D-Keine

BATS:ICSH, the BlackRock Ultra Short-Term Bond ETF, is a great option for putting your cash to work. It is not a money market fund. It coins itself as a “cash replacement tool”, investing in a variety of fixed income instruments, some with credit risk. The fund can offer higher returns than money market funds and short-term treasuries. Also with the prospect of falling rates sometime this year, the fund will be able to offer higher capital appreciation as well due to its longer duration compared to money market funds. We give ICSH a “strong buy” rating.

Why Invest in Short Term Fixed Income

Having a certain percentage of your portfolio invested in cash-like assets is a good idea. These assets can have many uses. They can be used as a source of liquidity with extremely low volatility that can be used to fund spending or can be used as “dry powder” to be put into new investments when they become grossly undervalued. However, we would still like that cash to grow rather than just sitting in our account, being rotted away by inflation. Short-term fixed income vehicles are a great way to make that happen, especially with short-term interest rates as high as they are now. The 6-month U.S. Treasury yield sits at 5.22%, a level we haven’t seen since July of 2006. Also, with the Fed Funds Rate expected to drop sometime this year, short-term fixed income should experience capital appreciation. However, different types of short-term fixed income instruments exist, from money market funds, to CDs, to vehicles like ICSH. In this article, we will explain various characteristics of ICSH, and why we prefer it to other short-term fixed income options.

Portfolio and Credit Risk

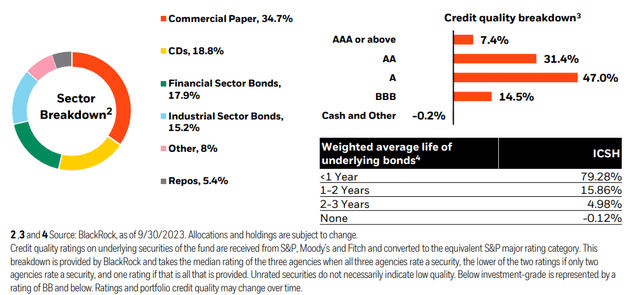

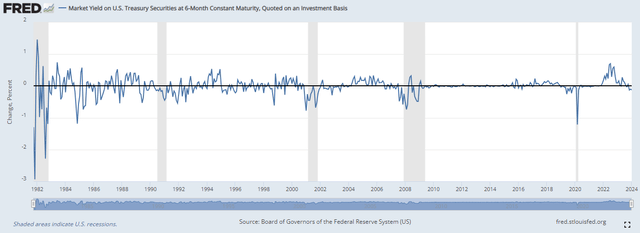

ICSH invests in a variety of fixed income instruments including CDs, commercial paper, sector bonds, and repos. Additionally, the instruments it holds can vary in credit quality all the way from AAA or Above to BBB. Some might see this as an unwise portfolio to invest in when thinking about how you want to store your cash. Cash is an investment that you want to be sure remains stable, acting as a buoy to your portfolio, even during the worst market downturn. Thus having your cash exposed to credit risk during a downturn in the economy doesn’t seem to make sense. However, for ICSH, its increased credit risk has done very little to hurt it when things get bad. In fact, its worst monthly return in the last 5 years was only negative 87 basis points. This period includes the COVID-19 crash, as well as months like July 2022, where the 6-month U.S. Treasury yield spiked 70 basis points, a magnitude of change in that figure we have not seen since 1983. Due to these outlier events in that time frame, we believe a risk of negative 87 basis points in one month is close to the maximum level of loss that could be expected for this fund over that time period.

Change in yield from previous month (FRED)

See below for a breakdown of debt instruments and credit quality in the ETF’s portfolio.

