It’s fascinating how two people can interpret a single image so differently. The same holds true for how homeowners and renters perceive the current economy. According to all the data, it’s clear that the economy is robust. However, the degree of its strength depends on whom you ask.

The rent versus buy debate has raged on since I started Financial Samurai in 2009, and it will continue long after I’m gone. My position is that it’s best to buy property as young as possible because inflation is too powerful a force to combat. You want to ride the inflation wave, not get pounded by it.

More than fifteen years later, I am even more convinced that homeownership is better for building long-term wealth than renting for the vast majority of people.

Homeownership forces you to stay disciplined with your finances by paying your mortgage each month. Meanwhile, thanks to a fixed mortgage, your disposable income will grow over time, allowing you to save and invest more money.

When it’s time to sell your property, you can bank $250,000 in tax-free profits as an individual or $500,000 as a married couple. Now that’s hard to beat.

Don’t Short the Real Estate Market Long Term

Renting long-term is like shorting the real estate market because you’re a price taker. Renters are at the mercy of ever-rising rents. Just as it’s not a good idea to short the S&P 500 long term, it’s not a good idea to short the real estate market.

Even though it’s clear that most people will build more wealth owning than renting, there are still plenty of naysayers. Why? Because people always justify their decisions. As long as there are renters, there will always be people against homeownership.

It doesn’t matter what the data says about how much home prices have increased or how the average net worth of a homeowner is much greater than that of a renter. Once you miss an opportunity, your default setting is to be against it.

It’s like the person who hates Google after the company didn’t give them a job offer. Even though Google’s stock price is up 200% since the rejection, the person still thinks Google is a terrible company. More gains brings about more dissension.

However, one key to being a good investor is recognizing when you’re wrong to make better decisions going forward. You can’t afford to get too emotion if you want to build great wealth.

For those who are renting and aspire to become homeowners, please continue saving and investing. You may want to consider investing in a real estate ETF, REIT, or private real estate fund to gain exposure, just in case real estate significantly outperforms other investments.

However, for those of you who are against homeownership, and perhaps harbor deep-seated resentment towards homeowners, I hope you will reconsider your stance.

How Is The Economy Doing? Depends If You’re A Homeowner Or Renter

If you need another reason to be a homeowner versus a renter, consider that homeowners tend to have a more optimistic outlook. And when you are more optimistic, you tend to be happier!

You can have all the money in the world, but if you’re not happy, then what’s the point? Money is only a means to a better life.

As a renter, you might get more disgruntled every time your rent increases. Cynically, you might hope the economy goes into a recession and lays off a bunch of people so rents can go down. After all, if others suffer more than you, you benefit!

Whereas if you’re a homeowner, you’re almost always on the side of economic growth. You want more people to get jobs, more restaurants to open, and more schools to grow their enrollments in your neighborhood. You love local economic catalysts that tend to be good for everyone, including homeowners. And when things turn down, you’re hopefully that people will find a way to recover.

The homeowner is like the long-only fund manager who buys and holds. There’s not too much stress. The renter, on the other hand, is like the hedge-fund manager who is always finding reasons to short. It can get exhausting.

Now doesn’t it sound better to be an optimist than a pessimist? I think so.

The economy is clearly doing well post-pandemic. The stock market is near an all-time high, unemployment is only at 3.9%, wage growth continues to be robust, and GDP growth continues to be positive.

However, your viewpoint on how the economy is doing may depend on whether you are a homeowner or a renter.

Renters Are Getting Squeezed

“The post-pandemic economy is treating people very differently, creating a headache for central bankers,” Jeffrey Roach, chief economist of LPL Financial, wrote in a research note. “The extreme differences can often be traced back to living situations, as renters have a very different experience than homeowners.”

“Since the start of the pandemic, rents have increased by more than 20%,” Roach noted, “with renters paying about $370 more each month on average. As rents continue to increase, so does a feeling of economic insecurity.”

Nearly 1 in 5 renters (19%) reported being behind on their rent at some point in the past year, a Federal Reserve report found, up from 17% in 2022.

Renters were also more likely than homeowners to report missing bill payments in the previous month, even when income was accounted for. This trend was consistent across various types of bills, including water, gas, electric, phone, internet, and cable.

