Elena Bionysheva-Abramova

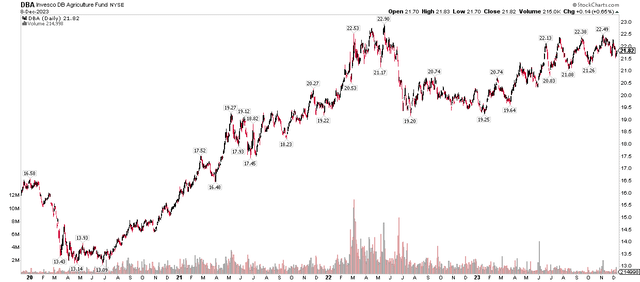

It has been a wild few years in the agricultural commodity complex. Russia’s invasion of Ukraine almost two years ago led to a bull-market crescendo across the softs. That helped many companies in the Materials sector, but a steep fall off in commodity prices over the back half of 2022 later weighed on many ag stocks. Today, the Invesco DB Agriculture Fund ETF (DBA) has recovered to within 5% of its Q2 2022 high, but not all equities related to such soft commodities have performed well.

I am upgrading shares of ICL Group (NYSE:ICL) from hold to buy on valuation. Shares are more attractively priced today, and I see some preserve on the chart, but risks remain. I’d also admire to see more clarity on the future of this international firm amid high geopolitical risks.

DBA Agriculture Commodity ETF: Rising Back Toward 2022 Highs

According to Bank of America Global Research, ICL is no. 6 in the global potash industry, with roughly 7% of capacity, selling mainly into agriculture. It is also no. 2 in the bromine industry, with about 30% of global capacity, selling brominated flame retardants, clear brine fluids, and other industrial applications. ICL also has a significant phosphates business (fertilizers, food ingredients, industrial applications) and a specialty fertilizer division.

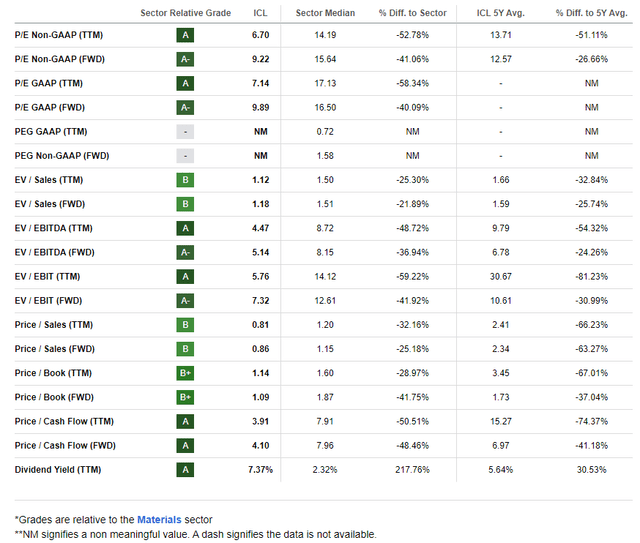

The Israel-based $6.5 billion market cap Fertilizers and Agricultural Chemicals industry company within the Materials sector trades at a low 9.2 forward 12-month non-GAAP price-to-earnings ratio and pays a high 7.4% trailing 12-month dividend yield. Ahead of earnings due out in mid-February, shares trade with a moderate 28% implied volatility percentage.

Last month, ICL reported a decent quarter. Q3 non-GAAP EPS of $0.11 beat the consensus assess of $0.09 while revenue came in at $1.9 billion, a 25% decrease from year-ago levels. The company reaffirmed its guidance for 2023 adjusted EBITDA, and the stock rallied in the weeks after the report. Elsewhere in the industry, peers Nutrien and Mosaic were recently double upgraded by analysts at Barclays on strength in the potash market, and that team raised its rating on ICL from Equal Weigh to Overweight, though noting that it is also the riskiest stock in the group amid geopolitical tensions in Israel.

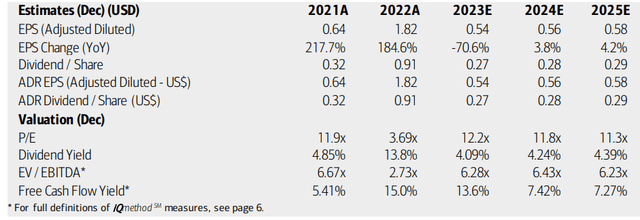

On valuation, analysts at BofA see earnings falling sharply this year following 2022’s ag bull market. Per-share profits are expected to boost at a low to mid-single-digit pace in both 2024 and ‘25. The current consensus assess, per Seeking Alpha, shows $0.51 of operating EPS next year, jumping to $0.64 by 2025. Annual sales are forecast to range between $7 and $8 billion, with little in the way of sustained top-line growth. Dividends, meanwhile, are expected to be volatile, but somewhat high – the firm has a long-standing policy of paying out 50% of adjusted net income each quarter, so don’t expect a consistent dividend rate.

