Editor’s note: Seeking Alpha is proud to welcome Stoic Investments as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Anchiy/E+ via Getty Images

Investment Thesis

Hims & Hers (NYSE:HIMS) represents a great growth opportunity in telehealth but beware of the shaky grounds of its main competitive advantage, its branding. If HIMS shows great growth and good fundamentals, everything could deteriorate quickly if they take a hit. Nonetheless, with a deep undervaluation compared to competitors and according to future estimations, HIMS remains a compelling investment opportunity.

Business Overview

Hims & Hers Financial Result Q2 Presentation

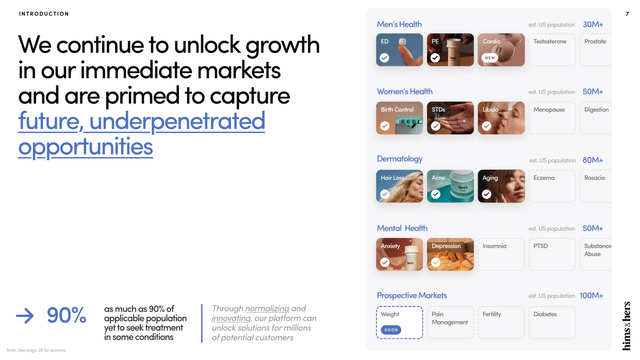

Hims & Hers is a telehealth company specialized in providing solutions to stigmatized conditions such as STDs, erectile dysfunction, hair loss, depression, etc. This remote service is a great solution for those who cannot or do not want to personally go visit a medical professional, leading to a lot of people not looking for the help they would benefit from because they fear judgment, resulting in overlooking their health.

HIMS is working with their “Affiliated Pharmacies” (10-K, page 9) which are licensed mail-order pharmacies providing prescriptions to Hims & Hers customers by video calls. These pharmacies represent an important part of the business, with over 70% of orders fulfilled by them during the second quarter.

Either on their site or app, you can choose between prescription drugs or non-prescription products, but you will be required to have a subscription to access prescription drugs. Plus, in order to better guide you through your use of their solutions, they also provide free content on the different subjects their products address.

Hims & Hers Financial Result Q2 Presentation

What’s To Fear

Let’s now talk more deeply about HIMS’s moat. If one could think that having partnerships with physicians in the telehealth industry is the most difficult aspect, many companies such as Roman or Teladoc (TDOC) have already been successful in doing so. We are instead going to look at HIMS brand.

A good way to fully grasp HIMS’s differentiating factor is to look at Roman, HIMS’s principal competitor who offers similar products but with a different approach. If Roman chose to emphasize the professional aspect, HIMS made the choice to prioritize giving special care and attention to their customers to ultimately make them feel more at ease and comfortable when addressing their healthcare needs. While Hims & Hers platforms provide the services, what makes the difference in attracting and retaining customers lies in the way they market it, in other words, their branding.

When a company relies on its brand as a moat, it can yield significant advantages but also exposes itself to certain risks. These risks include the following: high costs in maintaining a strong brand such as challenging customer acquisition costs [CAC], vulnerability to shifting customer preferences and trends, and competitive pricing pressures. While HIMS has implemented strategies to address these concerns, I remain cautious about their effectiveness in several areas:

Starting with changes in customer preferences or trends, the easiest way to antagonize this is to create retention and build trust between the clients and the company. Unfortunately, Hims & Hers clients have been referencing some issues related to customer service for some time now, none of which have been clearly dealt with. Since 2021, users have been sharing complaints on BBB, where most of them were related to: charges made without approval, difficulty in reaching the customer staff service with sometimes waits of 2 weeks, long deliveries, or foggy listing of prices.

