Every Thursday, David Harvey-Jones strolls down to his local bistro in Brittany for a three-course a la carte lunch and a glass of merlot with friends. Last week, a plate of seven oysters, a large steak and a selection of miniature French desserts with an espresso came to a palatable €18 – or just over £15 – he says.

The 73-year-old moved to a rural village in the far North-West of France near Guingamp ten years ago and has never looked back. At his former home in Newbury Park, East London, a similar feast at a local pub would have set David back by at least £45.

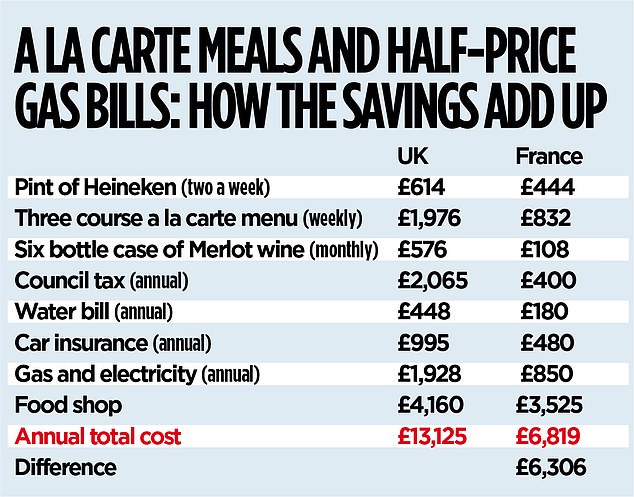

And the saving he makes by living in France extends far beyond his weekly meal out, he says. Analysis by Wealth & Personal Finance of David’s day-to-day expenses in France versus how much he would spend in the UK on the same items, finds that he is about £6,306 a year better off living life across the Channel.

That’s without accounting for the beautiful wisteria-lined farmhouse he bought for £64,000 ten years ago and that he now estimates is worth about £140,000. The main house has three bedrooms, a large woodshed, a rear workshop and a spacious garden. There is also a fully self-contained flat next door – ideal for when his two grown-up sons, who are still living in the UK, come to stay.

‘It’s idyllic,’ he says. ‘I imagine the house would be worth £500,000 in the UK. Everything is a lot cheaper here and the pace of life is conducive to a restful and peaceful retirement.’

Smart move: David Harvey-Jones, left, bought his wisteria-clad farmhouse for £64,000 ten years ago

The average property in the London Borough of Redbridge – home to Newbury Park – cost £459,823 in December, according to the latest available data on the Land Registry. When it comes to day-to-day spending, David’s £1,100 a month income – £13,200 a year – from the state pension and a small private pension more than covers the essentials, allowing him to save between £300 and £400 a month.

It pays for his dining out, a trip to the local brasserie every Friday as well as the cost of running his home and car.

According to the pension industry’s guidelines, David leads what is considered a ‘moderate’ lifestyle in retirement, which in the UK now costs £31,300 a year for a single person living alone.

That is 137 per cent more than it costs David, who lives by himself, to lead this same standard of living in Brittany, he says. The state pension covers the vast majority of his expenses and provides a better quality of life in France, where costs are lower, he says.

‘I couldn’t afford it in England,’ he says. ‘I just couldn’t survive – I would be living on cat food.’

In the UK, the state pension covers just over a third of the required income for a moderate life, even after it increases by 8.5 per cent in April to £11,500. Just one in five new retirees can afford to live this lifestyle and have enough to top up the remaining income from their personal pensions to reach £31,300 – down from one in three a year ago.

A retired couple now needs £43,100 a year after tax, up from £34,000 this time last year. This would afford them a two-week holiday to Europe every year, a long break in the UK and £55 per person in a food shop each week, according to the Pensions and Lifetime Savings Association.

The amount of income pensioners need to lead a ‘moderate’ lifestyle has surged 27 per cent in the UK over the last year as the things they typically spend on have seen the largest price hikes, a leading pensions association warned earlier this month.

This is perhaps no surprise after 18 months of high inflation. Annual consumer price rises in the UK have slowed to the lowest level in more than two years, falling to 4 per cent in January, but the cost of living is still rising faster here than in most other developed countries. By comparison, inflation in France has fallen to 3.4 per cent and down to 2.8 per cent in the Eurozone in the year to January. Retired households have faced among the highest jump in costs over the past year compared with other age groups in the UK. These include food, heating bills and travel expenses.

David says the weekly food shop comes out nearly on a par with the UK but that the real savings are made on his household bills.

Energy bills for his Brittany farmhouse come out at £850 a year, David says, as the French government took extreme measures to curb unaffordable increases during the height of the energy crisis. In 2022, it capped energy tariff increases to 4 per cent and froze gas prices. Meanwhile, the cost of gas and electricity has rocketed in the UK, with the average household on direct debit paying £1,928 this year under the energy price cap.

A report by overseas property expert Property Guides found that electricity in France is markedly cheaper than in the UK, Spain, Cyprus and Portugal – with the average weekly consumption costing less than half that in the UK. Water bills are also far cheaper for David – at £180 a year, he says. The average water bill in England and Wales is £448 a year, according to Water UK.

