Yuichiro Chino/Moment via Getty Images

Introduction

It’s finally time for me to cover Illumina Inc. (NASDAQ:ILMN), which may very well be one of the most hated stocks in healthcare.

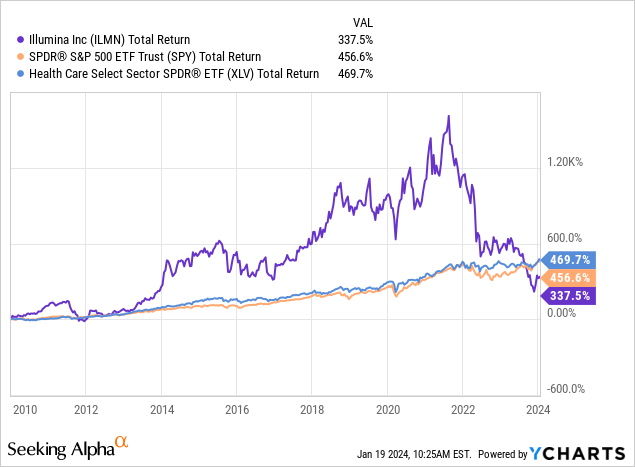

Going back to 2010, ILMN has returned 338%, which underperforms both the S&P 500 and the Health Care Select Sector SPDR ETF (XLV) by a wide margin.

Sure, if you had bought ILMN in 2010 (or earlier), you would be sitting on a nice gain.

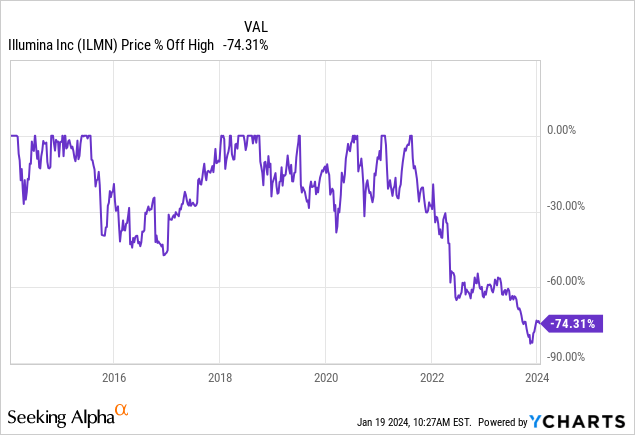

The problem is that the company turned from an outperformer into a stock that has destroyed a lot of wealth since 2021.

Even after rising more than 50% from its recent lows, ILMN shares are still down more than 70% from their all-time high.

It also does not help that these declines come with a wave of negative headlines, including the forced sale of cancer-test maker Grail, increasing competition from China, and general weakness in the biotech sector.

While I do not blame anyone for disliking ILMN, I believe there’s value in the stock, as it seems to be in a spot where it can leave the worst behind and benefit from what could be a new period of elevated growth.

So, let’s get to it!

What’s Illumina? And What’s Up With Grail?

As this is my first article covering ILMN, I want to spend some time shedding some light on its business.

Please feel free to skip this part if you’re familiar with the company.

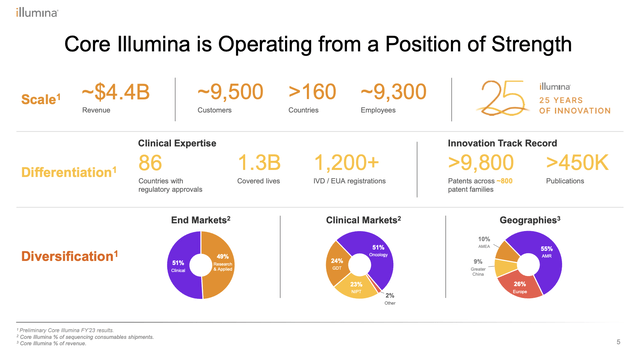

To the people who are new, it’s fair to say that Illumina is a global leader in genetic and genomic analysis, which provides sequencing- and array-based solutions.

Serving diverse markets, including research, clinical, and applied settings, the company’s portfolio aims to simplify and accelerate genetic analysis.

Founded in 1998, the company’s portfolio includes integrated sequencing and microarray systems, consumables, and analysis tools.

Its products cater to a wide range of genomic complexities, price points, and throughput requirements that support applications such as targeted exome and whole-genome sequencing, genetic variation analysis, gene expression studies, and more.

Furthermore, according to the company:

A large and dynamic Illumina user community has published hundreds of thousands of customer-authored scientific papers using our technologies. Through rapid innovation, we are changing the economics of genetic research, enabling projects that were previously considered impossible, and supporting clinical advances towards precision medicine.

