onurdongel/E+ via Getty Images

Introduction and Thesis

Hooker Furnishings Corporation (NASDAQ:HOFT) stands as a distinguished player in the furniture industry, renowned for its commitment to craftsmanship and innovation. With a rich history dating back to 1924, the company has established itself as a provider of high-quality home furnishings, catering to a diverse clientele.

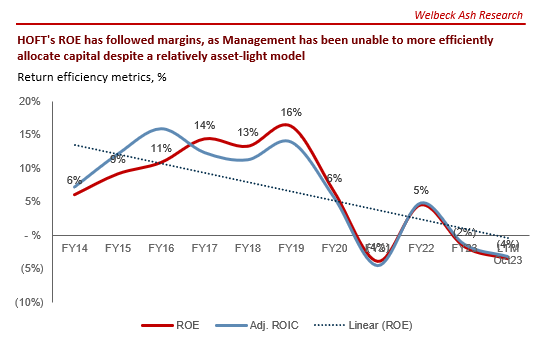

HOFT has serially underperformed during the last decade, owing to a number of commercial factors that Management has struggled to respond to. This has contributed to declining market share and increased difficulty in “stemming the bleeding”. This has translated to its financial performance, with worsening margins and uninspiring organic growth. The risk is that HOFT continues to experience a slow relative decline, leading to a languishing share price.

We feel innovation and renewed marketing efforts are required, however, the ability to execute on this is difficult due to the slow-moving nature of the industry and level of competition. The lack of development to date implies Management lacks the ability to deliver.

With an unattractive valuation and economic headwinds, we see further downside at its current valuation.

Share price

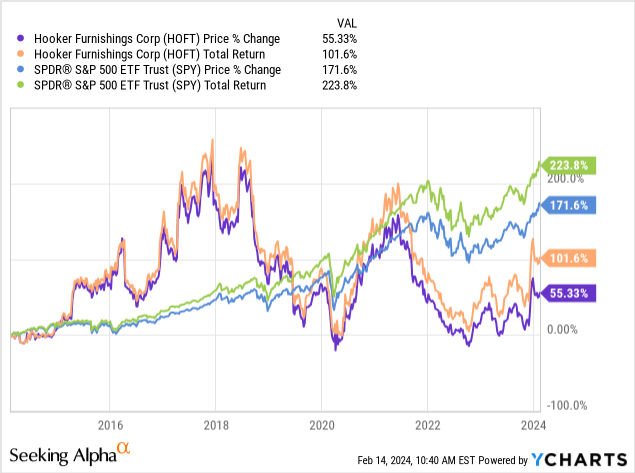

HOFT’s share price performance has been relatively volatile, with a linearity of <0.1, reflecting a period of uncertainty as investors seek to understand the long-term trajectory of the company.

The company’s financial performance during this period has been moderate but lacks the clear upward development that gives investors more comfort.

Commercial analysis

Presented above are HOFT’s financial results.

HOFT’s revenue growth has been impressive, in large part due to an acquisition in FY17 and FY18 (Meridian Homes and Shenandoah), although with a linearity of 0.4 reflecting (again) volatility in its trajectory.

Business Model

HOFT is primarily engaged in designing, manufacturing, and distributing residential furniture. The company produces a wide range of furniture, including bedroom, dining room, living room, home office, and home entertainment furniture.

The company emphasizes the quality and craftsmanship of its products, positioning itself in the top range of the industry. This commitment to quality alongside its longstanding history contributes to strong brand recognition and loyalty.

HOFT manages multiple brands, each catering to different market segments, products, and consumer preferences. These brands include Hooker Furniture, Lexington Home Brands, Bobo, and Pulaski.

HOFT distributes its products through a combination of both wholesale and retail channels based on the brand in question. It sells to independent retailers, department stores, online retailers, and directly to consumers through its branded retail stores. This combination gives HOFT diversification benefits, namely a degree of certainty over demand and limited direct exposure to end demand.

Furniture Industry

The Furniture industry is estimated to grow at a CAGR of +5.3% in the coming years, contributing to a size in excess of $1tn by 2032. The wood segment, which HOFT is heavily exposed to, is expected to remain considerable in size.

The furniture market is highly competitive with numerous players, ranging from large corporations to smaller niche brands. For this reason, the industry is fairly fragmented, limiting market share growth and putting pressure on pricing due to competition.

The industry has experienced fluctuations in the costs of raw materials, such as wood and metal, impacting the profitability of furniture manufacturers. This has softened in recent quarters but continues to be a near-term concern.

Competitive Positioning

HOFT’s competitive position is primarily centered around its brands, we feel. The company’s brands have a long history and are known for their quality, design, and customer service, impacting the company’s ability to attract and retain customers. Its targeting of a wealthier demographic has allowed HOFT to enjoy broadly robust demand despite limited organic growth.

