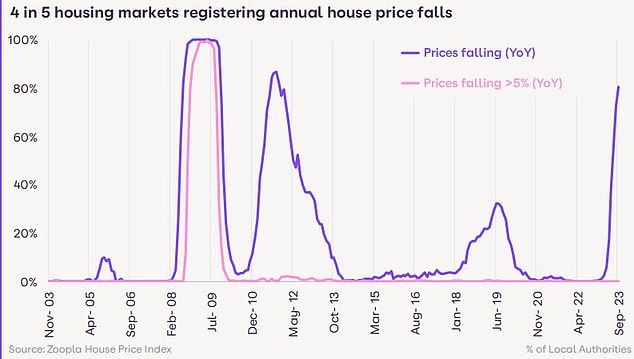

The house price slump is being felt across the country, with 80 per cent of local areas registering annual falls, according to Zoopla.

Home value falls were previously concentrated to the South. But now the downturn has spread to lower-value markets, including the East and West Midlands and Yorkshire and the Humber, according to Zoopla.

The housing market slowdown is the most stark the property website has reported since 2009 in the aftermath of the financial crisis, it says.

Widespread: 4 in 5 housing markets are registering small annual price falls, says Zoopla

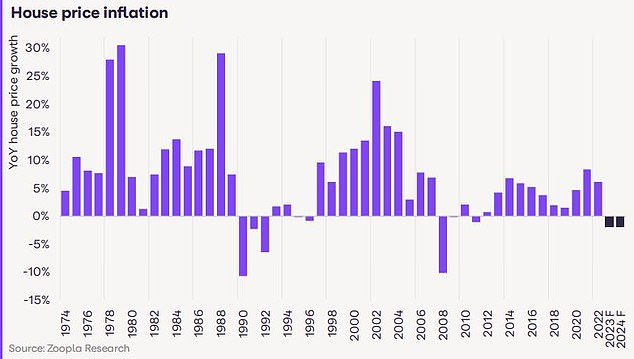

Higher mortgage rates have translated into weaker demand and reduced buying power, which in turn has resulted in prices falling.

However, while the housing market has transformed from double digit house price growth year-on-year to a falling market, the scale of the falls remains limited thus far, according to Zoopla.

Overall, it reports that house prices are down annually by 1.1 per cent on average. when factoring the entire country.

The largest annual falls have been registered in commuter towns around London and across the South East.

For example house prices are 3.5 per cent down in Colchester and 3.3 per cent lower annually in Luton.

But no local markets have registered annual price falls over 5 per cent, according to Zoopla. However, it expects to start seeing some markets register such falls in the coming months in the face of weaker buying power.

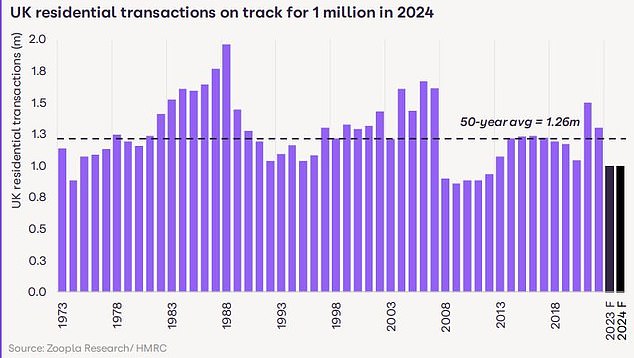

While prices have taken a mild hit, it is transaction volumes that have been hit the hardest by higher mortgage rates.

There has been a 23 per cent reduction in housing sales so far this year compared to the same time last year.

It’s all gone quiet: Transactions have been hit hardest and will be 23% lower than 2022 with Zoopla predicting this will remain broadly the same throughout next year

Richard Donnell, executive director at Zoopla says: ‘House prices have proven more resilient than many expected over the last year in response to higher mortgage rates.

‘However, almost a quarter fewer people will move home due to greater uncertainty and less buying power.

‘Modest house price falls over 2023 mean it’s going to take longer for housing affordability to reset to a level where more people start to move home again.

‘Income growth is finally increasing faster than inflation but mortgage rates remain stuck around 5 per cent or higher.’

What lies ahead?

