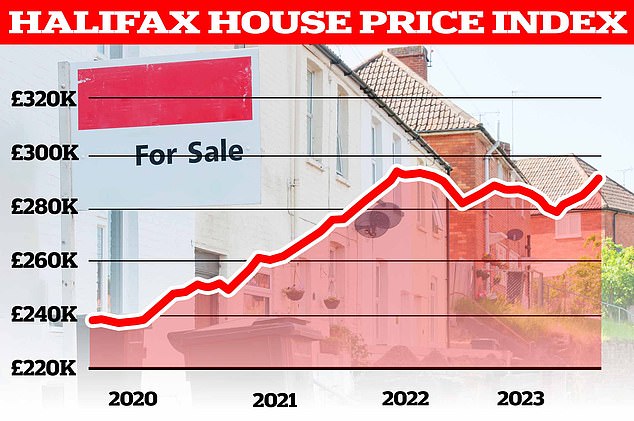

Average house prices have risen for the fourth month in a row, according to the latest figures from Halifax.

The mortgage lender revealed that average prices rose by 1.3 per cent in January alone.

The typical home now costs £291,029, which is almost £4,000 more than in December.

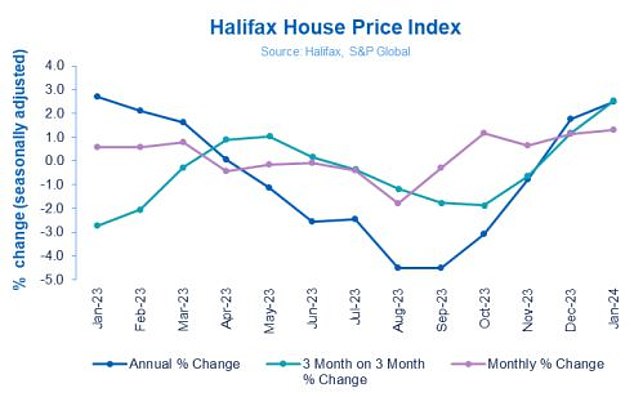

The resurgence of prices in recent months means that year-on-year, house prices are up 2.5 per cent, based on Halifax’s data.

On the up: The average house price in January was £291,029, up 1.3% or, in cash terms, £3,924 compared to December 2023

Kim Kinnaird, director at Halifax Mortgages, said falling mortgage rates helped reverse the consecutive monthly house price falls that were recorded between April and September last year.

Mortgage lenders began cutting rates from September and this rate cutting continued into 2024. In January alone, more than 50 mortgage lenders cut their residential rates – some more than once.

While the cuts have largely come to a standstill over the past two weeks, and some lenders have increased their rates, borrowers securing the cheapest deals can now get a rate of just below 4 per cent when fixing for five years or just above 4 per cent when fixing for two years.

Kinnaird said: ‘The recent reduction of mortgage rates from lenders as competition picks up, alongside fading inflationary pressures and a still-resilient labour market, has contributed to increased confidence among buyers and sellers. This has resulted in a positive start to 2024’s housing market.’

However, Kinnaird said affordability pressures remain given that mortgage rates remain far higher than they were prior to when rates first soared in 2022.

She added: ‘While housing activity has increased over recent months, interest rates remain elevated compared to the historic lows seen in recent years and demand continues to exceed supply.

‘For those looking to buy a first home, the average deposit raised is now £53,414. It’s not surprising that almost two thirds of new buyers getting a foot on the ladder are now buying in joint names.

‘Looking ahead, affordability challenges are likely to remain and further modest falls should not be ruled out, against a backdrop of broader uncertainty in the economic environment.’

Yearly rise: After a fourth consecutive month of house prices rising, the pace of annual growth is now 2.5%

Market on the up according to estate agents

Estate agents are widely reporting that Halifax’s figures line up with what they’re seeing on the ground in the housing market.

In fact, some believe that house prices could start to rise sharply in some areas.

Simon Gerrard, managing director of Martyn Gerrard Estate Agents said:’ Last year, a lot of people put their property searches on hold to weather wider economic turbulence.

‘Now, however, the economy has started to stabilise, and it’s encouraging that large lenders are responding the right way to inflation coming under control by bringing down interest rates.

‘Whilst affordability of homes at this moment is quite good, a quickly increasing population and total lack of new housing supply means prices will then start to rise sharply, particularly in London.’

Jeremy Leaf, north London estate agent and a former Rics residential chairman added: ‘In our offices, more valuations, listings and especially viewings, has been the result.’

Marc von Grundherr, director of Benham and Reeves said: ‘The general view is that 2024 will be a far more fruitful year for the UK property market and we’re already seeing early signs of this, with a fourth consecutive monthly increase in house prices and a sharp increase in both new sales listings and the number of buyers submitting offers.

‘It really is all systems go at the moment and as market activity continues to build, property values will continue to ripen.’

Verona Frankish, chief executive of online estate agent Yopa, also believes the housing market will continue to build momentum as the year progresses.

‘Looking ahead, it’s likely that not only has the property market bottomed out with respect to the decline in house prices seen last year, but it’s also likely that interest rates have now peaked,’ said Frankish.

‘This combination of factors will enthuse both buyer and sellers in equal measure and as the year progresses, we expect further momentum to build.’

Momentum building? Agents say they are seeing more activity in the housing market

Different housing markets

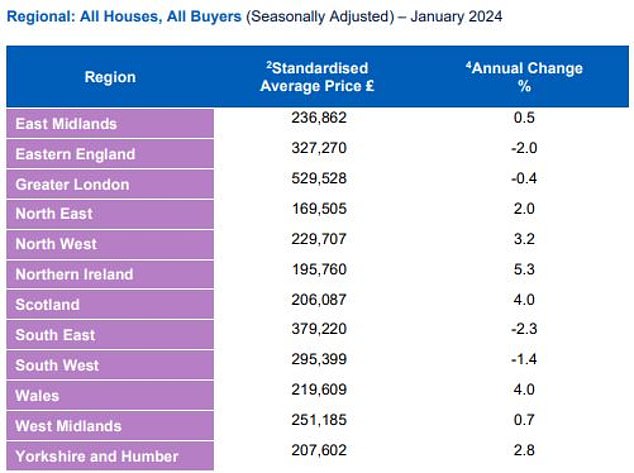

The average UK house price won’t reflect everyone’s experience, given that the property market is made up of thousands of independent micro markets.

Even when looking at different UK regions, it is already possible to see significant differences.

Northern Ireland recorded the strongest growth across all the nations or regions within the UK, according to Halifax. House prices there increased by 5.3 per cent year-on-year.

Scotland and Wales both saw positive growth of 4 per cent on an annual basis, according to Halifax.

Typical prices in the North West of England rose by 3.2 per cent, while Yorkshire and Humber saw prices rise by 2.8 per cent.

Prices in the South East fell the most last month when compared to other UK regions, with homes selling 2.3 per cent below this time last year.

While London retains the top spot for the highest average house price across all the regions, at £529,528, prices in the capital have declined by 0.4 per cent year-on-year.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.