Anticipating future trends can direct to smart investments. Drawing from my 20 years of real estate investing encounter, I expect bidding wars to resurge in the housing market in 2024 and beyond.

The main reasons for the return of bidding wars in the housing market are as follows:

- Growing pent-up demand since mid-2022, when the Fed began its aggressive 11-rate-hike cycle. Potential homebuyers decided to put their lives on hold and make do with their current living situations. However, eventually, life must go on.

- Mortgage rates dropped appreciate a rock after Jerome Powell’s December 13, 2023 testimony inferring a pivot in 2024. There are now expectations for 3-6 rate cuts in 2024, which could help bring mortgage rates below 6% for the average 30-year fixed.

- Still lower-than-average supply due to the locked-in effect of locking in the lowest mortgage rates in history from 2020 – 2021.

- Increased demand for real estate due to the millennial generation well into their home buying and family formation years.

I Hate Getting Into A Bidding War

I decided to buy a home in 4Q2023 because my stocks had rebounded and a higher-end home I had been eying for 16 months came back on the market at a lower price. With high mortgage rates, I was able to buy with little competition.

My kids are 6 and 3, which means I only have 12 and 15 years left at home with them before they go to college. The best time to own the nicest house you can afford is when your kids are at home. You get to amortize the cost across more people while also providing greater comfort and joy to more people. After your kids leave, it is unlikely you will want to buy an even bigger and nicer home.

I was unwilling to expect until the perfect time to buy a new home because I refused to live a suboptimal life with the time I had left. I’m an older parent focused on living life to the maximum now.

Finally, I hate missing out on an ideal property. Getting into a bidding war is suboptimal because emotions can sometimes provoke us to act irrationally and pay above market. Once the bidding wars happen, home prices tend to take a step up instead of a gradual boost.

Surprise! If you find a dream property, other people will too. I may have bought too earlier. However, I’d rather buy a little too early than a little too late.

How To Prepare For Upcoming Home Bidding Wars

I believe with 75% certainty the housing market is going to be strong in 1H 2024. The 25% doubt comes from the economy potentially going into a worse-than-expected recession.

As a result, if you’re unwilling to buy a home during the slow winter, the best time of the year to get housing deals, here are ways to prepare if you strategize to buy a house when bidding wars return.

