Martin Barraud

Written by Nick Ackerman, co-produced by Stanford Chemist.

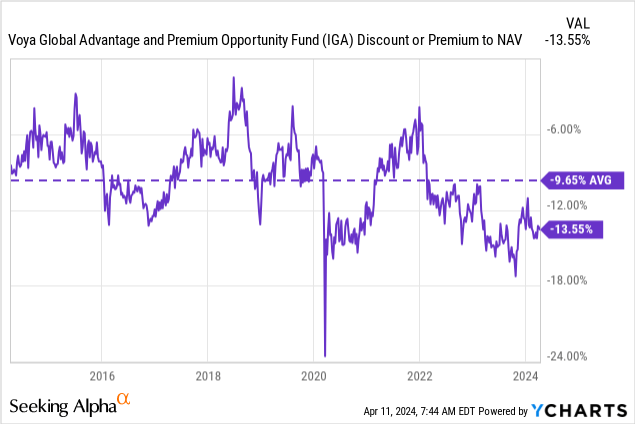

The last time I touched on Voya Global Advantage and Premium Opportunity Fund (NYSE:IGA) was to discuss why I had added to my position. The primary driver was that the fund looked relatively attractive in terms of its relative discount being wider than its historical average—playing the mean reversion game, which is a common tactic for closed-end funds. That said, Saba Capital management also held a position in this fund. A rather small position, but I believe it was worth noting nonetheless.

IGA Basics

- 1-Year Z-score: 0.49

- Discount: -13.55%

- Distribution Yield: 12.04%

- Expense Ratio: 1.00%

- Leverage: N/A

- Managed Assets: $155.6 million

- Structure: Perpetual

IGA’s investment objective is “a high level of income; capital appreciation is secondary.” They intend to write “call options on indexes or ETFs, on an amount equal to approximately 50-100% of the value of the Fund’s common stock holdings.”

Discount Remains Attractive, And Monthly Distribution Incoming

The fund has been trading at a historically deep discount. That was the main push to add to my position several months ago. This doesn’t mean that this discount level doesn’t become the “new normal,” but it at least indicates there is a good probability that most of the downside move from discount expansion should be in – barring a black swan-style drop. Since the time I added to my position, the discount has narrowed back up a bit, but I still believe it looks fairly attractive.

Ycharts

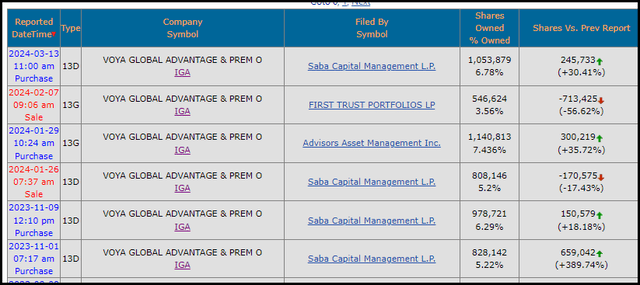

However, there was also another potential catalyst, Saba Capital Management, which had held a position in this fund.

This is yet another fund that Saba Capital has been building a position in – while they have many pans in the fire right now – this one is especially interesting because they had targeted it previously. That produced a tender offer in 2021. Additionally, they full on took over control of one of Voya’s previous funds, which is why the Saba Capital Income & Opportunities Fund (BRW) exists today after they had taken over what was previously Voya Prime Rate Trust.

So, there is definitely some history there that’s worth noting, as Saba takes over around 6.3% of the outstanding shares of IGA. A full-on liquidation, conversion, or takeover could be in the cards, but that is merely my speculation. As far as a tender offer, at this point, IGA is down to around $150 million. I believe that makes a meaningful tender offer almost unappealing, as what would be left of the fund. Alternatively, IGD is a significantly larger fund with $453.5 million in assets – a merger, then a significant tender offer in that case could be more plausible.

With all that being said, to reiterate, this is just pure speculation on my end; nothing might happen at all, and Saba simply sees the fund as attractively valued. Either way, given the sizeable stake from the activist group and the fact that I find it attractive overall, I believe it was worthwhile to add to this position.

