DSCimage/iStock via Getty Images

Introduction

Hudson Technologies (NASDAQ:HDSN) is the largest player in the U.S. refrigerant reclamation market and is strategically positioned to capitalize on the transformative changes driven by the AIM Act. With a 65% stock increase since its 2023 low and a staggering 900% return over five years, Hudson may be poised for even more growth in the years ahead. Hudson isn’t just a supply chain and inflation beneficiary or a COVID-era work-from-home story. Let’s explore Hudson’s market opportunity and how it might be able to take advantage of the regulation poised to shake up the industry.

Investment Thesis

The AIM Act is a long-term catalyst that will provide Hudson with an opportunity to accelerate revenues and take advantage of its operating leverage as the reclamation market expands. Hudson already holds the largest share of the U.S. refrigerant reclamation market; this positioning, combined with its technology advantage over competitors, a strong balance sheet, and a management team focused on the long-term opportunity of the AIM Act provides the opportunity for investors to attain market-beating returns, even after Hudson stock has gained more than 65% since its 2023 low.

The refrigerant reclamation market is in high growth mode. A Dataintelo report in 2021 estimated a 10.5% CAGR from 2023 to 2031. However, I believe that the AIM Act could more than double that growth rate, as it brings the beginning of a dramatic step down in HFC production starting this year. This provides an incredible opportunity for Hudson, which is perfectly positioned to benefit. Just like Hudson’s management, I believe 2024 could mark an inflection point for the company’s business.

Reclamation Market Is Set for Unprecedented Growth

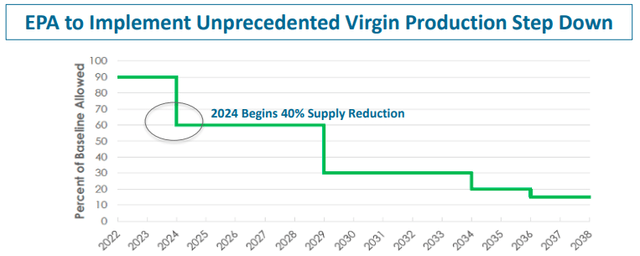

The refrigerant market is undergoing another regulatory change with the AIM Act. The AIM Act mandates a gradual reduction in the production and consumption of high GWP (high global warming potentials) refrigerants (HFCs) in the United States, ultimately reducing HFC production by 85% in 2036 and beyond. The phase-down of higher GWP refrigerants will forever alter the supply and demand landscape.

Timeline of HFC Production Reduction from AIM Act (HDSN Investor Presentation (Q3 2023))

Effective January 1st of this year, the amount of HFCs allowed to be produced has now fallen to 60% of baseline. This marks a dramatic reduction in virgin HFC production, increasing the need for recycled and alternative refrigerants to fill the gap. As with any reduction in a commodity market, it is expected to drive refrigerant prices higher.

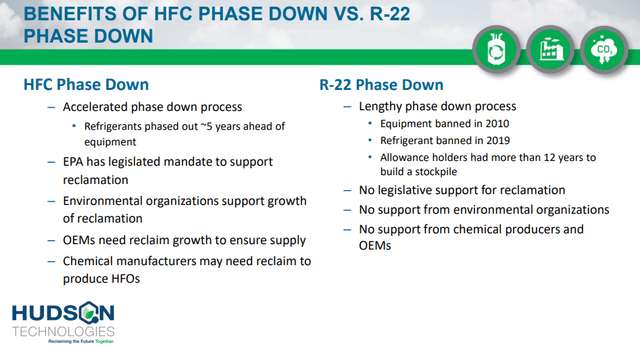

Unlike past phase-outs of refrigerants, the AIM Act is expected to make a more meaningful change to HFC supply. When R-22 was phased out, the equipment was the first to go, allowing manufacturers to stockpile R-22 before the refrigerant was phased out. Prices fell when suppliers flooded the market with stockpiled R-22, and Hudson suffered. However, this time, the HFC refrigerants are slated to be phased out first.

HFC step-down is expected to be more impactful than past step-downs (HDSN Investor Presentation (Q3 2023))

The exact impact the AIM Act will have on refrigerant production and reclamation markets is not fully understood, but it will reduce the production of virgin refrigerants; Hudson’s management anticipates a supply shortage resulting within two years. As a result, prices and the demand for reclamation, recycling, and re-use of existing refrigerants will likely rise. Hudson is already positioned to take advantage of this shift; 2024 could mark an inflection point for the company’s business.