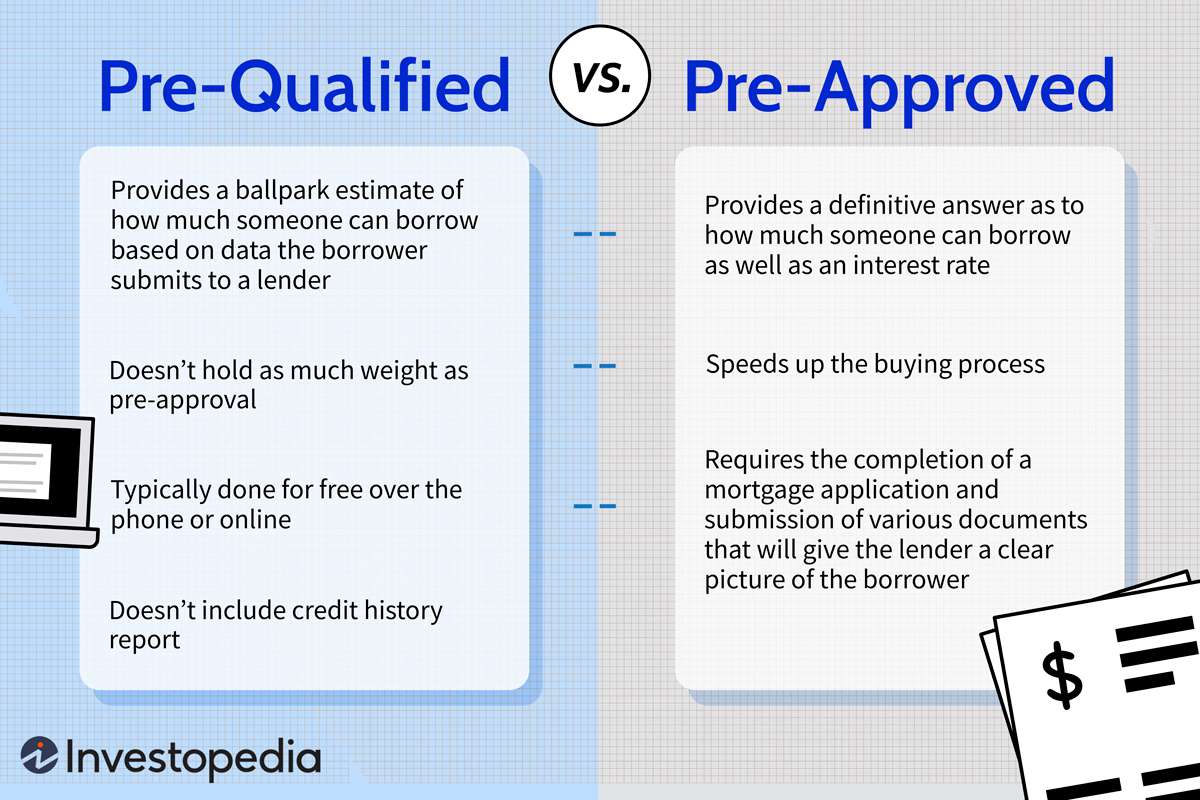

1) Get pre-approved, not just pre-qualified

Don’t delay getting pre-approved. Pre-approved is getting the bank to approve a specific loan amount so you can confidently buy a house. It involves a much deeper process than getting pre-qualified.

To get pre-qualified is much easier. The lender reviews everything and gives an assess of how much the borrower can expect to acquire. Pre-qualification can be done over the phone or online, and there’s usually no cost involved. But getting pre-qualified doesn’t mean much to the seller.

To get pre-approved, the borrower must complete an official mortgage application as well as supply the lender with all the necessary documentation to perform an extensive credit and financial background check. The lender will then offer pre-approval up to a specified amount.

Once pre-approved, lenders will supply a conditional commitment in writing for an exact loan amount, allowing borrowers to look for homes at or below that price level. This puts borrowers at an advantage when dealing with a seller because they’re one step closer to getting an actual mortgage.

2) Be ready to advance fast.

New listings may attract multiple offers quickly. Be vigilant about new listings and be prepared to see homes and make offers promptly. A typical “hot home” stays on the market for two weeks and then goes into contract due to an artificially set deadline.

Prime properties on prime blocks in the best neighborhoods get swallowed up by family estates for generations. We’re talking quiet streets, extra large lots, homes with views, and rare architecture. If you miss the window, the home will likely be gone for decades, if not forever.

Some hot homes get into contract even sooner as the seller decides to accept offers as they come. As a result, try to visit the home during the first open house. Even better is trying to see the property before it goes to market if your real estate agent has connections.

3) Line up escalation clauses.

Consider having your agent include an escalation clause in your offer to automatically bid higher up to a capped amount if other offers come in higher. Be careful with how much you’re willing to pay. You don’t want to pay so far above market where it will take years to be in the money.

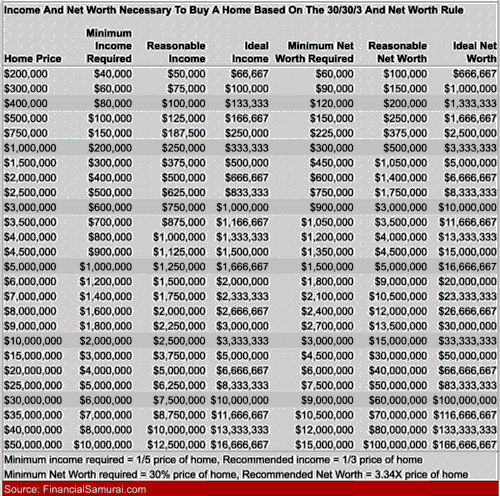

Please stick to my home buying guide so you don’t let emotions override your financial senses. Below is a chart that shows the income and net worth necessary to buy a home based on my 30/30/3 and net worth rules.

I would shoot for at least a combination of Reasonable Income + Ideal Net Worth or Ideal Income + Reasonable Net Worth. The best combination is obviously to earn the Ideal Income and have the Ideal Net Worth.

4) Highlight your offer strengths through writing.

Write a real estate love letter.

I cannot highlight enough how powerful making a connection is with a seller by writing a letter. Selling a home can be even more emotional than buying a home, especially if you’ve owned the home for a long time. The more you can convince the seller to feel good about who they are selling to, the higher your chances.

In the letter, highlight your strong down payment amount, flexible advance-in date, not requiring the sale of another home to buy the home, and commitment to closing escrow. Most importantly, tell the seller your story. Find commonalities between you and the seller that go beyond money. A seller wants to sell to someone they appreciate and trust.