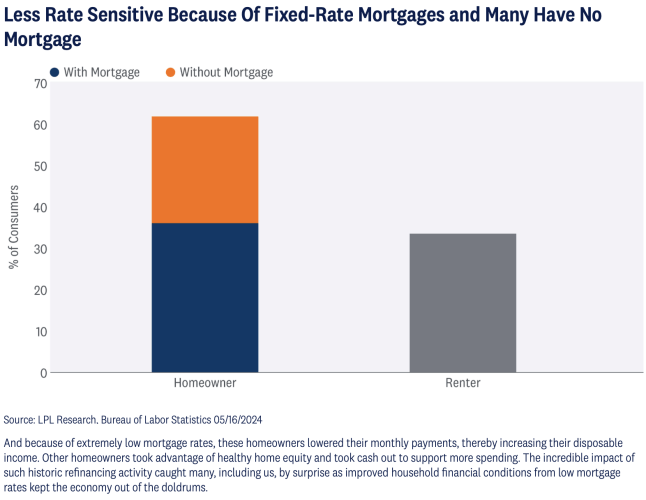

Homeowners are less sensitive to higher rates and higher inflation because most refinanced or don’t have mortgages. The average American spends about 33% of their income on housing. When that cost is fixed or low, higher interest rates and inflation simply aren’t as impactful.