When it comes to personalization, Hims & Hers distinguishes itself more through its marketing/experience approach rather than providing revolutionary products. But compared to Hims, Hers doesn’t seem to emphasize this aspect as effectively. For instance, approximately half of Hers’ product range, which includes items like skincare products, condoms, lubricants, birth control pills, and certain hair products, lacks distinctiveness or specialized care for specific conditions (such as treatments for STDs or depression). This absence of a distinct brand identity for most of its product line could raise questions in customers’ minds about why they should choose Hers. More specifically, the lack of personalization options may leave customers with the impression that they are not receiving a genuinely tailored and individualized experience, especially when purchasing these common products, ultimately leaving growth potential aside.

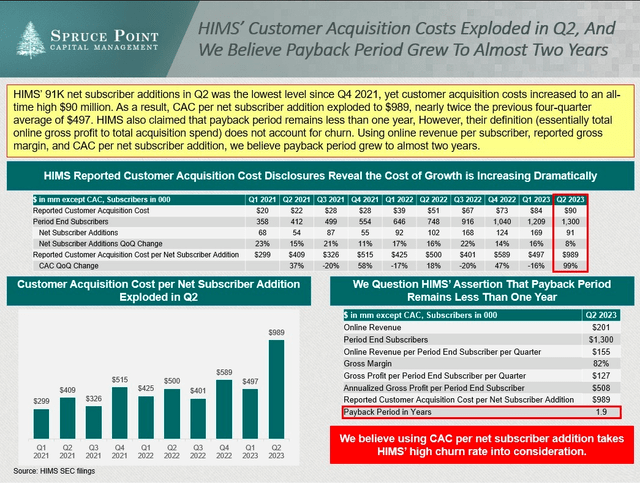

In the context of monitoring costs and possible customer dissatisfaction that can be caused by our previously discussed points, Customer Acquisition Cost [CAC] becomes a crucial metric. To maintain current profitability, CAC should be lower than the annual revenue per subscriber. In HIMS’s case, with an average monthly revenue per subscriber at $53, the annual revenue per subscriber is $636. This means that to maintain a payback period of less than a year, the CAC should be less than $636, much lower compared to the $989 spike recorded this quarter. To answer these concerns, Yemi Okupe, CFO, stated in the Q2 Earnings Call that investments in marketing were “more heavily weighted toward the back half of the quarter and the expected slowdown in customer acquisition were the main reasons for a higher customer acquisition cost.” They also added that the investments made should lead to better customer acquisition in the following quarter (Q3 2023).

Although the management has given insights as to why the CAC increased this quarter and highlighted the fact that they were expecting this outcome, one should keep in mind that any future increase in CAC will impact the payback period. If the latter exceeds one year, the company will lose money during the first year whenever it adds subscribers and, in the long run, limit its ability to attract and retain new customers while pressuring the margins.

In conclusion, if Hers may represent potential slower growth or “unlocked value” within the company, I believe the mix of rising customer acquisition costs and declining customer satisfaction presents a concerning scenario. In my opinion, these factors could have a cascading effect, potentially leading to a reversal of positive free cash flow. Indeed, the increase in customer acquisition costs would directly hamper the company’s capacity to attract new customers where decreasing customer satisfaction would affect retention, resulting in increased costs and diminished revenue growth. In such a scenario and given the company’s current breakeven point, resorting to cash or stock-based compensation might become necessary to offset these adverse effects. This could result in putting pressure on the company’s financial health or causing dilution among investors, both of which are undesirable outcomes for shareholders.

