KathyDewar

Elevator Pitch

My Buy rating for Hitachi, Ltd. (OTCPK:HTHIY) [6501:JP] shares stays unchanged. I wrote about Hitachi’s latest M&A transactions and its carbon neutrality business in my December 27, 2023 write-up.

My view is that Hitachi’s upcoming quarterly results release won’t throw up any negative surprises. In the intermediate to long term, the company’s efforts to reshape its portfolio and grow its Indian business operations should be eventually rewarded with financial performance improvement. These above-mentioned factors provide support for my Buy rating assigned to the stock.

The company’s Japan-listed and OTC shares boasted mean daily trading values of $200 million and $7 million (source S&P Capital IQ), respectively for the last three months. Readers can utilize the services provided by US brokerages such as Interactive Brokers to deal in Hitachi’s comparatively more liquid shares listed on the Tokyo Stock Exchange.

Preview Of Hitachi’s Q4 FY 2023 Performance

Hitachi will be reporting the company’s financial results for the final quarter of fiscal 2023 ended March 31, 2024 on April 26.

The market estimates that HTHIY will register a positive +5.7% YoY growth in EBIT to JPY233 billion for Q4 FY 2023 as per S&P Capital IQ’s consensus data. If the analysts turn out to be right, this will represent an improvement as compared to Hitachi’s actual -4.0% YoY and -1.3% YoY contraction in EBIT for Q2 FY 2023 and Q3 FY 2023, respectively.

There are valid reasons to believe that Hitachi’s actual fourth quarter financial performance will be as good as if not better than the sell side’s projections.

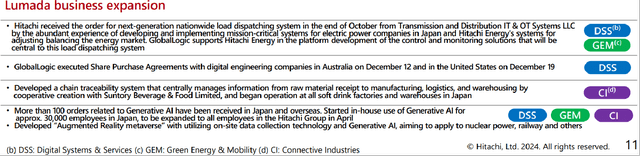

The first reason is that the company’s Lumada business should have done pretty well in Q4 FY 2023. I mentioned in my previous July 13, 2023 update that Lumada is the company’s “corporate digital transformation business” and “key growth engine.”

In its Q3 FY 2023 results presentation slides, HTHIY highlighted that the “expansion of (the) Lumada business by harvesting digital demand” was one of the key factors contributing to a +2% upward revision in its full-year FY 2023 EBITA guidance in January 2024. Specifically, Hitachi estimates that the EBITA contribution for Lumada as a percentage of its total EBITDA could potentially rise from 38% in FY 2022 to 41% for FY 2023.

Positive Growth Momentum For The Lumada Business In 9M FY 2023

Hitachi’s 9M FY 2023 Results Presentation Slides

As per the chart presented above, the Lumada business has exhibited positive growth momentum in the first nine months of the recent fiscal year judging by recent order wins and acquisitions of other businesses. This bodes well for the performance of Lumada and the company as a whole for Q4 FY 2023.

The second reason lies with the company’s levers to drive operating margin expansion.

Hitachi cited “selling price change” as a key EBITA expansion driver for the company in full-year FY 2023 in the company’s Q3 FY 2023 results presentation. As an example, HTHIY had previously implemented price hikes for its machinery products in 2022 and 2023. This suggests that the company might leverage on price increases for certain of its businesses with pricing power to boost its operating profitability.

Separately, HTHIY has been actively reshaping its portfolio by selling businesses which are non-core in nature and boast lower profit margins (e.g. metals business) than its other businesses. This means that Hitachi’s business mix should have been improving over time with an increase in sales contribution from higher-margin businesses.

In conclusion, I anticipate that Hitachi’s Q4 FY 2023 results will be in line or above the current consensus forecasts.

Watch Portfolio Optimization Activities And Indian Market’s Growth Potential

In this section, I focus on Hitachi’s key value drivers.

There could be potential portfolio optimization moves that the company can make.

With my late-2023 update, I highlighted Hitachi’s most recent “restructuring move” to “consolidate its operations associated with carbon neutrality under a single business entity.” In the early part of this year, Nikkei Asia reported that HTHIY might divest its interest in Japanese semiconductor company Renesas Electronics (OTCPK:RNECF) (OTCPK:RNECY) for JPY133 billion.

Assuming that HTHIY continues to engage in corporate restructuring and asset monetization activities like those mentioned above, this should eventually translate into a more focused and higher-quality business portfolio.

On the other hand, India could be a key growth market for HTHIY in the long run.

According to comments made by Hitachi’s India business head at the World Economic Forum this year cited by Reuters, the company has the potential to generate $20 billion in yearly sales by the end of this decade. As a comparison, Hitachi’s consensus top line estimate for the fiscal year ended March 31, 2028 is $69 billion (source S&P Capital IQ). In other words, the revenue contributed by Hitachi’s Indian operations as a proportion of its aggregate top line might be as high as 30% in the future.

A review of Hitachi’s past earnings releases and management commentary at results briefings suggests that India is hardly mentioned by the company and analysts. As such, there should be upside relating to HTHIY’s growth expectations, if its Indian business does expand significantly going forward.

In a nutshell, there are key value drivers for Hitachi like Indian market expansion and further portfolio optimization, if one looks beyond the quarterly results.

Key Risks To Watch

Hitachi has risks that shouldn’t be ignored.

As a conglomerate with multiple businesses, there are many moving parts that could affect HTHIY’s financial performance. Therefore, there is the risk that unexpected weakness associated with certain business areas leads to below-expectations Q4 FY 2023 results for Hitachi.

Also, there is no assurance that Hitachi will be able to monetize its non-core investments and assets successfully or grow its operations in India in a big way like what it anticipates. If these key value creation drivers don’t work out as well as expected, HTHIY’s long-term growth prospects might disappoint investors.

Final Thoughts

I continue to have a positive opinion of Hitachi as a potential investment candidate. The probability of a Q4 FY 2023 results miss is low, and there are favorable share price drivers for HTHIY like the Indian market expansion and portfolio restructuring.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.