Hudson’s management has mentioned that these changes could drive a 6x – 10x demand increase in reclamation. They did not specify what timeframe that 6x – 10x increase might occur over. This is a critical part of my thesis, but it is difficult to quantify the impact that it will have on the market for refrigerants. However, we can estimate the increase in recycled refrigerants required to replace virgin refrigerants during this step-down.

Note: These calculations exclude existing virgin refrigerant inventories.

Quantifying The Impact of The AIM Act

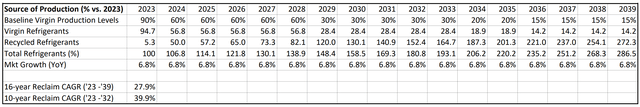

Let’s use the total refrigerant market as a baseline for demand growth, then adjust for the step-down in virgin HFC production and determine how much recycled refrigerants may be needed to fill the gap.

The North American refrigerant market is expected to grow at a 6.8% CAGR, but there will be a shift from new refrigerant production towards recycled refrigerants. But how much growth will the refrigerant reclamation market see as a result? Without available market size data for the North American reclamation market, we can use the worldwide market as a proxy and then make some adjustments for conservatism.

Based on the estimated global reclamation market size of $1.29 billion and the total global refrigerant market of $22.4 billion, the global share of refrigerant recycling is 5.3%. If the recycled refrigerant market makes up 5.3% of the total refrigerant market, we can use the step-down figures (“Baseline Virgin Production Levels”) from the AIM Act to estimate how much of a decrease in HFC production should occur (“Virgin Refrigerants”) and how much growth will be needed to account for a diminishing supply of virgin refrigerants (“Recycled Refrigerants”).

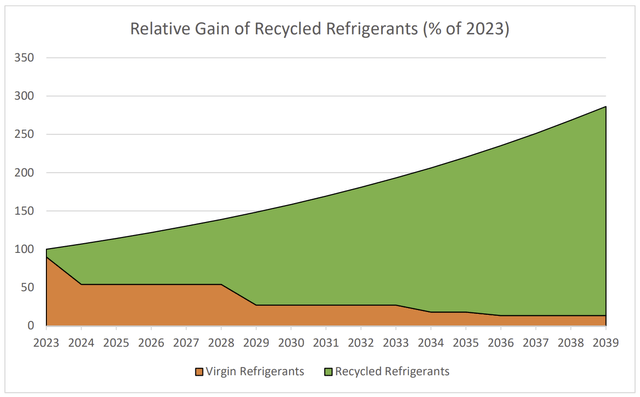

The phase-out of HFC production is expected to create significant growth potential in the reclamation and recycling market (Author-generated table)

We can see the potential for a 10-year CAGR of 39.9% for the refrigerant recycling market and a CAGR of 27.9% over the next fifteen years.

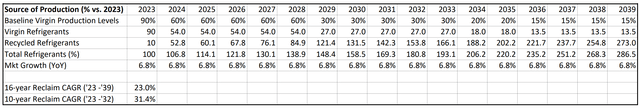

However, the American market may differ from the worldwide market. Because Hudson is the largest player in the U.S. market, we should consider the possibility that refrigerant recycling already makes up a larger share of the total market. Let’s conservatively assume that it already makes up 10% of the market.

If we tweak these assumptions to make the current recycling market share 10%, we still see significant growth potential. (Author-generated chart)

We can see that the reclamation market would still grow at an annual rate of 31.4% over the next ten years and 23% until 2039, several years after the step-down concludes.

We can visualize the potential forward growth in recycled refrigerants.

Forward Recycled Refrigerant Growth Potential (Author-generated chart)

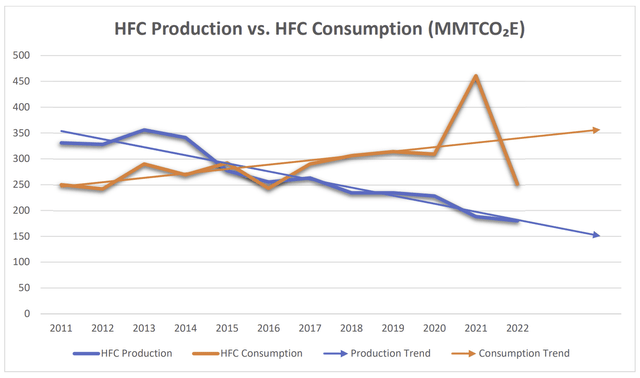

This growth is on top of a trend of decreased HFC production while consumption of HFCs has increased.