Homeowners Feel Better About The Economy

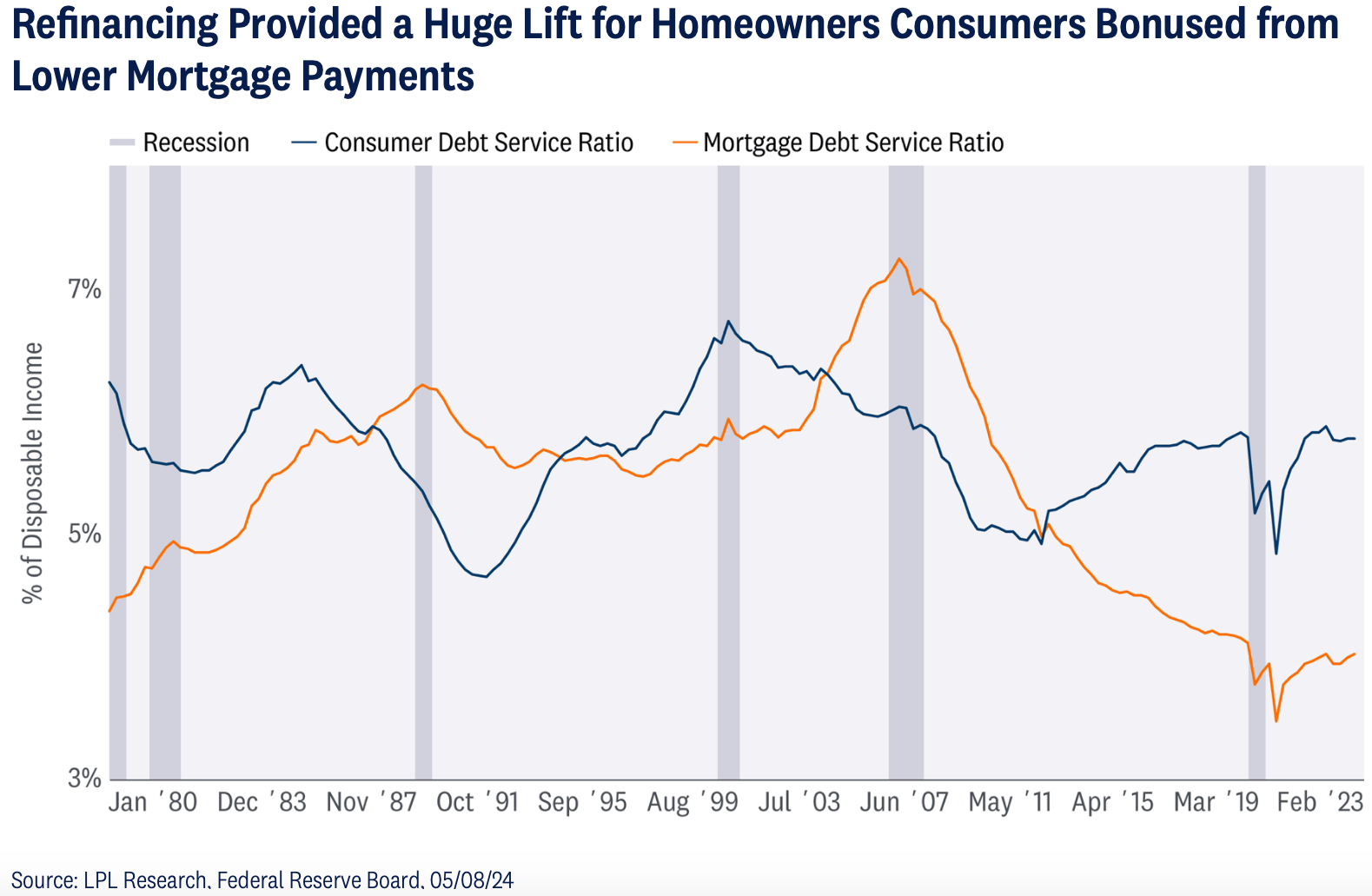

Now let’s turn our attention to homeowners. Any homeowner with a mortgage (~60% of all homeowners) could have refinanced to a lower rate in 2020 and 2021. We discussed refinancing your mortgage extensively on Financial Samurai back then, including whether to choose an ARM or a 30-year fixed-rate mortgage.

As a result, homeowners saved approximately $220 per month on average, with their mortgage payments taking up a historically low share of their disposable income, according to LPL’s Roach. Saving money feels great! Plus, it creates more economic security thanks to fixed payments.

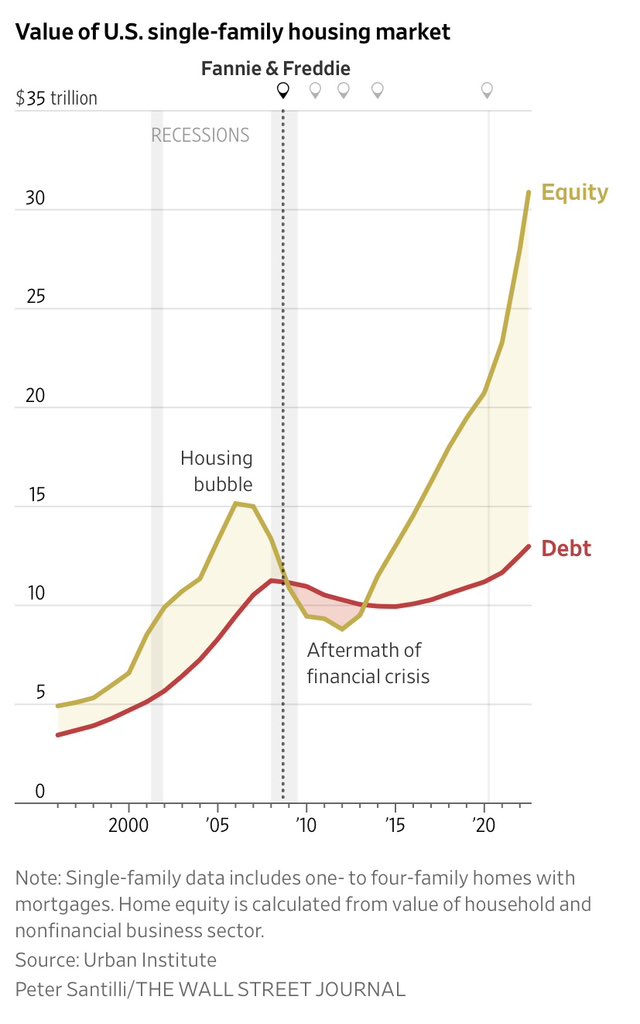

Meanwhile, the median price of a home has increased by roughly 40% from January 1, 2020, to June 1, 2024. According to one report, 48 million U.S. homeowners with mortgages have tappable equity at an average of $206,000 per borrower, up from $185,000 at the same time last year.

The combination of lowering your monthly mortgage payments and seeing your home equity grow naturally makes you feel much better about the economy. When you feel better, you become more optimistic and happier. You see how the cycle works?

But Renters Are Benefitting From Their Stock Investments Going Up

The most common argument against homeownership is that renters can save and invest the difference in the stock market. Given the stock market has historically returned a higher rate than real estate (~10% vs. ~5%), renters could potentially make more money.

This argument holds if renters and homeowners invested the same amount of capital in stocks and real estate. However, homeowners typically invest a much larger amount of capital into their homes than stock investors do into stocks, primarily due to leverage.

