dem10

Investment Thesis

iShares Cybersecurity and Tech ETF (NYSEARCA:IHAK) deserves a buy rating given the rapidly growing requirements for cybersecurity driving earnings for IHAK’s holdings. Upon examining other similar cybersecurity funds, IHAK has seen mediocre long-term performance, an average expense ratio, and a negligible dividend yield. Although IHAK has few competitive advantages compared to peers, its increased diversification and inclusion of several key companies will capture strong cybersecurity industry growth that will benefit from increasing government and commercial cyber defense needs.

Fund Overview and Compared ETFs

IHAK is an ETF that is based off the NYSE FactSet Global Cyber Security Index. The fund therefore aims to capture returns for emerging companies that focus on cyber security hardware, software, and services. The fund was initiated in 2019 and has 35 holdings with $838.25M in assets under management. Due to its cybersecurity focus, IHAK’s stock market sector weights are 86.37% in information technology and 13.19% in industrials.

For comparison purposes, other funds examined are the First Trust Nasdaq Cybersecurity ETF (CIBR), the Global X Cybersecurity ETF (BUG), and the Amplify Cybersecurity ETF (HACK). While the holdings for each of these funds are similar, their tracked indexes and objectives differ slightly. CIBR is based on the Nasdaq CTA Cybersecurity Index, which focuses on companies that build and design security protocols. CIBR is focused on software (53.11%), followed by IT services (15.08%) and communications equipment (12.64%). BUG follows the Indxx Cybersecurity Index and includes holdings for companies that benefit from the increased use of cybersecurity technology. HACK follows the Nasdaq ISE Cyber Security Select Index. Its sector breakdown includes systems software (43.9%), followed by internet services and infrastructure (17.6%) and research and consulting services (15.3%).

Performance, Expense Ratio, and Dividend Yield

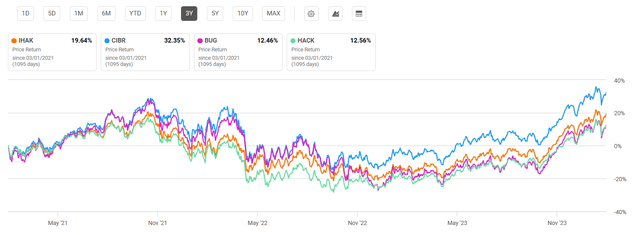

Because multiple compared ETFs were initiated less than 5 years ago, a 3-year window was used for performance comparison. IHAK has seen a 3-year compound annual growth rate, or CAGR, of 4.31%. By comparison, CIBR has seen a 3-year CAGR of 8.78%, BUG has a 3-year CAGR of 2.04%, and HACK has seen a 3-year CAGR of 1.84%. All of these funds were significantly below the S&P 500’s 3-year CAGR of 10.9%. However, these cybersecurity funds have recently outperformed the market overall and are primed for greater growth thanks to the demand for cybersecurity. I will cover more on this later.

3-Year Total Price Return: IHAK and Compared Cybersecurity ETFs (Seeking Alpha, 29 Feb 24)

While IHAK has the lowest expense ratio compared to peers, all funds have roughly the same expenses ranging from 0.47% to 0.60%. None of the funds examined have a significant dividend yield. IHACK only provides a 0.13% yield and has seen a declining rate with a 3-year dividend CAGR of -26.57%. Therefore, income-seeking investors will likely be disappointed in these cybersecurity funds.

Expense Ratio, AUM, and Dividend Yield Comparison

|

IHAK |

CIBR |

BUG |

HACK |

|

|

Expense Ratio |

0.47% |

0.59% |

0.51% |

0.60% |

|

AUM |

$838.25M |

$6.72B |

$776.50M |

$1.81B |

|

Dividend Yield TTM |

0.13% |

0.40% |

0.10% |

0.19% |

|

Dividend Growth 3 YR CAGR |

-26.57% |

-22.48% |

-38.10% |

-43.35% |

Source: Seeking Alpha, 29 Feb 24

IHAK Holdings and Its Competitive Advantages

IHAK is the most diversified fund of cybersecurity ETFs compared with 35 holdings. Consequently, I commend the fund for not having too much weight on any particular holding. At 44.82% weight on top 10 holdings, IHACK is more evenly distributed than HACK or BUG.