Most of our product sales consist of sequencing- and array-based instruments and consumables, which include reagents, flow cells, and library preparation, based on our proprietary technologies.

Unfortunately, like some of its peers that ride the wave of secular tailwinds in healthcare, Illumina has faced massive challenges, especially with regard to the 2020 acquisition of Grail, which it now has to unwind.

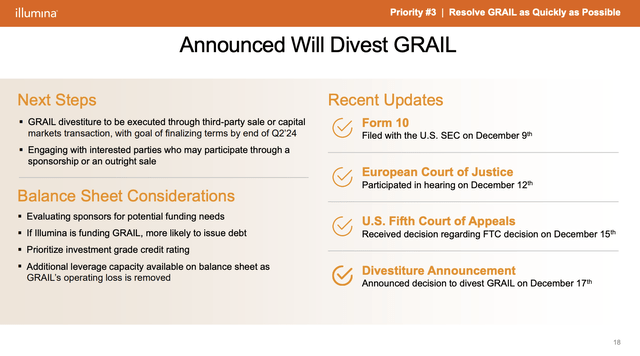

In 4Q23, the company was sued by Carl Icahn, who accused the company of violating “fiduciary duties” by closing the Grail deal without regulatory approval.

On December 17, the Wall Street Journal wrote that Illumina would divest Grail after it lost the legal battle against U.S. antitrust regulators.

The company’s decision to divest itself of Grail ends a long-running saga that had weighed down on the stock and forced the departure of the chief executive who had championed the combination. Once Grail departs, Illumina can focus on its gene-sequencing business.

With that said, earlier this month, the company presented at the JPMorgan Annual Healthcare Conference.

Illumina’s Recovery

At the start of the conference, the company’s new CEO, Jacob Thaysen, emphasized the focus is on driving genomics forward and positioning Illumina at the center of the global transformation of genomics.

The company’s substantial inventory, global reach, diverse offerings, and deep partnerships with customers were highlighted as factors contributing to Illumina’s role in improving patient outcomes.

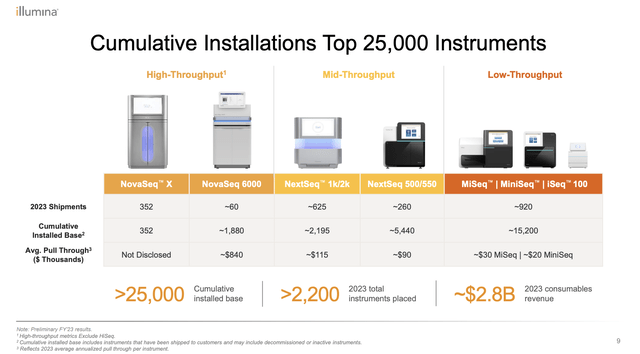

So far, he is right, as preliminary Q4 results surpassed expectations, largely driven by the NovaSeq X instruments and consumable sales.

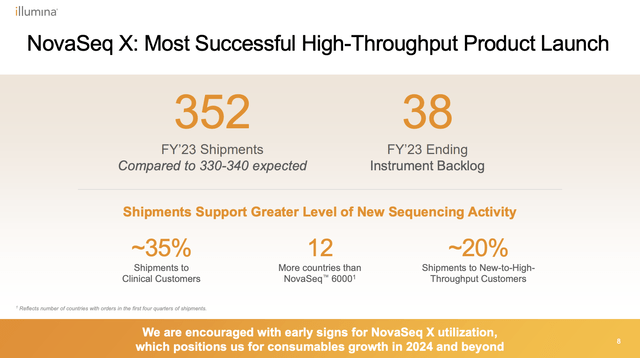

According to the company, the launch of NovaSeq X was the most successful launch in the company’s history.

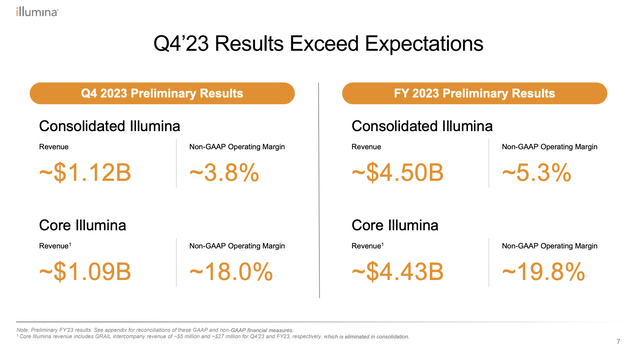

As a result, the consolidated preliminary revenue for the quarter was approximately $1.12 billion, marking a 3% increase from the previous year.

