It is the stock market success story of the century – and one that will shape the rest of our lives.

Since going public on the eve of the Millennium, computer chip designer Nvidia has come from nowhere to become the world’s biggest company.

The remarkable milestone was passed yesterday when its share price soared to a new high, overtaking tech giant Microsoft to value the Silicon Valley pioneer at $3.34trillion (£2.6trillion).

To put that into context, Nvidia’s stock market valuation now trumps the annual output of the entire British economy.

It’s been a truly stratospheric rise.

In February, Nvidia became the fastest company ever to go from $1trillion to $2trillion. Astonishingly, it took just eight months.

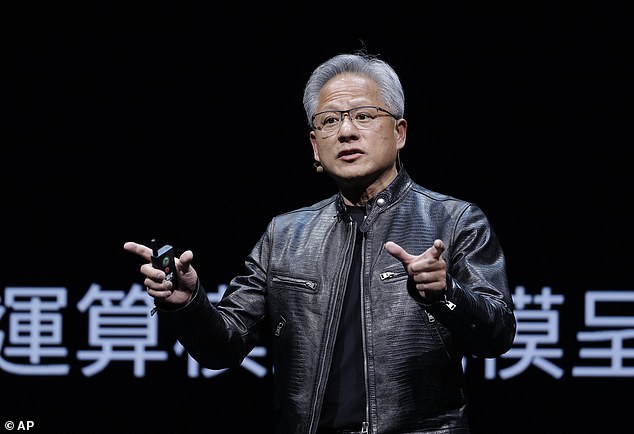

Jensen Huang, 61, the Taiwan-born electrical engineering graduate who founded Nvidia alongside microchip designers Chris Malachowsky and Curtis Priem

Nvidia originally made computer chips for video game software, but has since expanded its horizons to dominate the AI sector

The latest surge means the company – whose chips have turbo-charged the meteoric rise of artificial intelligence (AI) – has seen its share price rise from under $4 in June 2019 to almost $136 today. That’s an incredible 3,477 per cent increase in five years.

So just how did a start-up without a business plan, that was founded in a California diner, conquer all before it? And can British private investors get a slice of the action?

Nvidia is the brainchild of Jensen Huang – a Taiwan-born electrical engineering graduate whose parents sent him to the US as a child – and two microchip designers, Chris Malachowsky and Curtis Priem.

They founded Nvidia in 1993 at a Denny’s restaurant in San Jose, in the heart of Silicon Valley.

The plan was to call their company NVision – until they found out that name was taken by a toilet paper manufacturer. Huang, who once worked as a waiter and dishwasher in a Denny’s outlet for $2.65 an hour, suggested Nvidia instead, based on the Latin word ‘invidia’ meaning ‘envy’.

He has run the company ever since, becoming one of the world’s richest people in the process.

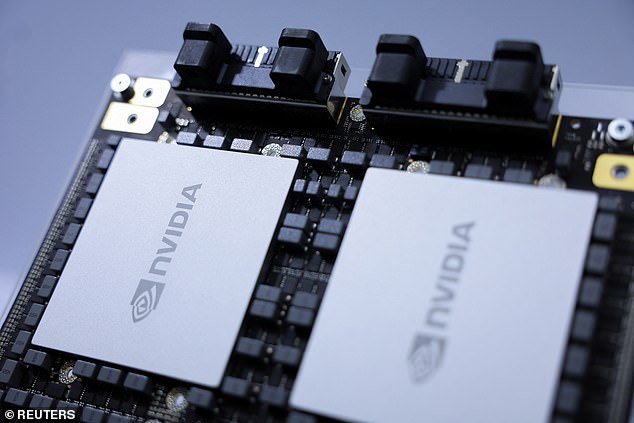

Nvidia’s main product is a graphics-processing unit (GPU) – a wafer-thin circuit board with a powerful microchip at its core. These processors allow lightweight, energy efficient personal computers and laptops to perform a huge number of calculations at high speed.

For decades the big microchip maker was Intel, but Nvidia differs from its rival in some key ways.

Intel and others make industry-standard general purpose chips known as ‘central processing units’ (CPUs), which handle all the main functions of a computer, producing one mathematical calculation at a time.

But Nvidia’s GPU can complete complex and repetitive tasks much faster, breaking them down into smaller components before processing them in parallel.

If CPUs are delivery vehicles dropping off one package at a time, Nvidia’s GPUs are more like a fleet of high-speed motorbikes spreading across a city. That made them the perfect processors to power the dawning AI revolution.

Unlike Intel, Nvidia doesn’t make its own chips – that’s mainly contracted out to the Taiwan Semiconductor Manufacturing Company. Crucially, though, Nvidia not only designs the hardware, but also the software on which they run.

‘What Nvidia does for a living is not build the chip – we build the entire supercomputer, from the chip to the system, to the interconnects, the NVLinks, the networking, but very importantly the software,’ says Huang, 61.

This secret-sauce software package is called Cuda. Nvidia’s chips originally set out to improve the computer graphics used by video gamers. Cuda’s creation in 2006 allowed other, all-purpose applications to run on Nvidia’s chips, too.

Initially, AI wasn’t one of them. In the early 2010s, AI was still a technology backwater where progress in areas such as speech and image recognition was slow.

Even less fashionable were ‘neural networks’ – computing structures which mimic the workings of the human brain.

Nvidia’s breakthrough came when the Cuda platform was championed by British-Canadian computer scientist and cognitive psychologist Geoffrey Hinton, dubbed the ‘godfather of AI’.

Two of his students trained a neural network to identify videos of cats using just two of Nvidia’s boards. Google boffins needed 16,000 CPUs to perform the feat. Machine learning had arrived.

The stunning results prompted Huang to go all-in on AI in 2013.

Nvidia’s GPUs were soon to be found in everything from smart cars to robotics and data centres with customers ranging from Tesla to Microsoft and Amazon. One setback was a failed £31billion bid to buy Cambridge-based chip designer Arm Holdings.

But Nvidia really came of age a year ago with news that ChatGPT – Open AI’s chatbot – was powered by its supercomputers. This propelled the shares into orbit.

The news led to a frenzy among big tech companies and AI start-ups for Nvidia’s processors, leading to shortages that could last into next year.

On May 23, bumper results that beat market expectations caused the company’s value to increase by $200billion in just one day.

To meet the insatiable demand, Nvidia plans to launch a new generation of AI chips – code-named Blackwell – later this year, costing more than $30,000 each.

It can charge so much because of its stranglehold on the AI chip market, with a market share of more than 80 per cent.

This near-monopoly has turned Nvidia into a massive money-making machine, fueling potentially huge future share price rises.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.