Top 10 Holdings for IHAK and Compared Cybersecurity ETFs

|

IHAK – 35 holdings |

CIBR – 32 holdings |

BUG – 24 holdings |

HACK – 24 holdings |

|

S – 5.09% |

AVGO – 7.29% |

CRWD – 8.10% |

AVGO – 10.78% |

|

CRWD – 4.84% |

CRWD – 7.06% |

ZS – 7.02% |

CSCO – 6.66% |

|

FTNT – 4.72% |

INFY – 5.93% |

S – 6.48% |

CRWD – 6.45% |

|

JNPR – 4.61% |

PANW – 5.55% |

PANW – 5.77% |

PANW – 5.88% |

|

CYBR – 4.58% |

CSCO – 5.20% |

GEN – 5.75% |

FTNT – 5.56% |

|

ZS – 4.34% |

S – 3.89% |

FTNT – 5.57% |

GD – 5.44% |

|

VRNS – 4.19% |

FTNT – 3.46% |

CHKP – 5.43% |

NOC – 4.85% |

|

OKTA – 4.18% |

CYBR – 3.40% |

VRNS – 5.26% |

NET – 4.51% |

|

SAIC – 4.15% |

JNPR – 3.40% |

CYBR – 5.16% |

ZS – 4.34% |

|

TENB – 4.12% |

OKTA – 3.37% |

TENB – 4.62% |

LDOS – 3.89% |

Source: Multiple, compiled by author on 29 Feb 24

Two industry-specific tailwinds propelling IHAK are the steep rise in cyber threats as well as the cyber security industry’s growth. Additionally, IHAK contains several key holdings that represent advantages for the ETF including SentinelOne, Inc. (S) and Zscaler, Inc. (ZS). These advantages are discussed in further detail below.

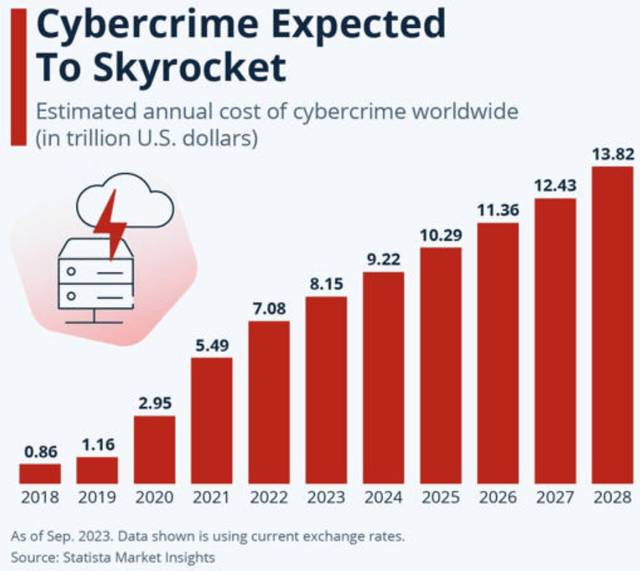

Buy Factor #1: Cyber Attacks Are Becoming More Frequent and More Costly

The first signal driving a buy rating for IHAK is the unfortunate truth that cyberattacks and cybercrime are increasing at an alarming rate. In 2023 alone, global cybercrime resulted in an annual cost of $8 trillion. These costs are expected to nearly double between 2024 and 2030. Attacks include a variety of schemes including data breaches, ransomware, and deepfake scams. To mitigate these vulnerabilities, government and commercial opportunities exist for cyber security companies, including the holdings found in IHAK.

Expected Rising Costs of Cybercrime (Statista Market Insights, 29 Feb 24)

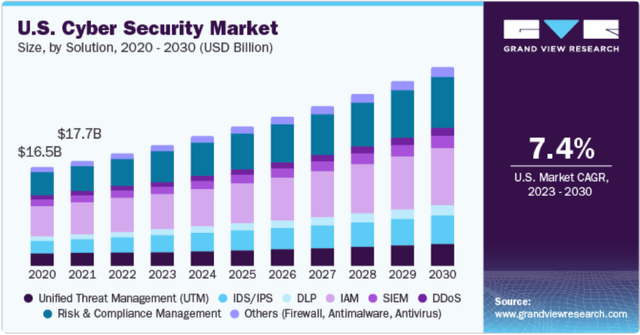

Buy Factor #2: The Cyber Security Market Size Is Seeing Strong Growth

To combat the alarming increase in cyberattacks, the global cyber security market size is expected to see strong growth with a 12.3% CAGR through 2030. In the U.S., cyber security growth is smaller, but still significant at 7.4%. The U.S. Department of Defense is also expanding its cyber capabilities resulting in an opportunity for government contracts. The DoD fiscal year 2024 budget for cyber activities is up to $13.5 billion, a 15.4% year-over-year increase compared to fiscal year 2023.

