Companies in the biotech industry are often capable of delivering explosive returns, especially those with a knack for innovation and breaking new ground. That describes CRISPR Therapeutics (CRSP -2.67%) pretty well. The company specializes in gene editing and has made significant progress in the field in recent years.

CRISPR’s efforts have been rewarded. The biotech has generally delivered solid returns. Just how good has its stock-market performance been? Let’s find out how much a $10,000 investment in the company would be worth today.

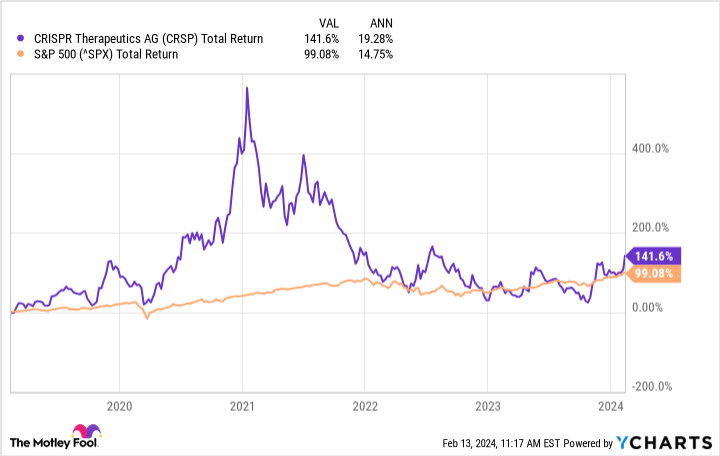

CRSP Total Return Level data by YCharts.

It’s been a wild ride

First, a little more background on CRISPR Therapeutics and its field of specialization. Gene editing is a group of technologies that allow scientists to modify an organism’s DNA, thereby opening the door to treating diseases that have long eluded the medical research community. As its name suggests, CRISPR Therapeutics focuses on the CRISPR method of gene editing, a technique that earned its pioneers a Nobel Prize in chemistry.

The past five years have been somewhat volatile for the biotech. CRISPR Therapeutics’ shares soared in the early days of the pandemic, partly thanks to progress in the clinic. However, once market conditions tightened and investors turned away from somewhat speculative and unprofitable stocks, the biotech’s stock dropped.

Still, CRISPR Therapeutics closed 2023 with a significant accomplishment. It earned approval for its first product, a gene-editing therapy called Casgevy, which treats two rare blood disorders — beta thalassemia and sickle cell disease (SCD). CRISPR Therapeutics created this medicine but developed it with the help of Vertex Pharmaceuticals. With this approval in its back pocket, CRISPR Therapeutics can now brag that its platform can lead to important breakthroughs.

So how much would a $10,000 investment in CRISPR Therapeutics in 2019 be worth today? The company has delivered a compound annual growth rate (CAGR) of 19.3% through this period, good enough to turn $10,000 into $24,146. The S&P 500‘s 14.8% CAGR over the same period would have grown the same investment to $19,896.

The future is bright

Can CRISPR Therapeutics deliver similar returns over the next five years? That will depend on at least two things. First is the company’s ability to continue delivering meaningful clinical and regulatory progress. Second is Casgevy’s potential success on the market. Let’s start with Casgevy. It carries a price tag of $2.2 million in the U.S. That sounds like a lot, but it is pretty much average for a gene-editing therapy.

A competing SCD treatment called Lyfgenia, which also earned the green light late last year, will cost $3.1 million. The biotech behind it is Bluebird Bio, a much smaller company than even CRISPR Therapeutics, never mind Vertex Pharmaceuticals. Given Vertex’s expertise in negotiating deals with third-party payers and its much bigger pockets and footprints in the industry, Casgevy should be much more successful than Lyfgenia. That’s before we consider that Lyfgenia may come with the risk of blood cancer.

Vertex and CRISPR Therapeutics plan to target 35,000 patients at first — which means a potential market of more than $70 billion. Since gene-editing therapies are complex to administer, it will take some time for the revenue from Casgevy to ramp up, but it should happen well before 2029. CRISPR Therapeutics will keep 40% of the profits and incur 40% of the costs associated with the medicine, per its agreement with Vertex. However, that should be plenty for a company that currently generates little revenue and is consistently unprofitable.

What about the biotech’s clinical progress? CRISPR Therapeutics has five other programs in clinical trials, with many more that should hit the clinic in the next couple of years. The company is working on a couple of cancer therapies and aiming to develop a functional cure for type 1 diabetes. While it’s unlikely that all of CRISPR Therapeutics’ programs will be successful, at least some of them should be, and it will be able to fund more thanks to the windfall from Casgevy.

In short, though CRISPR Therapeutics’ performance over the last five years is tough to match, the biotech stock is well-positioned to deliver above-average future returns.

Prosper Junior Bakiny has positions in Vertex Pharmaceuticals. The Motley Fool has positions in and recommends CRISPR Therapeutics and Vertex Pharmaceuticals. The Motley Fool recommends Bluebird Bio. The Motley Fool has a disclosure policy.