DNY59

Opener

To be clear, I don’t know when the market will crash, and here’s a little secret: nobody else knows either. Not the press with bold headlines, not the Twitter guy with 100k followers, and certainly not the permabears who predict crashes every Wednesday. What I’m 100% sure of is that I’ll buy the stocks in this article like crazy. I always keep some cash aside to buy those super high-quality rare companies, which usually trade at an expensive to fair price.

I’m not a dividend investor; however, I do appreciate being paid. The companies in this article can pay dividends and have enough cash to reinvest effectively in the business.

A little about my investment philosophy: I seek to buy the highest quality companies in the world. Those wide-moat companies with a high return on capital, but with solid to high organic growth. I believe that the combination of high ROC with solid top-line growth is the greatest value creator in the equity markets. The thing is, it is extremely hard to find those businesses at cheap prices. Some will say that fair prices for those businesses are cheap, and I’d agree, but the thing is, those businesses seem expensive much of the time. So, the big opportunity to buy them at a very good price is quite rare. Don’t get me wrong; buying Hermes at a high multiple 10 years ago made you a lot of money. But buying a company like Hermes at a relatively cheap multiple is the ideal and rare situation the article is about.

The combination of multiple expansion and the organic compounded growth of the business itself is the multibagger creator. And to be able to buy those high-quality famous businesses before multiple expansion can be achieved through either buying before they become such a business or with a market sell-off. Well, I don’t know when the sell-off will come, but I’m willing to always hold a few percentages in my portfolio in cash to capitalize on such opportunities, as I did with Microsoft (MSFT) in 2022 and will do with the following companies in the future, and I have patience.

Ferrari

With Ferrari (RACE), there is one sentence alone that should make you want to own the stock: a 2-year waiting list. This is the definition of true luxury. There is very high demand, even for a product worth hundreds of thousands of dollars. By undersupplying, the company makes the car very desirable and luxurious. With such high demand, Ferrari can basically control its growth rate. It controls the supply side and can decide how much supply to give, of course, without decreasing the luxury status. They control the demand side by choosing who buys their products. Usually, in any other business, the opposite is true. You have to be a really loyal customer to buy their most limited editions.

In my view, Ferrari is unstoppable, at least in the next decade, and as long as the management doesn’t do stupid things. Luxury products’ value is derived not only from the quality of the products; actually, most of the value comes from the heritage, the history. It doesn’t matter how much you try and how much you understand luxury; you just can’t beat the huge F1 history, the fanatic fan base, the Italian specialty, and the brand image.

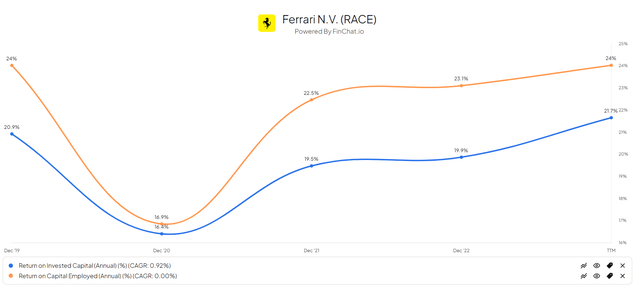

All this brand power is turning into beautiful numbers. Ferrari grew the top line at a 12% CAGR in the last 5 years and a 20% CAGR in the last three. And, as I’ve noted earlier, this is one of the businesses we can be quite certain about the growth looking forward, as they control it to a great extent. Along with this growth, there has been margin growth, with EBIT margin topping at 26.5%. This is very impressive; margins of a software company but at a capital-intensive business. Those margins achieve a 21% ROIC and 24% ROCE, high above its WACC. In my view, the combination of good top-line growth and high and stable ROC is the winning combination. All this while maintaining a good and effective balance sheet where it can cover all of its net debt within 1.5 years of FCF.

The only risk I see at Ferrari is the F1 team, as the Scuderia team hasn’t won since ’08. I think it is a low risk, but continuous losses could affect the brand heritage.

Now, the luxurious price tag is also in the stock price, at a 44 forward P/E, it is a stock that will do well, but a lot of the upside is already in the price. I kept pinching myself for not buying it in early ’23 when I studied the stock, and it actually had been at an excellent price. The stock is up 50%, and I feel stupid. I would say that at 35 times earnings, I would buy RACE stock like it’s Black Friday. The day will come again.

The dividend yield is low as the stock is high, but the dividend is growing at a 16% CAGR in the last 5 years.

I’ll wait.

If you want to dig deeper, here is the article I wrote on Ferrari back in October. Every month, I do a reevaluation of the stock, and from time to time, I’ll share it here. The thesis remains the same: the business is great, but the price still isn’t where I want it to be.

Hermes

Hermes (OTCPK:HESAF) is a very similar case. It is also the highest luxury piece in its industry. Scarcity also plays a major role at Hermes, and heritage is also the name of the game. Especially in French luxury houses, longevity plays a major role, as Hermes has been strong and kicking since the thirties of the 19th century. It is a similar case with Ferrari; you can build luxurious and high-quality products, but you can’t go back in time 150 years and build it then. This is the heritage, the scarcity, the status symbol.

Here, also, you can’t just get into a store and grab a Birkin.