5) Get pre-inspections done or potentially wave inspections.

examine the house as completely possible before making an offer. Let’s say the house will be on the market for two weeks with two open houses and two brokerage tours. Go to each one and examine the house thoroughly on your own and with an experienced real estate professional who knows what to look for. The more hands and eyeballs you have, the better!

assess everything including all the faucets and showers to the washing machine and dryer, and whether or not the windows close properly. Your goal is to try and minimize the number of surprise fixes and costs after closing escrow.

With sufficient pre-inspections completed, you may feel confident enough to make a no-inspection contingency offer together with your no-financing contingency offer. No contingency offers are much more attractive. That said, if you are not an experienced real estate investor who doesn’t know what to look for, you should include contingencies in your offer.

Although you will likely lose in a bidding war, it is important to protect yourself from buying a home that may overwhelm your finances.

6) Enhanced down payment and earnest money deposit amount.

Putting down more than 20% can signal you have cash reserves and are serious. The higher your down payment percentage, the more attractive you will look to the buyer. If you can pay all cash, even better.

In addition to making a larger-than-average down payment, consider offering to make a higher earnest money deposit, which currently averages 3%. The earnest money deposit is what the seller gets to collect if a buyer backs out after contingencies are removed.

If you are truly confident you want to buy the house, then putting down either a 3% earnest money deposit or a 10% earnest money deposit shouldn’t matter to you. Just be sure you have thoroughly inspected the house multiple times and have your finances right beforehand.

7) Make a preemptive offer

Although a seller may set an offer date, you can always make an attractive preemptive offer based on your budget and favorite home-buying guide. The worst the seller can say is no.

Even if the listing agent says no to preemptive offers, the listing agent has a fiduciary duty to present all offers to their client as they are received. If you are the seller, it is nearly impossible to resist looking at a preemptive offer even if you say you won’t accept one.

The preemptive offer is one of the best ways to avoid getting into a bidding war.

8) visualize the inverse of a dead market

It feels uncomfortable to be buying a house in a down market. With little-to-no competition, you feel appreciate you might be walking into a booby trap.

Due to the strangeness of seemingly appreciate the only one house shopping, you may end up not making an offer on any house because you’re too scared. Instead, you establish to expect until the all-clear sign because you desire affirmation from other people wanting to buy what you want.

The reality is, often the best time to buy a home is when the majority of buyers are fearful. I experienced this first-hand when I visited open houses between April 15 – May 15, 2020, a month after lockdowns began. I ended up talking for hours over multiple sessions to the listing agent for the home I eventually bought because nobody else wanted to confront. Then the housing market took off in 2H2020.

If you’ve found your ideal home, it’s time to visualize how it would sell during a strong market. How many buyers will come out of the woodwork to bid on your dream home and snatch it away?

The best way to avoid a bidding war is to not buy a home when everyone else wants to as well.

Don’t Let Your Emotions Get The Best Of You When Submitting A Bid

The risk of paying far above the current market during a bidding war is real. Essentially, your winning bid resets the market higher, which might be OK if the market keeps going up. Or it could be risky and leave you stuck.

If you win a bidding war, then you must deal with the “winner’s curse,” which means nobody else was willing to pay what you paid. Hence, you need to hope the overall market continues to go up after you win.

The good news is that the chances of the housing market crashing right after you buy are low. However, if you buy in a down market, the market will unlikely turn higher right after closing either. Thankfully, over the long term, the housing market tends to go up.

If you lose a bidding war, stew with your disappointment for a while and then advance on. There will always be another dream house waiting for you. When that time comes, hopefully, your finances will be in even better shape.

Reader Questions And Suggestions

Do you think bidding wars are coming back as the Fed cuts rates? Or do you think the housing market will stay lukewarm for a while longer? If you are expecting bidding wars to return, how are you preparing if you are a homebuyer or current owner? Why do buyers expect until everybody wants to buy a home until they buy?

If you believe the real estate market will reinforce, as I do, consider dollar-cost averaging now. Check out Fundrise, which manages over $3.3 billion in equity by investing mostly in residential and industrial properties in the Sunbelt region. The Sunbelt has lower valuations and higher yields. Financial Samurai is an investor.

combine 60,000+ others and sign up for the free Financial Samurai newsletter. Financial Samurai is one of the largest independently-owned personal finance sites that started in 2009.