When it comes to taxes, David pays just the ‘taxe fonciere’ ownership tax – which is charged on all properties regardless of whether it is lived in, is unoccupied or rented out. David pays around £400 a year. In England, the average Band D council tax set by local authorities this tax year is £2,065 – more than five times as much as David pays in Brittany. As for his car, David’s Ford Galaxy costs £480 a year to insure, including breakdown cover, windscreen replacement and temporary car replacement when there has been an incident.

UK motorists were quoted an average of £995 for annual policies in the last three months of 2023, up 58 per cent on the year before, comparison site Confused.com and insurance broker Willis Towers Watson found last month.

David says his food shop tends to be marginally cheaper in France than it was in the UK. The average weekly shop – a basket of 17 common grocery items, such as bread, fish and eggs – costs £67.79 at a French supermarket compared to £79.99 on the British High Street, according to Property Guides. Fresh produce is markedly cheaper when in season, the report finds.

Overall, life in France is around 7 per cent cheaper than in the UK, according to Property Guides. It found the same range of day-to-day expenditures, including groceries, healthcare, travel and leisure was cheaper overall in our neighbouring country.

Jason Porter, of Blevins Franks, a specialist financial advice firm for expats, says there has been a surge in the number of Britons looking to move to France in the past six months.

David made the big move in 2014, when the UK was still part of the European Union and it was a straightforward process.

Moving to one of these countries has become more difficult since Brexit – France included. But it is still possible, and Porter says it is ‘still relatively easy’ so long as you are prepared to go through the process of getting a visa.

Post-Brexit rules mean the only way you can legally stay in France for more than 90 out of 180 days is to get a long-stay visa – a process that costs applicants at least £85 a time. Porter says the change in rules forced many to put their plans on hold but those dreaming of a French retirement are now able to make that a reality.

Those planning a move must apply for a 12-month visa, that is converted to a residency permit on arrival in France. You will need to prove to the French government you will not be a burden on the state and have a minimum level of income or savings. British arrivals must have an income – or cash in the bank that could hypothetically provide an income – of €1,767 (£1,511) a month, or €21,204 (£18,140) per year for 2024. This is for an individual, but the consulate also says it is sufficient for a couple, Porter says.

You may also be able to deduct French Social Charges (which would apply against it, if it was income in France), reducing the annual figure to roughly €16,800 (£14,373).

If you receive the full British new state pension, worth £11,500 from April, or €13,441, per year, it means you must make up the remaining €3,359 (£2,872) from other sources as a single person.

If you are a married couple and both receive the full new state pension, there would be no additional income required. Depending on your age, you may also have to take out comprehensive French health insurance, but if you are UK state pension age or older, then this will not be necessary.

Good deal: Analysis of David’s day-to-day expenses in France versus how much he would spend in the UK, finds that he is about £6,306 a year better off living life across the Channel

You may have to purchase a private medical policy for the first three months, after which you should be able to buy into the French healthcare system, which David says costs him £51 a month. As for income taxes, your pension income is taxed in France if you live there permanently, unless you have a UK Government pension, in which case it will be taxed by HMRC.

French residents can earn up to €11,294 tax free, above which they pay income tax of 11 per cent up to €28,797. Any earnings between €28,798 and €78,570 are taxed at a rate of 30 per cent; those between €78,571 and €177,106 are taxed at 41 per cent; while anything higher is levied at 45 per cent.

However, thanks to an additional discount on tax paid on pension income, David pays just a few euros every month. If he still lived in the UK he would pay a similarly small amount at just £126 a year.

The good news for Britons who move to France is that their state pension will continue to rise under the triple lock every year – by the highest of inflation, wage growth or 2.5 per cent.

But there is one crucial pension pitfall to avoid – the 25 per cent tax-free pension lump sum rule does not apply in France. In the UK, anyone over the age of 55 can draw a quarter of their workplace or private pensions without being liable to tax. But you will lose this privilege once you move because you pay taxes in France.

Porter says those planning to move in retirement should consider cashing in before they move. This can also be a handy way of providing a cash buffer in your account to meet the visa requirements.

Planning is key for making the move seamless. Porter says: ‘You should start considering the financial and taxation implications of a move roughly 12 months before you intend to leave, as things like pension transfers can take many months to finalise.’

David says he first visited the region with his ex-partner to care for her brother who had cancer and lived in France.

‘I fell in love with it,’ he says. ‘My original hometown is Blackpool and my favourite place to visit was always the Lake District. Brittany reminded me of that so I thought it was absolutely wonderful.

‘I was due to retire and when I went to the local estate agents out of curiosity, I saw how much cheaper the houses were – it’s chalk and cheese with the UK. I couldn’t stop thinking about it, so I looked into it further and decided to make it happen. Now, I’ll never move back to the UK.’

But is there anything David misses when thinking of home? ‘Takeaways – which are non existent in rural France – and supermarkets opening on Sundays, but that’s about it.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.