HFC Production vs HFC Consumption (Author-Generated w/ data from the EPA)

It’s important to note that these are rough assumptions that do not include current stockpiles of HFCs. I think a more reasonable assumption is that the refrigerant recycling market will grow faster than the 10.5% that was expected in the Dataintelo report. The outlook has changed since then, as the AIM Act has impacted the market. I can reasonably see the reclamation market growing as much as 20% annually, but I do not expect it to grow at 40%.

Growth Assumptions

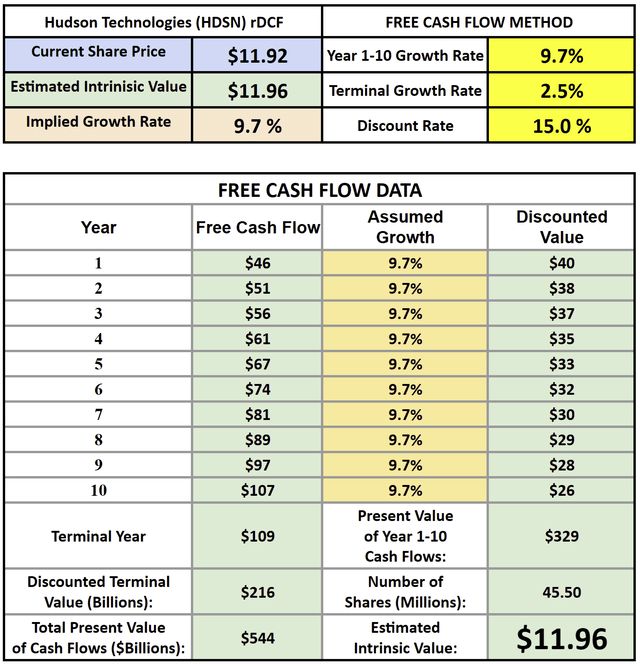

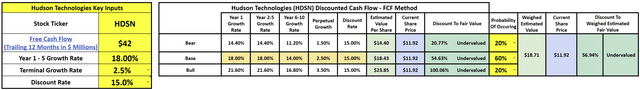

When I do my valuation work, I start with determining the growth assumptions needed to support a company’s current stock price using a simple reverse discounted cash flow model. Then, I work backward to ensure the company’s fundamentals support this growth.

HDSN is a small-cap growth stock; I want to see the potential for big returns before I commit to buying and holding a company in a cyclical industry with a volatile stock price. If I simply want market-like returns with some upside, I can more safely play the HVAC industry by investing in larger companies like Watsco (WSO), Lennox (LII), and/or Carrier (CARR), etc., and try to buy them when the stocks are relatively cheap. In investing in HDSN, I hope to achieve market-smashing returns in a sector with secular tailwinds. Therefore, I am going to use 15.0% as my hurdle rate. I believe that a 2.5% terminal growth rate is warranted, given the growth potential in the reclamation market over the next 15-plus years.

HDSN Reverse DCF – 9.7% FCF Growth Expectation (Inputs: Author-generated, Calculator: www.BrianFeroldi.com)

Based on Hudson’s TTM FCF of $42.2 million, the company would only need to grow free cash flow at 9.7% annually over the next ten years.

Let’s dig deeper to ensure Hudson can achieve this growth and hone in on a range of assumptions for its growth potential.

Revenue Growth and Operating Leverage

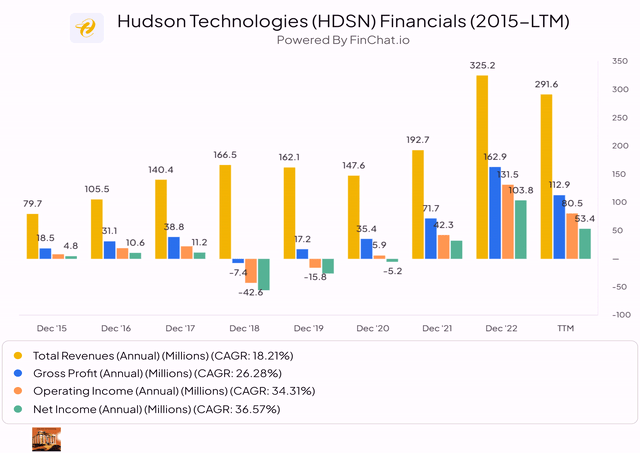

As recently as the Q3 earnings call, Hudson CEO, Brian Coleman has committed to achieving $400 million in revenue in 2025. That would represent a 17% CAGR based on LTM revenue. This would be a lower growth rate than the last 8 years, as seen below, but an acceleration in growth over the last twelve months of results.