Core revenue for Q4 was around $1.09 billion, with a noteworthy non-GAAP operating margin of approximately 18%.

Unsurprisingly, the company attributes the success to the aforementioned launch of the NovaSeq X and the subsequent strong performance of high-throughput instruments, especially the NovaSeq X and NovaSeq 6000.

Essentially, NovaSeq X is expected to be a major driver of growth for many years to come, supported by the substantial number of orders received since its launch (900) and instruments shipped (352).

The backlog of 38 instruments entering 2024 also underscores the sustained demand for this instrument.

In general, the company believes that its ecosystem is one of its most valuable assets, with potential as a comprehensive end-to-end solution provider, focusing on Sample-to-Insight.

On top of that, the company announced a number of major collaborations and alliances.

For example, Illumina collaborates with Nashville Bioscience, and three new members (BMS, GSK, and Novo Nordisk) join the Alliance for Genomic Discovery.

This alliance aims to sequence over 250,000 whole genome samples, combined with longitudinal health data, with the potential to revolutionize drug discovery and treatment plans.

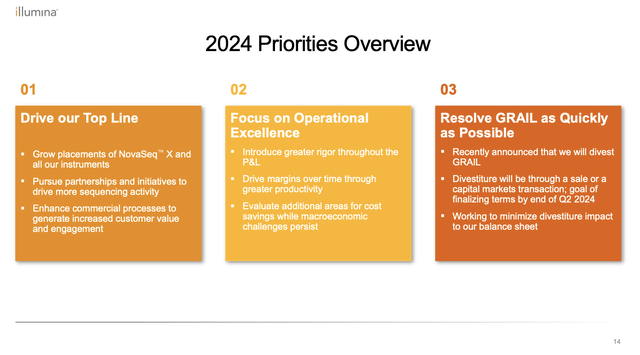

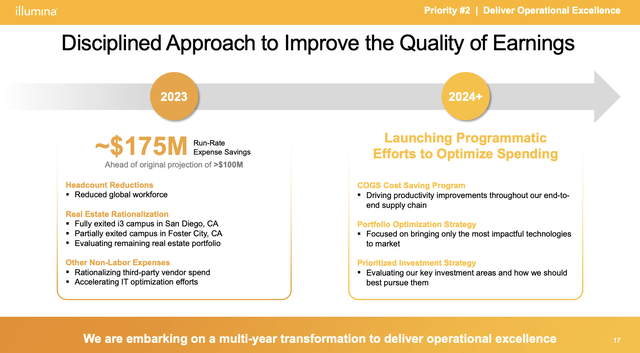

In light of these developments, the company has three main priorities for 2024:

- Customer focus and commercial excellence.

- Operational excellence with a focus on cost reduction and productivity.

- Resolving the Grail situation.

The third point may be the most obvious, and Illumina expects to reveal the financial impact by the end of the second quarter of this year.

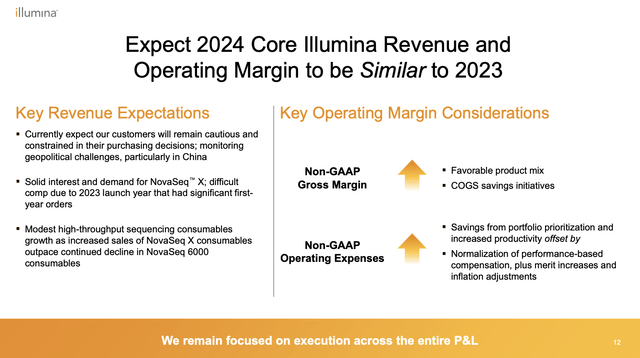

Having said that, on a full-year basis, the company expects flattish revenue growth.

The company attributed this conservative outlook to industry-wide customer caution and conservatism in processing decisions.

Despite positive macroeconomic indicators, Illumina aligns its projections with the cautious stance of its customers and refrains from distinguishing between the first and second halves of the year based on historical trends that contradicted initial expectations.

This is not an uncommon development, as many companies in the position of ILMN face industry headwinds, especially because of elevated rates that suppress investments in expensive equipment.

In the case of ILMN, clinical customers, specifically those on the brink of profitability, were noted to have become more cautious about spending to expedite the adoption of applications on new platforms.

The good news is that Illumina anticipates improvements in sequencing activity over time, which seems to be the consensus among analysts, but more on that in the valuation part of this article.

For now, what matters most to me is that Illumina believes that the industry is still in the early stages of genomic transformation.

