Chancellor Jeremy Hunt has confirmed in the Spring Budget that fuel duty will remain frozen for a 14th consecutive year – and he will extend the ‘temporary’ 5p-a-litre cut for another 12 months.

Easing some of the burden of higher motoring costs for Britain’s drivers, in his statement to the commons on Wednesday, Mr Hunt said: ”If I did nothing, fuel duty would increase by 13 per cent this month.’

It is estimated the freeze in duty will save drivers around £5billion-a-year. Yet taxation on fuel will still make up more than half of what drivers pay at the pump.

*SCROLL DOWN TO SEE HOW MUCH OF THE COST OF A LITRE OF PETROL IS TAX

Chancellor Jeremy Hunt has confirmed in his Spring Budget that fuel duty will remain frozen for a 14th consecutive year

In his statement, Hunt said: ‘The Shadow Chancellor complained about the freeze on fuel duty and Labour has opposed it at every opportunity.

‘The Mayor of London wants to punish motorists even more with his ULEZ plans, but lots of families and sole traders depend on their car.

‘If I did nothing, fuel duty would increase by 13 per cent this month.

‘I have decided to maintain the 5p cut and freeze fuel duty for another 12 months.

‘This will save the average car driver £50 next year and bring total savings since the 5p cut was introduced to £250 pounds.’

He added: ‘Taken together with the alcohol duty freeze, this decision also reduces headline inflation by 0.2 percentage points in 2024-25, allowing us to make faster progress towards the Bank of England’s 2 per cent target.’

The freeze means fuel duty will remain at 57.95p per litre, as it has done since March 2011.

The ‘temporary’ 5p cut on the fuel tax, which was first introduced in March 2022 by then-Chancellor Rishi Sunak in a bid to neutralise escalating pump prices triggered by the outbreak of war in Ukraine, will also remain in place until March 2025.

It means duty on fuel will stay at 52.95p for the next 12 months.

Treasury officials had pushed to scrap both the freeze and duty cut after a drop in pump prices, but this idea was vetoed by Mr Hunt as ‘politically untenable’.

The news will be a relief to the nation’s drivers facing higher motoring costs in 2024, namely a steep rise in insurance premiums and the cost of vehicle repairs.

The announcement also follows the biggest monthly jump in fuel prices seen since September, with petrol rising on average by 4p a litre and diesel by almost 5p in February as a result of higher oil prices.

The RAC’s Fuel Watch report said petrol went up from 140.75p at the start of February to 144.76p by the close, adding more than £2 to the price of a full tank (£77.41 to £79.62).

Diesel escalated from 148.53p to 153.22p (4.7p) increasing the cost of filling up an average 55-litre family car by £2.60 to £84.27.

That said, Mr Hunt’s decision regarding fuel duty comes as very little surprise to many.

This is because the current Government has seemingly backed itself into a corner when it comes to its limp intentions to hike fuel duty, having frozen the tax on petrol and diesel since 2011.

In fact, Mr Hunt is the seventh Tory Chancellor of the Exchequer in situ since the freeze was first initiated by George Osbourne.

While the freeze has benefited Britain’s drivers, it has come at a big cost to the Treasury.

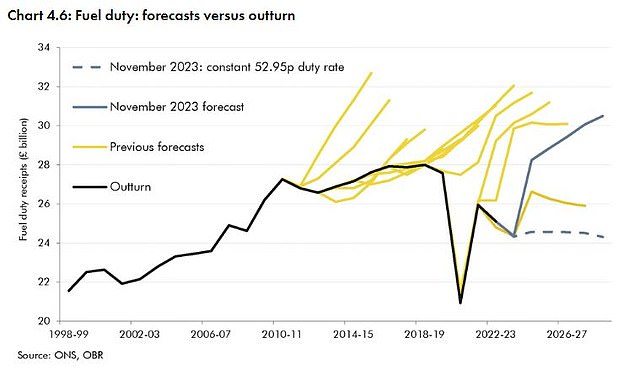

Following last year’s Autumn Budget, the Office for Budget Responsibility’s (OBR) economic and fiscal outlook report pointed to a ‘planned 6p increase in the fuel duty rate in March 2024’, in line with inflation.

