DNY59

IBHF strategy

iShares iBonds 2026 Term High Yield and Income ETF (BATS:IBHF) is a high yield bond fund paying monthly distributions with a total expense ratio of 0.35%. It was launched on 11/10/2020 with the objective of investing in components of the Bloomberg 2026 Term High Yield and Income Index. The fund may also invest in ETFs, U.S. government securities, and cash equivalents. It has 220 holdings, mostly corporate bonds below investment grade with a maturity date between 1/1/2026 and 12/15/2026, and an average yield to maturity of 7.68%. The fund itself has a trailing 12-month yield of 7.42%.

The underlying index is rebalanced on the last calendar day of each month until 6/30/2026. Then, as the bonds mature, it will transition to cash and cash equivalents. On or about 12/15/2026, the fund will terminate operations and be redeemed to shareholders, as its value will be almost entirely in cash.

Portfolio

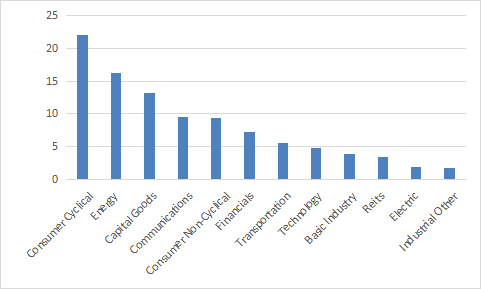

The IBHF fund is quite heavy in industrials: the sum of capital goods, transportation, basic industry (which may also include companies in the materials sector), and other industries represents about 24% of asset value. The consumer cyclical sector (“consumer discretionary” in GICS denomination) weighs 22% of assets. The third sector in the portfolio is energy with 16%. Other sectors are below 10%.

IBHF industry breakdown in % of assets (Chart: author; data: iShares)

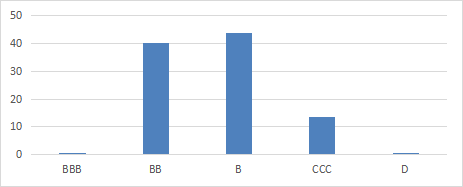

About 98% of the fund’s asset value is in bonds rated BB and below. IBHF is clearly positioned in the “junk bond” ETF category.

IBHF ratings in % of assets (Chart: author; data: iShares)

The next table lists the top 10 issuers, representing 15.8% of asset value. The heaviest one weighs less than 3%. The portfolio is well-diversified and risks related to individual companies are low.

|

Name |

Weight% |

|

TRANSDIGM INC |

2.87 |

|

MAUSER PACKAGING SOLUTIONS |

1.86 |

|

AADVANTAGE LOYALTY IP LTD |

1.69 |

|

NGL ENERGY PARTNERS LP |

1.47 |

|

DISH DBS CORP |

1.43 |

|

TENET HEALTHCARE CORPORATION |

1.36 |

|

CONNECT FINCO SARL |

1.34 |

|

NEWELL BRANDS INC |

1.28 |

|

NGL ENERGY |

1.27 |

|

UNITED AIRLINES INC 144A |

1.26 |

Who should hold IBHF?

This fund is clearly not a long-term investment: it will be converted to cash in 2026. In fact, IBHF is not a standalone product. It is designed as a component for bond ladder strategies, along with its siblings with different years of maturity: IBHD (2024), IBHE (2025), IBHG (2027), IBHH (2028), IBHI (2029) IBHJ (2030). The fund issuer also has bond ladder ETFs in investment grade corporate bonds (IBDP to IBDY), municipal bonds (IBMM to IBMR) and treasuries (IBTE to IBTO).

A bond ladder strategy allots a capital to several “rungs,” usually in equal weight and corresponding to equidistant maturity intervals. When the closest rung is converted to cash, the proceeds may be reinvested in a farther rung, or elsewhere. Rungs may vary from quite short term (for professional bond portfolio managers) to several years. iShares iBonds series allows investors to create rungs with intervals of one year or more. In a bond ladder strategy, these ETFs are designed to be held until maturity. Doing so, investors don’t have to worry about price variations due to interest rates and sentiment about them. However, keep in mind they hold junk bonds, so defaults may affect the net asset value.

A bond ladder strategy allows to:

- Manage cash flow based on planned distributions

- Smooth out the effect of fluctuations in interest rates

- Lock in higher yields when it is possible

- Have periodically some cash available to reinvest or spend.

ETFs like IBHF make bond ladder strategies simple for everyone. It doesn’t mean they are for everyone, and even less those in the high yield category. First, bonds usually represent only a part of an investor’s asset allocation. Second, to be worth the work, bond ladders need to be divided in several positions with at least a few thousands dollar in each. Third, a ladder in junk bonds makes sense only after creating at least another ladder in safer bonds (treasuries, munis, corporate investment grade). ETFs like the IBHx series have their place in the strategy of investors with enough capital to build all these positions.

Performance

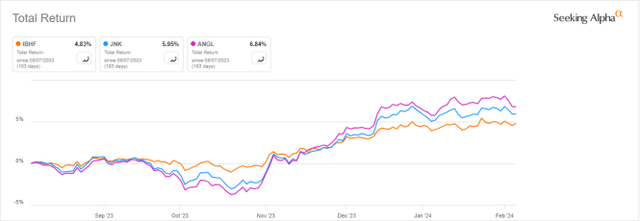

The next chart compares total return since inception of IBHF and two high-yield bond ETFs holding bonds of all maturities:

- SPDR Bloomberg High Yield Bond ETF (JNK), a benchmark for this asset category;

- VanEck Fallen Angel High Yield Bond ETF (ANGL), picking bonds that have lost their investment grade rating.

IBHF is the best performer in this time frame, as reported on the chart below.

IBHF since inception vs. JNK, ANGL (Seeking Alpha)

However, IBHF has been lagging over the last 6 months (next chart). It is much less volatile: it will start converting to cash in 2 years and 4 months, so there is a lower risk on NAV than for funds holding bonds of all maturities.

IBHF vs. JNK, ANGL year-to-date (Seeking Alpha)

Takeaway

iShares iBonds 2026 Term High Yield and Income ETF has an attractive 7.7% yield, but it is not a long-term investment. It is an element of a bond ladder ETF series and will be converted to cash in December 2026. Bond ladder ETFs are designed to be held until redemption to limit risks of price gyration. However, IBHF low volatility in the recent months shows that the risk is already much lower than for broader junk bond ETFs. Ladders in high-yield bonds are for investors who have enough capital to build ladders in safer bonds first (treasuries and/or investment grade).

Does it make sense to invest in corporate bond ladders when a much safer T-bill ETF like iShares 0-3 Month Treasury Bond ETF (SGOV) is at 5.4%, with a fee of only 0.07% and a very low volatility? It depends on your view on rates: if you think they will go down, bond ladders can lock in high rates in your portfolio for a few more years.