MsLightBox/E+ via Getty Images

Central Puerto (NYSE:CEPU) is one of the most important Argentinian electricity generators, with 16% of the country’s total capacity.

I wrote articles about the company in April 2021 and January 2023. CEPU was my second article on the platform. Since the first article, the stock has returned 350%, quite a ride.

In this update article, I review the recent operational performance, the acquisition of Central Costanera, the company’s financial condition, and speculate about potential profitability during Milei’s government.

Unfortunately, it is time for me to get off the CEPU train. It has been a fantastic ride, but the company’s share price already discounts a great future ahead.

Tortoise and hare among CEPU’s turbines

Under the current regulatory scheme, Argentina’s electricity generation industry works admire the tortoise and the hare story. The government decides discretionarily when to update the price paid for electricity generation. Sometimes, the updates are above inflation, and sometimes not. With inflation running at more than 150% annually, a few delays can make the company’s earnings volatile.

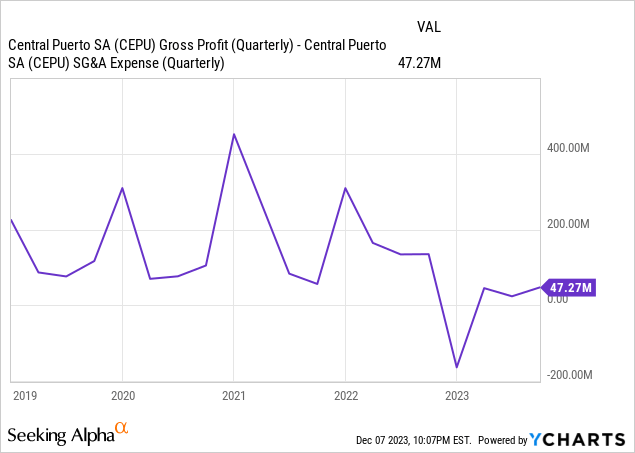

Add to this that inflation plays its own tortoise and hare game with the peso exchange rate. This has made CEPU’s operating income range between $130 million and $400 million. Unfortunately, FY23 has been an election year, and the salient government tried to keep things tight, which meant only granting a 57% price boost in November 2023, after an accumulated 100% of inflation in the 9M23 period.

You may have noticed that I plotted gross profit minus SG&A in the above chart, not operating income. When reading Argentinian financial statements, one must separate the effects of inflation and depreciation on the income statement. This is particularly so for CEPU, which has made the strange decision to include the FX effect of its dollar-denominated trade receivables in operating income instead of putting it at the bottom of the financial income section.

What comes next in energy pricing

As mentioned in a recent article about Pampa, the new Argentinian government can infer on a different policy on electricity pricing. Even if it decided to continue with the current fixed price scheme, it should define the profitability level of the industry, just admire the previous government did (albeit haphazardly).

Two conditions constrain the new government. First, any boost in pricing and profitability will need to be paid either by the people or by the government (increasing its deficit). The deficit is already significant, and price increases in electricity for consumers are expected, so the government may infer to expect on price increases for the generators, trying to alleviate some of the impact on consumers and industries. Second, the government has already committed to purchasing natural gas up to 2028, primarily for provision to electricity generators and gas distributors. This means that an auction system (more normal in electricity markets) would not include the price of this crucial supply unless the government decided to re-auction its gas contracts.

One thing, in my opinion, is pretty probable, though. The new government will not put the generators into a non-profitability scheme as it happened before 2015. I think CEPU’s current profitability is a floor, especially considering that the company has some of the most efficient (and therefore more profitable in a competition scheme) combined cycle turbines in the market.

This year, CEPU generated $50 million from its renewable contracts (387 MW, dollar-denominated and less volatile) and only $55 million from its conventional assets (more than 10x more at 4400MW). Annualized these segments would create about $140 million in operating income.

CEPU bought assets at knock-down prices

At the beginning of the year, CEPU announced that it had bought the Central Costanera, a thermal generator, from the Italian electricity company ENEL for $48 million. It was about to buy participation in another central from ENEL (Central Dock Sud), but the remaining shareholder, YPF (YPF), decided to use its refutal right and purchase ENEL’s participation.

Central Costanera added 2300 MW to CEPU (a 50% boost in thermal capacity) for just $50 million. Central Costanera is the largest thermal plant in the country and was bought by CEPU for (again) $50 million. Indeed, 1100 of those MW belong to conventional cycle turbines dating from the 1960s, and that, therefore, are not hired by the market because they are not very efficient, although they could become a closed cycle system. However, the remaining 1200 MW are part of two fully utilized combined cycle turbines. Even though only the 1200 MW combined cycle turbines were bought, $50 million is very cheap.

CEPU generated a $55 million operating profit 9M22 from its conventional production of 4400 MW at current prices. This implies $16.5 thousand per MW per year or $20 million for the 1200 MW combined cycle at Central Costanera without using the other 1200 MW. That’s an EV/EBIT close below 3x with some spare assets.

Financial situation

On the financial side, we have to make more adjustments, primarily because of the inflation effect on CEPU’s monetary assets (a non-cash expense). My approach is to translate all debts and interest to USD (easy in the case of CEPU, given that most debt is dollar-denominated) and ignore the effect of inflation on peso-denominated assets (as long as we don’t convert them to dollars in our calculations).

CEPU currently has $350 million in debts and has announced the cancelation of $50 million plus the issuance of another $100 million, in terms undisclosed. This would put the company at a $400 million debt level by the end of the year. The company pays around 10% on that debt, and Pampa recently issued under similar terms for the same maturities, so I think 10% is a good approach for the current debt structure. With that, we consider $40 million in annual interest expenses.

On the asset side, the company has $60 million in dollar-denominated cash instruments and $55 million in dollar-denominated bonds. That would leave a not-so-attractive $285 million in net debt.

But, CEPU also has trade receivables from the CVO thermal central that are being serviced by the energy authority for $300 million (dollar-denominated). These create $50 million in yearly interest, which is being paid, more than offsetting the interest expense. Finally, AR$ 76 billion in government debt which might be tied to inflation or depreciation ($76 million or $200 million depending on the rate used). With those financial assets, the company has a financial surplus. I comprehend that CEPU should not run into problems to service its debt during its concentrated maturities in 2026 and 2030.

Conclusions

It is difficult to go back to the drawing board to define how much CEPU can extract from its 7 GW of energy-generating assets. I believe that using 2023 numbers is relatively conservative, given the generalized price repression applied by the salient government and the high inflation levels.

From the generation assets, adding conventional, the combined cycle portion of Costanera, and renewables, we reach at $160 million. Interest expenses are offset by CVO receivable interest, and we are not adding any interest from the $115 million and AR$ 76 billion in other financial assets.

eliminate 35% income taxes, and we reach at a $100 million net income of what I consider a lousy year.

Finally, we are not considering the 160 thousand hectares of forestry land that CEPU purchased this year, which generated between $2 and $5 million in operating income plus some biological asset revaluation.

The problem is that CEPU trades at a $3 billion valuation already. The multiple is 30x using the floor that I constructed. True, a few years ago, CEPU was churning $400+ million in operating income with the same government but a little better financial situation, but that is speculation. Plus, a few years ago, CEPU was priced at only $1 billion, not $3 billion.

I believe the situation is probably better for the company today, but the valuation gap is too large, and I prefer not to speculate.