The OBR said that increasing the duty rate by RPI and reversing the temporary 5p cut would raise earnings by £3.8billion to £28.2billion in 2024-25, though that will no longer be the case following today’s announcement.

The Social Market Foundation (SMF) thinktank estimates that 14 years of frozen fuel duty freeze and the 5p cut since 2022 has cost the Treasury £130billion since 2011.

The SMF coined retaining the fuel duty cut a ‘regressive policy’, claiming it benefits the wealthiest in society who drive large, gas-guzzling SUVs who will save around £60 a year, while those who earn the least and drive more economical cars will save just £22, according to its analysis.

Thom Groot, CEO of The Electric Car Scheme, described the continuation of the freeze on fuel duty as a ‘flip-flopping policy’, saying a fossil fuel subsidy worth billions of pounds a year could be ‘far better spent on encouraging the uptake of electric cars’.

He added that the Government’s inconsistent messaging over EVs has ‘dramatically slowed the uptake of electric cars’.

However, other industry insiders celebrated the tax break on petrol and diesel as a victory for the nation’s motorists.

The Social Market Foundation thinktank estimates that 14 years of frozen fuel duty freeze and the 5p cut since 2022 has cost the Treasury £130billion since 2011. This chart shows the comparison between fuel duty forecasts and outruns

The RAC calculates that the 12-month extension to the 5p-a-litre fuel duty alone will save motorists around £3.30 each time they fill up, once factoring in the impact of VAT.

Yet the motoring group says retailers are swallowing up the 5p cut with higher profit margins, which have inflated to 10p per litre in 2024, up from an average of just 6p (on petrol) in the pre-pandemic year of 2019.

‘With a general election looming, it would have been a huge surprise for the Chancellor to tamper with the political hot potato that is fuel duty in today’s Budget. It appears the decision of if or when duty will be put back up again has been quietly passed to the next government,’ says Simon Williams, fuel price expert at the RAC.

‘But, while it’s good news that fuel duty has been kept low, it’s unlikely drivers will be breathing a collective sigh of relief as we don’t believe they’ve fully benefited from the cut that was introduced just two years ago due to retailers upping margins to cover their ‘increased costs’.’

The AA welcomed the Chancellor’s decision, though pointed to the benefit halving from £100 a year in Sunak’s 2022 statement to the £50 annual saving quoted by Mr Hunt on Wednesday afternoon.

It also said generally higher motoring costs – whether fuel, maintenance or insurance – are already generating substantially higher VAT returns for the Treasury.

On petrol alone, the VAT on each fill up generates over £2 for Government coffers.

‘More people have been forced into their cars by unreliable trains, reduced bus services and higher housing costs sending them further away to cheaper areas,’ the AA said.

‘Councils are ramping up parking costs, even sometimes taxing city workers with a Workplace Parking Levy, to fill holes in their coffers.’

IAM RoadSmart director of policy and standards Nicholas Lyes said keeping fuel duty down has come at a time when motorists’ biggest concern is the cost of running their vehicle.

However, he caveated: ‘We’re disappointed there was no support within the Budget to help younger drivers with the spiralling costs of motor insurance. The Chancellor should have considered a cut to Insurance Premium Tax (IPT) for drivers under-25 who are facing sky-high premiums in excess of £2,000.’

Howard Cox, founder of the FairFuelUK campaign, somewhat unsurprisingly celebrated Hunt’s decision, saying ‘millions of much-maligned drivers’ will be ‘more than delighted’ with the fuel duty freeze for a 14th consecutive year, though dubbed fuel duty a ‘regressive, still-too-high tax’.

Independent fuel retailers also welcomed the announcement.

‘This move is poised to ease the financial burden on motorists when they refuel and is likely to be well-received.’ said Gordon Balmer, executive director of the Petrol Retailers Association.

‘PRA appreciates the Government’s commitment to reviewing fuel duty rates and hope they will continue their efforts to alleviate the burden of high energy prices on motorists.’

