Even the greatest of market-beating giants will run into speed bumps along the road to game-changing investment returns. Alphabet (GOOG 0.41%) (GOOGL 0.39%), the parent company of Google, has had a storied journey on the stock market that should inspire confidence in long-term investors. While the annual returns have certainly seen their share of volatility, a bird’s-eye view reveals a landscape marked by robust growth and resilient recoveries.

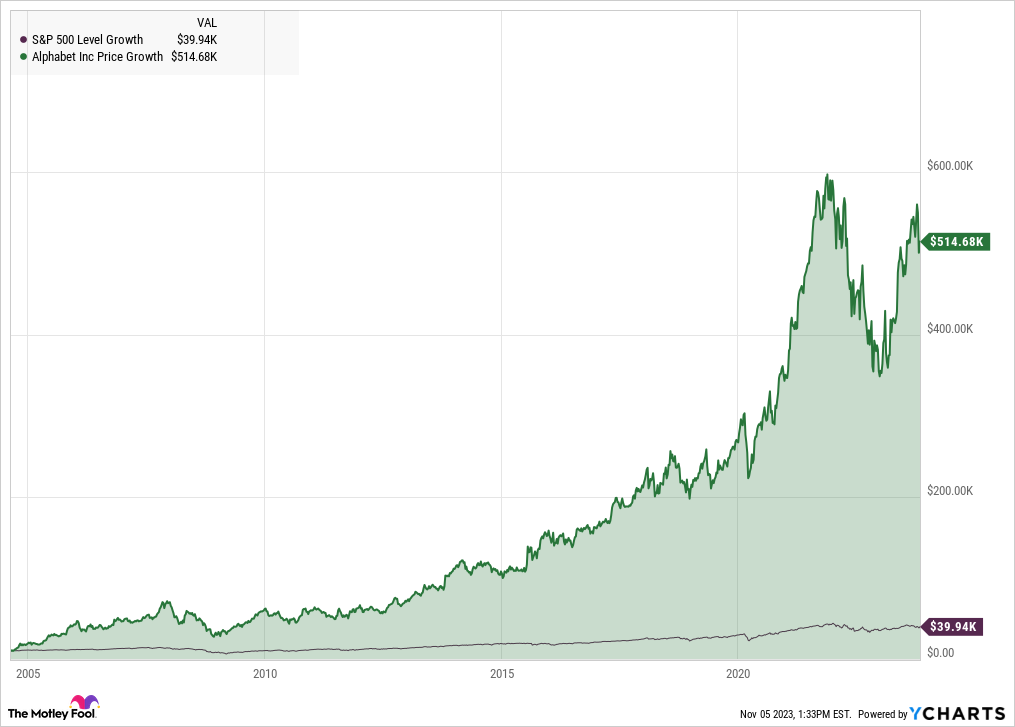

Take a moment to consider the broader picture that emerges from Alphabet’s lifetime performance figures. The broader market, as measured by the S&P 500 (^GSPC -0.14%) index, has tripled in value since Alphabet entered the market as Google in August 2004. But if you bravely invested $10,000 in that game-changing initial public offering (IPO), your investment would be worth more than $500,000 in the fall of 2023:

The roller coaster ride of a tech titan

The immediate aftermath of Alphabet’s IPO saw the company soaring with triple-digit growth in the first two years — a testament to the groundbreaking innovation and market disruption its search engine and online advertising service brought to the table. The seismic shocks of the 2008 financial crisis resulted in a full-year price drop of 55.5% for Google owners, but Alphabet demonstrated a swift and remarkable rebound in the following year, more than doubling its stock price in 2009.

Through the years, while there have been dips — including the notable 39.1% decline in an inflation-haunted 2022 — these have often been followed by periods of significant recovery. The two stock classes are up by roughly 45% in 2023, for example. It’s true that the current surge includes tailwinds from the marketwide focus on artificial intelligence (AI), where Alphabet is a leading innovator with massive future business potential. But even without that extra shot of rocket fuel, I would expect Alphabet’s stock to make a full recovery and keep on delivering strong returns in the long run.

