mikkelwilliam

This article was co-produced with Chuck Walston

The CEO of Humana (NYSE:HUM), Bruce Broussard, began the earnings call with the following comment:

…I’d like to start by stating the obvious. We are disappointed in the update provided today.

As the earnings call progressed, we were told that Q4 results fell well short of consensus and that guidance for fiscal year 2024 is now markedly lower.

Investors were more than disappointed.

It is not hyperbole to claim that many were stunned by what followed, and the market reacted accordingly. The stock fell 11% in one day.

To determine where the company goes from here requires one to dissect management’s response to analysts’ queries as well as a variety of trends facing the industry.

What Was So Hard?

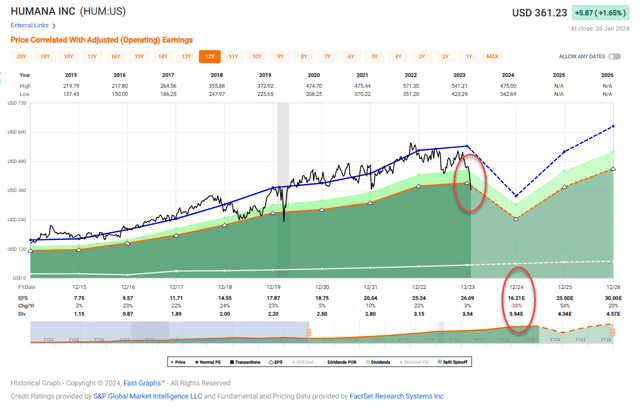

Humana reported a loss of $4.42 per share, or a non-GAAP loss of $0.11, well off the consensus estimate of $0.92. That number was also a far cry from the $1.97 in EPS recorded in the comparable quarter.

The big EPS miss was a bit of a head scratcher, considering Humana reported a 17.9% increase in revenue to $26.42 billion, up from $22.4 billion a year ago. That number beat analysts’ $25.6 billion forecast by a decent margin.

Unfortunately, on top of the big EPS miss, management lowered guidance for 2024 markedly. HUM now forecasts EPS of “approximately $16 on an adjusted basis.” That’s well below analysts’ consensus adjusted EPS of $28.91 for 2024.

Added to that, Humana projects a relatively anemic adjusted EPS growth in a range of $6 to $10 in 2025, versus the previous $37 target.

This stunned investors, considering that just three months ago, Humana projected adjusted EPS growth at the lower end of a 11% to 15% range for 2024.

Management cited “unprecedented increases in medical cost trends” and an increase in utilization of benefits as the primary factors leading to the decidedly miserable fourth quarter earnings.

Why Nobody Saw This Coming

Jefferies analyst David Windley had this to say following Humana’s earnings.

We did not think $16 was possible.

Windley believed the firm’s earnings might drop in 2024, but he had a range of $20 to $21 a share.

In the week leading up to Q4 earnings, the four analysts that provided updated price targets for HUM had an average share price of $542.25, well above the mid $400s valuation for the stock over the last thirty days.

I’ll proffer that analysts were influenced by several trends and recent developments in the Medicare Advantage space.

For one, UnitedHealth (UNH), the number one provider of Medicare Advantage plans, provided Q4 earnings earlier this month. UNH beat analysts’ estimates on the top and bottom lines with $94.4 billion in revenue, a 14% year over year increase, and a 16% year over year surge in EPS.

Unlike HUM, UnitedHealth reaffirmed its 2024 guidance for revenue in a range of $400 billion to $403 billion and adjusted EPS in a range of $27.50 to $28.00.

During UnitedHealth’s earnings call, when an analyst posed a question regarding increased medical costs and utilization of benefits, he received a markedly different picture versus the outlook posed by Humana.

Here is the CEO’s response:

…what we certainly saw was a click up in some seasonal activity, each of which individually are kind of pretty small. But added together just made a bit of a difference in that last run out of the quarter, around things like RSV vaccination, which has brought with it — dragged with it, if you will, some extra utilization of services from seniors who’ve come in for their vaccine.

Listen, to be clear, all of that is good news for healthcare, right? So, these are seniors, many of whom had not been to the office for a long time.

They’ve come back in and now got vaccinated. The physicians have picked up other things while they’ve been there. So a little bit of that going on combined with a little bit of heightened COVID activity just as we rolled out of the year. None of which we really think is durably impacting our outlook for ‘24.

Additional comments by UNH’s management team indicated rising costs aren’t expected to adversely affect the company’s guidance for 2024.

Furthermore, UnitedHealth isn’t the only major Medicare Advantage provider to report solid results and guidance.

Elevance Health (ELV) provided Q4 earnings the day before Humana.

Like UNH, Elevance beat on the top and bottom lines, and management set 2024 guidance ahead of consensus while bumping the dividend by just over 10%.

Here’s an excerpt from that company’s latest earnings call.

..we remain confident in the outlook for utilization and medical cost trends embedded in our 2024 bids.

Another conundrum lies in moves by CVS Health (CVS), the parent company of Aetna. That firm has been moving aggressively in building its Medicare Advantage business.

Early this month, CVS announced it expects enrollment in its Medicare Advantage plans to hit at least 800,000, an increase from the previous forecast of adding 600,000.

I could add to this list of the reasons why analysts and investors were blindsided by Humana’s Q4 results and guidance, but I believe I’ve proved my point.

How Humana Might Right The Ship

During the earnings call, Humana executives advised analysts that the entire industry would be forced to raise rates to meet surging costs associated with increased benefits utilization.

I looked at next year as a year that I think the whole industry will possibly reprice. I don’t know how the industry can take this kind of increase in utilization along with regulatory changes that will continue to persist in 2025 and 2026.

