In this video provided by METAoriginal to Fox News Digital, the Related Group’s Rivage property is shown through drone and life-like visuals.

Existing-home sales jumped unexpectedly in February to the highest monthly increase recorded in a year, according to the National Association of Realtors.

Total existing-home sales – which includes previously owned single-family homes, townhomes, condominiums and co-ops – increased 9.5% from January to a seasonally adjusted annual rate of 4.38 million in February. But sales are still down 3.3% from last year, when 4.53 million were recorded for February 2023, a NAR report released Thursday said.

“Additional housing supply is helping to satisfy market demand,” said NAR chief economist Lawrence Yun. “Housing demand has been on a steady rise due to population and job growth, though the actual timing of purchases will be determined by prevailing mortgage rates and wider inventory choices.”

A “For Sale” sign on March 19, 2024, in Austin, Texas. Home prices have surged 25% since President Biden took office in January 2021. (Brandon Bell / Getty Images)

While Americans may want to buy houses, scarce supply, inflated prices and high mortgage rates have made home ownership unaffordable for many. Housing inventory in 2022 dipped to its lowest point since the Federal Reserve began tracking the data in 2016, while housing costs reached record highs.

AMERICANS ARE MAKING A MASS EXODUS FROM BIG CITIES ACCORDING TO CENSUS BUREAU DATA

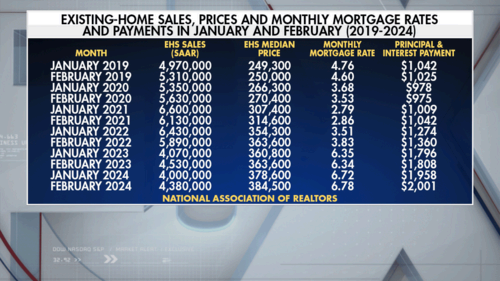

A data table showing existing home sales, prices, mortgage rates and mortgage payments in January and February for the years 2019-2024. (Fox News / Fox News)

Home prices and associated costs have followed the same inflationary trend as the rest of the economy since President Biden assumed office in January 2021.

Compared to three years ago, the median price for existing-home sales has increased 25%, from $307,400 in January 2021 to $384,500 in February 2024, according to NAR data.

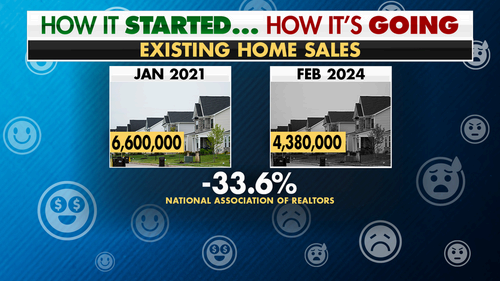

Existing home sales were 6.6 million when Biden took office and have since fallen to 4.38 million, according to Thursday’s report – a 34% decrease.

Not only are house prices up and supply down – home loan costs have skyrocketed. As of February 2024, the monthly mortgage payment on an existing home was $2,001, according to NAR. That compares to a January 2021 reading of $1,009 and represents a walloping 98% increase.

US HOMEBUILDER SENTIMENT UNEXPECTEDLY RISES TO HIGHEST LEVEL SINCE JULY

Existing home sales have fallen 33.6% from 6.6 million in January 2021 to 4.38 million in February 2024. (Fox News)

Mortgage rates, which were an average 2.79% in January 2021, are now 6.78%.

For those who can’t afford a home or don’t wish to purchase one, rent is also more expensive. The average monthly rent for a two-bedroom apartment in the U.S. was $1,132 in January 2021. Now the average rent for an apartment that size has climbed 20% to $1,363 per month, according to data from apartmentlist.com.

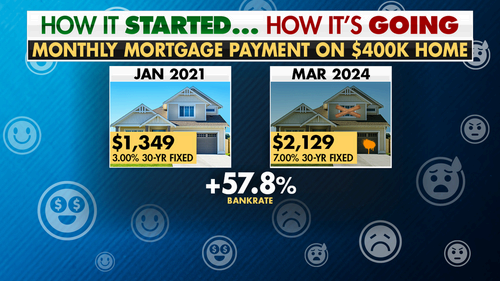

The median sales price for existing homes has increased from $307,400 in January 2021 to $384,500 in February 2024. (Fox News / Fox News)

Housing costs are expected to keep rising so long as there is strong demand and limited supply.

“Home sales dipped in February compared to a year earlier because not enough homes were on the market to meet demand,” explained Holden Lewis, a home and mortgage expert with NerdWallet.

HOW IT STARTED … HOW IT’S GOING: INFLATION UNDER BIDEN DRIVES UP COSTS FOR BREAD, BUTTER, CHICKEN

The average monthly mortgage payment on a $400,000 home with a 20% down payment has increased from $1,349 in January 2021 to $2,129 in February 2024. (Fox News / Fox News)

According to the NAR report, total housing inventory at the end of February – the number of homes listed for sale – was 1.07 million units, a 5.9% increase from January and 10.3% surge from 970,000 units one year ago.

“Just 1.07 million existing homes were for sale at the end of February. In the same month five years earlier, before the pandemic, there were 1.63 million homes on the market. Consequently, many more homes were sold back then,” Lewis said. “Because demand exceeds supply, buyers are competing with each other and driving up prices.”

Regional sales climbed in the West, South and Midwest, but remained unchanged in the Northeast, the report said. Year-over-year sales declined in all regions.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Housing became more expensive in all major U.S. regions as well, according to NAR. The median existing-home price for all housing types in February was $384,500, an increase of 5.7% from February 2023, according to NAR.

“Due to inventory constraints, the Northeast was the regional under-performer in February home sales but the best performer in home prices,” Yun said. “More supply is clearly needed to help stabilize home prices and get more Americans moving to their next residences.”