Hims & Hers Financial Result Q2 Presentation

What’s To Love

Hims & Hers Financial Result Q2 Presentation

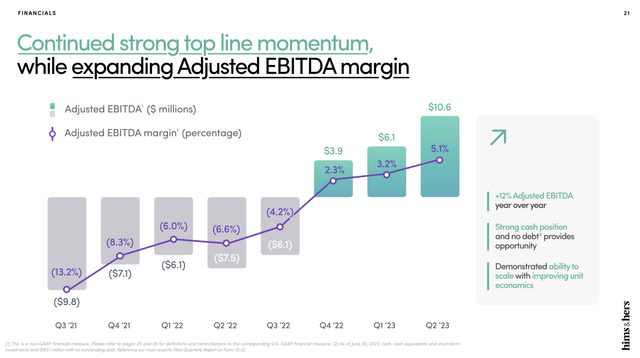

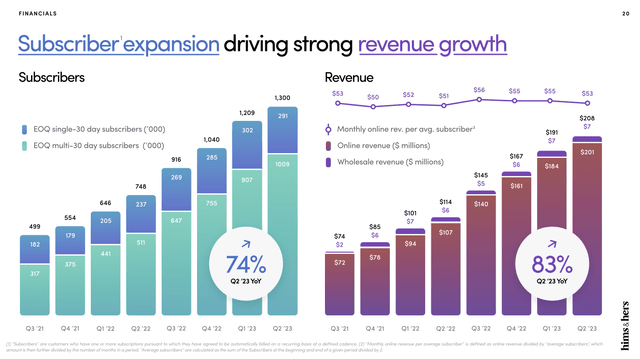

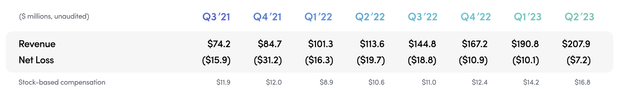

Looking through financials, HIMS has kept delivering great growth over the years, with online revenue being the main driver. This continuous growth has led the business to finish the second quarter with 1.3 million subscribers and $208 million in online revenue, reflecting growth of 74% YoY for new subscribers and 83% for online revenue. Furthermore, with adjusted EBITDA of $10.6 million in the latest quarter, as compared to $6.1 million in Q1 2023 and $3.9 million in Q4 2022, the company has marked its third consecutive quarter of positive EBITDA, a turning point where HIMS shows that it starts to consistently create value. Added to the strong track record of improving revenue, the balance sheet is another great aspect of HIMS with zero debt and $200M in cash and equivalents, a strong attribute especially appreciable within a macroeconomic climate in which high interest rates can be business killers.

On the accounting side, the balance sheet is another great aspect of HIMS with zero debt and $200M in cash and equivalents, a strong attribute especially appreciable within a macroeconomic climate in which high interest rates can be business killers. Also, HIMS becoming recently free cash flow positive without having to distribute absurd amounts of SBC (i.e., it still represents their entire free cash flow) or accumulating debt is pretty impressive, especially knowing the difficulty for companies in telehealth to become profitable (e.g. Teladoc’s situation). Indeed, they have been distributing an average of $12 million quarterly over the last 2 years with the Q2 of 2023 ending high at $16.8 million. If this still represents 1% of their market cap, I believe that number to be fair relative to HIMS’s growth and sector.

Hims & Hers Financial Result Q2 Presentation

I also believe the management to be a great asset for HIMS. During Q2, they demonstrated their ability to make bold decisions in pursuit of their long-term objectives, as evidenced by recent price cuts on certain SKUs aimed at bolstering customer retention. They were able to do so while maintaining and even increasing the year-over-year gross margin to 82%.

On another note, I see the opportunities for growth opened by the 2 new segments announced, weight management and “Heart Health by Hims“, as great catalysts for the future as it checks the box of providing special and personalized solutions as well as unlocking new Total Addressable Markets. In my opinion, Heart Health is a great proof of the management’s capacity to create synergies, recognizing that erectile dysfunction can serve as an early warning sign to cardiovascular disease, thus leveraging their already established presence in the sexual health market.

Altogether, these recent events provide a great testimony to the management’s efficacy in growing and preserving HIMS.