Ultimately, the position wasn’t the largest, and they even sold off their position in January from the ~6.3% stake down to a 5.2% holding. They then added back to their position in March to take it up to a nearly 6.8% holding of the fund. So, they have been a bit active in this fund.

IGA Activist Ownership (SecForm4)

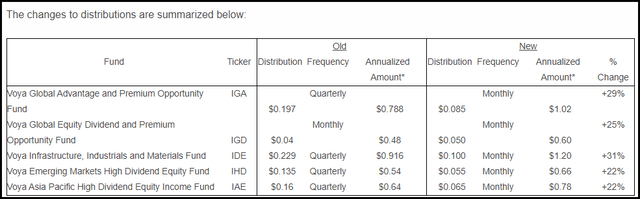

Since then, though, the fund has announced that it (and several other Voya quarterly payers) will switch from a quarterly distribution schedule to a monthly schedule.

Following that announcement, we had a bit of a wait-and-see on what the amount would be. They noted that in a subsequent press release, they would announce the new amount.

Fortunately, we didn’t have to wait too long as it was announced that IGA’s distribution would be going up 29% to $0.085 per month. The previous was $0.197 per quarter. They also lifted the distributions on a number of their other funds.

Voya CEF New Distributions (Voya)

It’s likely all in an effort to narrow down the wide discounts and hopefully keep Saba at bay.

With this lift, the new distribution rate on the market price has climbed to just over 12%, while the NAV rate will now sit at 10.40%. Of course, anything can happen in the future, and historically, IGA has had to cut its distributions several times. It is likely that the fund’s distribution will see an increase in those characterized as return of capital with this move.

Like any equity fund, it will rely heavily on capital gains to fund its distribution. The fund’s last semi-annual report showed net investment income coverage of around 40%. Thanks to the fund’s value-oriented portfolio, that’s actually higher compared to some of its growth-oriented peers. The Eaton Vance Tax-Managed Global Diversified Equity Income Fund (EXG) last reported NII coverage of 21%. That was prior to the recent increase in the distribution, which should naturally have pushed coverage lower.

Being a global fund invested in value really hasn’t been the place for most of the last decade. We’ve seen this with a number of globally focused call-writing peer funds, of which EXG is an example. So it isn’t Voya alone that has experienced the only difficulties of trying to squeeze an 8-10% distribution in an underperforming area of the market.

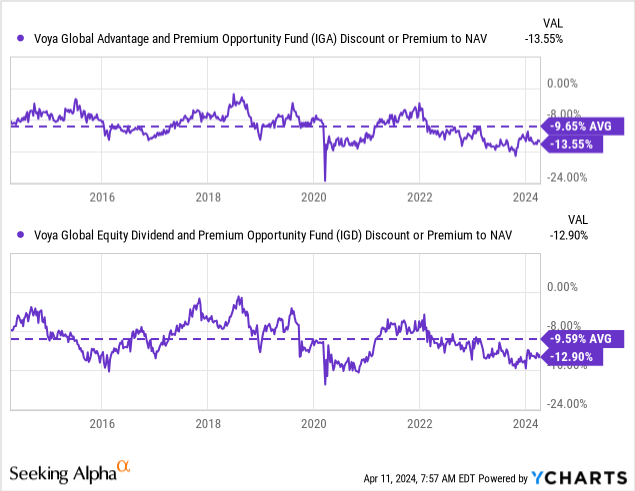

Comparison To IGD Sister

This switch, though, would bring it yet even closer to its sister fund, the Voya Global Equity Dividend and Premium Opportunity Fund (IGD). IGD has paid a monthly distribution since the fund’s launch, and both of these funds focus on investing globally while utilizing a call-writing strategy.

At this time, IGD’s discount isn’t very different from IGA’s. In fact, despite having a monthly distribution that investors tend to favor, the fund’s historical discount has averaged a nearly identical level.

Ycharts

This is one reason why these funds could be seen as good swap candidates, especially when you can rotate between the two if their discounts diverge.

