Modern work pensions are essentially cheap investment products provided and subsidised by employers.

At a time when money is tight, it’s worth exploring what they can do for you – including some obscure and surprising add-on benefits.

Auto enrolment into work pensions takes the hassle out of saving for retirement, and more of us are taking advantage than ever before, but you could be missing a trick or two by not looking any further than that.

Financial plan: Auto enrolment into work pensions takes the hassle out of saving for retirement, but it can pay to probe the other add-on benefits

What you need to know about work pensions

‘Many people either don’t save enough or believe that they’ll be able to rely solely on income from the state,’ says Emma Byron, managing director of Legal & General Retirement Solutions.

‘Whilst you’ll still receive a state pension at retirement, with automatic enrolment you’ll also receive extra income from the contributions you and your employer pay into your company pension scheme.’

Steven Cameron, public affairs director at Aegon, stresses how little effort you need to make to enjoy the benefits of work pensions: ‘Your employer is responsible for arranging a workplace pension scheme for all employees and automatically enrolling you into it.

‘This avoids you having to do anything – you effectively are made a member of a pension scheme automatically. You can “opt out” but this is effectively giving away free money.’

We will start by running through the obvious perks, like the cash thrown your way by employers and the Government, and then flag up some of the less well known benefits of work pensions below.

Free money

Employer and Government cash: You get free handouts for saving into a pension.

The money you put into your pot is topped up by your employer and the Government.

And while employers are not as generous as they were to staff in traditional final salary schemes, they still give a significant boost to retirement savings.

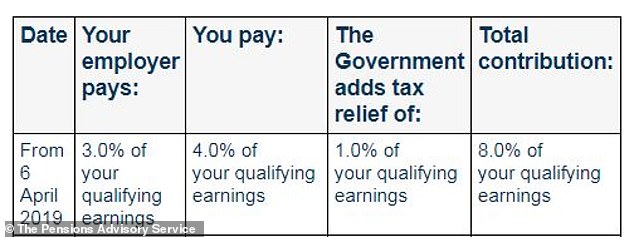

Under auto enrolment, employers are required to put a minimum of 3 per cent of your earnings between £6,240 and £50,270 into your pension. Tax relief from the Government provides another 1 per cent.

You must put in at least 4 per cent on your own behalf, and if you opt out all the above is lost.

‘Your contribution is doubled with no additional cost to you,’ points out Byron.

‘It’s a cheap and easy way to super-boost your pension savings.’

‘While it might be tempting to opt out of your workplace pension when the cost of living is so high, it’s worth bearing in mind that by opting out you are essentially saying no to free money.’

Matched contributions: Extra top-ups are frequently available, particularly from large employers.

For example, an employer might automatically match 3 per cent of your earnings as its minimum contribution to your pension already.

But it might be willing to make 4 per cent, 5 per cent or 6 per cent in matching contributions if you opt to save a higher proportion of your income.

Who pays what: Auto enrolment breakdown of minimum pension contributions

If you can afford to do this, you will also receive more pension tax relief from the Government than you would have done on the extra money saved towards retirement.

So it can be advantageous to divert savings to your pension to get this extra employer money, rather than sticking it in a cash Isa or other account – although it does mean you will be locking it up until retirement rather than having readier access to your funds.

Cameron says: ‘This can be a fantastic deal. It could mean for an extra £100 you pay into your pension, you’ll get £25 from the Government and possibly as much as another £125 from your employer.

‘That’s likely to be a far better deal than you’d get in any other form of savings.’

Personal contributions: Even after you have maxed out your employer’s matched contributions, you will carry on benefiting from free Government top-ups.

There is a relatively generous annual ceiling on how much you can pay into your pension and get tax relief – the equivalent of your annual salary, up to a maximum of £60,000.

The rules are more complicated for higher earners, whose pension annual allowance is ‘tapered’ down.

Many people concerned about the inflation threat to their savings might be considering whether to put any spare money in an investment rather than a cash Isa right now.

A simple and potentially cheaper option is to top up your work pension fund instead.

Our pensions columnist, former Pensions Minister Steve Webb, answered a reader question about whether it is better to put spare savings into a work pension or open an investment Isa.

He says there are broadly three advantages to opting for the pension: Government and employer top-ups; the opportunity to withdraw a 25 per cent tax-free lump sum when you decided to retire; and lower investment charges which are capped at 0.75 per cent on ‘default’ funds and can be even lower.

Emma Byron: ‘Many people either don’t save enough or believe that they’ll be able to rely solely on income from the state’

Cameron says: ‘Even if your employer doesn’t offer matching contributions, you will have the option of paying more than the minimum personal contributions.