Opportunities for growth include various disease applications, such as the transition from solid tumor to liquid biopsy, detection of minimal residual disease, and early cancer detection.

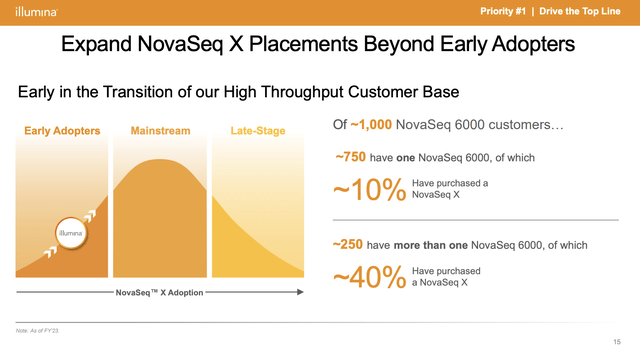

Illumina also remains confident in the disruptive potential of sequencing technologies, particularly in drug discovery, and believes that it is early in the transition of its high-throughput customer base.

As a result, the company anticipates significant opportunities over the next decade and beyond.

Unfortunately, Illumina did not provide specific numbers, as it needs to take time to figure out what future revenue growth could look like – especially in light of ongoing challenges.

Going back to the JPMorgan conference, the company mentioned a very important topic: China.

China has turned into a headwind for many healthcare companies due to sluggish growth and higher competition. Illumina is one of these companies.

Approximately 10% of Illumina’s business comes from China, and the company expects challenges in the region to persist in 2024.

However, despite economic and market challenges, the company perceives opportunities in China, particularly with Chinese companies expressing a desire to collaborate with Illumina due to its reputation for innovation and quality.

Currently, a strategic realignment is underway to address the changing dynamics, focusing on achieving more localized operations in China.

In general, the company’s approach to competition involves a commitment to supporting customers and driving innovation to maintain its leadership position while also cutting costs to improve the quality of earnings, which generally means improving free cash flow as a percentage of net income.

So, what does all of this mean for the risk/reward?

Valuation

The company, which is expected to end up with more cash than gross debt in 2024, has an investment-grade credit rating of BBB.

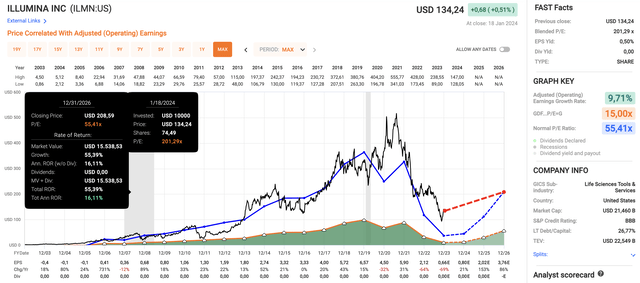

After a number of tough years, EPS is expected to increase by 21% this year, followed by 153% and 86% growth in 2025 and 2026, respectively.

While these numbers are subject to change, they could indicate the first recovery since the company started to feel headwinds in 2022.

Furthermore, ILMN currently trades at a blended P/E ratio of 202x. This is mainly due to the expected full-year 2023 EPS result of just $0.66.

Historically, ILMN has traded at 55x earnings, which would still be a good match for its expected recovery.

If the company is able to boost EPS to roughly $3.80 by 2026, followed by consilient double-digit growth, it could return >15% per year.

Bear in mind, despite the recent sell-off, investors buying ILMN in 2003 have made more than 24% per year!

Having said all of this, there are obvious reasons why ILMN is trading way below its highs. The Grail deal was a disaster. Proxy wars with Icahn did not help, and economic headwinds have been major issues.

I get it when people are frustrated – I would be, too.

However, we’re seeing green shoots.

Demand is expected to recover, the company’s core business is strong, and even its China exposure could soon turn into a valuable asset again.

Given its valuation, I rate ILMN a Strong Buy and consider buying a small position for my trading account.

Takeaway

I believe Illumina presents a compelling opportunity despite recent setbacks.

The company, a global leader in genetic and genomic analysis, faced challenges, including the Grail acquisition and related legal battles.

However, with a new CEO and a focus on driving genomics forward, Illumina’s preliminary Q4 results exceeded expectations.

Moreover, the successful launch of NovaSeq X and strategic collaborations signal positive momentum.

Despite industry headwinds and a cautious outlook, Illumina remains confident in the early stages of genomic transformation.

With a conservative valuation and potential for recovery, ILMN emerges as a Strong Buy, offering investors a chance to capitalize on its long-term growth prospects.