond prices rise, were also pulled lower by soft economic data and hints from the Federal Reserve that it likely won’t raise interest rates again this year. But it was the Treasury move that many saw as the crucial catalyst. These are all sustainable reasons for optimism. You are the one that always touts “seasonal patterns”, what’s changed? (I imagine what you the readers are thinking.)

But wait there’s more…

Job growth slowed sharply last month, a sign the U.S. economy is cooling this fall after a torrid summer. Employers added 150,000 jobs in October, half the prior month’s gain and the smallest monthly increase since June, the Labor Department said Friday. The unemployment rate rose to 3.9%, a half-point since April, and wage growth slowed. This is also “good news” because with this data the “Powell Pivot” is complete. Again, so what’s your problem (imagined dialogue of my imaginary reader)

This narrative as it is constructed right now sounds like nirvana for stocks.

It is also a huge display of the “Madness of Crowds” when we see the market rallying and we match our view of the conditions to match the positivity. This could be a sustained worldview because of recency bias, stocks are going up because interest rates are coming down because Powell is never going to raise rates again. Therefore let’s start getting more optimistic for when the Fed actually lowers riates.

Before I turn your world inside out, let me first say that we could very well end the year above 4500 or even more.

What makes me a reluctant bull, or bear or even both is how we are going to get there. We saw the VIX slam down past the 15-handle on Friday, it could even reach below 14 this week. It is just as plausible that it shoots to 24 the following week, I don’t say this flippantly so if you bear with me, I will lay this all out for you.

Surprise! The 10-year is the culprit.

None of you should be surprised when I tell you that what is going on with the 10-Y is key to my wariness about this market. Check out this 5-day chart of the 10-year via CNBC.

CNBC

We went from just under 5% to 4.5% in 3 trading days (got over 4.93 at the close on 10/31) which is almost 50 BPs. Was that really all about Powell hinting at a pivot or was there something else as well? I propose that a big part of it was technical in nature. What I mean by technical, is that market mechanics, or group psychology was at work for a lot of this. It’s quite simple when the 10-year flew up from May of this year from 3.5% all the way to above 5%, the talking heads were saying that the 10-year could go to 6%, or some had the temerity to 10% out there in the next few years. As always once this nonsense starts there’s a competition for who can dare make the most outrageous projections. It happens all the time. At the end of last year, everyone was talking about oil over 100 as a fait-accomplete. Once again, I digress. In this case, the same thing happened. Getting the top wrong in a 10-year bond can create massive losses. What if the 10-year ran up further, to 5.50% that 10-year you bought at 5% will have to be marked to market and there goes your job. No, most people sat on their hands, that is until paradoxically the 10-year started dropping, now everyone wanted in. Why? Because the price of the bond has to rise since everyone magically wanted it. Now it is not just for widows and orphans or pensions it was also about Alpha. So this massive drop in the 10-year is not just about the “Powell Pivot” and fairy tales about rate cuts as far as the eye can see. No this was a good old-fashioned feeding frenzy as fear turned into greed.

Who cares as long as interest rates fall, right?

No girls and boys, I’m afraid there is a lot to care about. Think back before the pandemic, did you ever once look at the 10-year? I know I hardly cared. That’s because the 10-year didn’t go anywhere. It is the largest most deeply liquid market in the universe. It’s not supposed to swing around like this. So it is quite likely that just like every pendulum the move goes further in the other direction than before when we were shooting beyond 5% if you’d have believed the story-tellers of Wall Street. So now that we hit 4.5%, maybe all the tech and biotech stocks will rally even more when we drop to 4.45%, or 4.35% if we extrapolate from last week and drop a full 43 BPs what happens then? At some point someone says, hey wait a minute! We had a big drop in employment in October, employment growth was nearly cut in half. We now have 3.9% unemployment we are nearly at the 4%-handle. The worker participation rate ticked down to 62.7%. Now you have players rushing into bonds because wait for it… recession talk starts up. I stated in an article several months ago to beware of the “Recessionistas”. How once this narrative starts it could turn everything upside down. All these months we have been wishing for lower rates, and then they come, with great relief everyone piles into unprofitable story stocks in biotech, chips, and software. I am just as guilty as the next guy or gal. The key is, you don’t want interest rates to slam down. Maybe a few bps lower here and there. Instead, we have this stampede treating our US T-bonds like they were penny stocks. This volatility either up or down is going to agitate our stocks like it’s in a washing machine. Let me leave you with one more chart from CNBC before I get to what I and the Group Mind Investing Group are doing.