Further, innovation and product development are also critical, allowing the business to stay ahead of trends and respond to changing consumer demands. We feel HOFT has also performed well in this regard, albeit has remained “safe” with its designs at a time when consumers are seeking to be more expression.

Additionally, the quality of its e-commerce offering is an important component of being competitive in today’s market, as retail spending increasingly transitions to this segment. HOFT’s offering is inconsistent in this regard, with some of its websites far better than others. It is promising to see this being an area of focus for Management, although the lack of a compelling offering has likely been the reason for its decelerating organic growth.

Whilst being slightly simplistic, its store locations inherently develop its competitive position, as consumers have a strong preference for trying before buying, particularly due to the cost of its furniture. This, alongside its historically strong brands, has likely slowed its decline and allowed revenue to marginally improve. The majority of its increased competitive pressures stem from online-only players who lack this key selling point.

Finally, effective marketing is crucial in the furniture industry, particularly as designs can, to an extent, be copied. Similarly to its e-commerce efforts, we believe more can be done to modernize its brands. As the following illustrates, interest in the Hooker Furniture brand, as measured by Google, has declined persistently over time.

Growth progression

Despite a solid business model and a relatively competitive offering, HOFT has struggled to achieve consistent revenue growth. The business is now smaller in size (revenue-wise) compared to its post-acquisition position in FY17.

We believe this reflects the level of competition in the industry, clearly overcoming HOFT’s attractiveness. The lack of modernization, which we highlighted as a key weakness, is inevitably playing a part in this.

Secondly, this is due to issues with its acquired Meridian Homes business, which has suffered to a greater degree than the core business. This has been adjusted, resized, and partially exited to create a more profitable segment, inherently impacting its top line.

The issue is that creating a new website or marketing on social media will not immediately return the company to where it once was. We believe its approach at a corporate level is dated, contributing to equal issues across all of its brands. HOFT has materially lost ground, particularly to the e-commerce players such as Wayfair (W) (albeit primarily operating in a different price bracket), and will not have an easy time getting this back. To right this, the business requires a fundamental revitalization in its marketing approach, which is costly and does not guarantee success.

Margins

Capital IQ

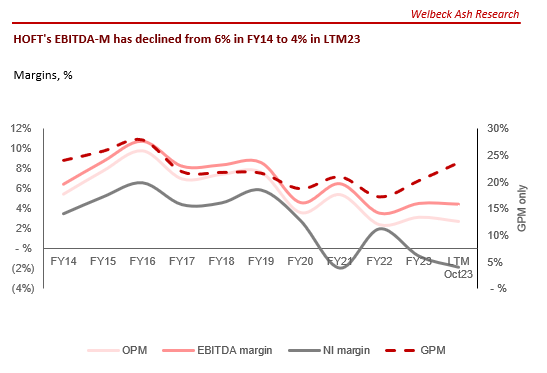

HOFT’s margin development has been non-existent, principally due to the inability to consistently increase revenue, limiting economies of scale, and competitive threats restricting the ability to reduce S&A costs (which have risen as a % of revenue despite GM% being flat). All of HOFT’s fortunes are inherently tied to its competitive position, with limited scope for margin gain we feel without improvements.

We believe more of the same is ahead, as HOFT is not in a position to extract greater value without demand declining.

Opportunities

We see the following opportunities for HOFT to improve its growth consistency in the coming years:

- E-commerce Expansion – Capitalizing on the surge in online furniture purchases and using this to enhance its brand. Improving traction should be fairly straightforward through “low-hanging fruit”, such as website improvement and social media marketing.

- Customization Trend – Offering personalized furniture solutions and other luxury options to customers. This will seek to utilize its strong brand to offer higher margin services.

- Sustainable Practices – Adapting early to the eco-conscious trend, such as utilizing wood alternatives. We consider this a longer-term play for brand development.

- Housing shortage – The housing shortage in the US should ensure healthy growth in the coming years and importantly, greater consistency. Furniture aimed at key new-home demographics, alongside positioning its locations in high-build areas, will improve growth we feel.

Notable threats

We believe the company still faces considerable threats, including but not limited to:

- Economic cyclicality – The furniture industry is often highly sensitive to economic conditions. Economic downturns can lead to reduced consumer spending on non-essential items, as well as reduced activity in the housing market.

- Supply chain – Disruptions in the global supply chain, whether due to geopolitical issues, trade disputes, or natural disasters, can impact the production and distribution of furniture.

- Design Imitation – The company clearly does not have strong enough brands to offset the downside risk associated with copied designs. The industry is increasingly becoming “commoditized by design”, contributing to decisions based on price. HOFT must be able to effectively communicate quality.