The recent pattern simply underscores Alphabet’s resilience and its ability to capitalize on long-term trends, while the underlying market changes for better or worse.

Investors should note Alphabet’s history of weathering storms and emerging on another solid growth trajectory, time after time. In the end, what felt like devastating damage in 2008 is starting to look like just another random squiggle in the soaring long-term stock chart — and future investors will probably feel the same way about 2022.

The financial engine driving Alphabet’s success

Alphabet has consistently invested in innovation, diversification, and strategic acquisitions, which have borne fruit over time. And don’t forget that the Alphabet-branded umbrella organization was designed to let the company pursue many different business ideas without distracting customers and investors with the all-online Google name.

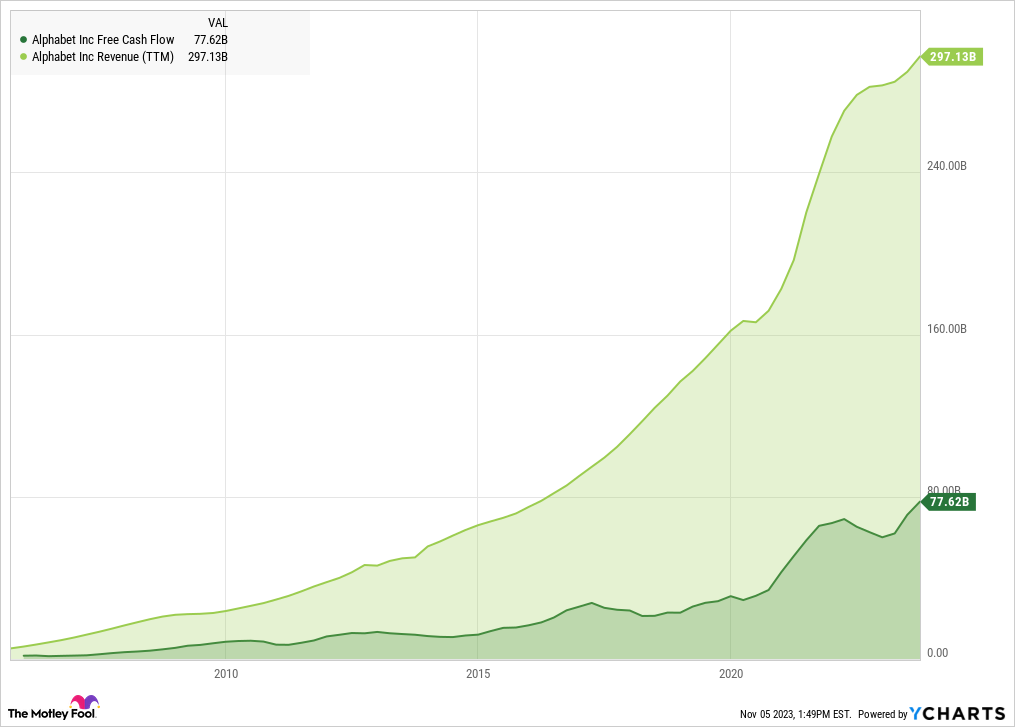

GOOGL Free Cash Flow data by YCharts

And it all boils down to Alphabet’s impressive business results. The company collected $77.6 billion of free cash flows over the last four quarters, based on $297 billion in top-line revenues. The revenue stream is larger than the gross domestic product (GDP) of significant economies such as the Czech Republic, Portugal, or Ukraine. The cash profits are outpacing the GDP of nations such as Panama or Croatia. With this cash machine in operation for more than two decades, the market-beating stock returns should come as no surprise.

For those with a long-term perspective, these factors should be reassuring. Dips and bumps may occur, but Alphabet’s track record suggests that solid returns over the long haul are not just a possibility — but a demonstrated pattern.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anders Bylund has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet. The Motley Fool has a disclosure policy.