3D_generator

Investment Thesis

IBEX Limited (NASDAQ:IBEX) represents an investment opportunity within the Business Process Outsourcing (BPO) sector. The company operates as a global provider of customer engagement and technology-driven outsourcing solutions, serving various industries. Our investment thesis for IBEX is shaped by several key factors. IBEX’s performance is significantly influenced by the prevailing macroeconomic conditions. Unlike some of its peers, such as TaskUs and TELUS International, IBEX may not have a sufficient differentiation strategy to shield itself from macroeconomic headwinds. Therefore, its stock performance is expected to closely track the overall macro environment. IBEX is well-positioned as a GARP investment, offering growth potential at a reasonable price. While the company’s performance is tied to macro conditions, its focus on technology-driven solutions and customer engagement places it in a favorable position to benefit from industry growth when the macroeconomic landscape improves. IBEX’s strong balance sheet with minimal debt provides ample flexibility for future investment opportunities. The company’s commitment to stock buybacks, driven by the perception of undervaluation, demonstrates its willingness to enhance shareholder value. Additionally, IBEX’s capacity to take on debt can be leveraged for accretive mergers and acquisitions (M&A) activity in the future, potentially enhancing its market position. Given IBEX’s sensitivity to the macroeconomic environment and the competitive landscape within the BPO sector, we maintain a HOLD rating on the stock. We recommend that long-term investors closely monitor the company’s performance as the overall macro environment improves. As macro conditions become more favorable, IBEX’s stock may offer greater potential for value appreciation.

Company Overview

IBEX Limited, founded in 2004, is a global provider of BPO services and Customer Engagement technology solutions. The company has grown significantly over the years, expanding its reach and service offerings. IBEX specializes in delivering innovative customer support and engagement services across various industries, leveraging technology to enhance efficiency and customer satisfaction.

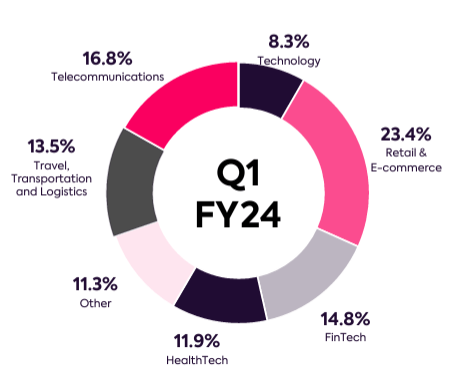

IBEX Revenue Breakdown (Company Materials)

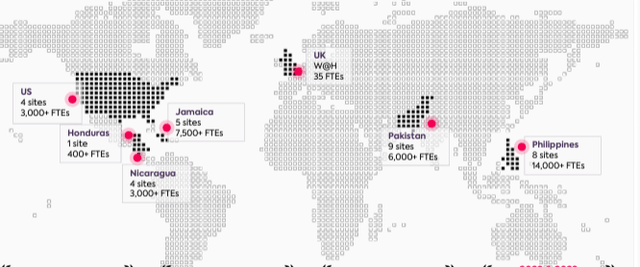

The company’s evolution has been marked by its expansion into multiple global markets and sectors, adapting to changing business environments and customer needs. IBEX Limited operates in 22 countries globally and employs over 33,000 individuals. The company’s customer base spans various sectors, including technology, telecommunications, retail, e-commerce, financial services, healthcare, and more.

IBEX Global Footprint (Company Materials)

Market Trends and IBEX Positioning

The BPO market is subject to the following trends which are pertinent to IBEX:

-

Tailwinds:

- Digital Transformation: Companies are increasingly outsourcing non-core functions like customer support, driving growth in the BPO sector.

- Globalization: As businesses expand internationally, they rely more on BPO services to manage diverse customer needs across different regions.

-

Headwinds:

- Economic Fluctuations: Economic downturns can lead businesses to cut costs, potentially affecting outsourcing budgets.

- Regulatory Changes: Varying international regulations can impact BPO operations, particularly in data security and privacy.

-

Technology Disruption:

- The integration of AI and automation technologies is reshaping the BPO industry, leading to more efficient and effective service models.

-

Market Growth:

- The BPO market is experiencing significant growth, driven by the increasing adoption of these technologies and the expansion of service offerings.

-

Key Competitors:

- IBEX faces competition from other major BPO players such as Teleperformance, Concentrix, and Alorica.

-

Marketing Positioning:

- IBEX positions itself as a “technology-driven, innovative provider, focusing on customer experience enhancements and leveraging AI and analytics to stand out in the market”. Our view is that while there are elements of these items present within the company, overall IBEX is a traditional BPO player and hence its prospects are closely tied to the overall macro environment

Recent Performance

IBEX Limited’s recent performance demonstrates its resilience and ability to navigate through various market conditions.

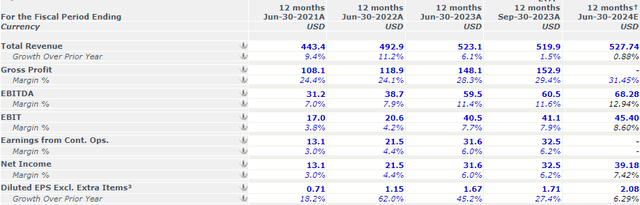

- Revenue Growth: IBEX reported a 6.1% increase in FY23 revenue, indicating its capacity to maintain revenue growth even in the face of challenges. This growth is significant and underscores the company’s ability to adapt to evolving market dynamics.