‘Some employers will allow you to change your pension contribution whenever you like, while others may limit it to specific times of the year, for example during a flexible benefit window.’

Higher rate tax relief: Pensions tax relief allows everyone to save for retirement out of untaxed income.

That means you get a bigger sweetener the more you earn.

The rebate is based on people’s income tax rates of 20 per cent, 40 per cent or 45 per cent, which tilts the system in favour of the better-off because they pay more tax.

Speculation about a Treasury raid on these tax breaks for higher earners never entirely goes away, but it hasn’t happened yet.

Meanwhile, there can be some extra admin for higher earners you need to know about.

Byron cautions: ‘Everyone is entitled to receive tax relief at their highest rate on personal contributions.

‘However in some schemes, only basic rate tax relief is added automatically so it’s important to remember you may need to claim higher rate relief back yourself via self-assessment.‘

Even if you are in a pension scheme where higher rate relief is added automatically on your regular contributions, lump sum personal contributions probably won’t be covered by that.

In that case, you will also have to fill in a self-assessment form in order to get the money you are owed in the form of a cash rebate.

‘While it might seem like an admin headache, it is well worth it,’ says Byron. ‘If you’re a higher-rate taxpayer then you may be able to claim back a further 20 per cent or 25 per cent, making pension saving even cheaper.

‘For every £10,000 you save into your pension you could find it only costs you £6,000 or even as low as £5,500, if you’re a higher or additional rate taxpayer.’

Well paid workers might benefit from higher rate tax relief while working, but at retirement can take 25 per cent of their pot tax-free, and then might only have to pay income tax on withdrawals of the rest at the basic rate.

Handy perks

Salary sacrifice: Arrangements like this are a nice little earner for many workers and their employers. They are essentially a legal way to dodge National Insurance payments.

Employers allow staff to take a supposed ‘pay cut’, but the money gets ploughed into their pension or put towards some other benefit like childcare or an electric vehicle instead, and both sides pay less NI as a result.

Bonus sacrifice works in roughly the same way, if you receive such payouts from your employer.

Cameron says: ‘This is a tax-efficient way for you to make pension contributions.

‘Furthermore, your employer may share their National Insurance saving with you, boosting your pension contribution further.’

Child benefit: This is reduced for those earning £50,000-plus a year, or wiped out entirely for those earning £60,000-plus – something officially known as the ‘high income child benefit charge’ or HICBC.

The rules introduced in 2013 came under fire from the start because they penalise families in which one parent earns just over £50,000, but those where both parents earn just under that amount still get child benefit paid in full.

Putting extra into your pension could push you back below the threshold for claiming child benefit.

Cameron says: ‘If you or your partner earn over £50,000, you’ll lose part or all of your child benefit entitlement.

‘Paying a personal contribution into your workplace pension reduces your net income and you could regain some or potentially all of your child benefit entitlement.’

Note that even if you don’t qualify for child benefit, it is important to register for it anyway and tick the box saying you are not eligible for the payments.

Parents who have failed to do this have lost valuable credits towards their state pension. The Government has now promised to fix this anomaly, but not explained how yet and so it it is better to register for child benefit.

Whether you qualify for the payments or not, make sure a non-earning parent claims the child benefit as they are the ones who need the state pension credits. However, if the ‘wrong’ parent has claimed, there is a way to swap the credits between partners.

Financial advice: If you want to get financial advice but baulk at the cost, look into saving some money by doing it via your work pension.

‘There is the option to take tax-free payments out of your pension to cover the cost of advice, through something called the pension advice allowance,’ says Becky O’Connor, head of pensions and savings at Interactive Investor.

‘The tax-free amount is up to £500 a session, it’s available at any age and you can use it three times in your lifetime but only once per tax year.

‘The £500 will not be taxed on withdrawal from the pension pot, regardless of your income.’

Cheap and easy investing

Capped charges: Saving into a work pension is a simple entry point into the world of investing, if you don’t want the hassle of doing it yourself.

It’s often cheaper too, because employers have better bargaining power to get fund costs down than individuals putting money into investment Isas or personal pensions.

If you keep your pension in your employer’s ‘default’ or standard investment fund, the charge is capped at 0.75 per cent.

However, Cameron notes: ‘Investment related “transaction costs” incurred when buying and selling stocks and shares, designed to get you good returns, are outside the cap.’

Default funds and the alternatives: Staff are automatically opted into their employer’s pension scheme unless they actively object, and their money is placed in its default fund.

