I am a full-time working mum and earn £65,000 a year while my husband who works in a care home earns about £27,000.

We have two children aged 6 and 4. When my first daughter was born I earned under £50,000 and so initially took child benefit.

When my salary then went up, I stopped taking it and have not claimed it for the past four years – although looking back I think I should have tried to claim some while I was on maternity leave, as it would have really helped out.

A friend told me that the child benefit rules changed in the Budget and I should now be able to get some and it would be worth me taking it again.

How do I do this and will the fact that I have to pay some be worth the hassle, will I have to do a tax return, for example?

I earn £65,000 and have two young children – should I start reclaiming child benefit again?

Angharad Carrick of This Is Money says: The child benefit high income charge has been a contentious topic ever since its introduction by George Osborne in 2013.

Previously, the Government clawed back child benefit from households where the highest earner had an income above £50,000, and withdrew it completely when they earned over £60,000.

This meant that a household with two parents each earning £49,000 would receive the child benefit in full, while a household with one parent earning £50,000 would see some or all of it withdrawn.

Unlike other taxes, it was based on total individual income rather than the household so the higher earner bore the brunt of the charge.

While income tax and national insurance for someone earning £50,300 is 42 per cent, the child benefit removal means that the marginal tax rate for a parent with one child is 54 per cent, while for a parent with two children it is 63 per cent. That rises to 71 per cent for parents with three children.

All of this meant that many parents, like you, didn’t bother registering for self-assessment and filling in a tax return to claim child benefit.

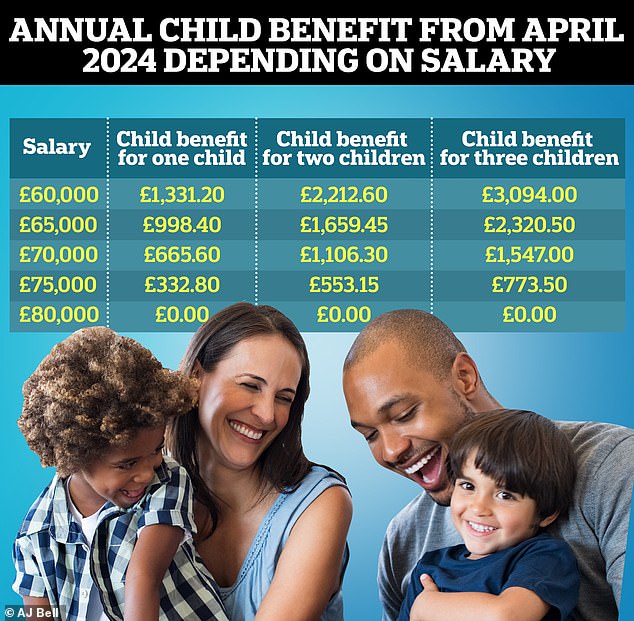

However, last month the child benefit rules changed, raising the threshold at which some child benefit is removed to £60,000, and the threshold at which it is withdrawn to £80,000.

Tax traps: The chart above shows marginal tax rates for income tax and national insurance on the red line, with a rise to 62% between £100k to £125k due to the removal of the personal allowance. The blue lines show the effect of child benefit removal between £50k and £60k

Under these new rules, you would have to pay back some of the child benefit because you earn over £60,000. The current rules state that you will be charged 1 per cent of your child benefit for every £200 of income over £60,000.

So is it worth applying for child benefit again? We asked the experts.

Shaun Moore, tax and financial planning expert at Quilter says: Since your income is £65,000, you will need to pay a portion of the benefit back. This equates to approximately 25 per cent of the child benefit you receive.

Therefore, for two children the child benefit rate is approximately £2,212 per year but you will need to pay around £553 of this back due to the charge, leaving you with £1,659.

Since you have not claimed your child benefit for four years you will need to reapply for it via the HMRC child benefit page or download the HMRC app and claim via that.

Child benefit can be backdated for up to three months, so if you apply now, you can receive payments from as far back as February 2024.

Robert Salter, partner at Blick Rothenberg says: I would generally recommend that anybody who is eligible for child benefit – even where some of this will be clawed back – does pro-actively claim it.

There are a number of reasons for doing this. First, why should you give up on money to which you are legally entitled?

And second, what happens if your income suddenly falls during the course of the year and your income, for example, falls below the relevant thresholds?

This is an obvious risk for those who are self-employed, but can also happen when one of the following occurs:

- You receive a significant part of your income based on commission, bonuses etc. and these can vary from year-to-year

- You are ill for a significant part of the year; or

- You get made redundant or put on reduced hours working;

The rules about claiming child benefit typically allow one to only backdate a child benefit claim for up to 3 months from the date of application.

As such, if you suddenly fell ill and weren’t paid (e.g. because you are self-employed) or lost your job, you wouldn’t necessarily be able to retrospectively claim child benefit for the full tax year.

Claiming the benefit initially and then having to pay it back (in part), if necessary is – in simple terms – a type of insurance policy.

Filing a tax return

Angharad Carrick says: Given you will have to pay back 25 per cent of the child benefit, around £550 on your current salary, you will need to file a tax return for 2024/25.

This means you will have to register for self-assessment, which is fairly straightforward.

You will need to head to the Government website and reactivate your account. Make sure you have your Government Gateway information and Unique Taxpayer Reference number to hand.

Robert Salter says: Whilst you would be obliged to complete a 2024/25 UK tax return in due course, I would highlight the following:

The tax return won’t need to be submitted to HMRC until 31st January 2026 – so you have ‘access’ to the child benefit monies for a considerable period of time automatically before any refund is required; and

If the only items which need to be reported on the tax return are your salary and the child benefit claims, you should be able to submit your tax return to HMRC yourself. There shouldn’t be any need to pay an accountant to prepare a tax return, for example.

If you have some concerns about being able to ‘pay back’ the 25 per cent of the child benefit which would be due back in this case come January 2026 when the tax return is due, for example because you’re worried you would have spent the money, you could ask HMRC to make an adjustment to your PAYE tax code to recognize the money which will be due back.

This should help ensure that at the end of the tax year, you have paid broadly the correct amount of tax, including any adjustments which are required because of the child benefit clawback.

Reducing your adjusted net income

Angharad Carrick says: Before you start considering whether to claim the money and do a tax return or opt out, it is worth looking at what counts towards the higher income threshold and some ways to reduce it.

The child benefit charge is applied to adjusted net income, which excludes the value of any pension or gift aid charity contributions you make, for example.

Charlene Young, pensions and savings expert at AJ Bell says: If you’re making your own payments into a workplace or personal pension scheme, make sure you’re deducting these from your income as it could give you a chance of being able to get the full amount of child benefit back.

For example, someone earning a salary of £65,000 before tax could make a £4,000 contribution to a pension, which would automatically be boosted to £5,000 thanks to automatic tax relief of £1,000.

This means not only an extra £5,000 in their pension pot, but £5,000 deducted from their adjusted net income figure.

Their adjusted income would come down to £60,000 and get them the full value of child benefit back. As a higher rate (40 per cent) taxpayer, they could also claim an extra £1,000 in tax relief by contacting HMRC.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.