Hims & Hers Financial Result Q2 Presentation

Valuation

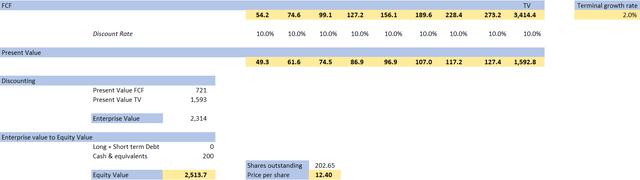

For the valuation, I will be using both DCF and comparable methods. Because HIMS is still in its early stages of being positive in free cash flow, added to its free cash flow adjusted to SBC being still negative, the amount of SBC granted will hold a great weight in the variability of the free cash flow in the coming years. Estimating future SBC is difficult, this is where the comparable method will offer us a less biased view.

So let’s start with the assumptions surrounding the DCF analysis that will go over 8 years, from the start of 2024 to the end of 2031:

- 10% discount rate, as it is the performance we are trying to achieve.

- Revenue is set to achieve ~$1.2bn in 2025, following the guidance of HIMS, this means 24% growth the first year, diminishing by 3% each year for the first 4 years and then steadily growing 10% for the 4 remaining years.

- Adjusted EBITDA Margin is projected to be 6.5% the first year, increasing each year by 1.5%. This gives us adjusted EBITDA of + $100 million in 2025 as guidance suggests and forecasts 17% margin for 2031 (relatively fair estimate compared to the 20-30% long-term guidance)

- CapEx is 0 as other assumptions are already conservative compared to guidance, interest on debt is 0

- Terminal growth rate is 2%

- SBC and D&A represent ~ $35 million per year

- FCF is calculated as Adjusted EBITDA subtracted by taxes (Taxes = (Adj. EBITDA – SBC – D&A)*0.35).

Discounted Cash Flow (source of assumptions: HIMS Earnings Call/Presentation)

According to this analysis, the model indicates that the fair value of $12.40 implies that the current share price is significantly underestimated. Even with a conservative margin of safety set at 30%, the resulting fair value stands at $8.68, offering investors an upside around 50%.

Getting to comparable method, we will take HIMS’s closest competitor, Roman. Roman is not public but it has been recently revalued from 5 billion to 7 billion, making it approximately 5 times larger compared to HIMS’s 1.32 billion valuation. But based on the last data on their revenue in 2021 of 300 million, it is difficult to see Roman having more than 5 times the revenue of HIMS as it would translate into more than 4 billion per year (assuming $800 million for HIMS in 2023). Therefore, we can reasonably assume that HIMS is undervalued based on Discounted Cash Flow method and Comparable method.

Conclusion

In summary, Hims & Hers, a telehealth company, presents a complex landscape with both promising strengths and significant challenges. On the positive side, the company has demonstrated impressive growth, maintained a robust balance sheet, and recently achieved free cash flow positivity without resorting to excessive stock-based compensation or debt. The management’s strategic decisions, such as price adjustments to improve customer retention and the maintenance of strong gross margins, are noteworthy. Furthermore, the entry into new segments like weight management and “Heart Health by Hims” presents promising growth opportunities.

Regarding the risks, the company faces challenges related to customer acquisition and retention, largely due to its heavy reliance on branding. High costs, susceptibility to shifting customer trends and competitive pricing pressures are potential risks. To mitigate these concerns, HIMS must concentrate on customer relationship management, enhancing personalization, product diversification, and closely monitoring Customer Acquisition Cost [CAC]. Resolving customer complaints related to billing, accessibility, and delivery times is crucial to enhance customer satisfaction and retention. On a final note, I would also add that the “growth” in Adjusted EBITDA or FCF can almost exclusively be attributed to the ramp up of SBC. If the SBC is still reasonable, I would personally prefer “no growth” as opposed to a manipulated one.

Taking these factors and the attractive valuation into account, I would recommend a “Buy” rating for Hims & Hers, with a caveat to keep a vigilant eye on the discussed risks. The company’s growth prospects, solid balance sheet, and strategic agility make it an attractive investment opportunity. However, it is essential to monitor how the company addresses the challenges related to customer acquisition and retention and ensure that its branding strategy remains effective in a dynamic market.

This “Buy” rating reflects optimism about the company’s potential while acknowledging the need for prudent risk management.