Bruce Broussard, CEO

During the earnings call, management repeatedly spoke of increasing profits. Unfortunately, the problem with raising rates is that it could lead to a fall in Medicare Advantage members.

…we just don’t want to fall off the cliff and lose hundreds of thousands of members.

CEO Bruce Broussard

Furthermore, HUM appears to be behind the eight ball in terms of the costs associated with increased benefits utilization. During the earnings call, the CFO noted “$3 billion of additional (outpatient care) trend that’s emerged that we’re having to absorb in 2024.”

Don’t Dismiss Humana’s Strengths

For three consecutive years, Forrester ranked Humana the top health insurer in terms of customer service experience quality. Humana also gained the top spot in the U.S. News and World Report’s ranking of the best overall Medicare Advantage providers, and JD Power ranked Humana as the second-best Mail-Order Pharmacy in the US.

Aside from helping to retain current members and wooing prospective customers, this outperformance translates indirectly into hefty bonus payments. In bonus year 2023, Humana was awarded $4.4 billion in star bonus income.

The government pays Medicare Advantage insurers bonus payments for high star ratings related to patient outcomes, processes, experiences, and access. Using a Star rating system, with 1 being the worst and 5 the best, insurers are awarded a star score.

Humana had the highest percentage of members in 4 star or higher-rated contracts over the last six years, and next year, around 98% of the company’s Medicare Advantage members will be enrolled in 4-star plans or above, an industry leading score.

To place this in context, the national average 4-star ratings for all providers is 72%.

Humana also lowers costs by providing quality care. Patients enrolled in HUM’s value-based care programs experienced 12% fewer emergency room visits and 245,000 fewer days in hospital beds.

Humana also recorded robust growth prior to the 2023 fiscal year. Total revenue increased to $92.9 billion in 2022, marking a three-year compound annual growth rate of 13%.

Is Humana Stock A Buy, Sell, Or Hold?

Humana’s results on Thursday were arguably dismal.

Moving forward, the company can cut back on benefits to boost margins, and/or raise prices, but those moves would likely lead to subdued growth.

Nonetheless, it is apparent that Humana will prioritize margin recovery and profitability over membership growth for the short to midterm.

However, the CFO, noting that there was $3 billion in increased costs associated with the surge in inpatient utilization, provided this less than reassuring reply to an analyst’s question regarding the company’s plans to increase prices.

“And with that level of trend, which was never contemplated in the $31, there’s only so much margin expansion you can get once you actually cover the trend.”

Other comments reinforced that view. The following is some back and forth between the UBS analyst and CEO Bruce Broussard:

(Analyst)…you’re saying you’re underpriced for the 2024 trend you’re dealing with, whereas that usually results in big enrollment growth, your enrollment expectations for 2024 are quite modest.

(‘CEO’) We see the business as being much tougher as a result of regulatory environment. We see that things like what we saw this year relative to utilization, getting back to above COVID levels, we just see it not being as easy to price to membership growth.

For a company noted for fairly robust growth and a low yielding dividend, the slowdown in growth caused by the increase in pricing needed to raise profits may pose problems for some investors.

On the plus side, over half of US seniors get their benefits through private plans, and demographic trends still favor Medicare Advantage providers.

Also, the previously noted Jefferies analyst, David Windley, opined that Humana is likely providing a conservative forecast. I’ll add that the tone of the earnings call led me to believe management sought to err on the side of caution.

Furthermore, HUM is a leader in the Medicare Advantage space, one of the fastest-growing areas in U.S. medical insurance. Humana leads the industry in terms of customer satisfaction scores that drive growth, membership retention, and also earns multi-billion-dollar government bonuses related to the Star rating system.

Management also reaffirmed projections for 2024 Medicare Advantage membership growth of approximately 100,000 in 2024, along with $1 billion in share repurchases for the year.

It is here that I confess I struggled mightily when determining how I would rate Humana. In fact, I’ll confess that upon launching my investigation into the company, I expected to rate the stock as a Buy.

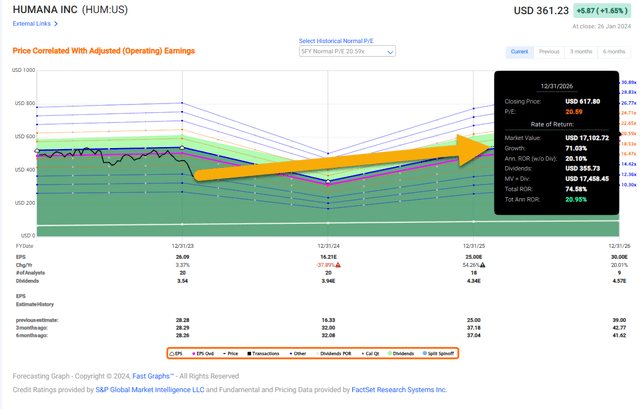

In large part, that is because I believe the shares are significantly undervalued.

However, if Humana’s leadership cannot even come close to accurately predicting revenues and profits for the company, how can I assess the stock moving forward?

Additionally, the very fact that the firm’s competitors appear to have weathered the storm caused by higher medical utilization trends leaves many unanswered questions.

There is simply too much uncertainty associated with Humana, and prospects for HUM at this juncture are decidedly opaque. In the best of times, evaluating companies’ is a difficult task. Consequently, it has been my practice to avoid investing in companies when I lack the means to make an assessment.

I’ll add that waiting until 2025 for a turnaround in a stock with a low yield that currently exhibits poor growth prospects is decidedly unappealing.

Therefore, I rate HUM as a HOLD.

I have a small investment in Humana. As I view the stock as significantly undervalued, I will monitor closely moving forward.