It stays there if they don’t choose any of the alternatives usually available, and the vast majority stick with the one-size-fits all fund.

Default funds tend to play investments safe because employers don’t want to get blamed for costly mistakes that endanger their staff’s pension savings.

Most such funds are trackers, although some are actively run to a certain extent.

Trackers passively match the performance of one or a selection of the world’s stock markets, and are cheap to own.

Active fund managers pick investments to outdo the market but often underperform despite charging a lot more.

Cameron says: ‘Because your money is being invested in a large fund, it can diversify its investments across different types of assets which can help reduce risks.

Becky O’Connor: ‘There is the option to take tax-free payments out of your pension to cover the cost of advice’

It’s increasingly common for those running default funds to follow ESG [environment, social and governance] strategies or look for ‘sustainable’ investments, such as contributing to ‘net zero’ targets.

Tools and calculators: A dedicated pension scheme website with an array of tools and research apps comes pretty much as standard these days.

Once you have set up the log-in, it’s easy to check how much you have in your fund and other basic information.

How much you want to tinker with the rest of what’s on offer – this might include sliders, quizzes, videos and so on – depends on your level of interest and patience.

‘Many modern workplace pensions give you the ability to access your pension online, to check on things like how much you’re contributing, how much your fund is currently worth, where you are invested and how much you might have by the time you reach your selected retirement age,’ says Cameron.

‘You may also be able to change your personal details or switch funds.

‘Some also offer tools to allow you to explore “what if” scenarios – for example, how much more might you have as a retirement income if you increase your contributions or defer taking an income for a couple of years.’

Merging old pensions: Savers tend to collect a string of pension pots during their working lives, and schemes make it fairly easy to roll them up if you choose, though there can be drawbacks.

A tidying up exercise can reduce fees and paperwork and bring new investment options but you can lose valuable benefits. We looked here at the advantages of merging pension pots and the traps to avoid.

Byron says: ‘We’re now a nation of job hoppers, but that doesn’t mean you can’t take your pension pot with you when you leave for a new role and combine it with your pension in your new employer’s scheme.

‘You’ll be able to organise this with your next employer, or you can leave it where it is if you prefer.’

Less well known benefits

Bankruptcy protection: If this happens to you, savings in a pension scheme can be retained, though they might be up for grabs once you reach retirement.

‘Pension funds are usually protected if you are made bankrupt,’ explains Cameron.

‘They aren’t treated as assets in bankruptcy, unlike other savings, shares or investments. The official receiver can’t force you to take money from your pension savings if you don’t want to.

‘But they could claim any lump sums of cash you take (age 55 onwards) or extra income you receive after your bankruptcy.’

Death benefits: Your pension scheme will offer the option to name beneficiaries and it is sensible to do this and keep them updated, especially after important changes in your life like getting married or divorced.

‘Pension funds don’t normally form part of people’s estates for inheritance tax purposes, as payments on death tend to be paid under a discretionary trust,’ says Cameron.

‘This means that it’s the trustees or scheme administrator who chooses to whom to pay the death benefits, but they will take into account any beneficiaries you’ve nominated.’

STEVE WEBB ANSWERS YOUR PENSION QUESTIONS

If you decide to stay invested and use income drawdown to fund your retirement, beneficiaries either pay no tax if the owner dies before age 75, or their normal income tax rate if they are 75 or over.

However, the Government has floated plans to make the pension inheritance rules less generous.

Inheritance planning is complex so think about getting financial advice on this issue if your estate is large enough to be liable for inheritance tax.

Not earning or now self employed: Non-earners can put up to £2,880 a year into their retirement pot, to gain a maximum £720 or 20 per cent in tax relief from the Government.

You might also be able to keep on saving into your old workplace pension after you become self-employed.

Free help, seminars and mid life MOTs: It is worth browsing your employer’s pension site for offers of help like this, as such general guidance can be useful, especially if you don’t have the means or desire to pay for financial advice.

For example, Legal & General runs an online midlife MOT on finances and health via the Open University, which This is Money tested.

If you have an L&G work pension, your employer might also have signed up for its ‘Go&Live’ financial wellbeing hub, which is designed to offer employees support at any stage of their lives.

It includes help with the state pension, debt management, mental wellbeing, will writing and power of attorney, among other topics.

Arranging care: This is not something you would think your pension provider would offer help with, but L&G has a confidential guidance and advocacy service for people with a care need.

This is why it’s worth looking into every area of what your work pension provider will do for you, in case something like this turns up when you need it.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.