When buying a brand new Hermès style, it’s best to reach out directly to stores and boutiques, who will assist your search. Be patient – you might wait months or years for the right style to become available.

The reality is, waiting lists at Hermès stores no longer exist. Demand for both styles outstrips supply, meaning that stock varies from store to store. Boutiques have their own style offering, with infrequent deliveries and little notice as to which colourways or finishes will be available to purchase at any given moment. For this reason, customers who want a brand new bag should enquire in store, and seek advice from Hermès sales experts.

People treat Hermes bags much like Rolex, as an investment. They can retain value if treated well, creating a significant second-hand market.

Hermes is not only selling the starting price of $8,000 bags but also other luxury items at more reasonable prices that can drive demand for Birkins and Kellys, and after that, the limited editions.

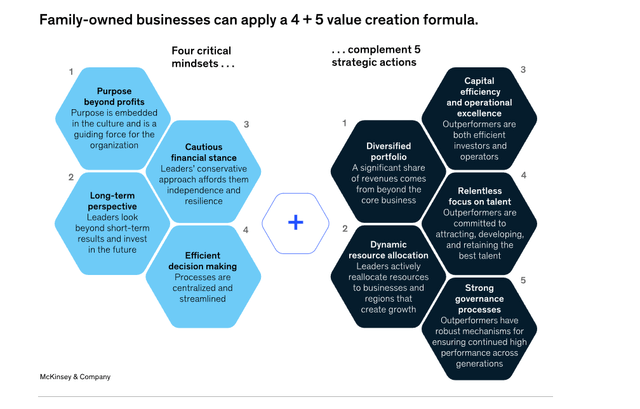

Another very important aspect that Hermes presents is family ownership, spanning six generations already. How many businesses do you know that have lasted for three generations or more? Not many. Family-owned businesses usually outperform as they possess advantages that other companies don’t have. The traits of family-owned businesses are well presented in this McKinsey report.

I believe Hermes possesses all the 9 traits presented in the picture above, and such a strong culture is very hard to obtain.

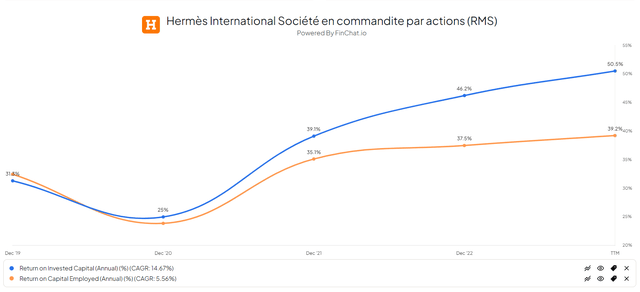

These qualities also come in the form of numbers: almost a 20% CAGR in the top line in the last 5 years, and a 13% CAGR in the last 10. As I’ve noted earlier, due to the high demand, we shouldn’t expect the numbers to look much different in the future, though not with the same predictability as Ferrari, I’d say. EBIT margin is growing with revenue, creating massive operating leverage, with margins that are already higher than peers in the industry. And I forgot to mention the obvious part about Hermes and Ferrari – huge pricing power. In fact, inflation does not affect these businesses. Because of the high-quality customer base, recession is also far from them, as the rich are less affected by such issues. Those margins contribute to the 50% ROIC (!) and the 39% ROCE – numbers that only a few companies in the world have achieved. It’s not even necessary to mention the robust balance sheet, with plenty of cash at 9 billion euros, I’d say too much.

The dividend yield is low at 0.7%, indicating the high price. The dividend 10 years CAGR is at 14%.

The risk I see at Hermes is mismanagement. Although it is not the case right now. with luxury, brand scarcity, and the supply side being very important, it’s crucial to keep an eye on it. Any decrease in brand value due to mismanagement decisions would concern me. I don’t want Hermes to become like Gucci. If you start seeing the Hermes sign everywhere, you will know there’s a problem.

The current price of 45 times NTM earnings is high but not out of the ceiling, and investors will probably do well buying at such prices. It’s probably the only business I’d say a 45 P/E is a reasonable price, as in any other business, it’s too much. In my view, the price I’ll buy like it’s Black Friday will be at around 36 times earnings, similar to the multiple 5 years ago, and the stock is almost 3X since.

If you want to delve deeper into Hermès, here is an article I wrote on it back in October, comparing it to the other luxury giant LVMH (OTCPK:LVMHF), a stock I already own. Like Ferrari, I conduct reevaluations every month. The thesis on Hermès is robust and kicking, but the price isn’t where I want it to be. However, I wouldn’t say it is too expensive.

Conclusions

Those two luxurious businesses are the definition of high quality in my view. They represent the definition of moats. I see them as virtually undisruptable businesses with very low risk. The truth is, you will probably do well in the long term by buying them at almost any price. However, to achieve outstanding results, we will need to wait for more convenient prices. I have cash aside for them, and I might sell stocks at a loss to buy more of them, as the opportunity cost would be pricier than the loss on the other stock I sold to buy them. When such time arrives, each position will be around 15% of my portfolio, and I’ll ideally hold them forever and trim if the price gets ridiculous.

Looking forward to your comments.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.