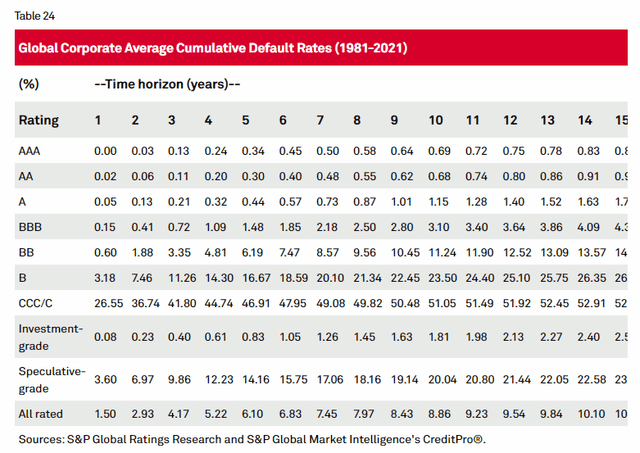

What may concern some is the allocation to BBB-rated fixed income. It should be noted that BBB is still an investment grade rating, and although these securities have a higher risk of default than their A and above-rated counterparts, in reality, it is not that much higher. When looking at the default probability for BBB bonds within a 1 year time period, which is what we are interested in because the average maturity of this fund is 220 days, we see it only sits at 0.15%. Yes, higher than the 0% of AAA but in absolute terms still extremely low. Based on the analysis in this section of the article, we are not particularly concerned with the level of credit risk this investment has.

Yield Comparison

When looking at the yield of ICSH compared to other cash management strategies, it has a solid advantage. Its SEC Yield sits at 5.46%. Some notable money market funds include VUSXX, the Vanguard Treasury Money Market Fund and SPRXX, the Fidelity® Money Market Fund. Their SEC Yields sit at 5.30% and 5.07%, respectively. ICSH also has an advantage in yield over the 6-month treasury, which sits at 5.22% as of January 24th. The only cash investment offering a better yield is certain CDs, with one on this Bankrate list at 5.50%. However, when considering the hassle of setting up a CD and the lack of liquidity compared to an ETF, we can accept a lower yield of just 4 basis points.

Returns

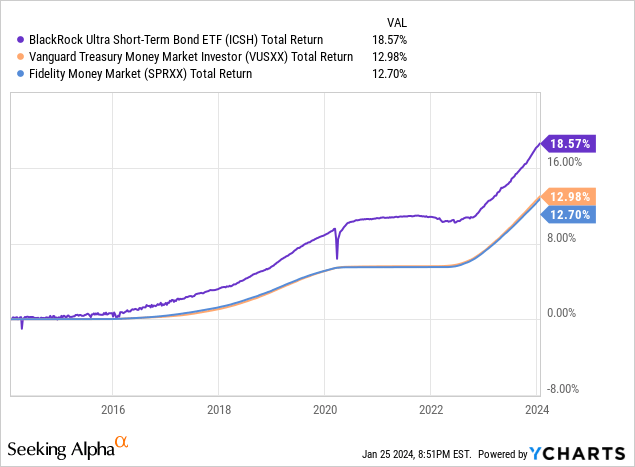

If you still think that ICSH is too risky compared to money market funds, the good news is that you’re being paid for that risk. Over the last 10 years, ICSH has had an annualized return of 1.70%. This handily beats VUSXX and SPRXX, which returned 1.19% and 1.17%, respectively.

The last major point to make about ICSH is the fact that it has a higher duration than many money market funds, which could allow it to benefit more from this year’s anticipated rate cuts by the Federal Reserve. VUSXX and SPRXX have average weighted maturities of 40 and 20 days, respectively, while ICSH sits at approximately 220 days. We could not find data on the exact duration of all these funds, so we are using weighted average maturity as a proxy. Clearly, the duration of ICSH will be substantially longer, allowing it to benefit from the falling rates many expect at some point this year.

Risks

1. Rising rates – Due to the longer duration if rates rise ICSH will suffer more than a money market investment. If you expect rising short-term rates, this is not the cash management investment for you.

2. Higher-than-expected inflation – The main catalyst for rising rates would be another flare-up of inflation. Most do not expect this to happen as inflation has been on a steady decline. However, nothing in this world is certain. An investor anticipating an inflation resurgence would not want to use ICSH as their cash management tool.

Conclusion

All in all, we believe ICSH and its higher yield, limited risk, outperformance, and ability to benefit from rate cuts make it a fantastic cash management tool, and thus we rate it a “strong buy.”