- Surveyors say that house prices are still falling all across the country

- But the rate of this seems to be slowing, and this is set to continue into 2024

House prices continued to record widespread falls last month – but property experts think the worst could be coming to an end.

A survey by the Royal Institution of Chartered Surveyors (Rics) found most surveyors are still seeing falling prices in their local areas, although not as much as in previous months.

The monthly survey takes the temperature of Rics’ members – both estate agents and surveyors, and gives a snapshot of what is happening on the ground in the property market.

Its members mostly say house prices are falling in their local areas, but that this could be easing off.

House prices continued to record widespread falls last month – but property experts think the worst could be coming to an end (Stock Image)

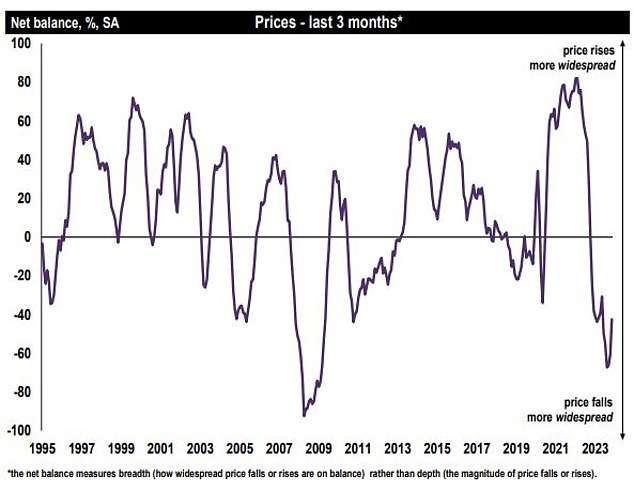

Still negative: November’s Rics survey suggests the pace of house price declines is slowing

November’s survey recorded a net balance of -43 per cent for house prices, compared to -61 per cent in October and -69 per cent in September.

The net balance refers to the proportion of surveyors and estate agents reporting a rise in prices, minus those reporting a fall, and can range from -100 to +100.

For example, if 63 per cent say prices have fallen and 20 per cent are saying prices have risen, this would result in a net balance of -43 per cent.

Under this scenario, it would also mean an additional 17 per cent of those surveyed would have stated that prices were unchanged.

November’s results suggest the pace of house price declines is continuing but has slowed down – though this varies depending on location.

Trevor Brown, a Rics member from Southend-On-Sea, says: ‘The private survey phones are very quiet. Most properties that we are now seeing are forced sales, i.e mostly empty due to death, debt, divorce etc.

‘Prices are often significantly below asking price. Can’t see a trend reversal until Ukraine, Israel and interest rates are sorted.’

John Frost, a Rics member based in Buckinghamshire, adds: ‘Deals are being made but buyers are very cautious.’

Meanwhile, Howard Davis, a Rics member based in Bristol, says: ‘The Bristol market is correcting. We have already seen prices fall by 5 per cent to 10 per cent and this trend is likely to continue.’

Looking ahead, most Rics members clearly expect house prices to fall over the coming three months.

However, only a slight majority of Rics members think that house prices will be lower in 12 months’ time.

In November a net balance of -10 per cent of Rics members said they expect prices to fall over the next 12 months.

This is a big improvement on the -43 per cent of Rics members saying prices would fall over that time period merely the month before.

This is likely a result of mortgage rates no longer shooting up, with many experts now forecasting interest rates to fall next year.

This could mean first-time buyers and homemovers who held off this year may be more tempted to act next year, according to some Rics members.

Greg Davidson, a Rics member from Perth in Scotland says: ‘The base rate looks reasonably stable and lenders are starting to contend for business with competitive mortgage rates.

‘This, combined with more reasonable inflation figures, seems to have created some reassurance which should create a more positive market into 2024.’

Mortgage rates have been heading downwards in recent months, with the best rates available now almost 1 percentage point lower than the Bank of England base rate, which is at 5.25 per cent.

Last week, Nationwide Building Society sent advocate ripples across the mortgage market after it announced its eleventh consecutive round of rate cuts in four months. The building society now has the cheapest deal on the market at 4.29 per cen.