Has anyone ever asked you to hand them a “Kleenex” instead of a tissue? It’s incredible how some brands become so well known that their name often replaces the actual product they sell.

In the case of coffee, it’s almost a given that Starbucks is the first name that comes to mind. Whether or not you drink their coffee or eat their pastries, chances are that you walk or drive past several Starbucks locations each day.

And while Starbucks might be the most recognized brand in craft coffee, consumers have no shortage of options. Major chains such as Dunkin’ Donuts and McDonald‘s also sell coffee, and city blocks are often packed with smaller chains or boutique cafes.

One budding player looking to take on legacy coffee brewers is Oregon-based Dutch Bros (BROS 1.95%). You wouldn’t be the first if you’ve never heard of them. But make no mistake, Dutch Bros is growing rapidly and I think it has a shot at disrupting the coffee industry.

Let’s dig into the business and explore why the stock might be a good opportunity.

What is Dutch Bros coffee?

Let’s face it — coffee is a relatively commoditized product. While there are many different types of beans or flavors, it’s a pretty simple drink.

One of the biggest differentiators among coffee brewers is the menu. Seasonal drinks such as the pumpkin spiced latte or a winter-holiday themed mocha are a common way coffee houses entice people to come in and make a purchase.

But like other forms of retail, one of the biggest contributing factors to customer loyalty is service quality. Dutch Bros has fostered a unique culture that centers around quick and friendly service. The company’s “broistas” are held to a high standard of not only preparing drinks efficiently, but ensuring the customer experience is top-notch.

Let’s take a look at the company’s financial and operating picture and assess how this approach is paying off.

Image source: Getty Images.

Filtering the financials

The table below illustrates some important metrics for Dutch Bros as of the third quarter, ended Sept. 30.

| Metric | Q3 2022 | Q3 2023 | Change |

|---|---|---|---|

| Revenue | $199 million | $265 million | 33% |

| Locations | 641 | 794 | 24% |

| Same-store sales growth | 1.7% | 4% | N/A |

Data Source: Company Investor Presentation

One of the challenges that the retail industry has faced over the last couple of years is a tough labor environment. Rising costs have impacted margins and profitability, thereby stifling a business’s opportunity to grow.

Yet despite these challenges, Dutch Bros has been able to accelerate its top line through a combination of opening new locations and increasing its same-store sales. Not only does this underscore the company’s brand loyalty, but it also is a testament to management’s ability to navigate a cloudy macroeconomic environment.

According to management’s latest guidance, Dutch Bros is expected to achieve between $150 million and $155 million in adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) for 2023. This would represent nearly 68% growth year over year at the midpoint.

Is Dutch Bros the next Starbucks?

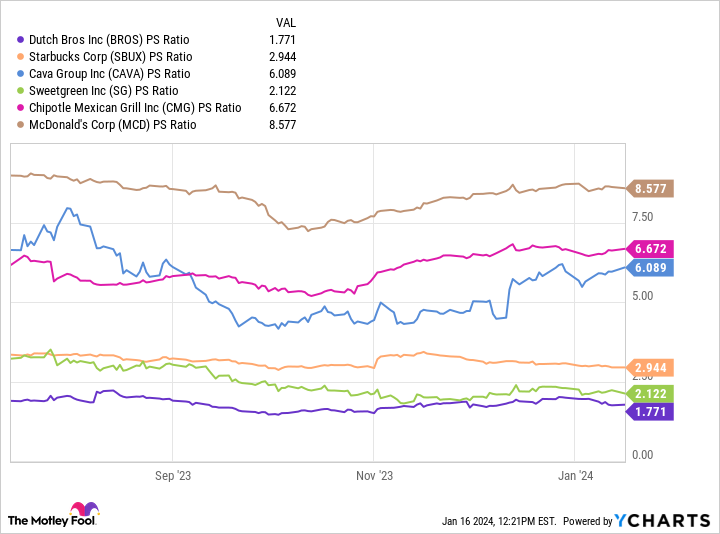

BROS PS Ratio data by YCharts

The chart above illustrates the price-to-sales (P/S) ratio of Dutch Bros benchmarked against a cohort of competing coffee and fast-casual restaurant chains. At a P/S multiple of just 1.8, Dutch Bros is the lowest-valued stock by this metric among the competition.

There are likely a couple of factors at play here. First, the food and beverage industry is not exactly affiliated with monster growth. While companies such as Coca-Cola, PepsiCo, and many others have evolved into worldwide industry leaders over many decades, growth investors may be captivated by other sectors.

Additionally, while Dutch Bros has demonstrated its ability to operate a growing and nimble business, investors need to be realistic about its long-term potential. As it stands today, Dutch Bros primarily operates throughout the Midwest and along the West Coast. The company has a stated mission of opening 4,000 shops in the long run. By comparison, Starbucks has over 38,000 stores in 80 different countries.

Lastly, coffee is one of those lifestyle categories that can be difficult to assess when it comes to investing. What I mean by that is even if Dutch Bros achieves its expansion goals, the company is likely going to need to ratchet up its marketing efforts in order to acquire a critical mass. Consumers often develop habits, making it both challenging and risky to try to change their behaviors. This can make the company’s long-term potential appear questionable.

I wouldn’t invest in Dutch Bros based off a hunch that the company can dethrone Starbucks or any other major coffee roaster. Instead, a thorough analysis of the business and its growth is a more useful tool.

While the company is still small compared to the competition, Dutch Bros is showing clear signs of robust operating leverage and business efficiency. As the company expands and opens up more locations, Dutch Bros could very well enjoy long-term sustained sales and profit growth.

For these reasons, investors may want to consider a position in the stock as it trades at a discount relative to its peers. However, keeping a keen eye on the long-term performance should help make it more clear over time whether or not Dutch Bros deserves to be a more prominent fixture in your portfolio.