The median home price in America is about $421,000, according to the St. Louis Fed. Meanwhile, the median stock portfolio balance for a 30-something investor is below $100,000.

Even for 30-something users of Empower, a free financial app where users are more financially focused, the median stock portfolio balance is only about $150,000.

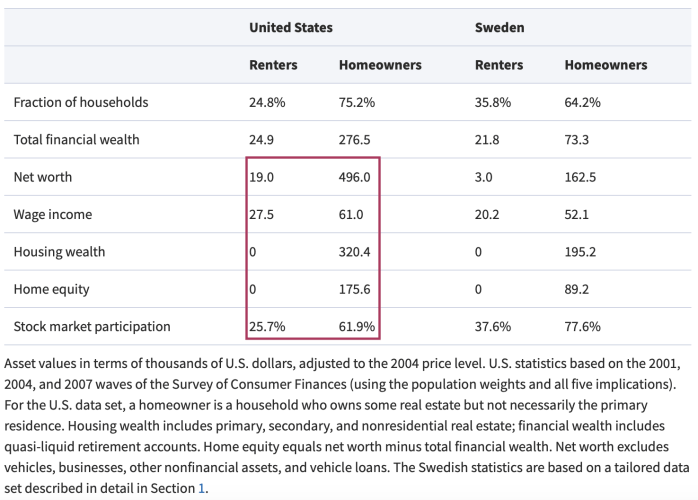

Moreover, homeowners are more likely to own stocks than renters by a ratio of 2:1. According to an Oxford Academic study, homeowners have a 61.9% stock market participation rate versus only 25.7% for renters.

Therefore, homeowners have not only benefited from refinancing and higher home prices, but they’ve also seen their stock portfolios increase in value. It’s hard not to feel more positive about the economy under this scenario.

Net Worth Differential Between Homeowners And Renters

According to the Oxford Academic study, the average net worth of a homeowner is $496,000, compared to only $19,000 for the average renter—a difference of 26 times. See the chart above.

The power of homeownership lies in its passive wealth-building nature. You don’t have to actively manage investments; you simply need to pay your bills, maintain your home, and enjoy living in it. Inflation will naturally increase your home’s value over time.

New homeowners do face higher homeowners insurance costs and mortgage rates no doubt. The Fed study found that the average monthly mortgage payment today is $2,100, which is $700 more than those who bought before the pandemic.

However, the vast majority of homeowners are in a much better financial position now than they were before the pandemic.

Renting Is A Temporary Solution

Renting is absolutely fine in the short term. Maybe you’ve relocated to a new city and are trying to figure out which neighborhood you like best. Maybe you’re uncertain about whether you want to get married and have children. Renting is a great solution.

However, as soon as you are more than 70% sure you plan to stay somewhere for at least five years, I’d recommend buying. Just don’t get caught up in bidding wars. Be strategic about when you buy and at what price.

The next time someone says renting is a better way to build wealth, understand their perspective. Are they a renter or an owner, and for how long? How are they making and investing their money? Are they mentally and physically stable?

Certainly, a financial expert might advise you that homeownership is not an effective way to build wealth. However, if this “money guru” has been renting for the past 20 years and makes millions as an expert marketer selling financial courses, you might want to take their advice with a grain of salt. They missed out on the opportunity of homeownership, and they can afford to rent because they’re already making substantial amounts of money.

In 20 years, your children will be astonished at how inexpensive real estate prices were today. If you’re not going to purchase property to build wealth for yourself, at least do so for your kids. This way you’ll prevent them from shaking their fists at the sky because they cannot afford to buy property in the future.

Reader Questions

Are you a renter or a homeowner? How do you view the economy right now? Are renters more pessimistic and cynical about the economy than homeowners? Why do you think there are still so many people who are vehemently agains homeownership? Will you be telling your children to rent forever?

Invest In Real Estate Without A Mortgage

You can invest in real estate without taking on a mortgage by investing in private real estate funds. Take a look at Fundrise, a leading private real estate investment firm, manages over $3.3 billion in assets with a minimum investment of just $10. It focuses on residential and industrial real estate in the Sunbelt region, known for its lower valuations and higher yields.

Personally, I’ve allocated $954,000 to private real estate funds, predominantly targeting properties in the Sunbelt. With remote work becoming more prevalent, there’s a growing trend towards lower-cost areas of the country.

Fundrise is a sponsor of Financial Samurai, and Financial Samurai is an investor in Fundrise.