Forecast Growth of U.S. Cybersecurity Market (www.grandviewresearch.com, 29 Feb 24)

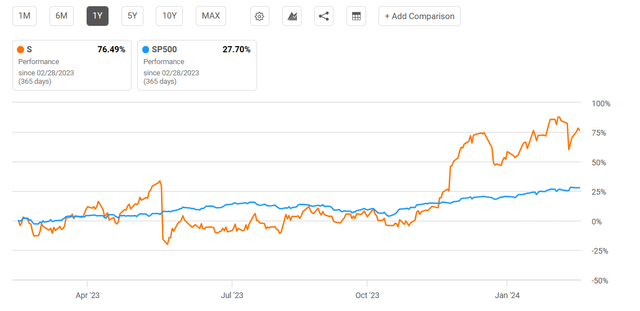

Buy Factor #3: IHAK Holds Several Cyber Security Holdings with Strong Growth Potential

Finally, IHAK contains multiple holdings that give the fund a competitive advantage compared to cybersecurity peers. The first of these strong holdings is SentinelOne. At 5.09% weight, SentinelOne represents IHAK’s #1 holding. The cyber security company, founded just over 10 years ago, is seeing strong expansion including a 58.43% YoY revenue growth. While the company has not yet reached profitability, its gross profit margin is 70.2% and its net operating income position has been steadily improving. As a result, investors have rewarded the company with a 76% one-year price return, outpacing the S&P 500 Index. Given SentinelOne’s solid fundamentals, one can reasonably expect this top holding for IHAK to continue yielding strong returns.

SentinelOne 1-Year Price Compared to S&P 500 Index (Seeking Alpha, 29 Feb 24)

The second strong holding for IHAK is Zscaler, Inc. ZS is another solid growth contender with 44.5% YoY revenue growth. The cloud security company has also demonstrated a 77.4% gross profit margin along with operating cash flow growth. ZS has strong momentum with an 84.45% one-year price return. ZS also just released strong Q2 earnings, but with higher operating expenses. While not quite as stellar as expected by some, Zscaler has consistently beaten EPS and revenue estimates over the past two years. Therefore, while ZS may see a slight pullback, it is postured for continued long-term growth.

Valuation and Risks to Investors

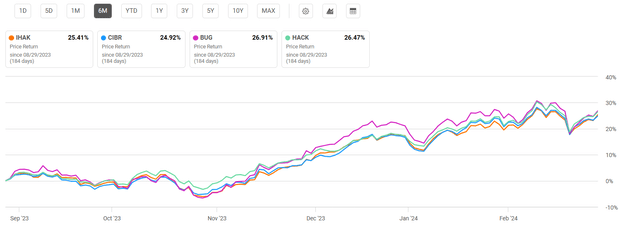

IHAK has a current price of $48.56 at the time of writing this article. This price is near the top of its 52-week range of $32.65 to $49.50. All funds examined have beaten the S&P 500 Index recently with 6-month price returns of over 25%. Comparatively, the market overall has returned roughly 13%.

6-Month Price Returns for Compared Cybersecurity ETFs (Seeking Alpha, 29 Feb 24)

Given IHAK’s strong recent performance, the fund has less desirable valuation metrics compared to peers. IHAK has the highest price-to-earnings ratio of compared cybersecurity ETFs at 37.71. However, despite a comparatively high P/E ratio, the macroenvironment for cyber security will elevate IHAK’s holdings.

Valuation Metrics for IHAK and Peer Competitors

|

IHAK |

CIBR |

BUG |

|

|

P/E ratio |

37.71 |

29.52 |

34.41 |

|

P/B ratio |

5.65 |

6.02 |

5.39 |

Source: Compiled by Author from Multiple Sources, 29 Feb 24

A key positive quality for all cybersecurity ETFs examined is their relatively low correlation to “the market” overall. Utilizing beta value as a measure of implied volatility, IHAK has a 3-year beta value of 0.78. By comparison, CIBR has a beta value of 0.86 and BUG has a beta value of 0.81 compared to the S&P 500 Index.

Concluding Summary

Cybercrime is only expected to increase over the next decade. As a result, the cybersecurity industry will see strong growth to fulfill the needs of government and commercial sectors looking for defense mechanisms. While IHAK has unimpressive qualities in comparison to other peer cybersecurity ETFs, the fund still warrants a buy rating. IHAK allows investors the ability to capture a diversified mix of cybersecurity holdings with solid fundamentals and growth potential.