VioletaStoimenova

Summary

Readers may find my previous coverage via this link. My previous rating was a buy, as I believed Houlihan Lokey (NYSE:HLI) would continue to grow earnings as the business conditions continue to normalize. The stock has done just as I expected given the strong 3Q24 results, reaching my target price of ~$124 just a few days ago. I am reiterating my buy rating for HLI as the outlook remains very positive for HLI, with my expectation that rates are going to stay at the current level for longer than the market expects. This bodes well for HLI in two of its major segments: corporate finance and restructuring.

Financials / Valuation

Giving an update on the key figures, 3Q24 sales grew 12% on a y/y basis to $511 million. The growth was driven by all 3 segments, wherein corporate finance [CF] grew by 6%, restructuring grew by 30%, and financial and valuation advisory [FVA] grew by 9%. Consolidated growth also beat the consensus estimate by ~8%. HLI maintained its operating cost structure compared to last year, which resulted in EBIT growing faster than the topline. HLI saw EBIT of $114.7 million in 3Q24 vs. $103 million in 3Q23. As such, EPS also grew compared to last year, reaching $1.22, in line with consensus estimates.

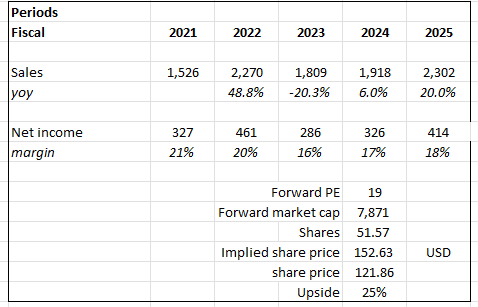

Based on author’s own math

Based on my view of the business, I expect HLI to continue to sustain its growth momentum for the rest of the year. I increased my growth expectations modestly from 5.3% to 6% for FY24, reflecting a higher y/y growth for 4Q24 as the momentum rolls over from 3Q24. As I have a view for rates to stay higher for longer, I expect HLI to see higher growth in FY25 (20% vs. my previous expectation of 18.9%). My margin outlook for FY24 has improved, as I was surprised by how HLI managed to keep its cost structure flat despite a strong 3Q24 performance. That said, I held my margin outlook flat for FY25 as I believe they might need to add additional headcount to meet demand. All in all, I believe the current outlook for HLI is very positive, and this should support a premium valuation of its historical performance. That said, I do think the current 22x forward PE seems like too much of a premium given that HLI has sustained trading at such a high multiple before. I think a more appropriate premium is at the high end of the HLI trading range. I model HLI to trade at 19x forward PE, the high end of its standard deviation.

Comments

HLI performed very well against my expectations, and I expect the current momentum to continue as HLI takes advantage of the current high rate environment on two major fronts: M&A and restructuring.

Contrary to what the market is expecting—the Fed cutting rates—I don’t think the Fed will be able to cut rates as easily as they intended, given how the macroeconomic environment is not giving a good reason to do so. In my opinion, the Fed will only cut rates when inflation has been proven to stay in the ~2% range and the labor market is not as hot as it is now. On the latter, while job growth has tapered, the fact that unemployment is still at an all-time low is concerning, which I take as an indicator that the labor market has not cooled. Instead of asking when the Fed will cut rates, I think the right question is: why should the Fed cut rates given such conditions? Hence, I think the high-rate environment will last longer than expected, which plays well for the HLI CF segment. High rates push down asset valuations, making it more attractive for companies with a strong balance sheet to acquire. This dynamic is well seen in HLI 3Q24 performance, where CF y/y growth recovered to a positive 6% after six consecutive quarters of y/y decline due to an improving M&A backdrop. This trend should sustain itself for the coming quarters, as management reiterated that the macro outlook continues to improve since the April 2023 trough, suggesting that the trend is sustainable and that growth in the near term should remain elevated as demand is still below normal market conditions (growth to benefit from the recovery trend). Furthermore, sponsor M&A dialogues are getting better and many private equity firms are interested in starting the transaction process for portfolio companies, which paints a good positive outlook for HLI. That said, I think it is worth noting that there are events on the horizon that could make this segment slightly volatile. Specifically, there is a heightened geopolitical risk that is outside of HLI control such as wars; the US elections are also coming up (some corporations might delay M&A until after the election to make sure they will not be tangled up with any change in regulations).

You’re correct, obviously in the total number or percentage importance of financials sponsors versus strategics as way more towards the strategic and during this upper time period. We are seeing more activity in financial sponsors.

So the first part of your question I think the general view of either investors, private equity firms, CEOs, they’re getting more confidence, predictability is getting better for them.

We do think that at a certain point the private equity firms, they’re in the business of doing transactions, and they cannot go year by year by year and not do transactions. Source: 3Q24 earnings

On the other front—restructuring—a higher rate environment also meant a higher cost of capital for businesses, which forces a lot of businesses to take a good look at their balance sheet to figure out how they can reposition themselves. HLI 3Q24 results reflect this trend as well, with restructuring revenue growing 30% year over year and 12% sequentially to $129 million. I expect restructuring to remain elevated for the foreseeable future, as liability management continues to play an important role and as the overall business benefits from the approaching debt maturity wall and higher interest rates.

Finally, touching on HLI’s capital return policy, I support management’s decision to not repurchase this quarter, as I believe having a strong balance sheet today is much more important. A strong balance sheet allows HLI to reinvest for growth organically (hiring more personnel to take on more deals; remember, human capital is the most important asset for HLI) and inorganically (M&A).

Risk & conclusion

While I think the current rate environment works in favor of HLI, if rates were to rise by another significant amount, say 10%, I think the overall impact would be negative for HLI. While asset prices will devalue due to a higher rate environment, it also means that businesses are going to be more risk-averse, opting for hoarding cash on the balance sheet rather than M&A. The higher cost of capital also meant that some businesses would simply go out of business rather than attempt to restructure themselves.

I reiterate my buy rating for HLI based on its impressive performance in 3Q24 and a positive outlook driven by the sustained high-rate environment. The company’s growth in corporate finance and restructuring segments should continue, supported by favorable conditions for M&A activities and increased restructuring demand. While I do acknowledge the volatility potential from external events, I believe HLI’s strong balance sheet should position it well to navigate uncertainties. However, it’s crucial to monitor interest rate fluctuations closely, as a significant rise could negatively impact asset valuations and business decisions. Overall, the current rate environment aligns favorably with HLI’s strengths and growth strategies.