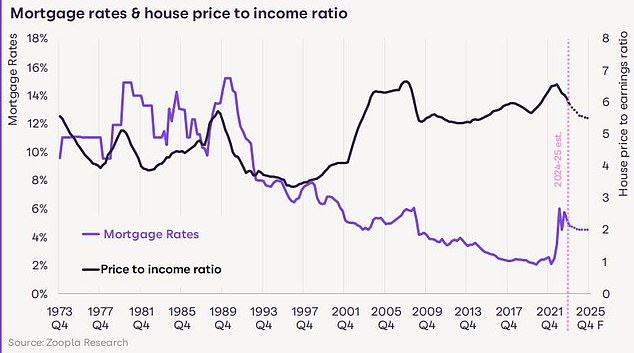

The jump in mortgage rates over the last 18 months has been the primary driver of the current overvaluation in home values, according to Zoopla.

House prices need to fall further, and incomes increase, or mortgage rates need to fall further to reset affordability and support demand or sales.

The fact that house prices have fallen less than expected over 2023 combined with 5 per cent mortgage rates, means purchasing a property still remains relatively expensive for an average household.

Assuming mortgage rates remain at the current level, Zoopla predicts UK house price falls remaining in the low single digits for the next one to two years.

It also anticipates housing transactions to stay flat at around one million in 2024, although this could improve if mortgage rates drop back towards 4 per cent over the first half of 2024.

This they claim will support a modest rebound in activity in the first half of 2024 as people who have delayed moving decide to return to the market.

Donnell adds: ‘We believe that house prices will post further small falls, averaging 2 per cent, over 2024 with one million home moves.

‘Slow house price growth and rising incomes over the next 12-18 months will improve affordability to levels last seen a decade ago, creating the potential for a rebound in home moves as consumer confidence returns.’

Should people delay or buy in 2024?

Zoopla says that there are parts of the population that remain keen to move.

However, they have been biding their time in 2023 and waiting for the outlook to become clearer – in particular, the likely trajectory for mortgage rates and house prices.

Upsizers are likely to remain the group most sensitive to higher mortgage rates as they tend to buy bigger homes which require larger mortgages.

However, those who are buying with view to remain in the property for the long-term should have little to fear from the current downturn, according to Karl Knipe, director of Kings Group estate agents

‘Very low single-digit price rises or falls make no difference when buying a home that you will live in for many years,’ Knipe, ‘it shouldn’t be relevant.’

‘The forecasts are showing that 2024 looks like it will be a similar year to 2023, so if you want or need to move and buy your own ‘castle’ – now is the time to do your homework and put yourself in the best position for the new year knowledge wise, financially wise and ability wise.

‘ This will ensure you’re set up to move quickly if you find a home that suits your needs.’

Negative territory: Zoopla says average house price inflation has slowed from 9.6% to -1.1% over the last year

Next year, first-time buyers will continue to be pushed into buying by the continued, rapid growth in rents, according to Zoopla.

Nicholas Mendes, mortgage technical manager at John Charcol broadly agrees.

He says: ‘Purchasing a property provides you with more security than renting and allows you to invest in your future by building up equity – rather than lining someone else’s pocket.

‘Trying to pinpoint the right time to buy a home is impossible. For example, if rates were to fall in a years’ time, would the property you desired still be on the market?

‘If property prices were to fall, you could find yourself with equally like minded prospective buyers, all bidding on the same property.

‘Property values fluctuate, but history shows that UK property value will inevitably increase, thereby allowing you to make a profit on your initial contribution and provide you with more options for the future.’

Zoopla expects house price-to-income ratio to fall back to levels not seen for a decade, setting the housing market up for a rebound in activity as buyers become more confident

Cash buyers will also remain an important buyer group next year, according to Zoopla.

Nigel Bishop of buying agency Recoco Property Search says: ‘The UK’s property market, particularly at the higher end where properties cost a minimum of £1million, has seen a noticeable boost in cash buyers over the past year.

‘This increase has been driven by less favourable interest rates and, with rates unlikely to decrease any time soon, will continue in 2024.

‘The presence of more cash buyers could create further challenges for buyers who are reliant on a mortgage as some sellers favour cash transactions for their chain free nature which often results in an overall faster sales process.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.