All three major indexes slipped into bear territory in 2022, and ever since, one question has been on investors’ minds: When will the next bull market arrive? It’s impossible to answer that question with 100% accuracy, but a couple of things offer us reason to be optimistic that a bull market may be on the way.

First, bear markets always lead to bull markets, so down times are temporary. Second, a look at history shows us the Nasdaq Composite has a good chance of roaring higher in 2024. The index surged 43% last year, surpassing gains of the Dow Jones Industrial Average and the S&P 500, which climbed 13% and 24%, respectively. And a look at Nasdaq’s performance over time shows that after every year of rebounds from a bear market, the index has gone on to climb for a second year.

In fact, after each annual loss of more than 10%, the Nasdaq went on to gain an average of 56% over the following two years. This shows that, if the index follows its pattern so far, the Nasdaq has plenty of room to run this year, and this makes now a great time to invest in quality growth stocks. These are companies that have shown their ability to increase earnings over time, and these players also offer solid long-term prospects. So, by scooping up shares of these companies, you could score a win in the near term and over time. Let’s check out two surefire growth stocks to buy now.

Image source: Getty Images.

1. Apple

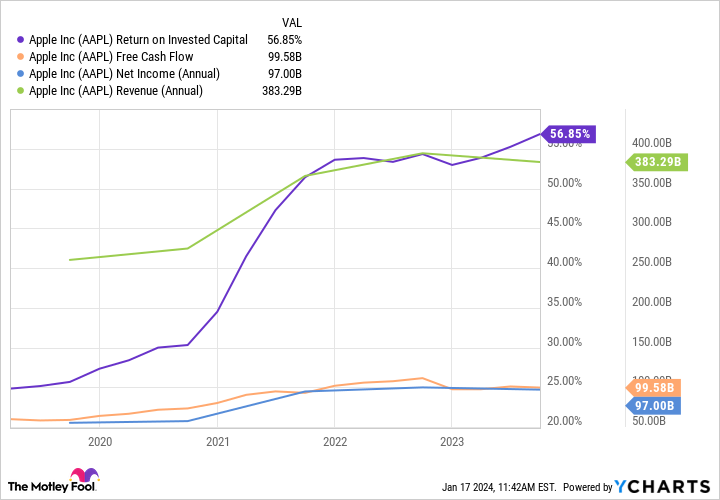

Apple‘s (AAPL 1.55%) revenue and profit have soared over time, and so have other key measures like free cash flow and return on invested capital. This shows the technology giant has what it takes to consistently turn increasing revenue into profit — and make wise investment decisions.

AAPL Return on Invested Capital data by YCharts.

The share price has followed, helping the company reach a market value of more than $2.8 trillion. It’s clear Apple has a track record of success.

All of this is thanks to the company’s brand strength. Customers keep coming back to snap up the latest iPhone or Mac and haven’t been easily lured away by rival products. This strength represents a moat, or competitive advantage, that should keep the momentum going.

On top of this ability to keep current customers loyal, Apple also continues to gain new fans. In the most recent quarter, for example, half of Mac and iPad buyers were new to those particular products. And Apple continues to innovate, with its latest product — the Apple Vision Pro spatial computer — set to launch early next month.

Today, more than 2 billion people around the world use Apple devices, and this leads me to the subject of Apple’s next big growth driver. I’m talking about the services Apple offers these device users — from cloud storage to digital content. In the most recent quarter, services revenue reached a record high, and that should continue thanks to this enormous (and growing) number of Apple users. Even better, Apple’s services margins are significantly higher than product margins — 70% vs. 36% in the recent quarter.

All of this means Apple, even after gains of 48% last year, has a lot of fuel in the tank. And in a market favoring growth, this top stock could easily rocket higher.

2. Amazon

Amazon (AMZN 1.20%) is a leader in two markets set to grow in the double digits this decade: e-commerce and cloud computing. And the company is likely to maintain its dominance thanks to moves it’s made over the past couple of years. A difficult 2022 that led to Amazon reporting its first annual loss in nearly a decade prompted these moves.

Rising inflation weighed on Amazon’s costs and on its customers’ wallets. So Amazon decided to revamp its cost structure and transform itself into a stronger company that not only could recover from difficult times but could excel in better times.

Amazon focused on boosting efficiency across its fulfillment network, investing in high-growth areas and supporting its Amazon Web Services (AWS) customers by offering them lower-cost tools during tough economic times. All of these efforts have been bearing fruit, with Amazon shifting from billion-dollar outflows of cash and declines in operating income to growth. In the latest quarter, operating income quadrupled, and the company reported free cash flow of more than $21 billion.

Moving forward, the company’s move to a regional fulfillment model from a national one could continue to lower Amazon’s costs and increase revenue. By dispatching packages from centers closer to your home, Amazon spends less money on the task, and you receive your order more quickly. Amazon is also introducing an ad-supported tier to its Prime Video offer, a move that could add billions to revenue, analysts predict.

As for AWS, Amazon’s investment in artificial intelligence (AI) may make the company a winner in the potential AI revolution. That’s big news considering AWS generally has driven profit at Amazon.

After an 80% increase last year, Amazon, like Apple, has plenty of potential for more gains. And that’s why, if the Nasdaq follows its historical pattern in 2024, this market giant could once again roar higher.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adria Cimino has positions in Amazon. The Motley Fool has positions in and recommends Amazon and Apple. The Motley Fool has a disclosure policy.