Though solid free cash flow is expected over the coming quarters (with over $400 million of operating cash flow and $217 million of free cash flow in the third quarter that just ended), the management team said they do not think share buybacks is the right use of cash right now given their focus on growth. I would admire to see that shift and more shareholder accretive activities be the priority.

ICL Group: Earnings, Valuation, Free Cash Flow, Dividend Yield Forecasts

If we assume a normalized EPS figure of $0.55 and apply ICL’s 5-year historical non-GAAP forward earnings multiple of 12.6, then shares have a fair value near $6.90, but that lookback includes the extreme bull market of early 2022, so applying a 10% extra margin of safety is prudent. That would bring the fundamental target price to near $6.20, making the stock about 20% undervalued today.

ICL: Compelling Valuation Metrics

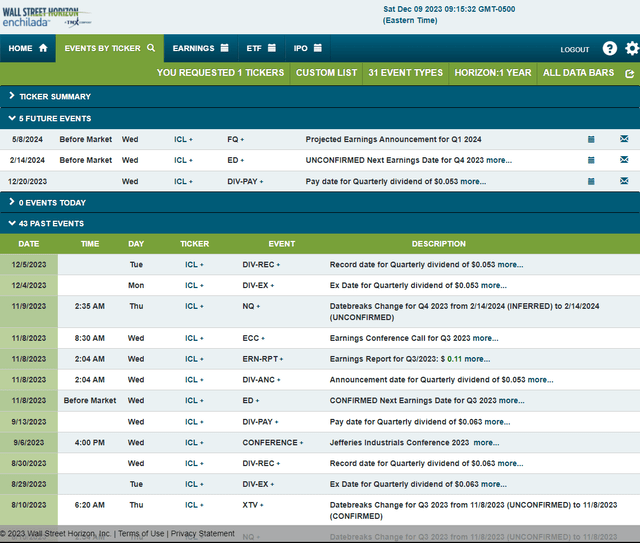

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 2023 earnings date of Wednesday, February 14 BMO. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

The Technical Take

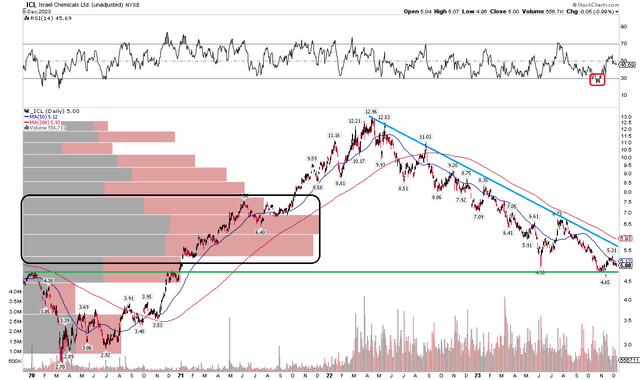

ICL shares remain in a steep bear market. Notice in the chart below that the stock peaked near $13 in April 2022. Down about 60% from that high, I spotted possible preserve at ICL’s early 2020 zenith, just before the onset of the pandemic. The $4.50 to $5 zone has attracted a few buyers lately, but there are technical risks apparent.

First, the long-term 200-day moving average is negatively sloped, indicating that the bears are in charge. Next, a series of lower highs and lower lows has been the mantra over the past handful of quarters. Furthermore, the RSI momentum oscillator at the top of the graph printed a new low when the stock dipped to its November nadir of $4.65. Finally, the bulls may have a tough time on rally attempts given the high amount of volume by price between $5 and $8.

So, there are major concerns here, but long with a stop under $4.50 (below the 2023 low) could work given that I see the stock fundamentally undervalued. This $4.50 technical point incorporates all the pieces of information presented and is used for risk management purposes.

ICL: Bearish Downtrend, Key preserve Under $5

The Bottom Line

I am upgrading ICL from a hold to a buy on valuation but remain concerned about a slew of technical risks.