Economic & External Consideration

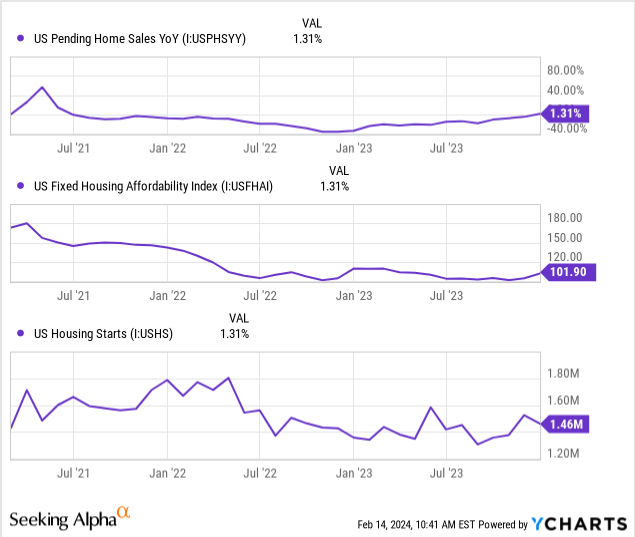

The demand for furniture is closely tied to the housing market. Economic factors, namely interest rates, directly affect home purchases or renovations, thus influencing furniture sales.

With rates significantly higher than in the last decade, consumers are protecting their finances and avoiding moving home, seeking to keep their low rates. Conversely, many of those without a home have now been priced out of a purchase as affordability falls to record-low levels.

Finally, with this depression in demand and a decline in affordability, we are seeing a reduction in the number of new homes being built, compounding the downside issues.

This is reflected in HOFT’s recent financial performance, which has been disastrous, with top-line growth of (2.6)%, (17.3)%, (36.0)%, and (22.9)% in its last four quarters. In conjunction with this, margins have declined, albeit not to a significant degree.

Management attributes this to market conditions. Interestingly, Management is seeing an improvement in conditions, particularly with greater customer contact in stores and online, with ~150 new customers added each month. Further, there has been an improvement in orders compared to the prior year. Despite this, inventory turnover continues to decline, sitting at 3.6x and below its decade average of 5.3x. It is critical to lift this beyond ~5x to generate strong FCFs.

We are not expecting the top-line impact to subside anytime soon, particularly as all signals point to rates declining. Why would consumers increase activity if they know rates will decline? We expect 2024 to be more of the same, potentially reaching a “bottom” part way through the year.

It is likely activity will improve once we have experienced multiple rate cuts, which will likely be in 2025 at the earliest.

Balance sheet & Cash Flows

HOFT is conservatively financed, positioning the company to reinvest in growth or distribute to shareholders. We would like to see more activity internally, given the issues the company has faced. While M&A is an option we are usually encouraging of, we believe its weak corporate strategy could lead to further inefficiencies through the portfolio effect. Once a better organic trajectory is established, M&A can be used to increase its footprint.

Instead, Management has paid a small dividend and repurchased shares, a poor use of capital we feel.

Capital IQ

Industry analysis

Presented above is a comparison of HOFT’s growth and profitability to the average of its industry, as defined by Seeking Alpha (10 companies).

HOFT disappoints relative to its peers, with lower growth and margins compared to its peers. The size of the difference is considerable, with limited scope to reach the average within the coming 5 years we feel.

The primary reason for the delta is a combination of competitive factors. Firstly, the e-commerce-first brands are still growing in the double-digits, lifting the average with their low-fixed-cost model. Secondly, stronger brands (such as Tempur (TPX) and Leggett & Pratt (LEG)) are able to boast superior margins through pricing. HOFT has the worst of both worlds.

Valuation

HOFT is currently trading at 14x LTM EBITDA and 12x NTM P/E.

HOFT is trading at an FCF yield of ~11%, which is higher than its historical average of ~7%. This premium is required to justify the company’s declining commercial position and the near-term risks we feel. Further, the company is not trading at a substantial discount to its peers (~15% on an EBITDA basis) despite the various issues identified, implying a misalignment of its valuation. We believe this valuation reflects a degree of near-term hesitancy from investors but greater confidence of stability from analysts in the NTM forecasts.

HOFT’s valuation does not imply substantial value we feel given the downward commercial trajectory, which is required to justify investing at its current position.

Final thoughts

HOFT has the potential to be a good business within its industry but is currently underperforming with limited scope for immediate improvement. We are concerned that the company will continue to lag behind, despite attractive growth in its industry. The business has failed to modernize and Management has been distracted by a disruptive acquisition.

With its valuation not clearly reflecting a discount to its peers while facing economic headwinds, we rate the stock a sell on near-term pain.