Ian Plummer, commercial director at the UK’s largest car marketplace, Auto Trader, was far from shocked by Mr Hunt’s announcement, commenting: ‘No self-respecting Chancellor would ever shoot himself in the foot by raising it in an election year.

‘Drivers may avoid higher pump prices for now, but the freeze does send yet more mixed messages to any motorists tempted to switch to electric vehicles.’

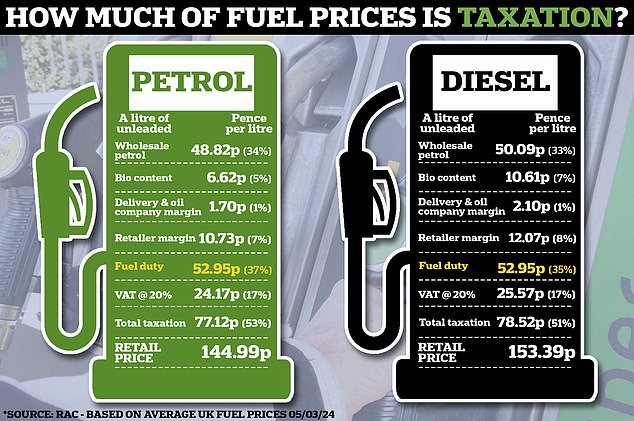

This infographic shows how much the cost of a litre of fuel is made up of tax. For petrol it is 53% while diesel is 51%, based on the latest fuel price data

How much of what we pay at the pumps is tax?

With petrol currently (based on 5 March 2024 data) priced at 145.0p per litre, fuel duty of 52.95p accounts for over a third (37 per cent) of what drivers pay at the pump today.

VAT at 20 per cent is also charged on fuel, meaning taxation makes up over half (53 per cent) of what motorists filling up with unleaded fork out each time they visit a forecourt.

For diesel at a UK average of 153.4p, fuel duty accounts for 35 per cent of the total fuel bill, while VAT bumps the total to 51 per cent of the full price paid at a filling station.

So, despite fuel duty not being adjusted for the next 12 months, it’s still a case of the Chancellor pocketing more than half of what drivers pay at forecourts.

In cash terms, that’s around £43 every time the tank of an average petrol-powered family car is filled up in Britain.

How much does the Treasury generate from fuel duty?

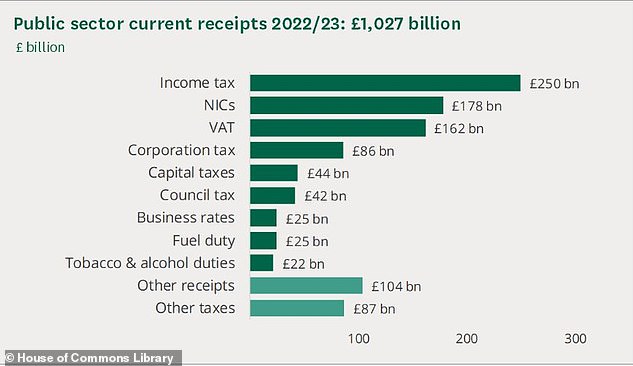

Fuel duties represent a significant source of revenue for the Government.

The OBR says fuel duties levied on purchases of petrol, diesel and a variety of other fuels raise £24.4billion per year for the Treasury.

That estimation is inclusive of the 5p-a-litre cut and duty at a rate of 52.95p a litre.

This represents 2.3 per cent of all receipts and is equivalent to £867 per household and 0.9 per cent of national income.

What does the Government spend fuel duty earnings on?

Combined with Vehicle Excise Duty (car tax), the Treasury generates around £35billion per year from vehicle and fuel taxation.

Around 20 per cent of this is spent on road maintenance budgets, with the rest used for general government expenditure.

However, a Conservative commitment to ring-fence vehicle tax revenue to fund road projects has recently been scrapped.

The Treasury said revenue from VED goes into the Consolidated Fund – a general pot of tax receipts – despite promising to launch a new National Roads Fund (NRF) in 2020.

