More than 12million Britons could improve their financial situation over the long term by shifting money in cash or Isas to investments, a new report from Hargreaves Lansdown reveals.

Many of us are not on track to have enough for a comfortable retirement, as only one in seven households put enough in their pension pots for a comfortable retirement, the report exclusively given to This is Money shows.

There are ways to turn this around though by shifting money from existing cash savings or an Isa choosing to invest some of your nest egg instead of keeping the whole amount in cash.

We look at savings and investing trends and how Britons could plug gaps in pensions and life insurance by moving savings.

More than 12million Britons could improve their financial situation by shifting some money from cash to investments and pensions

1. More have emergency savings than five years ago

The percentage of Britons with no spare cash at the end of each month nearly doubled between 2022 and 2023 – rising from 11 per cent in 2022 to 21 per cent in 2023, data from Nationwide Building Society suggests.

But, these new Hargreaves figures paint a different picture. It shows the number of households with enough emergency savings to cover them has risen from 46 per cent in 2019 to 63 per cent now.

The jump over the past five years can be attributed, in part to lockdown savings, according to Hargreaves Lansdown’s head of personal finance Sarah Coles.

Coles says: ‘The rise in savings owes a great deal to lockdown savings, which an awful lot of people are still holding onto – particularly those on above-average incomes.

‘The financial turbulence of the last few years persuaded people they needed to hoard every spare penny, and keep it close to hand, just in case things got even worse.

‘It means they haven’t spent their way through their pandemic savings, and in many cases have actually built on them. However, the siege mentality means they’re clinging onto them in cash.’

Personal finance experts recommend keeping between three to six months’ worth of household outgoings in a cash savings account.

The emergency fund should cover your rent or mortgage payments, utility bills, food shopping and childcare and which you can access at a moment’s notice should you have a change in circumstances.

2. Savers with large pots are not investing

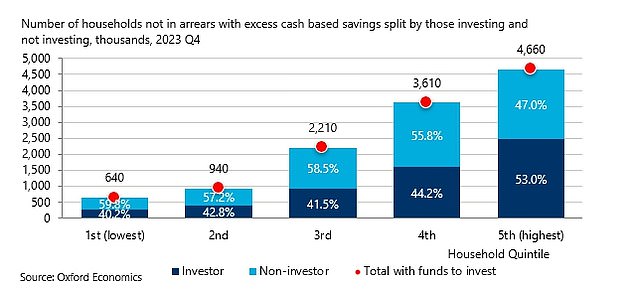

The research shows 12.1million households have enough savings and are in a position to grow their wealth for the future. But less than half of these are currently investing extra cash they have at the end of the month.

Households with incomes over £77,400 are most likely invest their cash, but still only around half of people in this bracket currently invest.

There are 5.6million households who have no arrears and more than enough savings, but do not invest in a stocks and shares Isa.

This means that only 47 per cent of the 12.1million households with no arrears and enough savings to be comfortable investing actually take the plunge.

For those people, this is a missed opportunity as investing over the long term enables your money to work harder.

If you put £20,000 into a savings account paying 3 per cent over the next 20 years, it could grow to be worth £36,415. If you put it into a stocks and shares Isa returning 5 per cent a year, after 20 years it could be worth £54,253 – or almost £15,000 more, simply from moving your money.

Moving extra savings you know you won’t need for five to ten years into a stocks and shares Isas would boost long-term financial health – especially when it comes to later in life.

3. Those with less to put away are still investing

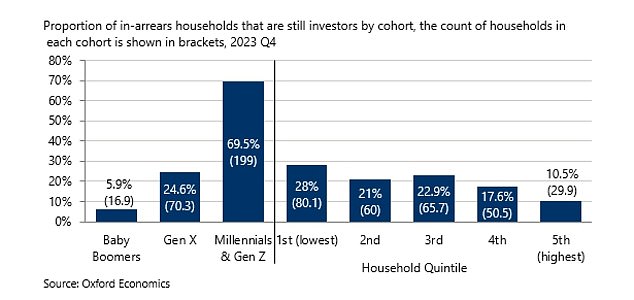

Younger and lower-income households are still managing to invest even if they are in arrears and have less cash left over.