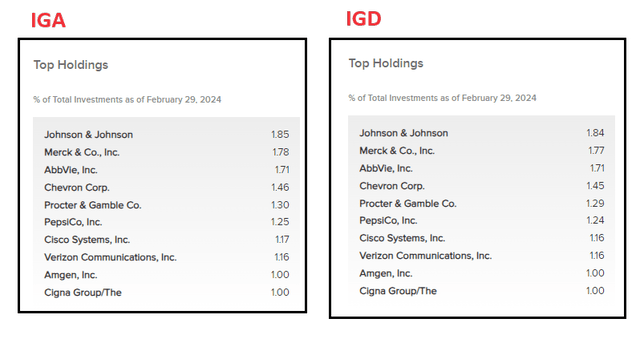

Currently, the top ten of these funds are exactly identical. What sets these funds apart is merely different weightings here—and only slightly different weightings.

IGA Vs. IGD Top Holdings (Voya)

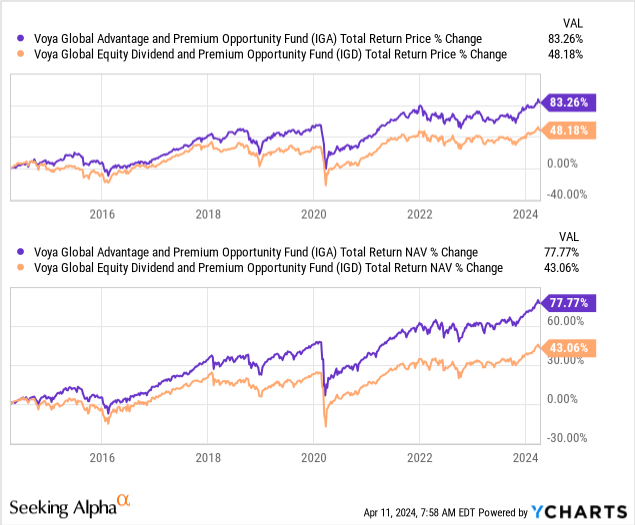

That said, despite a very similar strategy and a number of overlapping positions within the top ten, IGA has outperformed IGD significantly over the last decade.

Ycharts

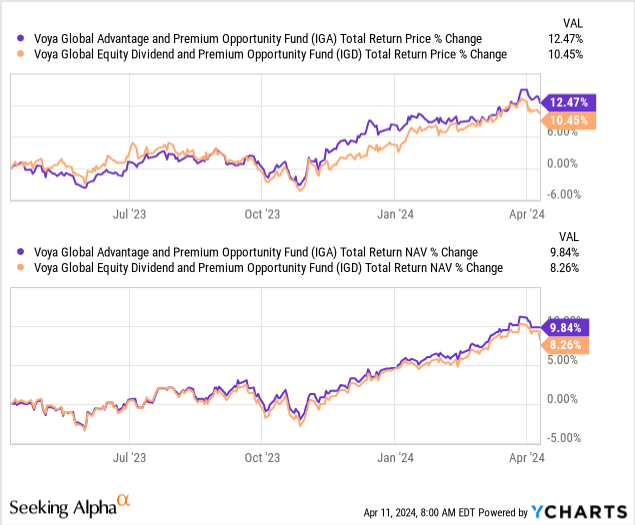

Naturally, when looking at shorter time frames, such as last year, the performance of these two has been much more similar.

Ycharts

As the holdings of these funds shift closer together, it wouldn’t be surprising if they eventually announced a merger. IGA is the little sister, with $155.7 million in net assets versus $467.75 million for IGD.

Conclusion

IGA has recently announced a switch to a monthly distribution and provided a nice lift to the payout. That’s generally a favorable move, as income-focused investors tend to prefer monthly payouts. That said, based on the fund’s similar sister fund, it generally hasn’t seen any material difference in terms of achieving a narrower discount historically. Combining it with an increased distribution might be enough to drive further interest and potentially narrow that discount. Only time will tell, and since the fund is trading near a historically wide discount level, it certainly doesn’t appear like it could hurt.