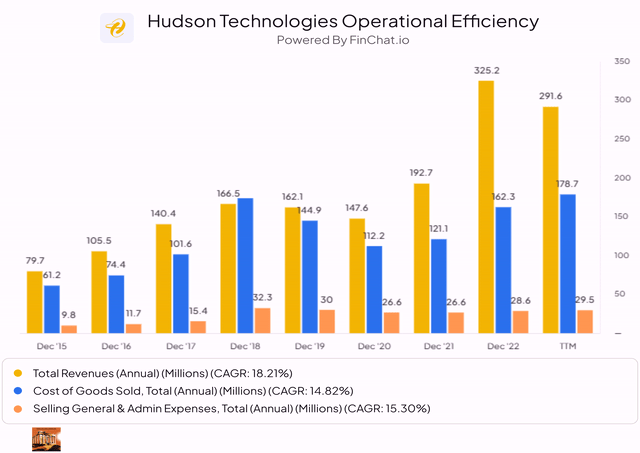

Hudson displays a great deal of operating leverage and the company has improved its operational efficiency since purchasing Airgas Refrigerants in 2017. Since 2015, Hudson has experienced exceptional profit growth, with net income growing at twice the rate of revenues (36.6% Net Income vs. 18.2% Revenue).

HDSN has operating leverage, as seen in its 2015-LTM financials. (www.FinChat.io)

During the same timeframe, revenue grew faster than COGS and SG&A expenses.

HDSN has grown revenues faster than COGS and SG&A (www.FinChat.io)

Balance Sheet

Hudson borrowed over $155 million in 2017 to fund its acquisition of Airgas. This acquisition may have enabled Hudson to position itself to become the leader in the reclamation market, but it put its financial health in a more precarious position. Hudson has since embarked on a mission to de-leverage in recent years, fully paying off its long-term debt in Q3 of 2023, leaving it with a net debt/EBITDA ratio of 0.1, a debt/equity ratio of 0.1, and a cash flow/debt ratio of 3.8. This puts the company in a position to weather any downturns in the market.

Now that this debt is off the books, Hudson will save around $10 million in interest expense per year, supporting net income and free cash flow growth.

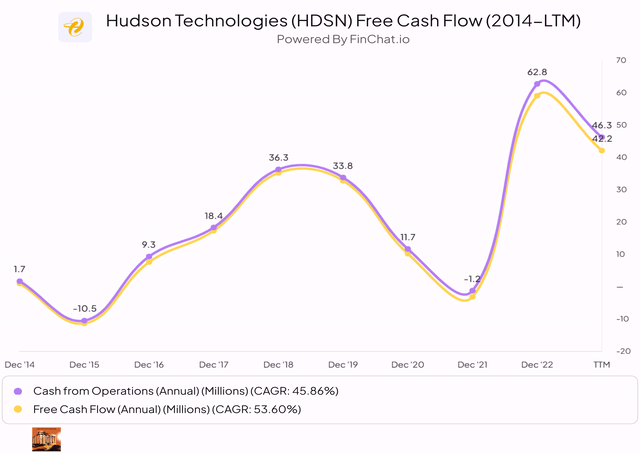

Cash Flows

Since turning positive in 2014, Hudson’s free cash flow has grown at a 53.6% CAGR, driven by sales growth, operational efficiency improvements, and low capex requirements.

HDSN generates a healthy growth rate in FCF and OCF (www.FinChat.io)

With a stronger balance sheet, secular tailwinds, and the AIM Act accelerating growth in a higher margin part of the business, free cash flow should continue to grow faster than revenue.

How Hudson Achieved Sustainable Growth

One of the biggest risks in investing in a company that has seen 900% returns in a span of five years, but only 2.5% annually since its IPO, is the possibility that recent growth is not sustainable. Hudson is tied to a cyclical industry, though it also provides services that are more recurring in nature. It may also be reasonable for some to question the sustainability of this growth, given the work-from-home tailwinds granted by the pandemic.