Figures show 15.8 per cent of households in arrears are currently investing.

Of these, almost 70 per cent of Millennial and Gen Z households who have arrears are investing compared to just 5.9 per cent of Baby Boomers who have arrears.

But this does mean that younger households may not have an ample emergency fund for a rainy day, Hargreaves Lansdown suggests.

One reason Britons are not investing extra cash is due to familiarity with investments and financial education – households with better financial literacy are more likely to invest than those with poor financial literacy.

Coles says: ‘A huge part of why more people don’t invest comes down to the fact that they’ve never been taught about investment, so unless they have specifically taken an interest, there has been no reason why they’d ever pick it up.

‘As a result, understanding of both investment and the impact of inflation isn’t terribly widespread.

‘It means some savers will just be focusing on the interest they have been making on their savings, and not considering how the spending power has been eroded by inflation.

‘It means some of them have been losing money after inflation, and yet feeling that their money is growing because they see interest payments added to it.

‘Others won’t ever have considered investment, and so they don’t understand the growth potential.

‘We can see the impact that a better understanding can have – because among those with better financial literacy, around half are investors – compared to fewer than a third of those with poor financial literacy.’

A larger proportion of younger and lower-income households who are in arrears are still investing compared to older counterparts

4. We’re not saving efficiently for retirement

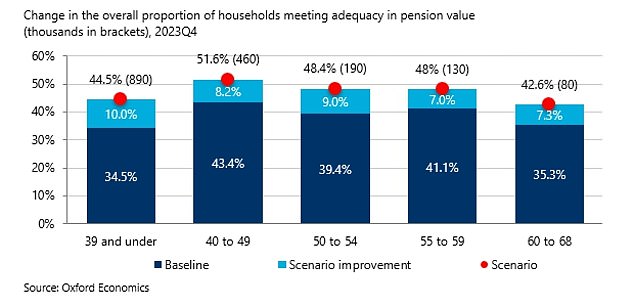

Just one in seven households, amounting to over 12.2million people, have a big enough pension for a comfortable retirement.

Within this group of people, 6.9million could boost their pensions as they have excess savings and hold investments which could be redirected to their pension.

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown said: ‘Building a good retirement income may feel like an enormous challenge but for millions of households the key to helping themselves rests in their bank accounts and Isas.

By making small changes in how they allocate their money, they can make an enormous difference to their retirement prospects.

Paying into a pension brings tax relief and because the money is invested rather than in cash, it has more of an opportunity to grow.

If you were putting £400 a month into cash savings, growing at 3 per cent, for 20 years, you’d build a nest egg of £131,321.

If you put it into a pension, and tax relief brought it up to £500 a month, growing at 5 per cent, after 20 years you might have £205,517 – giving you a lump sum that’s £74,196 larger, without you having to pay anything extra in.

If you are a higher or additional rate taxpayer, you stand to gain even more as you benefit from tax relief at 40 per cent and 45 per cent respectively.

Morrissey said: ‘It’s a relatively simple behavioural shift that could see 1.8million households passing the threshold for a moderate retirement income and securing their financial future, while the outlook for the remaining households would be significantly improved.’

Households who have excess savings could put this money towards their pension as only one in seven households are on track to have enough for a comfortable retirement

5. Life insurance gaps could be plugged

There are 14million households with children in Britain, but more than half of them don’t have enough life insurance cover to protect their families if something were to happen to them.

Those who own their homes and/or have children, require more life insurance cover. Households who have liabilities which are more than the value of their life insurance cover have a life insurance gap.

The gap is £89,800 for those with children, but goes down to £3,400 for the average renter with no children. It is an astonishing £194,200 for those who own their home and have children.

The report found there are 2.4million households not in arrears who can start to plug their life insurance gap by using spare cash they have at the end of the month. But this is mainly because they are higher earners.

Sarah Coles says: ‘The good news is that 2.4million households have a solution at their fingertips, because they can afford to close their life insurance gap from the spare cash they have at the end of the month – without leaving themselves short.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.