Last year was great for the Nasdaq Composite, surging 43% to lead all major indexes. This was a notable turnaround after the index lost a third of its value in 2022 amid rising inflation and recession fears.

One thing about history is that it often repeats itself, including in the stock market. If that continues to be the case, investors should be encouraged heading into 2024. The last few times the Nasdaq Composite finished a year in the negative (2002, 2008, 2011, and 2018), it bounced back with at least two straight positive years.

| Year of Decline | Decline Percentage | Gains One Year After Decline | Gains Two Years After Decline |

|---|---|---|---|

| 2008 | (40.5%) | 43.9% | 16.9% |

| 2011 | (1.8%) | 15.9% | 38.3% |

| 2018 | (3.9%) | 35.2% | 43.6% |

| 2022 | (33.1%) | 43.4% | TBD |

Data source: Nasdaq Composite historical data. Percentages rounded to the nearest tenth percent.

There’s no way to predict market movements, and past results don’t guarantee future performance, but many of the catalysts responsible for the Nasdaq’s 2023 bounceback — such as AI and cloud computing — are still relatively early in what they can become and should carry momentum through the year.

To get ahead of the game, here’s an exchange-traded fund (ETF) I’d buy.

Let top tech companies lead the way for you

The Nasdaq-100 is a subset index of the Nasdaq Composite that tracks the 100 largest non-financial companies trading on the Nasdaq Stock Market. The Invesco QQQ ETF (QQQ 0.05%) is an ETF that mirrors the Nasdaq-100 and is the second-most traded ETF on the U.S. stock market.

Much of the appeal of the Invesco QQQ ETF is its composition. Below are its top five holdings and how much of the ETF they account for (as of Jan. 5, 2024):

- Apple: 8.95%

- Microsoft: 8.68%

- Amazon: 4.77%

- Broadcom: 4.02%

- Meta Platforms: 3.95%

The Invesco QQQ ETF is undoubtedly tech-dominant (57% of the fund), but the companies cover a lot of areas within the tech sector. They cover consumer electronics (Apple), social media (Meta Platforms), software and services (Adobe, Alphabet, Intuit), semiconductors (Advanced Micro Devices, Intel, Nvidia), electronic design automation (Cadence Design Systems, Synopsys), and a handful of other subsectors of tech.

Many of the Invesco QQQ ETF’s top holdings are industry leaders who will be shaping the future of technology and innovation — especially the “Magnificent Seven.”

Investing in individual companies comes with inherent risks, including company-specific and industry-specific issues and downturns, but I trust them, as a whole, to drive sustainable long-term growth.

A reach that goes beyond the tech sector

The Invesco QQQ ETF is often associated with tech, but it goes beyond that. Below are non-tech sectors represented in the ETF and how much of it they make up:

- Consumer discretionary: 18.73%

- Healthcare: 7.12%

- Telecommunications: 5.48%

- Industrials: 4.87%

- Consumer staples: 4.23%

- Utilities: 1.24%

- Energy: 0.69%

- Real estate: 0.27%

- Basic materials: 0.27%

The tech sector will lead the charge, but it’s good to have other sectors to balance out the ETF. The tech sector isn’t immune to slumps, so any diversification benefits investors. Energy, real estate, and basic materials won’t have tangible effects on the ETF, but sectors like consumer discretionary and healthcare can be great to balance out the cyclical nature of other sectors like tech and industrials.

The Invesco QQQ ETF has market-beating potential

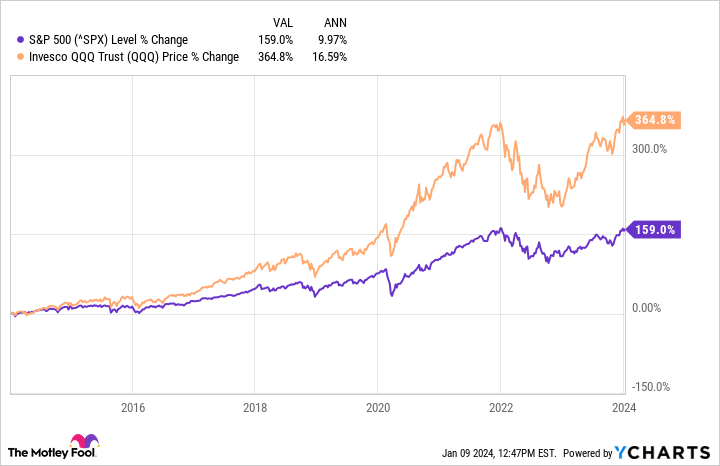

Maybe most important is that the Invesco QQQ ETF has proven results. Since its March 1999 inception, the Invesco QQQ ETF has far outperformed the S&P 500, with 695% gains compared to the S&P 500’s 270% gains over that time frame. The performance is even more impressive when looking at returns over the past decade.

There’s no way to predict if the Invesco QQQ ETF’s 16.5% average annual returns from the past decade will continue, but it has market-beating potential when considering the companies it has leading the way.

For investors interested in investing in Nasdaq stocks in 2024, the Invesco QQQ ETF is an ideal choice. It contains notable sector leaders, has non-tech sectors to help against downturns, and has proven historical results. It’s a 3-for-1 ETF that can play a key role in investors’ portfolios.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Adobe, Advanced Micro Devices, Alphabet, Cadence Design Systems, Intuit, Nvidia, and Synopsys. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2024 $420 calls on Adobe, long January 2025 $45 calls on Intel, short February 2024 $47 calls on Intel, and short January 2024 $430 calls on Adobe. The Motley Fool has a disclosure policy.