Airgas Acquisition

Hudson’s impressive growth in recent years has more to do with its acquisition of Airgas Refrigerants in late 2017, which allowed the company to expand its footprint in the U.S., expand its product offerings, and enhance its sales and distribution capabilities. The company’s acquisition thesis was that the increased scale would allow it to better serve customers and position the company to take advantage of reclamation growth as HCFCs were phased out. At the time, management was well aware of a future HFC phase-out period that we are currently entering. The acquisition helped Hudson become more efficient. Management has stated that it is responsible for as much as half of Hudson’s revenue base, positioning the company as the largest player in the reclamation market.

Since the Airgas acquisition, Hudson has dramatically increased its operational efficiency. Its COGS over the last 12 months is nearly the same as in FY 2018, despite increasing sales by 75%. Some of this is due to accounting rules that require mark-to-market inventory adjustments upon acquisition, but the longer-term trend confirms this. Since 2013, Hudson’s revenues have grown at 17.9% annually, but COGS has only increased by 12%, showing that Hudson holds some pricing power. SG&A expenses have also grown slower than revenues (14.7% vs 17.9%).

Competitive Advantages

With its proprietary ZugiBeast, Hudson holds a strong position in the reclamation market. The ZugiBeast is an in-line refrigerant reclamation unit that can be installed in large cooling systems, allowing it to service cooling systems on-site. ZugiBeast operates up to 10x faster than other equipment, both online and offline, allowing customers to minimize downtime and increase the efficiency of their systems. Hudson also owns 2 of the 4 AHRI-certified laboratories in the U.S. and has three state-of-the-art reclamation facilities. This gives them a large footprint and unmatched expertise in the industry. Holding the largest share of the reclamation market gives the company scale advantages, allowing it to form strategic partnerships with Lennox International and AprilAire.

Back to Valuation

If Hudson can merely maintain market share in an expanding reclamation market, and continue to capitalize on its leading position, it should be able to sustain healthy growth for the foreseeable future. Given management’s goals to reach $400m in 2025, I think a reasonable base assumption is that Hudson can grow normalized free cash flow at 18% over the next five years. Even reducing this growth rate for years 6-10 would provide great returns.

Hudson Technologies Discounted Cash Flow (Inputs: Author generated, Calculator: www.BrianFeroldi.com)

Using the same 15.0% hurdle rate, 2.5% terminal rate as the reverse DCF performed earlier, and factoring in these growth assumptions, Hudson stock is currently undervalued in the base, bear, and bull cases. A weighted average fair price for Hudson Technologies is $18.71. Based on these assumptions, HDSN is undervalued by almost 57%.

Risks

Hudson Technologies is in a cyclical industry, and the price of refrigerants can have outsized impacts on revenues. Any over-supply to the market would be a risk to revenues and particularly to the bottom line, considering the operating deleveraging effect that would take place. This happened in the late 2010s and nearly broke the company, forcing it to break debt covenants and default. Given the strength of its balance sheet, its greater foothold in the reclamation market, and the positive impact expected by the AIM Act, I do not see this happening this time.

Another risk to Hudson, like most investments, is a recession. If this happens, we could see a reduction in the growth of the installed base of HVAC systems throughout the U.S. I expect that Hudson is well-positioned to survive a recession and poised to perform well without one.

Volatility is another risk. I typically do not consider high-beta stocks risky investments, but for someone unwilling to stomach large down drafts in stock prices, this might not be the right stock to invest in. I have enough confidence in the thesis, that I tend to add to my position when the stock is beaten down.

Conclusion

Hudson already controls 35% of the U.S. refrigerant reclamation market, has strong relationships with customers, and has created new partnerships with large players in the HVACR industry in recent years. Its proprietary technology gives it an advantage over most, if not all, of its competitors. The company should see an immediate and long-lasting benefit from the AIM Act.

In my estimation, the AIM Act can potentially grow the refrigerant reclamation market by as much as 20% per year. The range of possible outcomes is wide and uncertain, providing investors with higher confidence in this potential growth to get ahead of Hudson’s potential inflection point and receive generous investment returns if the thesis plays out.

Hudson’s reclamation services provide a gross margin of roughly 50%, significantly higher than its net refrigerant services. As the AIM Act continues to reduce HFC production, I expect to see HDSN achieve its $400m revenue target in 2025 and I believe the company has the potential to sustain gross margins above its target of 35%.

HDSN may be a great investment opportunity for patient, long-term investors willing to stomach volatility.