It insisted VED ‘is being reinvested’ into road schemes.

The RAC said the Government ‘seems to have done a U-turn and are quietly hoping it goes unnoticed’.

The Department for Transport (DfT) said in 2016 the Government ‘guarantees that all revenue raised from VED will be allocated to a new National Roads Fund’ from 2020-21, adding this would be ‘underpinned by legislation’.

Then-chancellor Philip Hammond said at his budget in 2018 that £28.8 billion from VED would be invested in the NRF to pay for National Highways’ planned major road schemes between 2020 and 2025.

Revenue from vehicle excise duty is going into the Consolidated Fund – a general pot of tax receipts – rather than a roads fund

Simon Williams from the RAC said: ‘We welcomed the Treasury announcement that revenue from vehicle tax in England was to be ring-fenced for future investment in our busiest roads.

‘The Government seems to have done a U-turn and are quietly hoping it goes unnoticed.

‘We believe the creation of the National Roads Fund would have been a massive step in the right direction as it ensured around £6billion of the circa £45billion collected from drivers in all forms of motoring taxation each year would go directly back into the roads that carry the most traffic.’

The DfT announced in October 2023 that money saved from cancelling the northern leg of HS2 would enable it to provide local councils in England with £8.3billion over 11 years to maintain local roads, including fixing potholes.

Mr Williams described this as ‘a drop in the ocean considering the years of underinvestment and neglect’.

He urged the Government to ring-fence ‘a small proportion’ of money raised from fuel duty ‘to ensure our local roads don’t deteriorate any more than they already have’.

A Treasury spokesman said: ‘The Consolidated Fund receives the proceeds of Vehicle Excise Duty and most other tax revenues, such as those collected by HMRC.

‘VED is being reinvested into the English road network between 2020-2025 to fund road enhancement projects.’

When did drivers first start paying tax on road fuel?

Fuel duty has existed for over a century in Britain.

A petrol duty was first introduced as part of the Finance Act 1908 – which was also called the ‘People’s Budget’. It set out a taxation of a thruppence (3d) per gallon.

By 1915, this had doubled to 6d, albeit with a 50 per cent rebate for commercial vehicles.

However, just four years later it was abolished under the Finance Act 1919 in light of the first introduction of vehicle taxation and the tax disc. Unlike Vehicle Excise Duty today, taxation then was calculated in accordance with the horsepower rating of a car.

With the price of fuel declining dramatically in the following years, the Government reintroduced a petrol duty at a rate of 4d per gallon in 1928 and the levy rose gradually as years progressed.

It wasn’t until 1993 under a Conservative Government led by John Major that tax on fuel began to climb at a significant rate.

In the March 1993 Budget, then Chancellor Norman Lamont hiked fuel duty by 10p per litre and introduced a ‘Fuel Price Escalator’ that was initially set at 3 per cent ahead of inflation per year – though that was increased to 5 per cent later the same year.

The escalator was increased to 6 per cent in 1997 under the Tony Blair premiership, with Gordon Brown taking control of the red box.

As the coalition government took power in 2010, the duty on fuel was increased to 58.19p in October and again to 58.95p in January 2011 – the highest it has ever been.

In March 2011, it was announced that the fuel price escalator would be replaced with a ‘Fuel Duty Stabiliser’, along with the level being trimmed back to 57.95p – the same value it remained for 11 years.

The aim of the stabiliser was to increase fuel duty if oil prices dropped below $75 a barrel, though it has remained frozen at the same rate for over a decade.

This map compares fuel duty levied on a litre of petrol across Europe. Tax Foundation Europe says the UK ranks 8th in terms of the highest duty on unleaded and 1st for diesel

Are we paying more fuel tax than our European neighbours?

Taxation of fuel across Europe is different to the UK.

The European Union (EU) requires Member States to levy a minimum excise duty of €0.36 (approximately 30p) per litre on petrol. However, many have much higher rates.

A report published last year by Tax Foundation Europe found that only a handful of EU countries charge this minimum duty, including Bulgaria, Hungary, Malta, Poland and Romania.