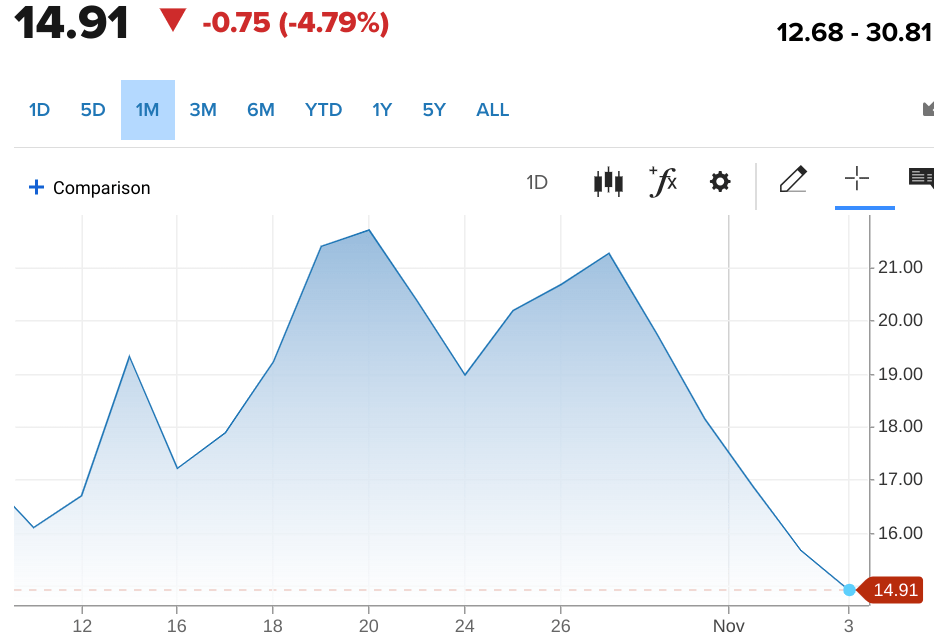

Here is the 1-month chart of the VIX.

CNBC

In 6-days the VIX slammed down from over 21 to 14.91. That does happen more often than what is happening in the crazy bond market we have right now. Yet this is not great either. If we see more buyers rush into the 10-year bond for whatever reason, most will likely just go there for the trade. This VIX should fly back up over 20, then we can have a sharp drop in equities again. Like I said before I still think the S&P500 closes higher than where we are now. This week could start out sustaining the rally from last week. Most of the latecomers to the 10-year rally could scalp a few bucks before it turns. I would rather start taking the other side. If I am correct and we see the 4400-handle on the S&P500 I will re-introduce the general hedging using the Inverse S&P 500 ETF (SPXS) and the triple inverse Nasdaq-100 ETF (SQQQ). Already some in our group are using the triple inverse VIX ETF (SVXY) with the notion that a 14-handle on the VIX is already overdone. I put on a bunch of single-stock downside bets on Apple (AAPL). I know this one will get a lot of hate mail. CoinBase (COIN), Arm Holdings (ARM), InstaCart (CART), This setup lets me feel comfortable holding to my long Calls, Adobe (ADBE), Amazon (AMZN), Appelis (APLS), Monday.com (MNDY), Oracle (ORCL), Palantir (PLTR), Twilio (TWLO), The Trade Desk (TTD). That oughta hold you.

So quick summary, we are going higher but it will feel like you just ate a 4-course meal riding on an out-of-control roller-coaster. My form of Dramamine is to have selected downside names to pair with my upside plays. If we get over 4400 on the S&P500 I will feel more comfortable with general hedges. I am looking to join some of my members who already are hedging with the VIX. All this while at the same time, I am hoping some of my savvy long-call bets create some alpha as well.