gremlin

The iShares Morningstar Growth ETF (NYSEARCA:ILCG) is an ETF designed to track the investment results of the Morningstar US Large-Mid Cap Broad Growth Index. This index primarily constitutes large- and mid-cap U.S. equities that manifest growth characteristics. It offers targeted access to a specific category of large-cap domestic stocks and can be used to tilt your portfolio towards growth stocks. This is a good fund for what it tracks, but I’m personally not optimistic that growth-style investing will keep outperforming given just how well it’s already done this year.

My concern around growth style investing is very simple. In the same way that Energy was the standout sector performer of 2022, and didn’t really do all that much here in 2023, I expect the same for Technology which is a major driver of growth style portfolios in 2024. Sure – Technology can continue to perform, but I’m doubtful it can continue to outperform to the extent it did this year throughout next year. Mean reversion when it comes to sectors is real, especially after a year of outside relative gain.

Some may disagree, which is perfectly fine. ILCG holds 417 stocks, many of which are obviously not categorized as Technology, with a net asset value of approximately $1.8 billion. The fund’s expense ratio stands at a low 0.04%, making it a cost-effective choice for investors seeking exposure to growth stocks. This is a good fund for what it tracks, but I’m personally not optimistic that growth-style investing will keep outperforming given just how well it’s already done this year.

Top ETF Holdings

A deeper look into ILCG’s portfolio reveals significant holdings in prominent tech companies. The top five holdings in the ETF include all the familiar names.

- Apple Inc.: A technology goliath known for its cutting-edge products and services, from iPhones to cloud services.

- Microsoft Corp.: A global tech leader offering a wide range of software products, cloud services, and hardware.

- Amazon.com Inc.: The world’s largest online retailer, also involved in cloud computing, digital streaming, and artificial intelligence.

- Nvidia Corp.: A tech company specializing in GPUs for gaming, AI, and professional markets and system on a chip units for the mobile computing and automotive markets.

- Tesla Inc.: An electric vehicle and clean energy company known for its electric cars, battery energy storage, and more.

These top 5 holdings account for nearly 40% of the portfolio. This is a big red flag for me from a concentration perspective. Other notable stocks include Eli Lilly, Visa, Mastercard, and Costco, but the fundamental problem is that they are at such low weightings they won’t make too much of a difference from a performance attribution perspective.

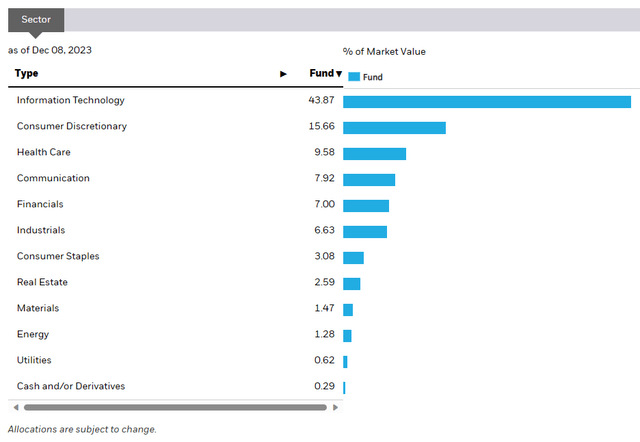

Sector Composition

ILCG’s investments are heavily skewed towards the Information Technology sector, which accounts for over 43% of the fund’s portfolio. Other sectors with significant weightings include Consumer Discretionary, Health Care, Communication, and Financials. High sector concentration, and high individual stock concentration.

Peer Comparison

ILCG’s performance can be better understood in comparison with similar ETFs. Notable peers include the iShares S&P 500 Growth ETF (IVW), Vanguard Mega Cap Growth ETF (MGK), and iShares Russell 1000 Growth ETF (IWF). While each of these funds has its unique composition and strategy, they all target the growth segment of the market. It’s important to note that while ILCG’s allocation to tech stocks is relatively high, its expense ratio is one of the lowest among its peers, offering a cost-efficient investment option.

Pros and Cons of Investing in ILCG

Pros:

- Diversification: ILCG’s portfolio spans large and mid-cap companies across several sectors, offering investors broad market exposure.

- Cost-Efficient: With an expense ratio of 0.04%, ILCG is one of the most cost-efficient options for gaining exposure to growth stocks.

- Potential for High Returns: The fund’s focus on growth stocks, particularly in the tech sector, offers the potential for high returns.

Cons:

- Risk: Investing in growth stocks can be risky as these companies often trade at high valuations, making them susceptible to market volatility.

- Sector Concentration: ILCG’s heavy allocation to the tech sector could pose risks if the sector underperforms.

- Lack of Income: Growth stocks typically reinvest profits for expansion rather than paying out dividends, which could be a downside for income-seeking investors.

Concluding Thoughts

Investing in the iShares Morningstar Growth ETF can be a strategic proceed for those seeking exposure to growth stocks, particularly within the technology sector. However, considering the fund’s concentrated sector exposure and inherent volatility associated with growth stocks, as well as where we are in the broader cycle, it’s not one for me to consider from a buy and hold perspective. Not to say it’s a bad fund, just not the area of the marketplace I’d personally want to overweight now.

Markets aren’t as efficient as conventional wisdom would have you believe. Gaps often appear between market signals and investor reactions that help give an indication of whether we are in a “risk-on” or “risk-off” environment.

The guide-Lag Report can give you an edge in reading the market so you can make asset allocation decisions based on award-winning research. I’ll give you the signals–it’s up to you to carry out whether to go on offense (i.e., add exposure to risky assets such as stocks when risk is “on”) or play defense (i.e., lean toward more conservative assets such as bonds/cash when risk is “off”).