- EBITDA Margin Improvement: The company’s EBITDA margin improvement is another positive indicator. This signifies efficient cost management and operational execution, leading to enhanced profitability. A strong EBITDA margin is critical in the BPO sector, where margins can be sensitive to labor costs and other operational factors.

- Net Income Rise: IBEX’s net income rose by 47.1% in FY23, reflecting not only revenue growth but also effective cost control measures. This is a substantial increase and highlights the company’s ability to convert its revenue into profit.

- Strategic Shift: IBEX’s strategic shift from onshore to offshore services contributed to its profitability and margin expansion. This shift aligns with industry trends and positions the company well for future growth.

IBEX Financial performance (Capital IQ)

Growth Catalysts

- Strategic Focus on Offshore Services: IBEX’s strategic shift towards high-margin offshore services is a key growth catalyst. By tapping into offshore regions, the company can leverage cost advantages and provide competitive services to clients. This shift aligns with industry trends and contributes to margin expansion.

- Integration of Advanced Technologies: IBEX’s investment in AI and automation is a significant growth driver. By incorporating these advanced technologies into its services, the company can enhance efficiency, reduce operational costs, and deliver a superior customer experience. This technological edge differentiates IBEX in the market and attracts clients seeking innovative solutions.

- New Client Acquisitions: The company’s ability to acquire new clients, particularly in growth sectors like HealthTech and FinTech, is a testament to its market appeal. Expanding its client base allows IBEX to diversify its revenue streams and reduce client concentration risk. The acquisition of new clients in these high-growth industries positions IBEX for sustained revenue growth.

- Expansion into New Geographies: IBEX’s expansion into new geographies is another growth catalyst. As the company broadens its global footprint, it gains access to a wider client base and diversified revenue sources. This geographical expansion enhances IBEX’s market presence and contributes to its growth trajectory.

Valuation

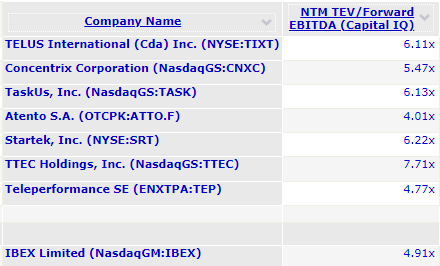

IBEX generally trades in-line with its peers. In our view, the company’s growth rate relative to its size is on the low end of the spectrum and its discount vs. its higher growth peers is justified.

IBEX Comps (Capital IQ)

Overall, IBEX’s stock price will very much be dependent on the macro environment. With talks of interest rate cuts in 2024, we can potentially see meaningful appreciation, especially if some of the clients IBEX serves have a good year (see highlighted clients below).

Risks

- Macroeconomic Sensitivity: IBEX’s performance is closely tied to macroeconomic conditions. Economic downturns can lead to reduced client spending, delayed projects, or renegotiated contracts, impacting the company’s revenue and profitability. As a result, IBEX’s financial health is influenced by the broader economic climate, making it vulnerable to economic fluctuations.

- Technology Disruption: The BPO industry is undergoing rapid technological changes, including the integration of artificial intelligence and automation. IBEX must continuously innovate and invest in advanced technologies to remain competitive. Failure to adapt to evolving technological trends could hinder its ability to attract and retain clients.

- Labor-Intensive Nature: The BPO sector is labor-intensive, with a significant portion of costs attributed to employee salaries. Fluctuations in labor costs, difficulties in talent acquisition and retention, and labor disputes can impact IBEX’s profitability. Managing labor-related challenges is crucial to maintaining cost-efficiency.

- Market Competition: IBEX faces competition from established players in the BPO market, including companies like TaskUs and TELUS International, which may have a more significant market presence or differentiation. Competition for clients and talent in a crowded market can affect IBEX’s growth prospects and profitability.

- Client Concentration Risk: IBEX’s business relies on a few major clients for a substantial portion of its revenue. Any downturn in these clients’ businesses, changes in their outsourcing strategies, or the loss of these accounts could have a disproportionately negative impact on IBEX’s financial performance. Reducing client concentration is a strategic imperative for the company.

- Regulatory and Compliance Risks: As a provider of digital customer experience and AI services, IBEX handles sensitive customer data. Changes in data protection and privacy laws, particularly in key markets, can impact its operations and increase compliance costs. Non-compliance with these regulations can lead to fines and reputational damage.

- Content Moderation and Ethical Challenges: IBEX’s involvement in content moderation and trust & safety services exposes it to ethical and regulatory risks. Scrutiny and regulatory attention on how online content is moderated can impact the company’s operations and legal responsibilities.

Conclusion

IBEX presents an intriguing investment opportunity within the BPO sector. However, our investment thesis is tempered by several key factors that investors should consider. Unlike some of its peers, IBEX may not have a sufficient differentiation strategy to shield itself from macroeconomic headwinds. Given its sensitivity to the overall macro environment, the company’s stock performance is expected to closely track macro conditions. Considering these factors, we maintain a HOLD rating on IBEX’s stock. We recommend that long-term investors closely monitor the company’s performance