The lowest tax on unleaded petrol is in Hungary at €0.29 (approx 25p) due to its rate being set in its domestic currency – the forint – resulting in an average rate below the EU minimum after exchange rate fluctuations.

At the opposite end of the spectrum, the Netherlands has the highest petrol taxation at €0.79 a litre (approx 68p), followed by Italy at €0.73 (approx 62p) and Finland at €0.72 (approx 62p).

The UK ranks eighth overall in the rankings of the highest duty levied on petrol.

In terms of overall fuel price, Denmark (which is seventh in the tax standings) is the most expensive country to fill up, while the UK sits tenth overall behind the Netherlands, Greece, France, Italy, Germany, Finland, Portugal and Ireland.

| COUNTRY | PRICE PER LITRE (EUR) |

|---|---|

| Netherlands (NL) | 0.79 |

| Italy (IT) | 0.73 |

| Finland (FI) | 0.72 |

| Greece (GR) | 0.70 |

| France (FR) | 0.68 |

| Germany (DE) | 0.67 |

| Denmark (DK) | 0.64 |

| United Kingdom (GB) | 0.62 |

| Belgium (BE) | 0.60 |

| Sweden (SE) | 0.58 |

| Estonia (EE) | 0.56 |

| Portugal (PT) | 0.55 |

| Luxembourg (LU) | 0.54 |

| Czech Republic (CZ) | 0.52 |

| Slovakia (SK) | 0.51 |

| Latvia (LV) | 0.51 |

| Spain (ES) | 0.50 |

| Ireland (IE) | 0.48 |

| Austria (AT) | 0.48 |

| Slovenia (SI) | 0.47 |

| Lithuania (LT) | 0.47 |

| Cyprus (CY) | 0.43 |

| Croatia (HR) | 0.41 |

| Poland (PL) | 0.37 |

| Bulgaria (BG) | 0.36 |

| Malta (MT) | 0.36 |

| Romania (RO) | 0.36 |

| Hungary (HU)** | 0.29 |

| Average | 0.53 |

| Minimum Rate | 0.36 |

| Source: Tax Foundation Europe |

As for diesel – which is far less popular on the continent – the EU sets a slightly lower minimum excise duty of €0.33 a litre (approx 28p).

At 52.95p, the UK’s taxation on diesel fuel is higher than the rest of Europe.

The next most expensive country is Italy at €0.62 per litre (approx 52p) and Belgium at €0.60 (approx 51p).

When looking at the total average cost of fuel across European nations, the UK is the sixth priciest place to fill up.

The only EU countries where diesel is dearer is Finland, Belgium, Italy, France and the Netherlands.

| COUNTRY | PRICE PER LITRE (EUR) |

|---|---|

| United Kingdom (GB) | 0.62 |

| Italy (IT) | 0.62 |

| Belgium (BE) | 0.60 |

| France (FR) | 0.59 |

| Finland (FI) | 0.53 |

| Netherlands (NL) | 0.52 |

| Slovenia (SI) | 0.51 |

| Germany (DE) | 0.49 |

| Denmark (DK) | 0.44 |

| Ireland (IE) | 0.43 |

| Portugal (PT) | 0.42 |

| Latvia (LV) | 0.41 |

| Luxembourg (LU) | 0.41 |

| Greece (GR) | 0.41 |

| Cyprus (CY) | 0.40 |

| Austria (AT) | 0.40 |

| Spain (ES) | 0.38 |

| Sweden (SE) | 0.38 |

| Estonia (EE) | 0.37 |

| Lithuania (LT) | 0.37 |

| Slovakia (SK) | 0.37 |

| Croatia (HR) | 0.35 |

| Czech Republic (CZ) | 0.34 |

| Poland (PL) | 0.33 |

| Bulgaria (BG) | 0.33 |

| Malta (MT) | 0.33 |

| Romania (RO) | 0.33 |

| Hungary (HU)** | 0.28 |

| Average | 0.43 |

| Minimum Rate | 0.33 |

| Source: Tax Foundation Europe |

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.